The F2 flare platform operates in Elf Aquitaine Angola's Palanca field off Angola. Exploration off West Africa is booming, with 53 exploration and appraisal wells drilled last year, compared with 35 in 1995 and 22 in 1994. Well numbers are expected to rise still further this year because of outstanding well commitments and recent deepwater successes. Photo courtesy of Elf.

Celebrations followed the signing of BP's deal covering the In Salah area in Algeria. The deal could lead to a $3.5 billion development of up to 10 tcf of gas in discoveries in Algeria's Sahara Desert region. Photos courtesy of BP.

- Africa's Oil and Gas Production and Reserves, End 1995 [46192 bytes]

- The Scarabeo 3 semisubmersible drills for Elf Aquitaine Angola near Palanca field off Angola, where the P2 processing platform handles production.

- Palanca's processing facilities mark the last step for oil from a number of fields before the journey by shuttle tanker to market. Last year Elf added a new processing platform in Cobo field, part of the complex, and is continuing development work in Cobo and nearby Pambi and Oombo fields. Photos courtesy of Elf.

As African countries continue a slow drift towards democratic government and market economics, the continent is increasingly attractive to international oil and gas companies.

Though Africa remains politically diverse, and its volatile politics remains a major barrier to petroleum companies, a number of recent developments reflect its growing significance for the industry.

Among recent projects and events reflecting changes in Africa:

- Oil and gas exporter Algeria has invited foreign oil companies to help develop major gas discoveries, with a view to boosting exports to Europe.

- Oil and gas producer Egypt invited foreign companies to explore in the Nile Delta region, and the result appears to be a flowering world scale gas play.

- West African offshore exploration has entered deep water and new areas, and a number of major projects are expected in years to come.

- Nigeria's reputation as a difficult place to operate has been justified by recent political and civil events, but a long-planned liquefied natural gas (LNG) export plant is being built there.

- South Africa, which has returned to the international scene after years of trade isolation because of apartheid, is emerging as a potential driver for energy industry schemes throughout the continent.

Algeria

BP Exploration Operating Co. Ltd. and state firm Sonatrach have begun survey work on the In Salah sector of Algeria's District 3 license area, which lies in the Sahara Desert 1,200 km south of Algiers (see map [35094 bytes]).

In December 1995 BP and Sonatrach signed an agreement which will lead to a $3.5 billion development of gas discoveries in the 25,000 sq km In Salah area. Produced gas will be exported by pipeline to southern Europe.

The first seismic data from the BP/Sonatrach joint exploration program were acquired in February. The survey is expected to last throughout the year.

The survey is being carried out by Algerian contractor Enageo and will comprise 2,000 line km of 2D and 750 sq km of 3D seismic data.

Helmer Fucke, BP's seismic operations manager, said: "This is only the first step. The drilling program of nine wells in 2 years is partially dependent on results from our seismic work."

Because of a tight schedule, BP and Sonatrach have adopted a seismic processing method now common in marine surveys but rare so far onshore.

"We are going to improve the 3D turnaround by doing a lot of the seismic processing out in the field," said Fucke. "The initial data from this will be good enough to pick a well location. By the time we have the well results we will also have the fully processed seismic information."

Fucke said some parts of the seismic survey will be difficult, because of steep cliffs. "However, a lot of it is dead flat gravel plain, which will make our lives easier. If you cannot carry out seismic work successfully there, you won't be able to do it anywhere."

Sonatrach made 40 gas discoveries in District 3 during the 1950s, when about 100 wells were drilled. These were not developed because the company found supergiant Hassi R'Mel field 520 km to the north in the 1970s.

Hassi R'Mel has estimated original reserves of 1 billion bbl of oil and 90 tcf of gas. The In Salah license area is reckoned to have seven finds with estimated reserves amounting to 5 tcf of gas and a number of prospects with total potential of a similar volume of reserves.

Gas exports

Late in 1996 first gas was exported from Algeria to Spain through the Gazudoc Maghreb Europe pipeline, which runs from Hassi R'Mel field to Cordoba in southern Spain, with an offshore stretch across the Strait of Gibraltar.

The 858 mile, 48-in. pipeline was built at a cost of $1.9 billion and has initial capacity of 8 billion cu m/year. With the addition of five compressor stations in time, Sonatrach plans to boost throughput capacity to 19 billion cu m/year in stages.

