pointe coupee parish police jury - i-Deal Prospectus

pointe coupee parish police jury - i-Deal Prospectus

pointe coupee parish police jury - i-Deal Prospectus

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

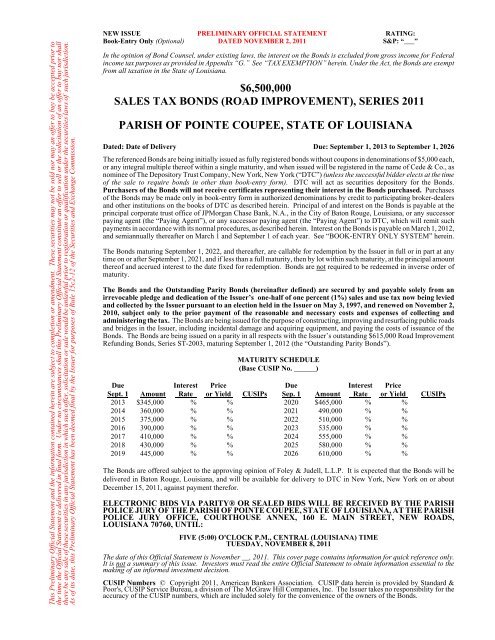

This Preliminary Official Statement and the information contained herein are subject to completion or amendment. These securities may not be sold nor may an offer to buy be accepted prior tothe time the Official Statement is delivered in final form. Under no circumstances shall this Preliminary Official Statement constitute an offer to sell or the solicitation of an offer to buy nor shallthere be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.As of its date, this Preliminary Official Statement has been deemed final by the Issuer for purposes of Rule 15c2-12 of the Securities and Exchange Commission.NEW ISSUE PRELIMINARY OFFICIAL STATEMENT RATING:Book-Entry Only (Optional) DATED NOVEMBER 2, 2011 S&P: “___”In the opinion of Bond Counsel, under existing laws, the interest on the Bonds is excluded from gross income for Federalincome tax purposes as provided in Appendix “G.” See “TAX EXEMPTION” herein. Under the Act, the Bonds are exemptfrom all taxation in the State of Louisiana.$6,500,000SALES TAX BONDS (ROAD IMPROVEMENT), SERIES 2011PARISH OF POINTE COUPEE, STATE OF LOUISIANADated: Date of Delivery Due: September 1, 2013 to September 1, 2026The referenced Bonds are being initially issued as fully registered bonds without coupons in denominations of $5,000 each,or any integral multiple thereof within a single maturity, and when issued will be registered in the name of Cede & Co., asnominee of The Depository Trust Company, New York, New York (“DTC”) (unless the successful bidder elects at the timeof the sale to require bonds in other than book-entry form). DTC will act as securities depository for the Bonds.Purchasers of the Bonds will not receive certificates representing their interest in the Bonds purchased. Purchasesof the Bonds may be made only in book-entry form in authorized denominations by credit to participating broker-dealersand other institutions on the books of DTC as described herein. Principal of and interest on the Bonds is payable at theprincipal corporate trust office of JPMorgan Chase Bank, N.A., in the City of Baton Rouge, Louisiana, or any successorpaying agent (the “Paying Agent”), or any successor paying agent (the “Paying Agent”) to DTC, which will remit suchpayments in accordance with its normal procedures, as described herein. Interest on the Bonds is payable on March 1, 2012,and semiannually thereafter on March 1 and September 1 of each year. See “BOOK-ENTRY ONLY SYSTEM” herein.The Bonds maturing September 1, 2022, and thereafter, are callable for redemption by the Issuer in full or in part at anytime on or after September 1, 2021, and if less than a full maturity, then by lot within such maturity, at the principal amountthereof and accrued interest to the date fixed for redemption. Bonds are not required to be redeemed in inverse order ofmaturity.The Bonds and the Outstanding Parity Bonds (hereinafter defined) are secured by and payable solely from anirrevocable pledge and dedication of the Issuer’s one-half of one percent (1%) sales and use tax now being leviedand collected by the Issuer pursuant to an election held in the Issuer on May 3, 1997, and renewed on November 2,2010, subject only to the prior payment of the reasonable and necessary costs and expenses of collecting andadministering the tax. The Bonds are being issued for the purpose of constructing, improving and resurfacing public roadsand bridges in the Issuer, including incidental damage and acquiring equipment, and paying the costs of issuance of theBonds. The Bonds are being issued on a parity in all respects with the Issuer’s outstanding $615,000 Road ImprovementRefunding Bonds, Series ST-2003, maturing September 1, 2012 (the “Outstanding Parity Bonds”).MATURITY SCHEDULE(Base CUSIP No. ______)Due Interest Price Due Interest PriceSept. 1 Amount Rate or Yield CUSIPs Sep. 1 Amount Rate or Yield CUSIPs2013 $345,000 % % 2020 $465,000 % %2014 360,000 % % 2021 490,000 % %2015 375,000 % % 2022 510,000 % %2016 390,000 % % 2023 535,000 % %2017 410,000 % % 2024 555,000 % %2018 430,000 % % 2025 580,000 % %2019 445,000 % % 2026 610,000 % %The Bonds are offered subject to the approving opinion of Foley & Judell, L.L.P. It is expected that the Bonds will bedelivered in Baton Rouge, Louisiana, and will be available for delivery to DTC in New York, New York on or aboutDecember 15, 2011, against payment therefor.ELECTRONIC BIDS VIA PARITY® OR SEALED BIDS WILL BE RECEIVED BY THE PARISHPOLICE JURY OF THE PARISH OF POINTE COUPEE, STATE OF LOUISIANA, AT THE PARISHPOLICE JURY OFFICE, COURTHOUSE ANNEX, 160 E. MAIN STREET, NEW ROADS,LOUISIANA 70760, UNTIL:FIVE (5:00) O'CLOCK P.M., CENTRAL (LOUISIANA) TIMETUESDAY, NOVEMBER 8, 2011The date of this Official Statement is November __, 2011. This cover page contains information for quick reference only.It is not a summary of this issue. Investors must read the entire Official Statement to obtain information essential to themaking of an informed investment decision.CUSIP Numbers © Copyright 2011, American Bankers Association. CUSIP data herein is provided by Standard &Poor's, CUSIP Service Bureau, a division of The McGraw Hill Companies, Inc. The Issuer takes no responsibility for theaccuracy of the CUSIP numbers, which are included solely for the convenience of the owners of the Bonds.

