STATE OF NEW YORK 2 0 1 1 ... - City of Hornell

STATE OF NEW YORK 2 0 1 1 ... - City of Hornell

STATE OF NEW YORK 2 0 1 1 ... - City of Hornell

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

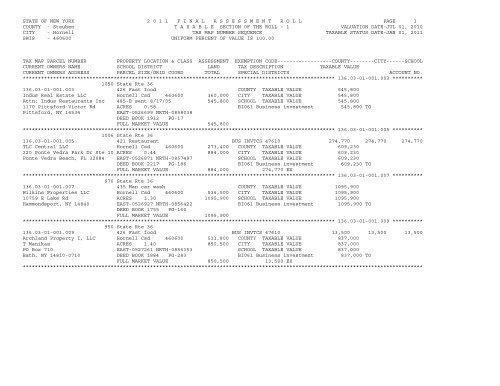

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 1<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 136.03-01-001.003 **********<br />

1050 State Rte 36<br />

136.03-01-001.003 426 Fast food COUNTY TAXABLE VALUE 545,800<br />

Indus Real Estate LLC <strong>Hornell</strong> Csd 460600 360,000 CITY TAXABLE VALUE 545,800<br />

Attn: Indus Restaurants Inc 485-B sent 8/17/05 545,800 SCHOOL TAXABLE VALUE 545,800<br />

1170 Pittsford-Victor Rd ACRES 0.58 BI061 Business investment 545,800 TO<br />

Pittsford, NY 14534<br />

EAST-0526699 NRTH-0858038<br />

DEED BOOK 1912 PG-17<br />

FULL MARKET VALUE 545,800<br />

******************************************************************************************************* 136.03-01-001.005 **********<br />

1006 State Rte 36<br />

136.03-01-001.005 421 Restaurant BUS INVTCS 47610 274,770 274,770 274,770<br />

TLC Central LLC <strong>Hornell</strong> Csd 460600 273,400 COUNTY TAXABLE VALUE 609,230<br />

220 Ponte Vedra Park Dr Ste 10 ACRES 0.44 884,000 CITY TAXABLE VALUE 609,230<br />

Ponte Vedra Beach, FL 32084 EAST-0526871 NRTH-0857497 SCHOOL TAXABLE VALUE 609,230<br />

DEED BOOK 2217 PG-186 BI061 Business investment 609,230 TO<br />

FULL MARKET VALUE 884,000 274,770 EX<br />

******************************************************************************************************* 136.03-01-001.007 **********<br />

970 State Rte 36<br />

136.03-01-001.007 435 Man car wash COUNTY TAXABLE VALUE 1095,900<br />

Wilkins Properties LLC <strong>Hornell</strong> Csd 460600 536,500 CITY TAXABLE VALUE 1095,900<br />

10759 E Lake Rd ACRES 1.30 1095,900 SCHOOL TAXABLE VALUE 1095,900<br />

Hammondsport, NY 14840 EAST-0526927 NRTH-0856422 BI061 Business investment 1095,900 TO<br />

DEED BOOK 1755 PG-160<br />

FULL MARKET VALUE 1095,900<br />

******************************************************************************************************* 136.03-01-001.009 **********<br />

950 State Rte 36<br />

136.03-01-001.009 426 Fast food BUS INVTCS 47610 13,500 13,500 13,500<br />

Archland Property I, LLC <strong>Hornell</strong> Csd 460600 511,800 COUNTY TAXABLE VALUE 837,000<br />

T Manikas ACRES 1.40 850,500 CITY TAXABLE VALUE 837,000<br />

PO Box 710 EAST-0527261 NRTH-0856353 SCHOOL TAXABLE VALUE 837,000<br />

Bath, NY 14810-0710 DEED BOOK 1884 PG-283 BI061 Business investment 837,000 TO<br />

FULL MARKET VALUE 850,500 13,500 EX<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 2<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> M A P S E C T I O N - 136 TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 S U B - S E C T I O N - 003 RPS150/V04/L015<br />

UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00 CURRENT DATE 3/14/2011<br />

*** S P E C I A L D I S T R I C T S U M M A R Y ***<br />

TOTAL EXTENSION EXTENSION AD VALOREM EXEMPT TAXABLE<br />

CODE DISTRICT NAME PARCELS TYPE VALUE VALUE AMOUNT VALUE<br />

BI061 Business inves 4 TOTAL 3376,200 288,270 3087,930<br />

*** S C H O O L D I S T R I C T S U M M A R Y ***<br />

TOTAL ASSESSED ASSESSED EXEMPT TOTAL STAR STAR<br />

CODE DISTRICT NAME PARCELS LAND TOTAL AMOUNT TAXABLE AMOUNT TAXABLE<br />

460600 <strong>Hornell</strong> Csd 4 1681,700 3376,200 288,270 3087,930 3087,930<br />

S U B - T O T A L 4 1681,700 3376,200 288,270 3087,930 3087,930<br />

T O T A L 4 1681,700 3376,200 288,270 3087,930 3087,930<br />

*** S Y S T E M C O D E S S U M M A R Y ***<br />

NO SYSTEM EXEMPTIONS AT THIS LEVEL<br />

*** E X E M P T I O N S U M M A R Y ***<br />

TOTAL<br />

CODE DESCRIPTION PARCELS COUNTY CITY SCHOOL<br />

47610 BUS INVTCS 2 288,270 288,270 288,270<br />

T O T A L 2 288,270 288,270 288,270<br />

*** G R A N D T O T A L S ***<br />

ROLL TOTAL ASSESSED ASSESSED TAXABLE TAXABLE TAXABLE STAR<br />

SEC DESCRIPTION PARCELS LAND TOTAL COUNTY CITY SCHOOL TAXABLE<br />

1 TAXABLE 4 1681,700 3376,200 3087,930 3087,930 3087,930 3087,930

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 3<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 150.16-01-001.000 **********<br />

W Main St 00317-010<br />

150.16-01-001.000 330 Vacant comm COUNTY TAXABLE VALUE 25,800<br />

Wilkins Ronald <strong>Hornell</strong> Csd 460600 25,800 CITY TAXABLE VALUE 25,800<br />

10759 E Lake Rd FRNT 110.00 DPTH 163.30 25,800 SCHOOL TAXABLE VALUE 25,800<br />

Hammondsport, NY 14840 EAST-0524304 NRTH-0852168 BI061 Business investment 25,800 TO<br />

DEED BOOK 1121 PG-244<br />

FULL MARKET VALUE 25,800<br />

******************************************************************************************************* 150.16-01-002.000 **********<br />

1080 W Main St 00316-000<br />

150.16-01-002.000 444 Lumber yd/ml COUNTY TAXABLE VALUE 607,700<br />

H S Associates LLC <strong>Hornell</strong> Csd 460600 180,200 CITY TAXABLE VALUE 607,700<br />

446 Waterloo-Geneva Plz ACRES 18.67 607,700 SCHOOL TAXABLE VALUE 607,700<br />

Waterloo, NY 13165 EAST-0523824 NRTH-0852038 BI061 Business investment 607,700 TO<br />

DEED BOOK 1641 PG-222<br />

FULL MARKET VALUE 607,700<br />

******************************************************************************************************* 150.16-01-003.000 **********<br />

W Main St 00021-000<br />

150.16-01-003.000 330 Vacant comm COUNTY TAXABLE VALUE 90,100<br />

Wilkins Ronald C <strong>Hornell</strong> Csd 460600 90,100 CITY TAXABLE VALUE 90,100<br />

10759 E Lake Rd ACRES 11.21 90,100 SCHOOL TAXABLE VALUE 90,100<br />

Hammondsport, NY 14840 EAST-0525034 NRTH-0851818 BI061 Business investment 90,100 TO<br />

DEED BOOK 1146 PG-144<br />

FULL MARKET VALUE 90,100<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 4<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> M A P S E C T I O N - 150 TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 S U B - S E C T I O N - 016 RPS150/V04/L015<br />

UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00 CURRENT DATE 3/14/2011<br />