Besides the development venture, BP and Sonatrach intend to set up another joint venture to market In Salah gas to European customers. Exports will be via Hassi R'Mel field and the Maghreb pipeline to Spain.

A BP official said that, with seismic data acquisition under way in In Salah, the next step is to set up the joint marketing company. No timing for the new company has yet been announced.

Less than 2 months after BP's deal, Sonatrach signed a deal with France's Total SA and Repsol SA of Spain for development of Tin Fouye Tabankort gas field in Southeast Algeria.

The field's combined reserves of gas and condensate are estimated to be equivalent to 1 billion bbl of oil. The partners will set up a joint venture company to be operator of an $850 million development.

Over 20 years the field is expected to yield 630 MMcfd of dry gas, 14,000 b/d of natural gas liquids (NGL), and 20,000 b/d of condensate. Development is expected to take 3 years, including drilling of 50 wells and fracturing of 30 existing wells.

Interests in the project are Total 35%, Repsol 35%, and Sonatrach 30%. Total and Repsol will exchange their shares of dry gas with Sontrach in return for equivalent volumes of NGL and condensate.

Although the dry gas will remain Sonatrach's property, the three companies have agreed to reserve the right to market the dry gas jointly in the future.

Besides natural gas, Algeria is also planning to expand exports of liquefied petroleum gas (LPG). Sonatrach is building two LPG separation trains at the Arzew complex with combined capacity of 2.4 million metric tons/year.

The new plant is expected to increase Algeria's total LPG production capacity to 8.4 million tons/year from 4.4 million tons/year in 1995.

Egypt

In Egypt's Nile Delta, exploration since 1992 has thrown up a string of discoveries now considered to represent a world scale gas/condensate play (see map, Aug. 26, 1996, p. 61).

Amoco Corp. and the International Egyptian Oil Co. unit of Italy's Agip SpA have registered the majority of 21 Nile Delta gas/condensate finds to date and are continuing exploration and appraisal while looking to development.

In February Amoco disclosed test results of its latest Nile Delta exploration well, which its says proves an eastern extension of a play building into a major strategic area for the company.

The Tao-1 wildcat was drilled on Egypt's North Sinai block, 35 miles offshore in 190 ft of water. Amoco is 100% holder of the license and claims to be the largest acreage holder in the Nile Delta.

The well flowed 37.9 MMcfd of gas on test from a 39 ft pay zone said to be representative of five in a total of about 500 ft of productive sands. Total measured depth of this directional well was 8,925 ft.

Denis Mascardelli, vice-president for exploration at Amoco Egypt, said: "One of the key findings of this well is that it extends the Pliocene gas trend further towards the edge of the Nile Delta basin.

"The trend is now confirmed to extend from the Amoco-operated Ha'py field on Ras El Barr concession approximately 60 miles southeastwards to Tao-1 well.

"All indications are that this trend will continue to the east, where Amoco holds a 50% working interest in the adjacent block."

Amoco is currently drilling another well on North Sinai block: Kamose-1 well, which will also target the Pliocene formation. The company plans to drill further Pliocene prospects this year.

Mascardelli said the number and thickness of pay sands in the Tao-1 well increase the chances of further Pliocene gas discoveries in the area. "Test results from this well indicate outstanding deliverability from the zone tested, which is similar in quality to other zones encountered."

In the western side of the play, BG Exploration & Production Ltd. recently reported high flows of gas during tests in a wildcat on the Rosetta block. The 1 Ji 57 well flowed more than 60 MMcfd of gas from at least 460 ft of net pay in three zones at about 6,000 ft. Water depth at the site exceeds 200 ft.

Development plans

Amoco and Agip are advancing development plans for the various discoveries, though they have declined to give estimates of reserves discovered to date.

In November 1996 Amoco signed a memorandum of understanding with Egyptian and Turkish authorities for development of LNG exports from the Nile Delta to Turkey.

The company is also considering options for sending gas by pipeline to other markets in the region.

An Amoco official said that the company expected to disclose test results of another gas discovery in the Nile Delta in late April and that exploration drilling continues.

Planning for the LNG export plant was said to be progressing also, with basic details of the engineering design being worked out. The company expects shortly to appoint a financial adviser for the LNG project.

Further south in Egypt's Western Desert area Apache Corp., Houston, and partners will supply gas from the Khalda concession to the country's gas grid under a 25-year take or pay contract beginning May 1, 1999.