NO DEALER, BROKER, SALESPERSON OR OTHER PERSON HAS BEEN AUTHORIZED BY THE PARISH POLICE JURY OF THEPARISH OF POINTE COUPEE, STATE OF LOUISIANA (THE “GOVERNING AUTHORITY”), THE GOVERNING AUTHORITY OF THEPARISH OF POINTE COUPEE, STATE OF LOUISIANA (THE “ISSUER”), TO GIVE ANY INFORMATION OR TO MAKE ANYREPRESENTATIONS WITH RESPECT TO THE OBLIGATIONS HEREIN DESCRIBED OTHER THAN THOSE CONTAINED IN THISOFFICIAL STATEMENT, AND IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATIONS MUST NOT BE RELIEDUPON AS HAVING BEEN AUTHORIZED BY THE GOVERNING AUTHORITY. THE INFORMATION SET FORTH HEREIN HAS BEENOBTAINED FROM SOURCES WHICH ARE BELIEVED TO BE RELIABLE BUT IS NOT GUARANTEED AS TO ACCURACY ORCOMPLETENESS. THE INFORMATION AND EXPRESSIONS OF OPINION HEREIN ARE SUBJECT TO CHANGE WITHOUT NOTICE,AND NEITHER THE DELIVERY OF THIS OFFICIAL STATEMENT NOR ANY SALE MADE HEREUNDER SHALL UNDER ANYCIRCUMSTANCES CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE ISSUER SINCETHE DATE HEREOF.THIS OFFICIAL STATEMENT IS BEING PROVIDED TO PROSPECTIVE PURCHASERS EITHER IN BOUND PRINTED FORM(“ORIGINAL BOUND FORMAT”) OR IN ELECTRONIC FORMAT ON THE FOLLOWING WEBSITE: http://www.i-dealprospectus.com.THIS OFFICIAL STATEMENT MAY BE RELIED UPON ONLY IF IT IS IN ITS ORIGINAL BOUND FORMAT OR AS PRINTED IN ITSENTIRETY DIRECTLY FROM SUCH WEBSITE.TABLE OF CONTENTSINTRODUCTION .................................... 1Security for the Bonds ................................. 1Purpose of Issue ...................................... 2THE BONDS ......................................... 2The Issue ........................................... 2Date of Issue......................................... 2Authority for Issue .................................... 2Average Life......................................... 2Form and Denomination ............................... 3Maturities; Interest Payment Dates ....................... 3Provisions Applicable if Book-Entry OnlySystem is Terminated ............................. 3General .......................................... 3Place of Payment ................................... 3Payment of Interest ................................. 3Provisions for Transfer, Registration and Assignment...... 4Redemption Provisions ................................ 4BOOK-ENTRY ONLY SYSTEM ..................... 4BIDDING INFORMATION .......................... 7Date of Sale ......................................... 7Hour of Sale ......................................... 7Place of Sale ......................................... 7Electronic Bids ....................................... 8Disclaimer .......................................... 8Electronic Bidding Procedures .......................... 8Sealed Paper Bids..................................... 9Bid Requirements..................................... 9Bond Insurance ...................................... 10Reoffering Prices .................................... 10Method of Award .................................... 11Delivery Date, Manner and Place ....................... 11CUSIP Numbers..................................... 11Additional Official Statements.......................... 12INFORMATION RELATING TO THE SALESAND USE TAX SECURING THE PAYMENT OFTHE BONDS AND THE OUTSTANDINGPARITY BONDS .................................. 12Authority for Levy of the Tax .......................... 12Description of the Tax ................................ 13Collection of the Tax ................................. 13Comparative Monthly Sales Tax Collections .............. 14Sales Tax <strong>Deal</strong>ers.................................... 14ESTIMATED COVERAGE .......................... 14SECURITY PROVISIONS ANDPROTECTIVE COVENANTS ....................... 15Pledge of Revenues .................................. 15Funds and Accounts .................................. 15Issuance of Additional Parity Bonds ..................... 17Reserve Fund Surety Bond ............................ 18ADDITIONAL PROVISIONS OF THEBOND ORDINANCE ............................... 19Bond Ordinance to Constitute Contract ................... 19Tax Covenants of the Issuer............................ 19Supplemental Ordinances ............................. 19Events of Default .................................... 20Defeasance ......................................... 21Continuation of Tax Levy ............................. 21TAX EXEMPTION .................................. 22Interest on Bonds .................................... 22State Taxes ......................................... 22Alternative Minimum Tax Consideration ................. 22General ............................................ 22Qualified Tax-Exempt Obligations (Bank Deductibility) ..... 23Tax Treatment of Original Issue Premium ................ 23Original Issue Discount ............................... 24Changes in Federal and State Tax Law ................... 24BOND RATING .................................... 24LEGAL MATTERS ................................. 25GOVERNING AUTHORITY ........................ 25CONTINUING DISCLOSURE ...................... 25ADDITIONAL INFORMATION ..................... 26CERTIFICATION AS TOOFFICIAL STATEMENT ........................... 26MISCELLANEOUS ................................. 26MAPSAppendix “A” - Notice of Bond SaleAppendix “B” - Financial and Statistical Data Relative tothe Parish of Pointe Coupee, State of LouisianaAppendix “C” - Audited Financial StatementsAppendix “D” - BudgetAppendix “E” - Debt StatementAppendix “F” - Estimated Annual Debt ServiceRequirementsAppendix “G” - Form of Legal OpinionAppendix “H” - Form of Continuing DisclosureCertificate

OFFICIALSPOINTE COUPEE PARISH, STATE OF LOUISIANAPOINTE COUPEE PARISH POLICE JURYMelanie Bueche, District 6, PresidentRussell Young, District 3, Vice PresidentAllen Monk, District 1John Pourciau, District 2Glenn Ray Cline, District 4Willie Olinde, District 5Albert Dukes, District 7Cornell Dukes, District 8Janet Vosburg, District 9Kurt Jarreau, District 10Joseph Bergeron, Sr., District 11Clifford Nelson, District 12PARISH ADMINISTRATOROwen “Jimmy” BelloSECRETARYGerrie MartinTREASURERRebecca L. MayeuxPARISH COUNSELJohn Wayne JewellBOND COUNSELFoley & Judell, L.L.P.

THIS PAGE INTENTIONALLYLEFT BLANK

PRELIMINARY OFFICIAL STATEMENT$6,500,000SALES TAX BONDS (ROAD IMPROVEMENT), SERIES 2011PARISH OF POINTE COUPEE, STATE OF LOUISIANAINTRODUCTIONThis Official Statement of the Parish of Pointe Coupee, State of Louisiana (the“Issuer” or the “Parish”) provides information with respect to the referenced bonds (the “Bonds”).This Official Statement contains summaries of certain provisions of the ordinance to be adopted bythe Parish Police Jury of the Parish of Pointe Coupee, State of Louisiana (the “GoverningAuthority”) on November 8, 2011, pursuant to which the Bonds are being issued (the “BondOrdinance”).The Parish is located within the central portion of the State of Louisiana (the “State”).The Parish has an area of approximately 557 square miles and a 2010 population of approximately22,802.Brief descriptions of the Parish, the Bonds, the Bond Ordinance, the Act (hereinafterdefined) and other proceedings described herein are contained in this Official Statement, andreference to such matters is qualified by reference to such entity, act, ordinance, or proceeding soreferred to or summarized.Additional information about the Parish is included in Appendix “B” hereto. Auditedfinancial statements of the Governing Authority appear in Appendix “C” hereto. The proposed formof opinion of Foley & Judell, L.L.P., is included in Appendix “G” hereto.Reference in this Official Statement to owner, holder, registered owner, Bondholderor Bondowner means the registered owner of the Bonds determined in accordance with the BondOrdinance.Security for the BondsMaps of the area are included before Appendix “A” hereto.The Bonds and the Outstanding Parity Bonds (hereinafter defined) are payable solelyfrom and secured by an irrevocable pledge and dedication of the Issuer’s one-half of one percent(1/2%) sales and use tax being levied and collected by the Issuer pursuant to an election held in theIssuer on May 3, 1997, and renewed in an election held in the Issuer on November 2, 2010 (the“Tax”), subject only to the prior payment of the reasonable and necessary costs and expenses of-1-

collecting and administering the Tax (the “Revenues of the Tax”). The Bonds are being issued ona parity in all respects with the Issuer’s outstanding $615,000 Road Improvement Refunding Bonds,Series ST-2003, dated January 1, 2003, maturing September 1, 2012 (the “Outstanding ParityBonds”), pursuant to an ordinance adopted by the Governing Authority on December 10, 2002, assupplemented and amended by an ordinance adopted on January 14, 2003 (the “Outstanding ParityBond Ordinance”). For additional information, see “SECURITY PROVISIONS AND PROTEC-TIVE COVENANTS” herein.The Bonds rank equally with and enjoy complete parity of lien with the OutstandingParity Bonds on the Revenues of the Tax, and the lien of the Owners of the Bonds and the Ownersof the Outstanding Parity Bonds on the Revenues of the Tax will be prior and superior to the lien onsuch Revenues of the Tax of any obligations hereafter issued and payable therefrom except paripassu additional obligations hereafter issued within the terms, limitations and restrictions containedin the Bond Ordinance and the Outstanding Parity Bond Ordinance. See “SECURITY PROVI-SIONS AND PROTECTIVE COVENANTS-Issuance of Additional Parity Bonds.”Purpose of IssueThe Bonds are being issued for the purpose of constructing, improving andresurfacing public roads and bridges within the Issuer including incidental drainage and acquiringequipment, and paying the costs of issuance of the Bonds.The IssueTHE BONDSSix Million Five Hundred Thousand Dollars ($6,500,000) of Sales Tax Bonds (RoadImprovement), Series 2011, of the Issuer are being issued.Date of IssueThe Bonds are dated as of the expected delivery date, which is anticipated to beDecember 15, 2011.Authority for IssueThe Bonds are authorized under the provisions of Sub-Part F, Part III, Chapter 4 ofTitle 39 of the Louisiana Revised Statutes of 1950, as amended (the “Act”), and other constitutionaland statutory authority.Average LifeThe average life of the Bonds is approximately 8.92 years from their dated date.-2-

Form and DenominationThe Bonds are initially issuable as fully registered bonds in “book-entry” only formand registered in the name of Cede & Co., as nominee of The Depository Trust Company, NewYork, New York (“DTC”). DTC will act as securities depository for the Bonds, and purchasers ofthe Bonds will not receive certificates representing their interest in the Bonds purchased. (See“BOOK-ENTRY ONLY SYSTEM.”) The Bonds are being issued in the denomination of FiveThousand Dollars ($5,000) or any integral multiple thereof within a single maturity.The winning bidder(s) (the “Purchaser”) at the time of the sale, however, may electto not receive book-entry only Bonds, in which case the Purchaser will receive one type written Bondper maturity, exchangeable in the manner provided in the Bond Ordinance.Maturities; Interest Payment DatesThe Bonds will mature on September 1 in the years and in the principal amountsindicated on the cover page of this Official Statement and will bear interest from the dated date ofthe Bonds, payable on March 1 and September 1 of each year, commencing March 1, 2012 (each an“Interest Payment Date”), at the rates per annum indicated on the cover page hereof. The Bondsshall bear interest from the date thereof or from the most recent Interest Payment Date to whichinterest has been paid or duly provided for.Provisions Applicable if Book-Entry Only System is TerminatedGeneral. Purchasers of Bonds will receive principal and interest payments, and maytransfer and exchange Bonds, pursuant to the following provisions only if the book-entry only systemis terminated. Otherwise, payments and transfers will be made only as described above under“Book-Entry Only System.”Place of Payment. Principal of the Bonds is payable at JPMorgan Chase Bank, N.A.,Baton Rouge, Louisiana, or any successor thereto (the “Paying Agent”).Payment of Interest. Upon discontinuation of the book-entry only system, intereston the Bonds will be payable by check mailed on or before the Interest Payment Date by the PayingAgent to the registered owner, determined as of the close of business on the 15th calendar day of themonth next preceding an Interest Payment Date, whether or not such day is a Business Day (the“Record Date”), at the address of such registered owner as it appears on the registration books of thePaying Agent.The person in whose name any Bond is registered at the close of business on theRecord Date with respect to an Interest Payment Date (unless such Bond has been called forredemption on a redemption date which is prior to such Interest Payment Date) shall be entitled toreceive the interest payable with respect to such Interest Payment Date notwithstanding thecancellation of such Bond upon any registration of transfer or exchange thereof subsequent to suchRecord Date and prior to such Interest Payment Date.-3-

