The interest in buying up steelmaker U.S. Steel (NYSE:X) has been fairly hot for some time. Now, it’s reaching a boiling point. Or, if not, at least a melting point. The latest reports note that Cleveland-Cliffs (NYSE:CLF) signed not only a non-disclosure agreement (NDA) but also a short standstill agreement so that it could get in on the bidding process to pick up U.S. Steel.

The standstill agreement will run until December 1, which should allow it to complete the process effectively. Meanwhile, ArcelorMittal (NYSE:MT) is still in the running, but a newcomer has stepped in as well: Canadian steelmaker Stelco (OTHEROTC:STZHF).

That Cleveland-Cliffs signed the NDA agreement suggests that it is indeed quite eager to get in on the bidding process. Previously, Cleveland-Cliffs wouldn’t sign such an agreement, which unnerved U.S. Steel. After all, if Cleveland-Cliffs didn’t sign such an agreement, it would be able to take what it learned from its look at U.S. Steel’s books—part of a due diligence process for any such major transaction—and use it against U.S. Steel directly. But with a $7.1 billion offer on the table, Cleveland-Cliffs means to be taken seriously.

Is U.S. Steel a Good Stock to Buy?

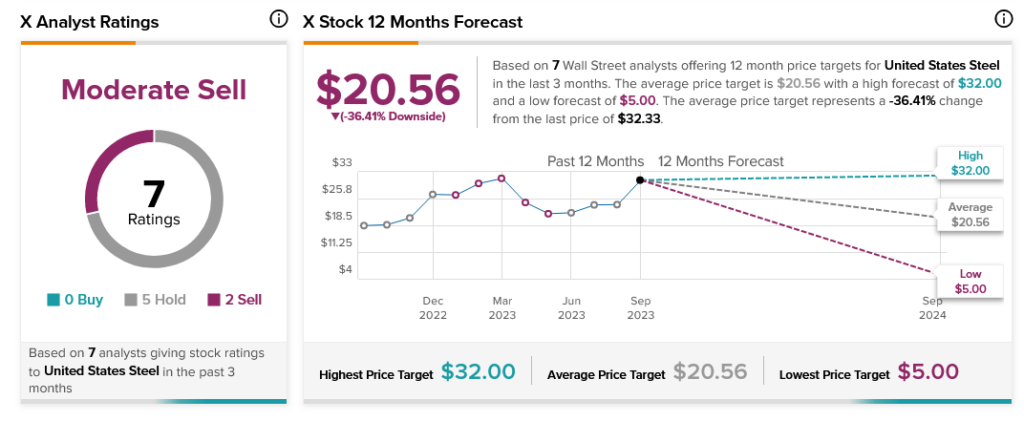

Who will walk away with U.S. Steel? That remains to be seen. But analysts are encouraging a sale one way or another; with five Hold ratings and two Sells, U.S. Steel is considered a Moderate Sell. Further, with an average price target of $20.56, it comes with a dizzying 36.41% downside risk.