Apache will deliver 4 tcf of gas under the deal at a rate of about 200 MMcfd. Development of the Khalda area will include construction of a 315-km, 34-in. pipeline in a deal with Royal Dutch/Shell and partners developing finds on the nearby Obaiyed concession.

In January, Egyptian General Petroleum Corp. (EGPC) announced details of six offshore and onshore blocks offered for bidding by Sept. 30.

The round's two offshore blocks in the Mediterranean Sea are virgin territory and include water up to 2,000 m deep.

EGPC said seismic data collected on the blocks to date showed bright spots, which could be indications of gas prospects (OGJ, Feb. 3, 1997, p. 30).

West Africa

Last year was a busy period for exploration and development offshore West Africa, where a number of significant discoveries will influence activity for years to come.

Wood Mackenzie Consultants Ltd., Edinburgh, said that in 1996 a total of 53 exploration and appraisal wells were completed offshore West Africa, a significant increase on 35 in 1995 and 22 in 1994.

The analyst said that among these wells, the number of new pool wildcats has also increased significantly: 33 last year compared with 24 in 1995 and 17 in 1994.

"The upward trend in activity in West Africa, established in 1995, continued apace in 1996," said Wood Mackenzie. "Drilling is expected to continue to increase in 1997 due to large numbers of outstanding well commitments, and, longer term, the recent deepwater successes in Girassol, Moho, and around Zafiro should have a positive impact on exploration activity."

West African offshore discoveries in 1996 were said to have combined estimated reserves of 1.17 billion bbl of oil, a massive rise on the 441 million bbl of oil found in 1995.

Girassol discovery

Wood Mackenzie attributed the good exploration results for last year to the discovery by Elf Aquitaine SA offshore Angola of Girassol, which alone has reserves tentatively pegged at 1 billion bbl of oil.

Girassol was discovered in more than 1,300 m of water on Angola's Block 17 in April 1996. It is the deepest water in which West Africa has yielded a discovery to date and most likely the largest discovery in the area so far.

In mid-April this year Elf announced test results of appraisal well Girassol 2A. The well flowed at a cumulative rate of 18,000 b/d of oil from two reservoirs.

Elf said the second well also detected a new oil reservoir deeper than the discovery accumulation. The operator is now drilling a deviated well, designated Girassol 2B, from the same location to appraise the find further.

An Elf official said that Girassol is undoubtedly a very important discovery and that the company has pegged its first estimate of reserves at 500 million bbl of oil.

"This figure represents the firmest estimate we can give based on two or three wells," said the official. "However, we are sure the final estimate will be much more."

One further well is slated to be drilled in the area of the Girassol discovery, and a further new pool wildcat well is likely on the block.

Block 17 license partners are operator Elf 35%, Exxon Corp. 20%, BP Exploration 16.67%, Den norske stats oljeselskap AS (Statoil) 13.33%, Norsk Hydro AS 10%, and Fina SA 5%.

Other offshore work

Also offshore Angola, operator Total SA made three oil discoveries last year on Block 2/92, where water depth is 20-30 m.

The Espadarte North-1 well, spudded by Total in December 1995, cut two pay zones. It tested 9,150 b/d of 37? gravity crude oil. Wood Mackenzie said reserves are tentatively estimated to be 30 million bbl of oil.

The Congro South-1 well, drilled on Block 2/92 in May and June, 1996, was suspended as a potentially commercial light oil and gas discovery after testing 2,300 b/d of 43? gravity oil and 2.54 MMcfd of gas.

Total completed the Veleiro-1 well on Block 2/92 in October 1996. The well tested 6,400 b/d of 35? gravity oil and has estimated reserves of 20 million bbl of oil.

Wood Mackenzie said that the Espadarte North and Veleiro reservoirs may be linked and that any development is likely to be a joint project, with Veleiro tied back to Espadarte North. Congro South is thought to be marginal.

Equatorial Guinea, Congo

Offshore Equatorial Guinea, operator Mobil Corp. made three discoveries last year in the region of Zafiro field, which it brought on stream in August 1996. Zafiro reserves are estimated at 200 million bbl of oil.

A production, storage, and offloading ship designated Zafiro Producer produces more than 50,000 b/d from seven wells. Output is expected to be raised to 80,000 b/d in 1997 through development of satellites.

Three Zafiro area discoveries made in 1996 by Mobil-Jade, Rubi, and Topacio-are expected to be appraised this year and tied back to Zafiro Producer as subsea satellites.