*** S P E C I A L D I S T R I C T S U M M A R Y ***<br />

TOTAL EXTENSION EXTENSION AD VALOREM EXEMPT TAXABLE<br />

CODE DISTRICT NAME PARCELS TYPE VALUE VALUE AMOUNT VALUE<br />

BI061 Business inves 3 TOTAL 723,600 723,600<br />

*** S C H O O L D I S T R I C T S U M M A R Y ***<br />

TOTAL ASSESSED ASSESSED EXEMPT TOTAL STAR STAR<br />

CODE DISTRICT NAME PARCELS LAND TOTAL AMOUNT TAXABLE AMOUNT TAXABLE<br />

460600 <strong>Hornell</strong> Csd 3 296,100 723,600 723,600 723,600<br />

S U B - T O T A L 3 296,100 723,600 723,600 723,600<br />

T O T A L 3 296,100 723,600 723,600 723,600<br />

*** S Y S T E M C O D E S S U M M A R Y ***<br />

NO SYSTEM EXEMPTIONS AT THIS LEVEL<br />

*** E X E M P T I O N S U M M A R Y ***<br />

NO EXEMPTIONS AT THIS LEVEL<br />

*** G R A N D T O T A L S ***<br />

ROLL TOTAL ASSESSED ASSESSED TAXABLE TAXABLE TAXABLE STAR<br />

SEC DESCRIPTION PARCELS LAND TOTAL COUNTY CITY SCHOOL TAXABLE<br />

1 TAXABLE 3 296,100 723,600 723,600 723,600 723,600 723,600

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 5<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.05-02-003.000 **********<br />

6953 Thacher St 00330-010<br />

151.05-02-003.000 340 Vacant indus COUNTY TAXABLE VALUE 3,100<br />

Parmley David <strong>Hornell</strong> Csd 460600 3,100 CITY TAXABLE VALUE 3,100<br />

PO Box 667 ACRES 0.20 BANK 638 3,100 SCHOOL TAXABLE VALUE 3,100<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0527004 NRTH-0853688<br />

DEED BOOK 2229 PG-76<br />

FULL MARKET VALUE 3,100<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 6<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> M A P S E C T I O N - 151 TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 S U B - S E C T I O N - 005 RPS150/V04/L015<br />

UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00 CURRENT DATE 3/14/2011<br />

*** S P E C I A L D I S T R I C T S U M M A R Y ***<br />

TOTAL EXTENSION EXTENSION AD VALOREM EXEMPT TAXABLE<br />

CODE DISTRICT NAME PARCELS TYPE VALUE VALUE AMOUNT VALUE<br />

NO SPECIAL DISTRICTS AT THIS LEVEL<br />

*** S C H O O L D I S T R I C T S U M M A R Y ***<br />

TOTAL ASSESSED ASSESSED EXEMPT TOTAL STAR STAR<br />

CODE DISTRICT NAME PARCELS LAND TOTAL AMOUNT TAXABLE AMOUNT TAXABLE<br />

460600 <strong>Hornell</strong> Csd 1 3,100 3,100 3,100 3,100<br />

S U B - T O T A L 1 3,100 3,100 3,100 3,100<br />

T O T A L 1 3,100 3,100 3,100 3,100<br />

*** S Y S T E M C O D E S S U M M A R Y ***<br />

NO SYSTEM EXEMPTIONS AT THIS LEVEL<br />

*** E X E M P T I O N S U M M A R Y ***<br />

NO EXEMPTIONS AT THIS LEVEL<br />

*** G R A N D T O T A L S ***<br />

ROLL TOTAL ASSESSED ASSESSED TAXABLE TAXABLE TAXABLE STAR<br />

SEC DESCRIPTION PARCELS LAND TOTAL COUNTY CITY SCHOOL TAXABLE<br />

1 TAXABLE 1 3,100 3,100 3,100 3,100 3,100 3,100

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 7<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.09-01-002.000 **********<br />

28 Old Almond Rd 00694-000<br />

151.09-01-002.000 210 1 Family Res COUNTY TAXABLE VALUE 41,100<br />

Butler Richard <strong>Hornell</strong> Csd 460600 12,800 CITY TAXABLE VALUE 41,100<br />

Butler Diane FRNT 80.00 DPTH 150.00 41,100 SCHOOL TAXABLE VALUE 41,100<br />

26 Old Almond Rd EAST-0524434 NRTH-0852788<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1767 PG-117<br />

FULL MARKET VALUE 41,100<br />

******************************************************************************************************* 151.09-01-003.000 **********<br />

26 Old Almond Rd 0003277-000<br />

151.09-01-003.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Butler Richard L <strong>Hornell</strong> Csd 460600 11,900 COUNTY TAXABLE VALUE 64,600<br />

Butler Diane FRNT 70.00 DPTH 150.00 64,600 CITY TAXABLE VALUE 64,600<br />

26 Old Almond Rd EAST-0524504 NRTH-0852768 SCHOOL TAXABLE VALUE 34,600<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1067 PG-614<br />

FULL MARKET VALUE 64,600<br />

******************************************************************************************************* 151.09-01-004.000 **********<br />

24 Old Almond Rd 01627-000<br />

151.09-01-004.000 210 1 Family Res STAR EN 41834 0 0 49,500<br />

Hilsdorf Ronald <strong>Hornell</strong> Csd 460600 15,400 COUNTY TAXABLE VALUE 49,500<br />

Hilsdorf Charles FRNT 100.00 DPTH 170.00 49,500 CITY TAXABLE VALUE 49,500<br />

24 Old Almond Rd EAST-0524594 NRTH-0852738 SCHOOL TAXABLE VALUE 0<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1316 PG-107<br />

FULL MARKET VALUE 49,500<br />

******************************************************************************************************* 151.09-01-005.000 **********<br />

22 Old Almond Rd 00916-000<br />

151.09-01-005.000 210 1 Family Res COUNTY TAXABLE VALUE 71,500<br />

Butler Diane <strong>Hornell</strong> Csd 460600 18,600 CITY TAXABLE VALUE 71,500<br />

24 Old Almond Rd ACRES 1.53 71,500 SCHOOL TAXABLE VALUE 71,500<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0524754 NRTH-0852658<br />

DEED BOOK 2051 PG-138<br />

FULL MARKET VALUE 71,500<br />

******************************************************************************************************* 151.09-01-007.100 **********<br />

10 Old Almond Rd 01013-000<br />

151.09-01-007.100 210 1 Family Res COUNTY TAXABLE VALUE 44,600<br />

Dodge Gregory P <strong>Hornell</strong> Csd 460600 17,000 CITY TAXABLE VALUE 44,600<br />

Dodge Jennifer L ACRES 1.30 44,600 SCHOOL TAXABLE VALUE 44,600<br />

10 Old Almond Rd EAST-0525084 NRTH-0852268<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 2261 PG-27<br />

FULL MARKET VALUE 44,600<br />

******************************************************************************************************* 151.09-01-007.200 **********<br />

4 Old Almond Rd 1013-020<br />

151.09-01-007.200 210 1 Family Res STAR B 41854 0 0 30,000<br />

Kull Thomas J <strong>Hornell</strong> Csd 460600 16,200 COUNTY TAXABLE VALUE 102,400<br />

4 Old Almond Rd ACRES 1.20 102,400 CITY TAXABLE VALUE 102,400<br />

<strong>Hornell</strong>, NY 14843 EAST-0525454 NRTH-0852068 SCHOOL TAXABLE VALUE 72,400<br />

DEED BOOK 1823 PG-229<br />

FULL MARKET VALUE 102,400<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 8<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.09-01-010.000 **********<br />

162 N Main St 01690-000<br />

151.09-01-010.000 220 2 Family Res STAR B 41854 0 0 30,000<br />

Moore James R II <strong>Hornell</strong> Csd 460600 30,500 COUNTY TAXABLE VALUE 68,800<br />

Moore Kathleen ACRES 1.28 BANK 450 68,800 CITY TAXABLE VALUE 68,800<br />

162 N Main St EAST-0525644 NRTH-0853088 SCHOOL TAXABLE VALUE 38,800<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1095 PG-300<br />

FULL MARKET VALUE 68,800<br />

******************************************************************************************************* 151.09-01-011.000 **********<br />

176 N Main St 02661-000<br />

151.09-01-011.000 210 1 Family Res COUNTY TAXABLE VALUE 57,300<br />

Cramp Roger T <strong>Hornell</strong> Csd 460600 17,000 CITY TAXABLE VALUE 57,300<br />

Cramp Gloria FRNT 275.00 DPTH 175.00 57,300 SCHOOL TAXABLE VALUE 57,300<br />

176 N Main St EAST-0525634 NRTH-0853338<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1337 PG-28<br />

FULL MARKET VALUE 57,300<br />

******************************************************************************************************* 151.09-01-012.000 **********<br />