Provisions for Transfer, Registration and Assignment. The Bonds may betransferred, registered and assigned only on the registration books of the Paying Agent, and suchregistration shall be at the expense of the Issuer. A Bond may be assigned by the execution of anassignment form on the Bonds or by other instruments of transfer and assignment acceptable to thePaying Agent. A new Bond or Bonds of the same series will be delivered by the Paying Agent tothe last assignee (the new registered owner) in exchange for such transferred and assigned Bondsafter receipt of the Bonds to be transferred in proper form. Such new Bond or Bonds must be in thedenomination of $5,000 or any integral multiple thereof within a single maturity. Neither the Issuernor the Paying Agent shall be required to issue, register the transfer of, or exchange any Bond duringa period beginning at the opening of business on the 15th day of the month next preceding an InterestPayment Date and ending at the close of business on the Interest Payment Date.Redemption ProvisionsThe Bonds maturing September 1, 2022, and thereafter, are callable for redemptionby the Issuer in full or in part at any time on or after September 1, 2021, and if less than a fullmaturity, then by lot within such maturity, at the principal amount thereof and accrued interest to thedate fixed for redemption.In the event a Bond to be redeemed is of a denomination larger than $5,000, a portionof such Bond ($5,000 or any multiple thereof) may be redeemed. Bonds are not required to beredeemed in inverse order of maturity. Official notice of such call of any of the Bonds forredemption shall be given by first class mail, postage prepaid, by notice deposited in the UnitedStates mails not less than thirty (30) days prior to the redemption date addressed to the registeredowner of each Bond to be redeemed at his address as shown on the registration books of the PayingAgent. The Issuer shall designate the maturities to be redeemed.BOOK-ENTRY ONLY SYSTEMThe Bonds initially will be issued solely in book-entry only form to be held in thesystem maintained by DTC. So long as such book-entry only system is used, only DTC will receiveor have the right to receive physical delivery of the Bonds and Beneficial Owners will not be or beconsidered to be, and will not have any rights as, owners or holders of the Bonds under the BondOrdinance.The following information about the book-entry only system applicable to the Bonds has been suppliedby DTC. The Issuer makes no representations, warranties or guarantees with respect to its accuracy or completeness.1. The Depository Trust Company (“DTC”), New York, NY, will act as securitiesdepository for the Bonds. The Bonds will be issued as fully-registered bonds registered in the nameof Cede & Co. (DTC’s partnership nominee) or such other name as may be requested by anauthorized representative of DTC. One fully-registered Bond will be issued for each maturity of theBonds, in the aggregate principal amount of such maturity, and will be deposited with DTC.-4-

2. DTC, the world’s largest securities depository, is a limited-purpose trust companyorganized under the New York Banking Law, a “banking organization” within the meaning of theNew York Banking Law, a member of the Federal Reserve System, a “clearing corporation” withinthe meaning of the New York Uniform Commercial Code, and a “clearing agency” registeredpursuant to the provisions of Section 17A of the Securities Exchange Act of 1934. DTC holds andprovides asset servicing for over 3.5 million issues of U.S. and non-U.S. equity issues, corporate andmunicipal debt issues, and money market instruments (from over 100 countries) that DTC’sparticipants (“Direct Participants”) deposit with DTC. DTC also facilitates the post-trade settlementamong Direct Participants of sales and other securities transactions in deposited securities, throughelectronic computerized book-entry transfers and pledges between Direct Participants’ accounts.This eliminates the need for physical movement of securities certificates. Direct Participants includeboth U.S. and non-U.S. securities brokers and dealers, banks, trust companies, clearing corporations,and certain other organizations. DTC is a wholly-owned subsidiary of The Depository Trust &Clearing Corporation (“DTCC”). DTCC is the holding company for DTC, National SecuritiesClearing Corporation and Fixed Income Clearing Corporation, all of which are registered clearingagencies. DTCC is owned by the users of its regulated subsidiaries. Access to the DTC system isalso available to others such as both U.S. and non-U.S. securities brokers and dealers, banks, trustcompanies, and clearing corporations that clear through or maintain a custodial relationship with aDirect Participant, either directly or indirectly (“Indirect Participants”). DTC has a Standard &Poor’s rating of AA+. The DTC Rules applicable to its Participants are on file with the Securitiesand Exchange Commission. More information about DTC can be found at www.dtcc.com.3. Purchases of the Bonds under the DTC system must be made by or through DirectParticipants, which will receive a credit for the Bonds on DTC’s records. The ownership interestof each actual purchaser of each Bond (“Beneficial Owner”) is in turn to be recorded on the Directand Indirect Participants’ records. Beneficial Owners will not receive written confirmation fromDTC of their purchase. Beneficial Owners are, however, expected to receive written confirmationsproviding details of the transaction, as well as periodic statements of their holdings, from the Director Indirect Participant through which the Beneficial Owner entered into the transaction. Transfersof ownership interests in the Bonds are to be accomplished by entries made on the books of Directand Indirect Participants acting on behalf of Beneficial Owners. Beneficial Owners will not receivecertificates representing their ownership interests in Bonds, except in the event that use of thebook-entry system for the Bonds is discontinued.4. To facilitate subsequent transfers, all Bonds deposited by Direct Participants withDTC are registered in the name of DTC’s partnership nominee, Cede & Co., or such other name asmay be requested by an authorized representative of DTC. The deposit of Bonds with DTC and theirregistration in the name of Cede & Co. or such other DTC nominee do not effect any change inbeneficial ownership. DTC has no knowledge of the actual Beneficial Owners of the Bonds; DTC’srecords reflect only the identity of the Direct Participants to whose accounts such Bonds are credited,which may or may not be the Beneficial Owners. The Direct and Indirect Participants will remainresponsible for keeping account of their holdings on behalf of their customers.-5-

5. Conveyance of notices and other communications by DTC to Direct Participants, byDirect Participants to Indirect Participants, and by Direct Participants and Indirect Participants toBeneficial Owners will be governed by arrangements among them, subject to any statutory orregulatory requirements as may be in effect from time to time. Beneficial Owners of Bonds maywish to take certain steps to augment the transmission to them of notices of significant events withrespect to the Bonds, such as redemptions, tenders, defaults, and proposed amendments to the Bonddocuments. For example, Beneficial Owners of Bonds may wish to ascertain that the nomineeholding the Bonds for their benefit has agreed to obtain and transmit notices to Beneficial Owners.In the alternative, Beneficial Owners may wish to provide their names and addresses to the registrarand request that copies of notices be provided directly to them.6. Redemption notices shall be sent to DTC. If less than all of the Bonds within an issueare being redeemed, DTC’s practice is to determine by lot the amount of the interest of each DirectParticipant in such issue to be redeemed.7. Neither DTC nor Cede & Co. (nor any other DTC nominee) will consent or vote withrespect to Bonds unless authorized by a Direct Participant in accordance with DTC’s MMIProcedures. Under its usual procedures, DTC mails an Omnibus Proxy to the Issuer as soon aspossible after the record date. The Omnibus Proxy assigns C ede & Co.’ s consenting or voting rightsto those Direct Participants to whose accounts Bonds are credited on the record date (identified ina listing attached to the Omnibus Proxy).8. Redemption proceeds, distributions, and dividend payments on the Bonds will bemade to Cede & Co., or such other nominee as may be requested by an authorized representative ofDTC. DTC’s practice is to credit Direct Participants’ accounts upon DTC’s receipt of funds andcorresponding detail information from the Issuer or Paying Agent, on payable date in accordancewith their respective holdings shown on DTC’s records. Payments by Participants to BeneficialOwners will be governed by standing instructions and customary practices, as is the case withsecurities held for the accounts of customers in bearer form or registered in “street name,” and willbe the responsibility of such Participant and not of DTC, Paying Agent, or the Issuer, subject to anystatutory or regulatory requirements as may be in effect from time to time. Payment of redemptionproceeds, distributions, and dividend payments to Cede & Co. (or such other nominee as may berequested by an authorized representative of DTC) is the responsibility of the Issuer or PayingAgent, disbursement of such payments to Direct Participants will be the responsibility of DTC, anddisbursement of such payments to the Beneficial Owners will be the responsibility of Direct andIndirect Participants.9. DTC may discontinue providing its services as depository with respect to the Bondsat any time by giving reasonable notice to the Issuer or Paying Agent. Under such circumstances,in the event that a successor depository is not obtained, the Bonds are required to be printed anddelivered.10. The Issuer may decide to discontinue use of the system of book-entry only transfersthrough DTC (or a successor securities depository). In that event, Bonds will be printed anddelivered to DTC.-6-