Last year Mobil had contractor Coflexip Stena Offshore SA, Paris, install a 40 km flexible flow line system and eight subsea wells in 270 m of water during development of Zafiro field.

This June, Coflexip will tie in eight additional wells in water up to 570 m deep and provide flexible flow lines linking these to the central production unit up to 5 km away.

Offshore Congo, Agip discovered oil with its Sounda Marine-1 well drilled on the Marine VII block. The well tested 32? gravity oil and has tentatively estimated reserves of 20 million bbl of oil.

Wood Mackenzie said the Sounda Marine discovery lies 6 km east of the Kitina discovery made earlier on the same block and is likely to be developed as its satellite.

This year exploration off West Africa is expected to heat up even further, with 55-70 exploration wells including 20 appraisal wells. In 1998, 45-75 exploration and appraisal wells are anticipated.

Last year's largest development was of N'Kossa field offshore Congo by Elf. Production began in June 1996 and is expected to peak at 122,000 b/d in 1998.

N'Kossa was developed with two wellhead platforms and a concrete barge carrying oil and LPG processing facilities. N'Kossa is expected to yield 440 million bbl of oil and 60 million bbl of LPG.

Exploration moves north

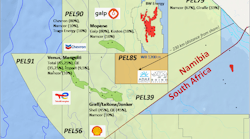

After recent successes off West Africa and Nigeria's long history of productivity, operators are increasingly taking up exploration licenses further northwards along the African coast.

For example, in March Ranger Oil Ltd., Calgary, signed a production sharing agreement with the government of Cote d'Ivoire for offshore Block CI-102.

The block lies immediately south of Abidjan with water mainly less than 200 m deep. It lies between Espoir oil field to the west and Belier oil field to the east.

License interest holders are operator Ranger 24%, Clyde Expro plc 24%, Energy Africa Ltd. 24%, Gentry Resources Ltd. 11%, TC Petroleum Inc. 5%, and Petroci 12%.

At around the same time, Dana Petroleum plc, London, secured an exploration, development, and production license from the government of Ghana for a 2,341 sq km area of the offshore Western Tano basin.

Dana is hoping Cretaceous plays will extend from the nearby Cote d'Ivoire offshore area. The company plans to acquire seismic data this year ahead of drilling.

License partners are operator Dana 45%, Seafield Resources plc, London, 45%, and Ghana National Petroleum Corp. 10%. The South Tano oil and gas discovery, which is surrounded by the contract area, is expected to be developed, with gas to be delivered to a gas-fired power station to be built on the coast 20 km to the north.

Nigeria

Though Nigeria has long been Africa's largest oil producer, mainly through joint ventures with government interest handled by Nigerian National Petroleum Corp. (NNPC), the country's political turmoil has made it a problem area for oil and gas companies.

Earlier this year it appeared that the government had finally realized it cannot pay its way in joint venture oil producing operations (OGJ, Jan. 13, 1997, p. 27).

Chief Anthony Ani, Nigeria's finance minister, announced plans to reduce NNPC's 57% stake in joint venture producing operations during 1997-2001.

However, Ani did not notify venture partners Shell, Mobil Corp., Agip, Elf, Chevron Corp., and Texaco Inc. of this plan. And since then, NNPC has once again been allocated less money than it reckons it needs to fund exploration and development.

Typical of its many commitments, NNPC holds 55% of the exploration and production joint venture that produces more than half the country's 2 million b/d or more of oil.

The venture, led by Shell Petroleum Development Co. of Nigeria Ltd. with minority partners Elf Nigeria Ltd. and Agip SpA, produces from a number of fields onshore and in the Niger Delta region.

Shell told NNPC it intended to spend $1.96 billion to fund its own share of work required by the joint venture. This and other ventures would have required NNPC to find a total $3 billion to spend in 1997.

But NNPC said it could only afford to spend $2.05 billion, a 31% shortfall which joint venture partners have rejected. Talks between NNPC and venture partners subsequently drew to a standstill.

Problems continue

While the budget shortfall is not a new experience for venture partners, it will ensure that some of the problems plaguing foreign participants in Nigeria's oil industry will continue.

Most worrying for foreign petroleum companies investing in Nigeria, a number of anti-government protests have involved local communities taking out their frustration against oil company operations.

For example, Shell and other oil companies are often targeted by protesters in local communities. Protests have taken the form of damage to oil installations, deliberate spillage of oil, and even attacks on Shell staff and contractors.