173 N Main St 01896-000<br />

151.09-01-012.000 210 1 Family Res COUNTY TAXABLE VALUE 33,900<br />

Cramp Roger T <strong>Hornell</strong> Csd 460600 14,000 CITY TAXABLE VALUE 33,900<br />

Cramp Gloria FRNT 176.00 DPTH 145.00 33,900 SCHOOL TAXABLE VALUE 33,900<br />

176 N Main St EAST-0525814 NRTH-0853448<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1485 PG-7<br />

FULL MARKET VALUE 33,900<br />

******************************************************************************************************* 151.09-01-015.000 **********<br />

169 N Main St 01378-000<br />

151.09-01-015.000 210 1 Family Res AGED C/T/S 41800 17,200 17,200 17,200<br />

Wise Beatrice <strong>Hornell</strong> Csd 460600 11,200 STAR EN 41834 0 0 17,200<br />

169 N Main St TS 03 34,400 COUNTY TAXABLE VALUE 17,200<br />

<strong>Hornell</strong>, NY 14843 FRNT 66.00 DPTH 145.00 CITY TAXABLE VALUE 17,200<br />

EAST-0525854 NRTH-0853328 SCHOOL TAXABLE VALUE 0<br />

DEED BOOK 1100 PG-283<br />

FULL MARKET VALUE 34,400<br />

******************************************************************************************************* 151.09-01-016.000 **********<br />

165 N Main St 03194-000<br />

151.09-01-016.000 210 1 Family Res COUNTY TAXABLE VALUE 53,500<br />

Hunt Lloyd A <strong>Hornell</strong> Csd 460600 10,600 CITY TAXABLE VALUE 53,500<br />

Ochs April FRNT 60.00 DPTH 145.00 53,500 SCHOOL TAXABLE VALUE 53,500<br />

209 <strong>Hornell</strong> St Ext BANK 450<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0525864 NRTH-0853258<br />

DEED BOOK 1672 PG-239<br />

FULL MARKET VALUE 53,500<br />

******************************************************************************************************* 151.09-01-017.000 **********<br />

163 N Main St 03235-000<br />

151.09-01-017.000 210 1 Family Res COUNTY TAXABLE VALUE 29,600<br />

KI Company Inc <strong>Hornell</strong> Csd 460600 12,200 CITY TAXABLE VALUE 29,600<br />

6 Taylor St Ext FRNT 75.14 DPTH 145.00 29,600 SCHOOL TAXABLE VALUE 29,600<br />

Canisteo, NY 14823-1000 BANK 622<br />

EAST-0525884 NRTH-0853188<br />

DEED BOOK 1608 PG-149<br />

FULL MARKET VALUE 29,600<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 9<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.09-01-018.100 **********<br />

159 N Main St 2592-010<br />

151.09-01-018.100 311 Res vac land COUNTY TAXABLE VALUE 5,300<br />

Hawkes Shirley Jones A <strong>Hornell</strong> Csd 460600 5,300 CITY TAXABLE VALUE 5,300<br />

155 N Main St FRNT 66.00 DPTH 79.00 5,300 SCHOOL TAXABLE VALUE 5,300<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0525864 NRTH-0853118<br />

DEED BOOK 1761 PG-303<br />

FULL MARKET VALUE 5,300<br />

******************************************************************************************************* 151.09-01-018.200 **********<br />

159 N Main St-Rear 2592-020<br />

151.09-01-018.200 311 Res vac land COUNTY TAXABLE VALUE 2,100<br />

Vanduser Scott A <strong>Hornell</strong> Csd 460600 2,100 CITY TAXABLE VALUE 2,100<br />

153 N Main St FRNT 66.00 DPTH 66.00 2,100 SCHOOL TAXABLE VALUE 2,100<br />

<strong>Hornell</strong>, NY 14843 BANK 450<br />

EAST-0525924 NRTH-0853138<br />

DEED BOOK 1711 PG-123<br />

FULL MARKET VALUE 2,100<br />

******************************************************************************************************* 151.09-01-019.000 **********<br />

155 N Main St 02113-010<br />

151.09-01-019.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Jones Shirley <strong>Hornell</strong> Csd 460600 8,400 COUNTY TAXABLE VALUE 61,500<br />

Jones Walter A I02,03 61,500 CITY TAXABLE VALUE 61,500<br />

155 N Main St FRNT 66.00 DPTH 79.00 SCHOOL TAXABLE VALUE 31,500<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0525873 NRTH-0853065<br />

DEED BOOK 2320 PG-345<br />

FULL MARKET VALUE 61,500<br />

******************************************************************************************************* 151.09-01-020.000 **********<br />

153 N Main St 03481-000<br />

151.09-01-020.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Vanduser Scott A <strong>Hornell</strong> Csd 460600 9,800 COUNTY TAXABLE VALUE 53,900<br />

153 N Main St FRNT 49.37 DPTH 161.48 53,900 CITY TAXABLE VALUE 53,900<br />

<strong>Hornell</strong>, NY 14843 BANK 450 SCHOOL TAXABLE VALUE 23,900<br />

EAST-0525914 NRTH-0853008<br />

DEED BOOK 1711 PG-123<br />

FULL MARKET VALUE 53,900<br />

******************************************************************************************************* 151.09-01-021.000 **********<br />

151 N Main St 01051-000<br />

151.09-01-021.000 210 1 Family Res VET COM CT 41131 9,875 9,875 0<br />

Drake - LU Margaret <strong>Hornell</strong> Csd 460600 10,600 STAR EN 41834 0 0 39,500<br />

Drake D M & D W FRNT 57.75 DPTH 140.25 39,500 COUNTY TAXABLE VALUE 29,625<br />

151 N Main St EAST-0525924 NRTH-0852958 CITY TAXABLE VALUE 29,625<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 2256 PG-276 SCHOOL TAXABLE VALUE 0<br />

FULL MARKET VALUE 39,500<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 10<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.09-01-022.000 **********<br />

147 N Main St 01440-000<br />

151.09-01-022.000 220 2 Family Res COUNTY TAXABLE VALUE 35,400<br />

Ross Joseph C <strong>Hornell</strong> Csd 460600 11,800 CITY TAXABLE VALUE 35,400<br />

Ross Gwendolyn FRNT 84.00 DPTH 135.00 35,400 SCHOOL TAXABLE VALUE 35,400<br />

PO Box 384 BANK 681<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0525944 NRTH-0852898<br />

DEED BOOK 990 PG-00829<br />

FULL MARKET VALUE 35,400<br />

******************************************************************************************************* 151.09-01-023.000 **********<br />

145 N Main St 00435-000<br />

151.09-01-023.000 210 1 Family Res COUNTY TAXABLE VALUE 50,100<br />

Barros Joseph <strong>Hornell</strong> Csd 460600 10,900 CITY TAXABLE VALUE 50,100<br />

145 N Main St FRNT 125.57 DPTH 63.91 50,100 SCHOOL TAXABLE VALUE 50,100<br />

<strong>Hornell</strong>, NY 14843 BANK 288<br />

EAST-0525994 NRTH-0852816<br />

DEED BOOK 2254 PG-346<br />

FULL MARKET VALUE 50,100<br />

******************************************************************************************************* 151.09-01-025.000 **********<br />

127 N Main St 02937-000<br />

151.09-01-025.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Remchuk Richard <strong>Hornell</strong> Csd 460600 17,000 COUNTY TAXABLE VALUE 67,500<br />

Remchuk Sandra FRNT 176.22 DPTH 290.00 67,500 CITY TAXABLE VALUE 67,500<br />

127 N Main St BANK 450 SCHOOL TAXABLE VALUE 37,500<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526090 NRTH-0852687<br />

DEED BOOK 854 PG-324<br />

FULL MARKET VALUE 67,500<br />

******************************************************************************************************* 151.09-01-027.000 **********<br />

119 N Main St 02958-000<br />

151.09-01-027.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Davies Michael E <strong>Hornell</strong> Csd 460600 12,100 COUNTY TAXABLE VALUE 69,300<br />

Davies Kristen L FRNT 49.50 DPTH 247.50 69,300 CITY TAXABLE VALUE 69,300<br />

119 N Main St BANK 288 SCHOOL TAXABLE VALUE 39,300<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526264 NRTH-0852528<br />

DEED BOOK 2077 PG-298<br />

FULL MARKET VALUE 69,300<br />

******************************************************************************************************* 151.09-01-028.000 **********<br />