11. The information in this section concerning DTC and DTC’s book-entry system hasbeen obtained from sources that the Issuer believes to be reliable, but the Issuer takes noresponsibility for the accuracy thereof.THE ISSUER CANNOT AND DOES NOT GIVE ANY ASSURANCES THAT THEDTC PARTICIPANTS OR THE INDIRECT PARTICIPANTS WILL DISTRIBUTE TO THEBENEFICIAL OWNERS OF THE BONDS (i) PAYMENTS OF PRINCIPAL OF OR INTERESTAND PREMIUM, IF ANY, ON THE BONDS; (ii) CONFIRMATION OF BENEFICIALOWNERSHIP INTERESTS IN BONDS; OR (iii) REDEMPTION OR OTHER NOTICES SENTTO DTC OR CEDE & CO., ITS NOMINEE, AS THE REGISTERED OWNERS OF THE BONDS,OR THAT THEY WILL DO SO ON A TIMELY BASIS OR THAT DTC, DTC PARTICIPANTSOR INDIRECT PARTICIPANTS WILL SERVE AND ACT IN THE MANNER DESCRIBED INTHIS OFFICIAL STATEMENT. THE CURRENT “RULES” APPLICABLE TO DTC ARE ONFILE WITH THE SECURITIES AND EXCHANGE COMMISSION AND THE CURRENT“PROCEDURES” OF DTC TO BE FOLLOWED IN DEALING WITH DTC PARTICIPANTS AREON FILE WITH DTC.NEITHER THE ISSUER NOR THE PAYING AGENT WILL HAVE ANYRESPONSIBILITY OR OBLIGATIONS TO SUCH DTC PARTICIPANTS OR THE BENEFICIALOWNERS WITH RESPECT TO (1) THE ACCURACY OF ANY RECORDS MAINTAINED BYDTC OR ANY DTC PARTICIPANT; (2) THE PAYMENT BY ANY DTC PARTICIPANT OFANY AMOUNT DUE TO ANY BENEFICIAL OWNER IN RESPECT OF THE PRINCIPALAMOUNT OR INTEREST OR PREMIUM, IF ANY, ON THE BONDS; (3) THE DELIVERY BYANY DTC PARTICIPANT OF ANY NOTICE TO ANY BENEFICIAL OWNER WHICH ISREQUIRED OR PERMITTED UNDER THE TERMS OF THE BOND ORDINANCE TO BEGIVEN TO BONDHOLDERS; (4) THE SELECTION OF THE BENEFICIAL OWNERS TORECEIVE PAYMENT IN THE EVENT OF ANY PARTIAL REDEMPTION OF THE BONDS;OR (5) ANY CONSENT GIVEN OR OTHER ACTION TAKEN BY DTC AS BONDHOLDER.Date of SaleHour of SalePlace of SaleTuesday, November 8, 2011.BIDDING INFORMATIONFive (5:00) o’clock p.m., Central (Louisiana) Time.Parish Police Jury Office, Couthouse Annex, 160 E. Main Street, New Roads,Louisiana 70760, telephone 225-638-9556.-7-

Electronic BidsElectronic bids will be received for the Bonds via PARITY®, in the manner describedbelow, until five (5:00) o’clock p.m., Louisiana time, on Tuesday, November 8, 2011.Bids may be submitted electronically via PARITY® pursuant to the Official Noticeof Bond Sale (see Appendix “A” hereto) until five (5:00) o’clock p.m., local Louisiana time, but nobid will be received after the time for receiving bids specified above. To the extent any instructionsor directions set forth in PARITY® conflict with the Official Notice of Bond Sale, the terms of theOfficial Notice of Bond Sale shall control. For further information about PARITY®, potentialbidders may contact PARITY® at (212) 849-5021.DisclaimerEach prospective electronic bidder shall be solely responsible to register to bid viaPARITY® as described above. Each qualified prospective electronic bidder shall be solelyresponsible to make necessary arrangements to access PARITY® for the purposes of submitting itsbid in a timely manner and in compliance with the requirements of the Notice of Sale. Neither theIssuer nor PARITY®, shall have any duty or obligation to provide or assure access to PARITY® toany prospective bidder, and neither the Issuer nor PARITY® shall be responsible for a bidder'sfailure to register to bid or for proper operation of, or have any liability for any delays orinterruptions of, or any damages caused by, PARITY®. The Issuer is using PARITY® as acommunication mechanism, and not as the Issuer's agent, to conduct the electronic bidding for theBonds. No other form of electronic bid or provider of electronic bidding services will be accepted.The Issuer is not bound by any advice and determination of PARITY® to the effect that anyparticular bid complies with the terms of this Official Notice of Bond Sale and in particular the “BidRequirements” hereinafter set forth. All costs and expenses incurred by prospective bidders inconnection with their registration and submission of bids via PARITY® are the sole responsibilityof the bidders; and the Issuer is not responsible, directly or indirectly, for any of such costs orexpenses. If a prospective bidder encounters any difficulty in submitting, modifying or withdrawinga bid for the Bonds, he should telephone PARITY® at (212) 849-5021 and notify the Issuer’s BondCounsel, Foley & Judell, L.L.P. at (504) 568-1249.Electronic Bidding ProceduresElectronic bids must be submitted for the purchase of the Bonds via PARITY®. Bidswill be communicated electronically to the Issuer at five (5:00) o’clock p.m., local Louisiana time,on November 8, 2011. Prior to that time, a prospective bidder may (1) submit the proposed termsof its bid via PARITY®, (2) modify the proposed terms of its bid, in which event the proposed termsas last modified will (unless the bid is withdrawn as described herein) constitute its bid for theBonds, or (3) withdraw its proposed bid. Once the bids are communicated electronically viaPARITY® to the Issuer, each bid will constitute an irrevocable offer to purchase the Bonds on theterms therein provided. For purposes of the electronic bidding process, the time as maintained onPARITY® shall constitute the official time.-8-

Sealed Paper BidsBids will also be accepted in written form on the Official Bid Form. Each sealedpaper bid must be in written form on the Official Bid Form in a sealed enveloped marked “Proposalfor the Purchase of $6,500,000 of Sales Tax Bonds (Road Improvement), Series 2011, of the Parishof Pointe Coupee.” For purposes of accepting written bids, the time as maintained on PARITY®shall constitute the official time.Bid RequirementsEach bid, whether submitted as a sealed bid or electronically (i) shall be for the fullprincipal amount of the Bonds, (ii) shall name the rate or rates of interest to be borne by the Bonds,(iii) shall prescribe one rate of interest, not to exceed seven per centum (7%) per annum, for theBonds of any one maturity, (iv) shall limit the interest due on each Bond for each interest period toa single rate, (v) shall be unconditional, (vi) in the case of sealed bids, shall be made on the formfurnished by the Issuer, without alteration, omission or qualification, and (vii) shall be subject to theterms, conditions and restrictions set forth in this Official Statement. No bids providing foradditional or supplemental interest will be considered.No bid for less than par or which specifies the cancellation of Bonds will beconsidered. Any premium bid must be paid in the funds specified for the payment of Bonds as partof the purchase price.In the event a bid for the Bonds is accepted, the acceptance of such bid shall besubject to the receipt of a good faith deposit (the “Deposit”) by wire transfer to the Issuer in theamount of one percent (1%) of the principal amount of the Bonds ($65,000) by 3:30 o’clock p.m.,on the day following the sale.Wiring instructions (account where Deposit should be sent) are:Bank: Regions BankCredit to: Pointe Coupee Police JuryOperating AccountABA# 065403626 Account# 4305011817Bank Contact: Jennifer Hill Telephone: 225-618-7221In the event the wire fund transfer is not received by the date and time set forth above,the acceptance and award of the bid for the Bonds shall be void. No other Deposit, by check orotherwise, is required in connection with a bid for the Bonds. The Deposit of the Purchaser will bedeposited and the proceeds credited against the purchase price of the Bonds, or in the case of neglector refusal to comply with such bid, will be forfeited to the Issuer as and for liquidated damages. Nointerest will be allowed on the amount of the Deposit.-9-

The Purchaser, by execution of the official bid form, will agree to provide the FinalOfficial Statement (with any required forms) to the Municipal Securities Rulemaking Board (the“MSRB”) or its designee in a manner sufficient to comply with MSRB Rule G-36. The Purchaseragrees to comply with all applicable provisions of S.E.C. Rule 15c2-12 and MSRB Rule G-36.The Bonds will be issued initially as one bond for each maturity, in the respectivedenominations of each annual maturity.Bidders are asked to indicate the total interest (less the amount of any premiumoffered) and the true interest cost on each official bid form in the spaces provided for that purpose,but their failure to do so will not invalidate their bids.The legal opinion, printed Bonds and transcript of record as passed upon will befurnished the Purchaser without cost to said Purchaser.Bond InsuranceIf the Bonds qualify for issuance of any policy of municipal bond insurance orcommitment therefor at the option of a bidder, the purchase of any such insurance policy or theissuance of any such commitment therefor shall be at the sole option and expense of such bidder andany increased costs of issuance of the Bonds resulting by reason of the same shall be paid by suchbidder. Any failure of the Bonds to be so insured or of any such policy of insurance to be issuedshall not constitute cause for a failure or refusal by the Purchaser of the Bonds to accept delivery ofand pay for Bonds in accordance with the terms of the purchase contract. The companies whichinsure Bonds may have been furnished information in addition to the information included in thisOfficial Statement. In the event the Bonds qualify and are sold with insurance, a free copy of thetranscript may be furnished to such insurance provider and additional copies of said transcript maybe furnished to such insurance provider at a cost not to exceed fifteen cents per page. As of the dateof this Official Statement no action has been officially taken regarding the qualification of the Bondsfor insurance.Reoffering PricesAs soon as practical after award of the Bonds to the Purchaser, but in any case no laterthan 2:00 p.m. Louisiana time on the third business day after the date of sale, the Purchaser shallfurnish to the Issuer a certificate acceptable to Bond Counsel to the Issuer stating (i) either, (A) inthe case of Bonds that the Purchaser intends to reoffer, the reoffering prices, expressed as apercentage of par, to the public of each maturity of the Bonds (the “Reoffering Prices”) or (B) thespecific Bonds that the Purchaser intends to retain; (ii) that, in the case of Bonds described in (i)(A),the Purchaser has made a bona fide public offering of the Bonds at the Reoffering Prices; (iii) thata substantial amount of the Bonds have been sold or were reasonably expected to be sold to thepublic (excluding bond houses, brokers and other intermediaries) at such Reoffering Prices; and(iv) that, at the time that the Purchaser submitted its bid, based upon prevailing market conditions,the Purchaser had no reason to believe that any of the Bonds would be initially sold to the public(excluding bond houses, brokers or similar persons or organizations acting in the capacity of-10-

underwriters or wholesalers) at initial offering prices greater than the Reoffering Prices representedin (i)(A). Bond Counsel to the Issuer advises that (i) such certificate must be made on the bestknowledge, information and belief of the Purchaser; (ii) the sale to the public of 10% or more in paramount of the Bonds of each maturity at (or below) the Reoffering Prices would be sufficient tocertify as to the sale of a substantial amount of the Bonds; and (iii) reliance on other facts as a basisfor such certification would require evaluation by Bond Counsel to the Issuer to assure compliancewith the statutory requirement to avoid the establishment of an artificial price for the Bonds.Method of AwardThe Bonds will be awarded to the bidder(s) whose bid offers the lowest “trueinterest cost” to the Issuer for the full amount of such Bonds, to be determined by doubling thesemiannual interest rate (compounded semiannually) necessary to discount the debt service paymentson such Bonds from their payment dates to the date of delivery, such that the sum of such presentvalues is equal to the price bid, including any premium bid but not including interest accrued to thedate of delivery (the preceding calculation is sometimes referred to as the “Canadian Interest CostMethod” or “Present Value Method”). In the case of a tie bid, the winning bid will be awarded bylot. If any bid for the Bonds shall be acceptable, a prompt award of the Bonds will be made. Theright is expressly reserved to waive any irregularity in any bid or to reject any and all bids received.Delivery Date, Manner and PlaceThe Bonds will be delivered at the Baton Rouge office of Bond Counsel on or aboutDecember 15, 2011, but the Purchaser is obligated to accept delivery at any time within sixty (60)days from the date of the sale in the event of the immediate acceptance by the Issuer of any bidsubmitted. If due to litigation the Bonds cannot be tendered to the Purchaser within the said sixty(60) day period in accordance with the terms of the sale, the Purchaser will have the option for sixty(60) days thereafter to cancel the sale and to request the return of his good faith deposit. If the Bondscannot be delivered to the Purchaser within the latter sixty (60) day period due to said litigation,thereafter either party will have the option to cancel the sale. Payment of the bid price plus accruedinterest to the date of delivery shall be made in federal funds payable to the Issuer.CUSIP NumbersIt is anticipated that the American Bankers’ Association Committee on UniformSecurity Identification Procedures (CUSIP) identification numbers will be printed on the Bonds.The Bonds will be numbered from R-1 upwards. Neither the failure to print such numbers or anyBond nor error with respect thereto shall constitute cause for a failure or refusal by the Purchaserthereof to accept delivery of and pay for the Bonds in accordance with the terms of the purchasecontract. All expenses in relation to printing of CUSIP numbers on the Bonds shall be paid by theIssuer; provided, however, that the fee of the CUSIP Service Bureau for the assignment of saidnumbers shall be the responsibility of and shall be paid for by the Purchaser.-11-

Additional Official StatementsAny dealer, broker, salesperson or other persons interested in bidding on theobligations herein described may receive additional copies of this Preliminary Official Statementprior to the date of sales upon request to Bond Counsel at the address indicated in the ADDITIONALINFORMATION section of this Preliminary Official Statement.The Purchaser will be furnished a reasonable number of final official statements onor before the seventh business day following the sale date of the Bonds.INFORMATION RELATING TO THE SALES ANDUSE TAX SECURING THE PAYMENT OF THE BONDSAND THE OUTSTANDING PARITY BONDSAuthority for Levy of the TaxThe Tax securing the Bonds and the Outstanding Parity Bonds, was authorized at anelection held in the Issuer on May 3, 1997 and renewed in an election held in the Issuer on November2, 2010, as per the following proposition:PROPOSITION (SALES & USE TAX RENEWAL)SUMMARY: RENEWAL OF A ½% SALES AND USE TAX FOR 15 YEARS FOR THE PURPOSEOF CONSTRUCTING, IMPROVING AND RESURFACING THE PUBLIC ROADS ANDBRIDGES IN THE PARISH OF POINTE COUPEE, WITH THE PROCEEDS OF THE TAX TOBE SUBJECT TO FUNDING INTO BONDS.Shall the Pointe Coupee Parish governing authority, under the provisions of Article VI, Section 29 ofthe Constitution of the State of Louisiana of 1974, Section 2721.6 of Title 33 of the Louisiana RevisedStatutes of 1950, as amended, and other constitutional and statutory authority, be authorized tocontinue to levy and collect, a tax of one-half of one percent (½%) (the “Tax”) (the estimated amountreasonably expected to be collected from the levy of said tax for one entire year being $1,700,000.00)upon the sale at retail, the use, the lease or rental, the consumption and the storage for use orconsumption, of tangible personal property and on sales of services in the Parish of Pointe Coupee (the“Parish”), all as defined by law, for a period of fifteen (15) years from the scheduled expiration dateof the current sales and use tax approved by the voters on May 3, 1997, the proceeds of the Tax (afterpaying the reasonable and necessary costs and expenses of collecting and administering the Tax) tobe used for the purpose of constructing, improving and resurfacing public roads and bridges in theParish, including incidental drainage and acquiring equipment therefor, and shall the governingauthority be authorized to fund the proceeds of the Tax into bonds from time to time for such purposeto the extent and in the manner permitted by the laws of Louisiana, including particularly Subpart F,Part III, Chapter 4, Title 39 of the Louisiana Revised Statutes of 1950, as amended?-12-

Description of the TaxIn compliance with the aforesaid statutes and election, the Issuer adopted on May 13,1997 and October 11, 2011, an ordinance levying within the Parish a tax of one-half of one percent(1/2%), initially effective July 1, 1997 (the “Tax Ordinance”). A copy of the Tax Ordinance levyingthe Issuer’s one-half of one percent (1/2%) sales and use tax described herein is available uponrequest from either Foley & Judell, L.L.P., Suite 2600, One Canal Place, 365 Canal Street, NewOrleans, Louisiana 70130-1138, telephone 504-568-1249.The following is a summary of the additional sales and use taxes being levied andcollected within the boundaries of the Parish:Taxing Body Election Rate EffectiveParish 5/03/97; 11/02/10 ½% 7/01/97Parish 9/19/84 1% 10/01/85Hospital 7/28/87; 11/07/06 ¼% 9/01/87School Board 9/30/67 1% 11/01/67School Board 11/20/99 1% 4/01/00Municipalities 09/1972*1% 10/01/72Fire District 4/02/05 ¼% 7/01/05State of Louisiana 4%9%* Not levied in the unincorporated area of the Parish.(The proceeds of these additional taxes (other than the Revenues of the Tax), are not pledged to secure thepayment of the Bonds or the Outstanding Parity Bonds.)Collection of the TaxThe Tax Ordinance providing for the levy and collection of the Tax requires thedealer to collect the Tax from the purchaser or consumer. Each dealer is required to file Each dealeris required to file with the Pointe Coupee Parish Sales & Use Tax Department (the “Director”) aregistration certificate in return for which the dealer is assigned a registration number and issued athcertificate of authority empowering him to collect the Tax. On or before the 20 day of each month,it is the duty of each dealer to transmit to the Director a complete report of sales and taxes collectedduring the preceding month and also to remit to the Director the amount of the Tax due for sales inthe preceding month. The Director also collects other sales and use taxes as described above.contact:For additional information regarding the collection procedures of the Tax, pleaseMs. Ronell Robique, DirectorSales Tax DepartmentPointe Coupee ParishP. O. Box 290New Road, Louisiana 70760Telephone (225) 638-5538-13-