115 N Main St 01718-000<br />

151.09-01-028.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Hoyt Michael F <strong>Hornell</strong> Csd 460600 14,200 COUNTY TAXABLE VALUE 86,400<br />

115 N Main St FRNT 49.50 DPTH 247.50 86,400 CITY TAXABLE VALUE 86,400<br />

<strong>Hornell</strong>, NY 14843 BANK 85 SCHOOL TAXABLE VALUE 56,400<br />

EAST-0526284 NRTH-0852478<br />

DEED BOOK 2170 PG-350<br />

FULL MARKET VALUE 86,400<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 11<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.09-01-029.000 **********<br />

113 N Main St 01716-000<br />

151.09-01-029.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Remchuk Rachelle <strong>Hornell</strong> Csd 460600 14,100 COUNTY TAXABLE VALUE 53,400<br />

113 N Main St FRNT 49.50 DPTH 222.75 53,400 CITY TAXABLE VALUE 53,400<br />

<strong>Hornell</strong>, NY 14843 EAST-0526304 NRTH-0852428 SCHOOL TAXABLE VALUE 23,400<br />

DEED BOOK 2163 PG-114<br />

FULL MARKET VALUE 53,400<br />

******************************************************************************************************* 151.09-01-030.000 **********<br />

111 N Main St 01151-000<br />

151.09-01-030.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

McMichael David <strong>Hornell</strong> Csd 460600 9,800 COUNTY TAXABLE VALUE 71,500<br />

McMichael Amy J FRNT 49.50 DPTH 220.00 71,500 CITY TAXABLE VALUE 71,500<br />

111 N Main St EAST-0526324 NRTH-0852388 SCHOOL TAXABLE VALUE 41,500<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1349 PG-176<br />

FULL MARKET VALUE 71,500<br />

******************************************************************************************************* 151.09-01-031.000 **********<br />

109 N Main St 03237-000<br />

151.09-01-031.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Simms David A <strong>Hornell</strong> Csd 460600 11,700 COUNTY TAXABLE VALUE 50,300<br />

109 N Main St FRNT 48.00 DPTH 130.00 50,300 CITY TAXABLE VALUE 50,300<br />

<strong>Hornell</strong>, NY 14843 EAST-0526294 NRTH-0852318 SCHOOL TAXABLE VALUE 20,300<br />

DEED BOOK 1386 PG-226<br />

FULL MARKET VALUE 50,300<br />

******************************************************************************************************* 151.09-01-032.000 **********<br />

107 N Main St 03236-000<br />

151.09-01-032.000 311 Res vac land COUNTY TAXABLE VALUE 10,600<br />

Simms David A <strong>Hornell</strong> Csd 460600 10,600 CITY TAXABLE VALUE 10,600<br />

109 N Main St 107 N Main St 10,600 SCHOOL TAXABLE VALUE 10,600<br />

<strong>Hornell</strong>, NY 14843 FRNT 121.00 DPTH 115.00<br />

EAST-0526334 NRTH-0852248<br />

DEED BOOK 1386 PG-226<br />

FULL MARKET VALUE 10,600<br />

******************************************************************************************************* 151.09-01-033.000 **********<br />

105 Steuben St 01863-000<br />

151.09-01-033.000 220 2 Family Res COUNTY TAXABLE VALUE 37,500<br />

Thomas Jeffrey J <strong>Hornell</strong> Csd 460600 13,400 CITY TAXABLE VALUE 37,500<br />

7708 Kellogg Rd FRNT 49.50 DPTH 174.50 37,500 SCHOOL TAXABLE VALUE 37,500<br />

Springwater, NY 14560 BANK 288<br />

EAST-0526394 NRTH-0852288<br />

DEED BOOK 2158 PG-268<br />

FULL MARKET VALUE 37,500<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 12<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.09-01-034.000 **********<br />

103 Steuben St 01620-000<br />

151.09-01-034.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Myers Jonathan W <strong>Hornell</strong> Csd 460600 12,500 COUNTY TAXABLE VALUE 39,800<br />

103 Steuben St FRNT 45.00 DPTH 177.21 39,800 CITY TAXABLE VALUE 39,800<br />

<strong>Hornell</strong>, NY 14843 EAST-0526444 NRTH-0852308 SCHOOL TAXABLE VALUE 9,800<br />

DEED BOOK 1508 PG-158<br />

FULL MARKET VALUE 39,800<br />

******************************************************************************************************* 151.09-01-035.000 **********<br />

101 Steuben St 01790-000<br />

151.09-01-035.000 210 1 Family Res AGED C/T 41801 25,850 25,850 0<br />

Houghtaling - LU D & E <strong>Hornell</strong> Csd 460600 12,000 AGED S 41804 0 0 20,680<br />

Biddle etal Kathy FRNT 49.50 DPTH 132.00 51,700 STAR EN 41834 0 0 31,020<br />

101 Steuben St EAST-0526494 NRTH-0852288 COUNTY TAXABLE VALUE 25,850<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1116 PG-176 CITY TAXABLE VALUE 25,850<br />

FULL MARKET VALUE 51,700 SCHOOL TAXABLE VALUE 0<br />

******************************************************************************************************* 151.09-01-036.000 **********<br />

99 Steuben St 01308-000<br />

151.09-01-036.000 485 >1use sm bld COUNTY TAXABLE VALUE 102,100<br />

Puorro Mario <strong>Hornell</strong> Csd 460600 15,700 CITY TAXABLE VALUE 102,100<br />

32 Russell St FRNT 82.50 DPTH 82.50 102,100 SCHOOL TAXABLE VALUE 102,100<br />

Canisteo, NY 14823<br />

EAST-0526564 NRTH-0852278<br />

DEED BOOK 2314 PG-157<br />

FULL MARKET VALUE 102,100<br />

******************************************************************************************************* 151.09-01-037.000 **********<br />

162 Madison Ave 03428-000<br />

151.09-01-037.000 210 1 Family Res VET COM CT 41131 14,400 14,400 0<br />

McGregor John G <strong>Hornell</strong> Csd 460600 9,400 STAR B 41854 0 0 30,000<br />

Mcgregor Kathleen FRNT 49.50 DPTH 82.50 57,600 COUNTY TAXABLE VALUE 43,200<br />

162 Madison Ave EAST-0526544 NRTH-0852348 CITY TAXABLE VALUE 43,200<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1142 PG-66 SCHOOL TAXABLE VALUE 27,600<br />

FULL MARKET VALUE 57,600<br />

******************************************************************************************************* 151.09-01-038.000 **********<br />

164 Madison Ave 01053-000<br />

151.09-01-038.000 312 Vac w/imprv COUNTY TAXABLE VALUE 24,000<br />

McGregor John G <strong>Hornell</strong> Csd 460600 10,600 CITY TAXABLE VALUE 24,000<br />

McGregor Kathleen 164 Madison Ave. 24,000 SCHOOL TAXABLE VALUE 24,000<br />

162 Madison Ave FRNT 49.50 DPTH 132.00<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526504 NRTH-0852388<br />

DEED BOOK 1142 PG-66<br />

FULL MARKET VALUE 24,000<br />

******************************************************************************************************* 151.09-01-039.000 **********<br />

166 Madison Ave 01405-000<br />

151.09-01-039.000 210 1 Family Res COUNTY TAXABLE VALUE 34,200<br />

Gottschall Brian <strong>Hornell</strong> Csd 460600 12,400 CITY TAXABLE VALUE 34,200<br />

166 Madison Ave FRNT 49.50 DPTH 145.00 34,200 SCHOOL TAXABLE VALUE 34,200<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526494 NRTH-0852438<br />

DEED BOOK 1824 PG-171<br />

FULL MARKET VALUE 34,200<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 13<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.09-01-040.000 **********<br />

Madison Ave 01715-000<br />

151.09-01-040.000 311 Res vac land COUNTY TAXABLE VALUE 6,400<br />

Gottschall Brian <strong>Hornell</strong> Csd 460600 6,400 CITY TAXABLE VALUE 6,400<br />

166 Madison Ave FRNT 39.00 DPTH 145.00 6,400 SCHOOL TAXABLE VALUE 6,400<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526484 NRTH-0852488<br />

DEED BOOK 1824 PG-171<br />

FULL MARKET VALUE 6,400<br />

******************************************************************************************************* 151.09-01-042.000 **********<br />

172 Madison Ave 02322-000<br />

151.09-01-042.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Morse Scott E <strong>Hornell</strong> Csd 460600 18,000 COUNTY TAXABLE VALUE 45,100<br />