Comparative Monthly Sales Tax CollectionsMonthly collections of the Tax received by the Issuer are shown below for thecalendar years indicated, viz:Month 2006 2007 2008 2009 2010 2011January $146,542 $140,787 $223,047 $170,391 $161,969 $148,345February 118,983 106,959 128,795 127,172 139,805 98,927March 101,163 114,345 134,726 126,084 100,637 106,408April 149,855 150,646 153,909 142,839 123,498 121,792May 129,053 147,064 134,321 123,186 141,864 104,262June 153,888 145,885 123,400 105,760 104,687 108,208July 151,575 169,711 153,579 202,852 135,511 136,609August 127,488 128,475 142,474 115,676 100,878 102,798September 149,346 130,514 113,785 116,907 111,836 --October 163,247 141,529 148,992 139,821 129,011 --November 121,834 139,595 128,250 130,090 124,021 --December 124,102 132,705 133,552 105,180 107,672 --$1,637,076 $1,648,215 $1,718,830 $1,605,958 $1,481,389 $927,349Source: Parish Sales Tax Department. Figures unaudited.Sales Tax <strong>Deal</strong>ersThe ten largest sales tax dealers located in the Issuer follow.Name of BusinessType of Business1. Wal-Mart Grocery2. Louisiana Generating LLC Power Plant3. Winn-Dixie Grocery4. Alma Plantation Sugar Mill5. Progressive Tractor Co. Inc. Tractor <strong>Deal</strong>ership6. Soprano’s Superstore Grocery7. Miller-Penniman Co. LLC Tractor <strong>Deal</strong>ership8. Family Dollar Discount Retail9. Dolgencorp, LLC (Dollar General) Discount Retail10. McDonald’s RestaurantSource: Parish Sales Tax Department.The largest sales tax dealers provided approximately 80% of the 2010 total sales and usetaxes collected in the Issuer.ESTIMATED COVERAGEThe highest estimated debt service requirements on the Bonds and the Outstanding ParityBonds is the sum of $846,370 for the fiscal year ending December 31, 2012. The Revenues of the Tax wereapproximately $1,481,389 for the fiscal year ended December 31, 2010. This amount will provide a coverageof approximately 1.75 times the estimated maximum debt service requirements on the Bonds and theOutstanding Parity Bonds in any future fiscal year. (For additional information, see Appendix “F” herein.)-14-

Pledge of RevenuesSECURITY PROVISIONS AND PROTECTIVE COVENANTSThe Bonds, equally with the Outstanding Parity Bonds are payable from and secured byan irrevocable pledge and dedication of the Net Revenues of the Tax. The Revenues of the Tax are herebyirrevocably and irreparably pledged and dedicated in an amount sufficient for the payment of the Bonds andthe Outstanding Parity Bonds in principal, and interest as they shall respectively become due and payable, andfor the other purposes hereinafter set forth in the Bond Ordinance. All of the Revenues of the Tax shall beset aside in a separate fund, as provided in the Outstanding Parity Bond Ordinance and as provided in theBond Ordinance, and shall remain pledged for the security and payment of the Bonds, the Outstanding ParityBonds and any additional parity bonds, in principal, and interest, and for all other payments provided for inthe Bond Ordinance until the Bonds and the Outstanding Parity Bonds shall have been fully paid anddischarged.The Bonds are hereby issued on a parity with the Outstanding Parity Bonds, and the Bondsshall rank equally with and shall enjoy complete parity of lien with the Outstanding Parity Bonds on all of theRevenues of the Tax or other funds specially applicable to the payment of the Outstanding Parity Bonds,including funds established by the Outstanding Parity Bond Ordinance. A complete description of the Tax,the method of collecting the same and the anticipated proceeds which will be available to service the Bondsand the Outstanding Parity Bonds is contained in this Official Statement under the section entitled“INFORMATION RELATING TO THE SALES AND USE TAX SECURING THE PAYMENT OF THEBONDS AND THE OUTSTANDING PARITY BONDS.”The Issuer is obligated to levy and collect the Tax in anticipation of which the Bonds arebeing issued and until all of the Bonds and the Outstanding Parity Bonds payable therefrom have been retiredas to both principal and interest, and the Issuer may not discontinue or decrease or permit the same to bediscontinued or decreased or in any way make any changes which would diminish the amount of Revenuesof the Tax to be received by the Issuer and pledged for payment of the Bonds and the Outstanding ParityBonds.Funds and AccountsThe Issuer, through its Governing Authority, by proper resolutions and/or ordinances,hereby obligates itself to continue to levy and collect the Tax until all of the Bonds and the Outstanding ParityBonds have been retired as to principal, interest and redemption premium, if any, and further obligates itselfnot to discontinue or decrease or permit to be discontinued or decreased the Tax in anticipation of thecollection of which the Bonds and the Outstanding Parity Bonds have been issued, nor in any way make anychange which would diminish the amount of the Revenues of the Tax to be received by the Issuer until all ofthe Bonds and the Outstanding Parity Bonds have been paid as to both principal and interest. In order thatthe principal of and the interest on the Bonds and the Outstanding Parity Bonds will be paid in accordancewith their terms and for the other objects and purposes hereinafter provided, the Issuer further covenants asfollows, that:All of the avails or proceeds of the Revenues of the Tax shall be deposited daily as thesame may be collected in the separate and special existing bank account maintained with the regularlydesignated fiscal agent of the Issuer and designated as the “Sales Tax Bond Reserve Fund” (hereafter called-15-

the “Sales Tax Fund”). The Sales Tax Fund shall constitute a dedicated fund of the Issuer, from whichappropriations and expenditures by the Issuer shall be made solely for the purposes designated in theproposition authorizing the levy of the Tax, including the payment of the Bonds and the Outstanding ParityBonds.Out of the funds on deposit in the Sales Tax Fund, the Issuer shall first pay (if notpreviously withheld by the Parish Sales Tax Collector) its portion of the reasonable and necessary expensesof collection and administration of the Tax. After payment of such expenses, the remaining balance of theRevenues of the Tax shall constitute a dedicated fund of the Issuer, from which appropriations andexpenditures by the Issuer shall be made solely for the purposes designated in the proposition authorizing thelevy of the Tax, including the payment of the Bonds and the Outstanding Parity Bonds, which fund shall beadminister and use in the following order of priority and for the following express purposes:(a) The maintenance of a Sales Tax Bond Sinking Fund (the “Sinking Fund”),established pursuant to the Outstanding Parity Bond Ordinance and continued in the BondOrdinance, sufficient in amount to pay promptly and fully the principal of and interest onthe Bonds and the Outstanding Parity Bonds, including any additional parity bonds issuedhereafter in the manner provided by the Bond Ordinance, as they severally become dueand payable, by transferring from the Sales Tax Fund to the regularly designated fiscalthagent bank of the Issuer, on or before the 20 day of each month while any of the Bondsare outstanding, a sum equal to one-sixth (1/6) of the interest due on the next InterestPayment Date and a sum equal to one-twelfth (1/12) of the principal falling due on thenext principal payment date on all bonds payable from the Sinking Fund, together withsuch additional proportionate sum as may be required to pay said principal and interestas the same respectively become due. Said fiscal agent shall transfer from the SinkingFund to the paying agent bank or banks for all bonds payable from the Sinking Fund, atleast three (3) days in advance of the date on which payment of principal or interest fallsdue, funds fully sufficient to pay promptly the principal and interest so falling due on suchdate.(b) The maintenance of a Sales Tax Bond Reserve Fund (the “Reserve Fund”),established pursuant to the Outstanding Parity Bond Ordinance, by depositing or retainingin the Reserve Fund from monies now on deposit therein, a sum equal to the ReserveFund Requirement (hereinafter defined), the money in the Reserve Fund to be retainedsolely for the purpose of paying the principal of and the interest on the Bonds payablefrom the aforesaid Sinking Fund as to which there would otherwise be default. In theevent that additional parity bonds are issued hereafter in the manner provided by the BondOrdinance, there shall be transferred from the proceeds of such additional bonds and/orfrom the said Sales Tax Fund into the Reserve Fund monthly or annually, such amounts(as may be designated in the ordinance authorizing the issuance of such additional paritybonds) as will increase the total amount on deposit in the Reserve Fund within a periodnot exceeding five (5) years to a sum equal to the Reserve Fund Requirement for alloutstanding bonds payable from the Sinking Fund and any such additional pari passubonds.-16-