Morse Mona H FRNT 99.00 DPTH 145.00 45,100 CITY TAXABLE VALUE 45,100<br />

172 Madison Ave EAST-0526454 NRTH-0852588 SCHOOL TAXABLE VALUE 15,100<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1945 PG-203<br />

FULL MARKET VALUE 45,100<br />

******************************************************************************************************* 151.09-01-043.000 **********<br />

174 Madison Ave 01705-000<br />

151.09-01-043.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Teator Clayton <strong>Hornell</strong> Csd 460600 18,000 COUNTY TAXABLE VALUE 49,000<br />

174 Madison Ave FRNT 99.00 DPTH 145.00 49,000 CITY TAXABLE VALUE 49,000<br />

<strong>Hornell</strong>, NY 14843 EAST-0526434 NRTH-0852658 SCHOOL TAXABLE VALUE 19,000<br />

DEED BOOK 1584 PG-14<br />

FULL MARKET VALUE 49,000<br />

******************************************************************************************************* 151.09-01-045.100 **********<br />

182 Madison Ave 1548-010<br />

151.09-01-045.100 210 1 Family Res COUNTY TAXABLE VALUE 55,200<br />

Swain Dale <strong>Hornell</strong> Csd 460600 21,200 CITY TAXABLE VALUE 55,200<br />

Penny Karen I 03 55,200 SCHOOL TAXABLE VALUE 55,200<br />

2477 Warm Spring Way FRNT 136.60 DPTH 145.00<br />

Odenton, MD 21113<br />

EAST-0526405 NRTH-0852767<br />

DEED BOOK 1596 PG-12<br />

FULL MARKET VALUE 55,200<br />

******************************************************************************************************* 151.09-01-045.200 **********<br />

N Main & Sheldon St 1550-00<br />

151.09-01-045.200 311 Res vac land CITY OWNED 13350 9,295 9,295 9,295<br />

Remchuk Richard W <strong>Hornell</strong> Csd 460600 14,300 COUNTY TAXABLE VALUE 5,005<br />

Remchuk Sandra FRNT 99.00 DPTH 264.00 14,300 CITY TAXABLE VALUE 5,005<br />

127 N Main St ACRES 1.34 SCHOOL TAXABLE VALUE 5,005<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526248 NRTH-0852681<br />

DEED BOOK 1510 PG-35<br />

FULL MARKET VALUE 14,300<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 14<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.09-01-046.000 **********<br />

190-192 Madison Ave 02549-000<br />

151.09-01-046.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Clark William W <strong>Hornell</strong> Csd 460600 15,100 COUNTY TAXABLE VALUE 50,500<br />

Clark Jana K FRNT 100.00 DPTH 138.00 50,500 CITY TAXABLE VALUE 50,500<br />

190-192 Madison Ave EAST-0526364 NRTH-0852948 SCHOOL TAXABLE VALUE 20,500<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 980 PG-01112<br />

FULL MARKET VALUE 50,500<br />

******************************************************************************************************* 151.09-01-047.000 **********<br />

194 Madison Ave 00122-000<br />

151.09-01-047.000 311 Res vac land COUNTY TAXABLE VALUE 12,300<br />

Arno Albert <strong>Hornell</strong> Csd 460600 12,300 CITY TAXABLE VALUE 12,300<br />

Arno Mary 194 Madison Ave 12,300 SCHOOL TAXABLE VALUE 12,300<br />

195 N Main St FRNT 50.00 DPTH 140.25<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526350 NRTH-0853014<br />

DEED BOOK 778 PG-364<br />

FULL MARKET VALUE 12,300<br />

******************************************************************************************************* 151.09-01-048.000 **********<br />

200 Madison Ave 00123-000<br />

151.09-01-048.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Arno Daniel T <strong>Hornell</strong> Csd 460600 12,400 COUNTY TAXABLE VALUE 79,500<br />

200 Madison Ave FRNT 50.00 DPTH 140.25 79,500 CITY TAXABLE VALUE 79,500<br />

<strong>Hornell</strong>, NY 14843 EAST-0526334 NRTH-0853068 SCHOOL TAXABLE VALUE 49,500<br />

DEED BOOK 1347 PG-213<br />

FULL MARKET VALUE 79,500<br />

******************************************************************************************************* 151.09-01-049.000 **********<br />

202 Madison Ave 02092-000<br />

151.09-01-049.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Brewer Deborah C <strong>Hornell</strong> Csd 460600 12,700 COUNTY TAXABLE VALUE 52,800<br />

Deborah C Thompson FRNT 66.00 DPTH 140.25 52,800 CITY TAXABLE VALUE 52,800<br />

202 Madison Ave EAST-0526324 NRTH-0853128 SCHOOL TAXABLE VALUE 22,800<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1582 PG-282<br />

FULL MARKET VALUE 52,800<br />

******************************************************************************************************* 151.09-01-050.000 **********<br />

204 Madison Ave 02152-000<br />

151.09-01-050.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Meehan Thomas J <strong>Hornell</strong> Csd 460600 14,800 COUNTY TAXABLE VALUE 46,200<br />

Meehan Heather A FRNT 66.00 DPTH 278.45 46,200 CITY TAXABLE VALUE 46,200<br />

204 Madison Ave BANK 288 SCHOOL TAXABLE VALUE 16,200<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526304 NRTH-0853198<br />

DEED BOOK 2262 PG-296<br />

FULL MARKET VALUE 46,200<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 15<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.09-01-051.000 **********<br />

208 Madison Ave 03090-000<br />

151.09-01-051.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Howe John L <strong>Hornell</strong> Csd 460600 14,800 COUNTY TAXABLE VALUE 45,500<br />

208 Madison Ave FRNT 66.00 DPTH 140.25 45,500 CITY TAXABLE VALUE 45,500<br />

<strong>Hornell</strong>, NY 14843 EAST-0526284 NRTH-0853258 SCHOOL TAXABLE VALUE 15,500<br />

DEED BOOK 1974 PG-40<br />

FULL MARKET VALUE 45,500<br />

******************************************************************************************************* 151.09-01-052.000 **********<br />

212 Madison Ave 03711-000<br />

151.09-01-052.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Daniels Michael A <strong>Hornell</strong> Csd 460600 14,800 COUNTY TAXABLE VALUE 56,200<br />

Daniels Karen FRNT 66.00 DPTH 140.25 56,200 CITY TAXABLE VALUE 56,200<br />

212 Madison Ave BANK 360 SCHOOL TAXABLE VALUE 26,200<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526264 NRTH-0853318<br />

DEED BOOK 1378 PG-246<br />

FULL MARKET VALUE 56,200<br />

******************************************************************************************************* 151.09-01-053.000 **********<br />

214-216 Madison Ave 03193-000<br />

151.09-01-053.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Senear Jonathan <strong>Hornell</strong> Csd 460600 12,400 COUNTY TAXABLE VALUE 57,700<br />

Senear Christine FRNT 50.00 DPTH 140.25 57,700 CITY TAXABLE VALUE 57,700<br />

PO Box 705 BANK 288 SCHOOL TAXABLE VALUE 27,700<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526264 NRTH-0853378<br />

DEED BOOK 954 PG-59<br />

FULL MARKET VALUE 57,700<br />

******************************************************************************************************* 151.09-01-054.000 **********<br />

218 Madison Ave 01339-000<br />

151.09-01-054.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Sheppard Wm <strong>Hornell</strong> Csd 460600 14,800 COUNTY TAXABLE VALUE 44,000<br />

Sheppard Judith G FRNT 66.00 DPTH 140.25 44,000 CITY TAXABLE VALUE 44,000<br />

218 Madison Ave EAST-0526244 NRTH-0853428 SCHOOL TAXABLE VALUE 14,000<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1015 PG-00598<br />

FULL MARKET VALUE 44,000<br />

******************************************************************************************************* 151.09-01-055.000 **********<br />

220 Madison Ave 01395-000<br />

151.09-01-055.000 311 Res vac land COUNTY TAXABLE VALUE 2,100<br />

Sackett Thomas N <strong>Hornell</strong> Csd 460600 2,100 CITY TAXABLE VALUE 2,100<br />

Sackett Doreen A FRNT 50.00 DPTH 90.75 2,100 SCHOOL TAXABLE VALUE 2,100<br />

228 Madison Ave BANK 659<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526254 NRTH-0853489<br />

DEED BOOK 2096 PG-336<br />

FULL MARKET VALUE 2,100<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 16<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.09-01-056.000 **********<br />

222 Madison Ave 01310-000<br />

151.09-01-056.000 210 1 Family Res COUNTY TAXABLE VALUE 15,200<br />

Sackett Thomas N <strong>Hornell</strong> Csd 460600 13,800 CITY TAXABLE VALUE 15,200<br />

Sackett Doreen A FRNT 66.00 DPTH 140.00 15,200 SCHOOL TAXABLE VALUE 15,200<br />

228 Madison Ave BANK 659<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526214 NRTH-0853558<br />

DEED BOOK 1806 PG-347<br />

FULL MARKET VALUE 15,200<br />

******************************************************************************************************* 151.09-01-058.000 **********<br />

26 Sheldon St 01154-000<br />

151.09-01-058.000 311 Res vac land COUNTY TAXABLE VALUE 3,200<br />

Sackett Thomas N <strong>Hornell</strong> Csd 460600 3,200 CITY TAXABLE VALUE 3,200<br />

Sackett Doreen FRNT 160.00 DPTH 97.00 3,200 SCHOOL TAXABLE VALUE 3,200<br />

228 Madison Ave BANK 659<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526094 NRTH-0853508<br />

DEED BOOK 1007 PG-00797<br />

FULL MARKET VALUE 3,200<br />

******************************************************************************************************* 151.09-01-059.100 **********<br />

22 Sheldon St 3896-010<br />

151.09-01-059.100 311 Res vac land COUNTY TAXABLE VALUE 1,600<br />

Herrneckar Alan J <strong>Hornell</strong> Csd 460600 1,600 CITY TAXABLE VALUE 1,600<br />

1125 Airport Rd FRNT 50.00 DPTH 109.90 1,600 SCHOOL TAXABLE VALUE 1,600<br />

<strong>Hornell</strong>, NY 14843-9653<br />

EAST-0526134 NRTH-0853358<br />

DEED BOOK 1266 PG-229<br />

FULL MARKET VALUE 1,600<br />

******************************************************************************************************* 151.09-01-059.200 **********<br />

24 Sheldon St 3896-020<br />

151.09-01-059.200 311 Res vac land COUNTY TAXABLE VALUE 1,900<br />

Sackett Thomas <strong>Hornell</strong> Csd 460600 1,900 CITY TAXABLE VALUE 1,900<br />

Sackett Doreen FRNT 66.40 DPTH 103.47 1,900 SCHOOL TAXABLE VALUE 1,900<br />

228 Madison Ave BANK 659<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526124 NRTH-0853408<br />

DEED BOOK 1376 PG-153<br />

FULL MARKET VALUE 1,900<br />

******************************************************************************************************* 151.09-01-060.000 **********<br />

16-18 Sheldon St 03895-000<br />

151.09-01-060.000 311 Res vac land COUNTY TAXABLE VALUE 6,400<br />

Herrneckar Alan J <strong>Hornell</strong> Csd 460600 6,400 CITY TAXABLE VALUE 6,400<br />

1125 Airport Rd FRNT 133.00 DPTH 124.50 6,400 SCHOOL TAXABLE VALUE 6,400<br />

<strong>Hornell</strong>, NY 14843-9653<br />

EAST-0526144 NRTH-0853248<br />

DEED BOOK 1266 PG-229<br />

FULL MARKET VALUE 6,400<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 17<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.09-01-062.000 **********<br />

12 Sheldon St 02093-000<br />

151.09-01-062.000 311 Res vac land COUNTY TAXABLE VALUE 1,900<br />

Brewer Deborah C <strong>Hornell</strong> Csd 460600 1,900 CITY TAXABLE VALUE 1,900<br />

Deborah C Thomspon FRNT 66.00 DPTH 124.50 1,900 SCHOOL TAXABLE VALUE 1,900<br />

202 Madison Ave EAST-0526194 NRTH-0853098<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1582 PG-282<br />

FULL MARKET VALUE 1,900<br />

******************************************************************************************************* 151.09-01-063.000 **********<br />

Sheldon St 02993-000<br />

151.09-01-063.000 311 Res vac land COUNTY TAXABLE VALUE 1,600<br />

Cone Howard F <strong>Hornell</strong> Csd 460600 1,600 CITY TAXABLE VALUE 1,600<br />

10 Sheldon St Sheldon St 1,600 SCHOOL TAXABLE VALUE 1,600<br />

<strong>Hornell</strong>, NY 14843 FRNT 50.00 DPTH 124.50<br />

EAST-0526204 NRTH-0853038<br />

DEED BOOK 897 PG-338<br />

FULL MARKET VALUE 1,600<br />

******************************************************************************************************* 151.09-01-064.000 **********<br />

8-10 Sheldon St 02994-000<br />

151.09-01-064.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Cone Howard F <strong>Hornell</strong> Csd 460600 12,400 COUNTY TAXABLE VALUE 63,900<br />

10 Sheldon St FRNT 55.00 DPTH 124.50 63,900 CITY TAXABLE VALUE 63,900<br />

<strong>Hornell</strong>, NY 14843 EAST-0526234 NRTH-0852968 SCHOOL TAXABLE VALUE 33,900<br />

DEED BOOK 897 PG-338<br />

FULL MARKET VALUE 63,900<br />

******************************************************************************************************* 151.09-01-065.000 **********<br />

2 Sheldon St 01672-000<br />

151.09-01-065.000 210 1 Family Res VET COM CT 41131 13,425 13,425 0<br />

Meehan Debra K <strong>Hornell</strong> Csd 460600 10,400 STAR B 41854 0 0 30,000<br />

Kerr Stephen FRNT 50.00 DPTH 100.00 53,700 COUNTY TAXABLE VALUE 40,275<br />

2 Sheldon St EAST-0526202 NRTH-0852898 CITY TAXABLE VALUE 40,275<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1087 PG-75 SCHOOL TAXABLE VALUE 23,700<br />

FULL MARKET VALUE 53,700<br />

******************************************************************************************************* 151.09-01-069.000 **********<br />

5 Sheldon St 02497-000<br />

151.09-01-069.000 210 1 Family Res AGED S 41804 0 0 13,625<br />

McGregor Phyllis <strong>Hornell</strong> Csd 460600 21,200 AGED C/T 41801 27,250 27,250 0<br />

5 Sheldon St FRNT 253.00 DPTH 266.00 54,500 STAR EN 41834 0 0 40,875<br />

<strong>Hornell</strong>, NY 14843 EAST-0526072 NRTH-0852899 COUNTY TAXABLE VALUE 27,250<br />

DEED BOOK 827 PG-214 CITY TAXABLE VALUE 27,250<br />

FULL MARKET VALUE 54,500 SCHOOL TAXABLE VALUE 0<br />

******************************************************************************************************* 151.09-01-072.000 **********<br />

11 Sheldon St 02310-000<br />

151.09-01-072.000 210 1 Family Res COUNTY TAXABLE VALUE 34,200<br />

Freeland Katherine <strong>Hornell</strong> Csd 460600 12,200 CITY TAXABLE VALUE 34,200<br />

11 Sheldon St FRNT 66.00 DPTH 95.00 34,200 SCHOOL TAXABLE VALUE 34,200<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526004 NRTH-0853088<br />

DEED BOOK 2220 PG-199<br />

FULL MARKET VALUE 34,200<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 18<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.09-01-075.200 **********<br />

19 Sheldon St 3054-020<br />

151.09-01-075.200 311 Res vac land COUNTY TAXABLE VALUE 3,400<br />

Sackett Thomas <strong>Hornell</strong> Csd 460600 3,400 CITY TAXABLE VALUE 3,400<br />

Sackett Doreen FRNT 240.00 DPTH 113.10 3,400 SCHOOL TAXABLE VALUE 3,400<br />

228 Madison Ave ACRES 0.98 BANK 659<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0525974 NRTH-0853398<br />

DEED BOOK 1278 PG-203<br />

FULL MARKET VALUE 3,400<br />

******************************************************************************************************* 151.09-02-002.000 **********<br />

221 Madison Ave 01600-000<br />

151.09-02-002.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Harmonson Curtis Sr <strong>Hornell</strong> Csd 460600 12,400 COUNTY TAXABLE VALUE 34,700<br />

Harmonson Marseena FRNT 50.00 DPTH 140.25 34,700 CITY TAXABLE VALUE 34,700<br />

221 Madison Ave BANK 450 SCHOOL TAXABLE VALUE 4,700<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526398 NRTH-0853584<br />