If at any time it shall be necessary to use monies in the Reserve Fund for the purpose ofpaying principal or interest on bonds payable from the Sinking Fund as to which there would otherwise bedefault, then the monies so used shall be replaced from the revenues first thereafter received from theRevenues of the Tax not hereinabove required to pay the expenses of collecting the Tax or to pay currentprincipal and interest requirements, it being the intention hereof that there shall as nearly as possible be at alltime in the Reserve Fund an amount equal to the Reserve Fund Requirement."Reserve Fund Requirement" means, as of any date, the lesser of (i) 10% of the proceeds of the Bondsand any issue of additional bonds payable from the Tax or (ii) the maximum principal and interest requirements in any succeedingbond year (ending September 1) on the Bonds and any issue of additional pari passu bonds payable from the Tax.Notwithstanding the foregoing, on the first day on which no Outstanding Parity Bonds remain outstanding (pursuant to the termsof the Outstanding Parity Bond Ordinance) and thereafter, “Reserve Fund Requirement” shall mean, as of any date ofcalculation, a sum equal to the lesser of (i) 10% of the proceeds of the Bonds, the Outstanding Parity Bonds and any issue ofadditional pari passu bonds payable from the Revenues of the Tax, (ii) the highest combined principal and interest requirementsfor any succeeding bond year on the Bonds, the Outstanding Parity Bonds, and any issue of pari passu bonds payable from theRevenues of the Tax, or (iii) 125% of the average aggregate amount of principal installments and interest becoming due in anycalendar year on the Bonds, the Outstanding Parity Bonds, and any issue of additional parity bonds payable from the Revenuesof the Tax.Issuance of Additional Parity BondsThe Bonds and the Outstanding Parity Bonds shall enjoy complete parity of lien on theRevenues of the Tax despite the fact that any of the Bonds may be delivered at an earlier date than any otherof the Bonds. The Issuer shall issue no other bonds or obligations of any kind or nature payable from orenjoying a lien on the Revenues of the Tax having priority over or parity with the Bonds and the OutstandingParity Bonds, except that bonds may hereafter be issued on a parity with the Bonds and the Outstanding ParityBonds under the following conditions:(a) The Bonds, or any part thereof, including interest thereon, may be refunded and therefunding bonds so issued shall enjoy complete equality of lien with the portion of the Bonds which is notrefunded, if there be any, and the refunding bonds shall continue to enjoy whatever priority of lien oversubsequent issues which may have been enjoyed by the Bonds refunded; provided, however, that if only aportion of the Bonds outstanding is so refunded and the refunding bonds require total principal and interestpayments during any bond year in excess of the principal and interest which would have been required in suchbond year to pay the Bonds refunded thereby, then such Bonds may not be refunded without consent of theOwners of the unrefunded portion of the Bonds, the Outstanding Parity Bonds and any additional parity bondsissued hereunder (provided such consent shall not be required if such refunding bonds meet the requirementsset forth in (b)(ii) below.(b)Additional parity bonds may also be issued if all of the following conditions are met:(i) The average annual Revenues of the Tax when computed for the two (2) completedcalendar years immediately preceding the issuance of the additional bonds must have beennot less than 1.35 times the highest combined principal and interest requirements for anysucceeding period on all bonds then outstanding, and payable from the Sinking Fund,including any additional parity bonds theretofore issued and then outstanding and any-17-

Reserve Fund Surety Bondother bonds or other obligations whatsoever then outstanding which are payable from theRevenues of the Tax (but not including bonds which have been refunded or provisionotherwise made for their full and complete payment and redemption) and the bonds soproposed to be issued.(ii) The payments to be made into the various funds provided for in the Bond Ordinancemust be current.(iii) The existence of the facts required by paragraphs (i) and (ii) above must bedetermined and certified by a firm of certified or registered public accountants who havepreviously audited the books of the Issuer or by such successors thereof as may have beenemployed for that purpose, except that after the Outstanding Parity Bonds are redeemed,defeased or mature, such facts may be determined and certified by the chief financialofficer of the Issuer.(iv) The additional parity bonds must be payable as to principal on September 1st ofeach year in which principal falls due beginning not later than three (3) years from thedate of issuance of said additional bonds and payable as to interest on September 1st andMarch 1st of each year.In lieu of the required transfers or deposits to the Reserve Fund, the Issuer may cause tobe deposited into the Reserve Fund a surety bond or an insurance policy for the benefit of the owners of theapplicable series of the Bonds or a letter of credit in an amount equal to the different between the ReserveFund Requirement and the sums then on deposit in the Reserve Fund, if any, after the deposit of such suretybond, insurance policy or letter of credit. Such difference may be withdrawn by the Issuer and be depositedin the Revenue Fund. The surety bond, insurance policy or letter of credit shall be payable (upon the givingof notice as required thereunder) or any due date on which monies will be required to be withdrawn from theReserve Fund and applied to the payment of principal, premium, if any, or interest on the related series of theBonds and such withdrawal cannot be met by amounts on deposit in the Reserve Fund. If a disbursement ismade pursuant to a surety bond, an insurance policy or a letter of credit provided pursuant to this section, theIssuer shall be obligated either (i) to reinstate the maximum limits of such surety bond, insurance policy orletter of credit or (ii) to deposit into the Reserve Fund, funds in the amount for the disbursement made undersuch surety bond, insurance policy or letter of credit, or a combination of such alternatives, as such shallprovide that the amount in the Reserve Fund equals the Reserve Fund Requirement for that series of theBonds. Any surety bond, insurance policy or letter of credit deposited into the Reserve Fund shall only beprovided by a bond insurance provider or a bank or other financial institution whose bond insurance policiesinsuring, or whose letters of credit, surety bonds or other credit facilities securing, the payment, when due,of the principal of, premium, if any, and interest on bond issues by public entities, at the time such suretybond, insurance policy, or letter of credit is obtained, result in such issues being rated in one of the two highestfull rating categories by one or more of the nationally recognized rating agencies; provided, however, thatnothing herein shall require the Issuer to obtain a rating on any additional parity bonds.-18-

ADDITIONAL PROVISIONS OF THE BOND ORDINANCEBond Ordinance to Constitute ContractThe provisions of the Bond Ordinance shall constitute a contract between the Issuer andthe Owner or Owners from time to time of the Bonds, and any Owner of any of the Bonds may either at lawor in equity, by suit, action, mandamus or other proceedings, enforce and compel the performance of all dutiesrequired to be performed by the Governing Authority as a result of issuing the Bonds, and may similarlyenforce the provisions of the Tax Ordinance and the Bond Ordinance.Tax Covenants of the IssuerIn providing for the issuance of the Bonds, the Issuer does hereby covenant that it has alegal right to levy and collect the Tax, to issue the Bonds and to pledge the Revenues of the Tax as provided,in the Bond Ordinance and that the Bonds will have a lien and privilege on the Revenues of the Tax on aparity with the Outstanding Parity Bonds, subject only to the prior payment of the Issuer=s portion of thereasonable and necessary costs and expenses of administering and collecting the Tax.Supplemental OrdinancesEffective Without Owner's Consent. For any one or more of the following purposes andat any time from time to time, the Governing Authority of the Issuer may adopt an ordinance supplementalhereto, which, upon the filing with the Paying Agent of a certified copy thereof, but without any consent ofOwners, shall be fully effective in accordance with its terms:(a) to add to the covenants and agreements of the Issuer in the Bond Ordinance othercovenants and agreements to be observed by the Issuer which are not contrary to orinconsistent with the Bond Ordinance as theretofore in effect;(b) to add to the limitations and restrictions in the Bond Ordinance other limitations andrestrictions to be observed by the Issuer which are not contrary to or inconsistent with theBond Ordinance as theretofore in effect;(c) to surrender any right, power or privilege reserved to or conferred upon the Issuerby the terms of the Bond Ordinance, but only if the surrender of such right, power orprivilege is not contrary to or inconsistent with the covenants and agreements of the Issuercontained in the Bond Ordinance;(d) to cure any ambiguity, supply any omission, or cure or correct any defect orinconsistent provision of the Bond Ordinance; or(e) to insert such provisions clarifying matters or questions arising under the BondOrdinance as are necessary or desirable and are not contrary to or inconsistent with theBond Ordinance as theretofore in effect.-19-

Effective With Consent of Owners. Except as provided above, any modification oramendment of the Bond Ordinance or of the rights and obligations of the Issuer and of the Owners of theBonds hereunder, in any particular, may be made by a supplemental ordinance, with the written consent ofthe Owners of a majority of the bond obligation at the time such consent is given. No such modification oramendment shall permit a change in the terms of redemption or maturity of the principal of any outstandingBond or of any installment of interest thereon or a reduction in the principal amount or the redemption pricethereof or in the rate of interest thereon without the consent of the Owner of such Bond, or shall reduce thepercentages of Bonds the consent of the Owner of which is required to effect any such modification oramendment, or change the obligation of the Issuer to levy and collect the Tax for the payment of the Bondsas provided herein, without the consent of the Owners of all of the Bonds then outstanding, or shall changeor modify any of the rights or obligations of the Paying Agent or the Escrow Agent without its written assentthereto. For the purposes of this section, Bonds shall be deemed to be affected by a modification oramendment of the Bond Ordinance if the same adversely affects or diminishes the rights of the Owners of saidBonds.A supplemental ordinance, upon the filing with the Paying Agent of a certified copythereof, shall become fully effective in accordance with its terms.Events of DefaultThe occurrence of one or more of the following events shall be an Event of Defaultunder the Bond Ordinance:a. if default shall be made in the due and punctual payment of the principal of anyBond when and as the same shall become due and payable, whether at maturity orotherwise; orb. if default shall be made in the due and punctual payment of any installment ofinterest on any Bond when and as such interest installment shall become due andpayable; orc. if default shall be made by the Issuer in the performance or observance of any otherof the covenants, agreements or conditions on its part in the Bond Ordinance, anysupplemental resolution or in the Bonds contained and such default shall continuefor a period of forty-five (45) days after written notice thereof to the Issuer by theOwners of not less than 25% of the bond obligation; ord. if the Issuer shall file a petition or otherwise seek relief under any Federal or Statebankruptcy law or similar law;Then, upon the happening and continuance of any Event of Default, the Owners of theBonds shall be entitled to exercise all rights and powers for which provision is made under State law.-20-