DEED BOOK 1792 PG-126<br />

FULL MARKET VALUE 34,700<br />

******************************************************************************************************* 151.09-02-003.000 **********<br />

215 Madison Ave 00975-000<br />

151.09-02-003.000 311 Res vac land COUNTY TAXABLE VALUE 8,300<br />

Baker Richard <strong>Hornell</strong> Csd 460600 8,300 CITY TAXABLE VALUE 8,300<br />

Baker Sharon R TS 03 8,300 SCHOOL TAXABLE VALUE 8,300<br />

219 Madison Ave FRNT 50.00 DPTH 140.25<br />

<strong>Hornell</strong>, NY 14843-1210<br />

EAST-0526404 NRTH-0853548<br />

DEED BOOK 903 PG-403<br />

FULL MARKET VALUE 8,300<br />

******************************************************************************************************* 151.09-02-004.000 **********<br />

219 Madison Ave 00976-000<br />

151.09-02-004.000 210 1 Family Res STAR EN 41834 0 0 30,800<br />

Baker Richard <strong>Hornell</strong> Csd 460600 10,600 COUNTY TAXABLE VALUE 30,800<br />

Baker Sharon R I03 30,800 CITY TAXABLE VALUE 30,800<br />

219 Madison Ave FRNT 40.00 DPTH 140.25 SCHOOL TAXABLE VALUE 0<br />

<strong>Hornell</strong>, NY 14843-1210<br />

EAST-0526414 NRTH-0853498<br />

DEED BOOK 903 PG-403<br />

FULL MARKET VALUE 30,800<br />

******************************************************************************************************* 151.09-02-005.000 **********<br />

213 Madison Ave 00201-000<br />

151.09-02-005.000 210 1 Family Res COUNTY TAXABLE VALUE 30,300<br />

Hurlburt M H Jr <strong>Hornell</strong> Csd 460600 13,900 CITY TAXABLE VALUE 30,300<br />

Hurlburt Sanford FRNT 60.00 DPTH 140.25 30,300 SCHOOL TAXABLE VALUE 30,300<br />

213 Madison Ave BANK 450<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526434 NRTH-0853458<br />

DEED BOOK 1598 PG-215<br />

FULL MARKET VALUE 30,300<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 19<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.09-02-006.000 **********<br />

211 Madison Ave 03732-000<br />

151.09-02-006.000 210 1 Family Res STAR EN 41834 0 0 51,300<br />

Harwood Francis L <strong>Hornell</strong> Csd 460600 12,400 COUNTY TAXABLE VALUE 51,300<br />

Harwood Pat FRNT 50.00 DPTH 140.25 51,300 CITY TAXABLE VALUE 51,300<br />

211 Madison Ave BANK 360 SCHOOL TAXABLE VALUE 0<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526444 NRTH-0853378<br />

DEED BOOK 1035 PG-00298<br />

FULL MARKET VALUE 51,300<br />

******************************************************************************************************* 151.09-02-007.000 **********<br />

207 Madison Ave 01960-000<br />

151.09-02-007.000 311 Res vac land COUNTY TAXABLE VALUE 8,300<br />

Harwood Francis L <strong>Hornell</strong> Csd 460600 8,300 CITY TAXABLE VALUE 8,300<br />

Harwood Pat FRNT 50.00 DPTH 140.25 8,300 SCHOOL TAXABLE VALUE 8,300<br />

211 Madison Ave EAST-0526454 NRTH-0853328<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1362 PG-116<br />

FULL MARKET VALUE 8,300<br />

******************************************************************************************************* 151.09-02-010.000 **********<br />

201 Madison Ave 03608-000<br />

151.09-02-010.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Sanford Carrie <strong>Hornell</strong> Csd 460600 24,000 COUNTY TAXABLE VALUE 88,900<br />

201 Madison Ave FRNT 144.00 DPTH 140.25 88,900 CITY TAXABLE VALUE 88,900<br />

<strong>Hornell</strong>, NY 14843 BANK 85 SCHOOL TAXABLE VALUE 58,900<br />

EAST-0526494 NRTH-0853178<br />

DEED BOOK 2127 PG-30<br />

FULL MARKET VALUE 88,900<br />

******************************************************************************************************* 151.09-02-011.000 **********<br />

199 Madison Ave 03693-000<br />

151.09-02-011.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Mcgregor M <strong>Hornell</strong> Csd 460600 11,200 COUNTY TAXABLE VALUE 46,800<br />

Mcgregor Smith L TS 01 46,800 CITY TAXABLE VALUE 46,800<br />

199 Madison Ave FRNT 44.00 DPTH 140.25 SCHOOL TAXABLE VALUE 16,800<br />

<strong>Hornell</strong>, NY 14843 BANK 360<br />

EAST-0526504 NRTH-0853128<br />

DEED BOOK 1711 PG-140<br />

FULL MARKET VALUE 46,800<br />

******************************************************************************************************* 151.09-02-012.100 **********<br />

195 Madison Ave-Rear 1396-020<br />

151.09-02-012.100 311 Res vac land COUNTY TAXABLE VALUE 3,200<br />

Schaumberg Steven P <strong>Hornell</strong> Csd 460600 3,200 CITY TAXABLE VALUE 3,200<br />

138 Greenwood St FRNT 40.00 DPTH 40.25 3,200 SCHOOL TAXABLE VALUE 3,200<br />

Canisteo, NY 14823<br />

EAST-0526584 NRTH-0853048<br />

DEED BOOK 927 PG-389<br />

FULL MARKET VALUE 3,200<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 20<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.09-02-012.200 **********<br />

197 Madison Ave 1396-010<br />

151.09-02-012.200 210 1 Family Res STAR B 41854 0 0 30,000<br />

Cleveland Michael P <strong>Hornell</strong> Csd 460600 11,800 COUNTY TAXABLE VALUE 42,800<br />

197 Madison Ave FRNT 47.00 DPTH 140.45 42,800 CITY TAXABLE VALUE 42,800<br />

<strong>Hornell</strong>, NY 14843 EAST-0526534 NRTH-0853088 SCHOOL TAXABLE VALUE 12,800<br />

DEED BOOK 1238 PG-90<br />

FULL MARKET VALUE 42,800<br />

******************************************************************************************************* 151.09-02-013.000 **********<br />

195 Madison Ave 03094-000<br />

151.09-02-013.000 210 1 Family Res COUNTY TAXABLE VALUE 56,200<br />

Schaumberg Michael A <strong>Hornell</strong> Csd 460600 8,900 CITY TAXABLE VALUE 56,200<br />

Schaumberg Denise A FRNT 40.00 DPTH 100.00 56,200 SCHOOL TAXABLE VALUE 56,200<br />

195 Madison Ave EAST-0526514 NRTH-0853038<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 2271 PG-334<br />

FULL MARKET VALUE 56,200<br />

******************************************************************************************************* 151.09-02-014.000 **********<br />

193 Madison Ave 02104-000<br />

151.09-02-014.000 210 1 Family Res COUNTY TAXABLE VALUE 27,100<br />

Cornerstone Homes Inc <strong>Hornell</strong> Csd 460600 10,600 CITY TAXABLE VALUE 27,100<br />

11801 Harrington Dr FRNT 40.00 DPTH 140.25 27,100 SCHOOL TAXABLE VALUE 27,100<br />

Corning, NY 14830-3609 BANK 643<br />

EAST-0526534 NRTH-0852998<br />

DEED BOOK 1824 PG-174<br />

FULL MARKET VALUE 27,100<br />

******************************************************************************************************* 151.09-02-015.000 **********<br />

191 Madison Ave 02103-000<br />

151.09-02-015.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Remchuk Michelle <strong>Hornell</strong> Csd 460600 10,100 COUNTY TAXABLE VALUE 46,200<br />

191 Madison Ave I98 46,200 CITY TAXABLE VALUE 46,200<br />

<strong>Hornell</strong>, NY 14843 FRNT 37.50 DPTH 140.25 SCHOOL TAXABLE VALUE 16,200<br />

EAST-0526544 NRTH-0852968<br />

DEED BOOK 1126 PG-311<br />

FULL MARKET VALUE 46,200<br />

******************************************************************************************************* 151.09-02-017.000 **********<br />

187 Madison Ave 01322-000<br />

151.09-02-017.000 210 1 Family Res VET COM CT 41131 10,575 10,575 0<br />

Mullen John J <strong>Hornell</strong> Csd 460600 14,600 STAR B 41854 0 0 30,000<br />

Mullen Ann M FRNT 64.50 DPTH 140.25 42,300 COUNTY TAXABLE VALUE 31,725<br />

187 Madison Ave EAST-0526564 NRTH-0852908 CITY TAXABLE VALUE 31,725<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1309 PG-241 SCHOOL TAXABLE VALUE 12,300<br />

FULL MARKET VALUE 42,300<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 21<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.09-02-018.000 **********<br />

185 Madison Ave 01958-000<br />

151.09-02-018.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Eldridge Tresa M <strong>Hornell</strong> Csd 460600 14,800 COUNTY TAXABLE VALUE 52,100<br />

185 Madison Ave FRNT 66.00 DPTH 140.25 52,100 CITY TAXABLE VALUE 52,100<br />

<strong>Hornell</strong>, NY 14843 EAST-0526574 NRTH-0852848 SCHOOL TAXABLE VALUE 22,100<br />

DEED BOOK 1925 PG-342<br />

FULL MARKET VALUE 52,100<br />

******************************************************************************************************* 151.09-02-019.000 **********<br />

181 Madison Ave 01162-000<br />

151.09-02-019.000 210 1 Family Res AGED C/T 41801 11,500 11,500 0<br />

Cleveland Beverly J <strong>Hornell</strong> Csd 460600 9,100 AGED S 41804 0 0 10,350<br />

181 Madison Ave FRNT 33.00 DPTH 140.25 23,000 STAR EN 41834 0 0 12,650<br />

<strong>Hornell</strong>, NY 14843 EAST-0526594 NRTH-0852808 COUNTY TAXABLE VALUE 11,500<br />

DEED BOOK 1273 PG-28 CITY TAXABLE VALUE 11,500<br />

FULL MARKET VALUE 23,000 SCHOOL TAXABLE VALUE 0<br />

******************************************************************************************************* 151.09-02-020.000 **********<br />

179 Madison Ave 03034-000<br />

151.09-02-020.000 210 1 Family Res COUNTY TAXABLE VALUE 25,000<br />

Bacon Larry <strong>Hornell</strong> Csd 460600 9,100 CITY TAXABLE VALUE 25,000<br />

15 Hakes Ave Apt 101 TS 04 25,000 SCHOOL TAXABLE VALUE 25,000<br />

<strong>Hornell</strong>, NY 14843 FRNT 33.00 DPTH 140.25<br />

EAST-0526604 NRTH-0852778<br />

DEED BOOK 2262 PG-280<br />

FULL MARKET VALUE 25,000<br />

******************************************************************************************************* 151.09-02-022.000 **********<br />

175 Madison Ave 02488-000<br />

151.09-02-022.000 210 1 Family Res COUNTY TAXABLE VALUE 45,500<br />

Eason Sharon L <strong>Hornell</strong> Csd 460600 14,400 CITY TAXABLE VALUE 45,500<br />

175 Madison Ave FRNT 63.25 DPTH 140.00 45,500 SCHOOL TAXABLE VALUE 45,500<br />

<strong>Hornell</strong>, NY 14843<br />

EAST-0526594 NRTH-0852708<br />

DEED BOOK 2182 PG-208<br />

FULL MARKET VALUE 45,500<br />

******************************************************************************************************* 151.09-02-023.000 **********<br />

173 Madison Ave 03835-000<br />

151.09-02-023.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Roe Michele M <strong>Hornell</strong> Csd 460600 12,200 COUNTY TAXABLE VALUE 32,100<br />

173 Madison Ave FRNT 49.50 DPTH 137.60 32,100 CITY TAXABLE VALUE 32,100<br />

<strong>Hornell</strong>, NY 14843 EAST-0526624 NRTH-0852668 SCHOOL TAXABLE VALUE 2,100<br />

DEED BOOK 2254 PG-244<br />

FULL MARKET VALUE 32,100<br />

************************************************************************************************************************************

<strong>STATE</strong> <strong>OF</strong> <strong>NEW</strong> <strong>YORK</strong> 2 0 1 1 F I N A L A S S E S S M E N T R O L L PAGE 22<br />

COUNTY - Steuben T A X A B L E SECTION <strong>OF</strong> THE ROLL - 1 VALUATION DATE-JUL 01, 2010<br />

CITY - <strong>Hornell</strong> TAX MAP NUMBER SEQUENCE TAXABLE STATUS DATE-JAN 01, 2011<br />

SWIS - 460600 UNIFORM PERCENT <strong>OF</strong> VALUE IS 100.00<br />

TAX MAP PARCEL NUMBER<br />

PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------CITY------SCHOOL<br />

CURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUE<br />

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.<br />

******************************************************************************************************* 151.09-02-024.000 **********<br />

171 Madison Ave 00390-000<br />

151.09-02-024.000 210 1 Family Res VETERANS 41101 5,000 5,000 0<br />

Thompson Rolland <strong>Hornell</strong> Csd 460600 12,300 STAR EN 41834 0 0 45,400<br />

Thompson Mary FRNT 49.50 DPTH 140.00 45,400 COUNTY TAXABLE VALUE 40,400<br />

171 Madison Ave EAST-0526634 NRTH-0852628 CITY TAXABLE VALUE 40,400<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 929 PG-776 SCHOOL TAXABLE VALUE 0<br />

FULL MARKET VALUE 45,400<br />

******************************************************************************************************* 151.09-02-026.000 **********<br />

169 Madison Ave 03458-000<br />

151.09-02-026.000 210 1 Family Res VET COM CT 41131 20,000 15,000 0<br />

Pulvino Veronica <strong>Hornell</strong> Csd 460600 12,300 VET DIS CT 41141 40,000 30,000 0<br />

169 Madison Ave FRNT 99.00 DPTH 140.00 92,700 STAR B 41854 0 0 30,000<br />

<strong>Hornell</strong>, NY 14843 EAST-0526656 NRTH-0852538 COUNTY TAXABLE VALUE 32,700<br />

DEED BOOK 1719 PG-333 CITY TAXABLE VALUE 47,700<br />

FULL MARKET VALUE 92,700 SCHOOL TAXABLE VALUE 62,700<br />

******************************************************************************************************* 151.09-02-027.000 **********<br />

163 Madison Ave 02381-000<br />

151.09-02-027.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Dunning James G <strong>Hornell</strong> Csd 460600 15,900 COUNTY TAXABLE VALUE 60,500<br />

Dunning P FRNT 49.50 DPTH 140.00 60,500 CITY TAXABLE VALUE 60,500<br />

163 Madison Ave EAST-0526684 NRTH-0852448 SCHOOL TAXABLE VALUE 30,500<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 958 PG-943<br />

FULL MARKET VALUE 60,500<br />

******************************************************************************************************* 151.09-02-029.000 **********<br />

161 Madison Ave 03191-000<br />

151.09-02-029.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

McGillivray Rebecca <strong>Hornell</strong> Csd 460600 8,200 COUNTY TAXABLE VALUE 42,500<br />

161 Madison Ave FRNT 47.01 DPTH 68.62 42,500 CITY TAXABLE VALUE 42,500<br />

<strong>Hornell</strong>, NY 14843 BANK 288 SCHOOL TAXABLE VALUE 12,500<br />

EAST-0526674 NRTH-0852378<br />

DEED BOOK 1680 PG-325<br />

FULL MARKET VALUE 42,500<br />

******************************************************************************************************* 151.09-02-030.000 **********<br />

93 Steuben St 03842-000<br />

151.09-02-030.000 210 1 Family Res COUNTY TAXABLE VALUE 45,100<br />

Wyant -LU Ethal <strong>Hornell</strong> Csd 460600 14,300 CITY TAXABLE VALUE 45,100<br />

Gemmell Karen FRNT 90.00 DPTH 90.00 45,100 SCHOOL TAXABLE VALUE 45,100<br />

93 Steuben St EAST-0526694 NRTH-0852318<br />

<strong>Hornell</strong>, NY 14843 DEED BOOK 1730 PG-240<br />

FULL MARKET VALUE 45,100<br />

******************************************************************************************************* 151.09-02-031.000 **********<br />

89 Steuben St 02974-000<br />

151.09-02-031.000 210 1 Family Res STAR B 41854 0 0 30,000<br />

Ritenburg Richard <strong>Hornell</strong> Csd 460600 10,500 COUNTY TAXABLE VALUE 39,600<br />