DefeasancePursuant to Chapter 14 of Title 39 of the Louisiana Revised Statutes of 1950, as amended,and the Bond Ordinance, the Bonds, in whole or in part, shall be defeased and shall be deemed to be paid andshall no longer be considered to be outstanding under the Bond Ordinance, and the covenants, agreements,and obligations contained in the Bond Ordinance with respect to such Bonds shall be discharged if one of thefollowing shall occur:(1) There is deposited in an irrevocable trust with a bank which is a member of the FederalDeposit Insurance Corporation, or its successor, or with a trust company, monies in an amountsufficient to pay in full the principal of and interest and call premiums, if any, on such Bondsto their stated maturity.(2) There is deposited in an irrevocable trust with a bank which is a member of the FederalDeposit Insurance Corporation, or its successor, or with a trust company, noncallable directgeneral obligations of the United States of America or obligations unconditionally guaranteedin principal and interest by the United States of America, including certificates or otherevidence of an ownership interest in such noncallable direct obligations, which may consistof specified portions of interest thereon, such as those securities commonly known as CATS,TIGRS, and STRPS, the principal of and interest on which, when added to other monies, ifany, deposited therein, shall be sufficient to pay when due the principal of and interest and callpremiums, if any, on such Bonds to their stated maturity.Neither the obligations or the moneys deposited in irrevocable trust nor the principal orinterest payments on any such obligations shall be withdrawn or used for any purpose other than and shall beheld in trust for the payment of the principal of and interest on the Bonds defeased. The owners of the Bondswhich are so defeased shall have an express lien on such moneys or governmental obligations until paid out,used, and applied as set forth above.Continuation of Tax LevyThe Issuer does hereby obligate itself and is bound under the terms and provisions of lawto cause to be levied, imposed, enforced and collected the Tax and to provide for all reasonable and necessaryrules, regulations, procedures and penalties in connection therewith, including the proper application of theRevenues of the Tax, until all of the Bonds and the Outstanding Parity Bonds have been retired as to bothprincipal and interest. Nothing herein contained shall be construed to prevent the Issuer from altering,amending or repealing from time to time as may be necessary the Tax Ordinance or any subsequentresolution/ordinance providing with respect to the Tax, said alterations, amendments or repeals to beconditioned upon the continued preservation of the rights of the Owners with respect to the Revenues of theTax. The Tax Ordinance and the obligation to continue to levy, collect and allocate the Tax and to apply theRevenues of the Tax in accordance with the provisions of the Bond Ordinance, shall be irrevocable until theBonds and the Outstanding Parity Bonds have been paid in full as to both principal and interest, and shall notbe subject to amendment, alteration or repeal in any manner which would impair the rights of the Ownersfrom time to time of the Bonds or the owners of the Outstanding Parity Bonds or which would in any wayjeopardize the prompt payment of principal thereof and interest thereon. More specifically, neither the-21-

Legislature of Louisiana nor the Issuer may discontinue or decrease the Tax or permit to be discontinued ordecreased the Tax in anticipation of the collection of which the Bonds and the Outstanding Parity Bonds havebeen issued, or in any way make any change which would diminish the amount of the Revenues of the Taxpledged to the payment of the Bonds and the Outstanding Parity Bonds and received by the Issuer, until allof such Bonds and the Outstanding Parity Bonds shall have been retired as to both principal and interest.In providing for the issuance of the Bonds, the Issuer does hereby covenant that it has alegal right to levy and collect the Tax, to issue the Bonds and to pledge the Revenues of the Tax as providedin the Bond Ordinance, and that the Bonds will have a lien and privilege on the Revenues of the Tax on aparity with the Outstanding Parity Bonds, subject only to the prior payment of the Issuer=s portion of thereasonable and necessary costs and expenses of administering and collecting the Tax.Interest on BondsTAX EXEMPTIONThe delivery of the Bonds is subject to the opinion of Foley & Judell, L.L.P., Baton Rouge,Louisiana, to the effect that interest on the Bonds is excluded from gross income for federal income taxpurposes (See Appendix “G”).State TaxesThe opinion of Bond Counsel will state that pursuant to the Act, the Bonds and the incometherefrom are exempt from all taxation by the State of Louisiana. Each prospective purchaser of the Bondsshould consult his or her own tax advisor as to the status of interest on the Bonds under the tax laws of anystate other than Louisiana.Alternative Minimum Tax ConsiderationExcept as hereinafter described, interest on the Bonds will not be an item of tax preferencefor purposes of the federal alternative minimum tax on individuals and corporations. The Code, as amended,imposes a 20% alternative minimum tax on the “alternative minimum taxable income” of a corporation, ifthe amount of such alternative minimum tax is greater than the amount of the corporation’s regular incometax. Generally, a corporation’s “alternative minimum taxable income” includes 75% of the amount by whicha corporation’s “adjusted current earnings” exceeds a corporation’s “alternative minimum taxable income.”Interest on the Bonds will be included in a corporation’s “adjusted current earnings.”GeneralThe Code imposes a number of requirements that must be satisfied for interest on stateand local obligations to be excluded from gross income for federal income tax purposes. These requirementsinclude limitations on the use of bond proceeds and the source of repayment of bonds, limitations on theinvestment of bond proceeds prior to expenditure, a requirement that excess arbitrage earned on theinvestment of certain bond proceeds be paid periodically to the United States, except under certaincircumstances, and a requirement that information reports be filed with the Internal Revenue Service.-22-

The opinion of Bond Counsel will assume continuing compliance with the covenants inthe Bond Ordinance pertaining to those sections of the Code which affect the exclusion from gross incomeof interest on the Bonds for federal income tax purposes and, in addition, will rely on representations by theIssuer with respect to matters solely within the knowledge of the Issuer, which Bond Counsel has notindependently verified. If the Issuer should fail to comply with the covenants in the Bond Ordinance or if theforegoing representations should be determined to be inaccurate or incomplete, interest on the Bonds couldbecome included in gross income from the date of original delivery of the Bonds, regardless of the date onwhich the event causing such inclusion occurs.Owners of the Bonds should be aware that (i) the ownership of tax-exempt obligations,such as the Bonds, may result in collateral federal income tax consequences to certain taxpayers and(ii) certain other federal, state and/or local tax consequences may also arise from the ownership anddisposition of the Bonds or the receipt of interest on the Bonds. Furthermore, future laws and/or regulationsenacted by federal, state or local authorities may affect certain owners of the Bonds. All prospectivepurchasers of the Bonds should consult their legal and tax advisors regarding the applicability of such lawsand regulations and the effect that the purchase and ownership of the Bonds may have on their particularfinancial situation.Qualified Tax-Exempt Obligations (Bank Deductibility)The Tax Reform Act of 1986 revised Section 265 of the Code so as to generally denyfinancial institutions 100% of the interest deductions that are allocable to tax-exempt obligations acquiredafter August 7, 1986. However, an exception is permitted under the Tax Reform Act of 1986 for certainqualified tax-exempt obligations which allows financial institutions to continue to treat the interest on suchobligations as being subject to the 20% disallowance provision under prior law if the Issuer, together withcertain subordinate entities, reasonably expects that it will not issue more than $10,000,000 of governmentalpurpose bonds in a calendar year and designates such bonds as “qualified tax-exempt obligations” pursuantto the provisions of Section 265(b)(3)(B) of the Code. The Bonds are designated as “qualified tax-exemptobligations” pursuant to Section 265(b)(3)(B) of the Code.Tax Treatment of Original Issue PremiumThe Bonds maturing September 1, ____ to September 1, ____, inclusive (the “PremiumBonds”), are being offered and sold to the public at a price in excess of their stated principal amounts.Such excess is characterized as a “bond premium” and must be amortized by an investorpurchasing a Premium Bond on a constant yield basis over the remaining term of the Premium Bond in amanner that takes into account potential call dates and call prices. An investor cannot deduct amortized bondpremium related to a tax-exempt bond for federal income tax purposes. However, as bond premium isamortized, it reduces the investor’s basis in the Premium Bond. Investors who purchase a Premium Bondshould consult their own tax advisors regarding the amortization of bond premium and its effect on thePremium Bond’s basis for purposes of computing gain or loss in connection with the sale, exchange,redemption or early retirement of the Premium Bond.-23-