Shell is Nigeria's largest foreign investor and in particular finds itself trapped. Many of the protests are about government's failure to meet promises to fund local community welfare programs.

Some of this funding is supposed to come through the oil joint ventures, and NNPC budget cutbacks curtail funding of community welfare, which in turn causes more frustration and protests.

Prompted by recent media attention to allegations of oil pollution in the Niger Delta area, oil companies are working to try to break the cycle. Shell led an environmental assessment of the Niger Delta area, which is expected to show that oil pollution is less of a problem than poverty and unsanitary water supplies.

But oil companies are planning to clean up oil spills too. Richard Genochio, managing director of Oil Cleaning Bio-Products Ltd., Royston, U.K., was on a recent trade mission to Nigeria.

As a result, his company is to provide materials for field trials by "a major oil company" for clean-up of contaminated land in Nigeria.

"It was made clear to us," said Genochio, "that environmental protection is a key objective of the Nigerian government and of the oil companies. While some of the pollution of land by oil in recent years has been caused by equipment or operational failure, most has been caused by sabotage of pipelines and other installations.

"The oil companies were very open about the environmental issues they faced. I was invited to some particularly problematic sites and am pleased to announce that field trials will be conducted as soon as we can ship our bacterial products."

Protest actions

While the oil companies appear to be starting work on solving some of Nigeria's problems, a number of recent protest actions show how difficult it is to operate in a volatile political climate.

Most recently, Shell has reopened six oil producing stations in Nigeria's Delta State, which were shut down by protesters campaigning against local government changes.

Local people took 127 Shell staff and contractors hostage on Mar. 22 and damaged equipment in the stations. A number of local people were killed, and some hostages injured, in the skirmish.

A Shell official said the hostages were released in groups, and the last were brought out on Mar. 27. The protesters then left in small launches.

The first of the closed flow stations was opened again on Mar. 28, and all were back up and running on Apr. 1. Normally, Shell's Delta fields produce 450,000 b/d of oil.

The official said Apr. 2 that force majeure clauses in export contracts were brought into effect at Bonny terminal. Nine shipments were delayed by up to 3 days, but loadings were expected to return to normal in the last third of the month.

Though Shell once again found itself caught in a dispute outside its jurisdiction, there was nothing the company could do but negotiate a solution with the activists. "Shell was just there," the official said. "Invading oil installations was seen as a good way of bringing attention to the protesters' demands."

This protest followed capture of a lay barge by protesters 2 weeks before in marshland along the Nigerian coast. The DLB-1 lay barge of ETPM, Paris, was seized as it delivered goods to a Chevron Corp. terminal on the Escravos River.

A crew of 70 Nigerians from the Igbutu community, 16 French workers, three Britons, and a U.S. citizen were held by people from another local community who reached the barge in small boats.

An ETPM official said the lay barge crew was released after the company paid "compensation money" to the protesters for not being given jobs on the vessel.

The official said there is rivalry between Igbutu people and another local community. There was anger among the boarders that only Igbutus are employed on the barge.

"The others would like to work for us also," said the official, "but they picked an odd way to convey it. There was no panic or danger, and there was no violence. We got a negotiator on board, and the whole thing was over in a couple of days."

ETPM suffered a similar problem at the end of last year with its Polaris lay barge. Then the Nigerian navy was mobilized to regain control of the vessel and free hostages.

Nigeria's military dictator, Gen. Sani Abacha, has said the government intends to return the country to civilian rule by October 1998. Recent local elections were seen as a first test of its seriousness in pursuit of democracy.

This, and the government's earlier vow to divest itself of at least some of its large stake in joint venture producing operations during 1997-2001, offer some hope to oil companies.

Lure of prospects

While Nigeria's government continues unpredictable, and though its people are frustrated and apparently in a mood to protest, the lure of oil prospects keeps foreign companies interested.

Most recent recruit is Tuskar Resources plc, Dublin, which in March acquired a 2.5% working interest in Ukpokiti field offshore Nigeria from Camac International (Nigeria) Ltd.

Tuskar will issue ordinary shares to Camac in payment. The field is being developed by operator Conoco Energy (Nigeria) Ltd., with first oil due in July.

Conoco has a 40% interest, and Nigerian firm Express Petroleum & Gas Co. Ltd. holds 57.5%. Tuskar said field reserves are estimated at 32 million bbl of oil, and peak production is expected to be 20,000 b/d.

Most positively for Nigeria, though not without problems, Nigeria LNG Ltd., a consortium of NNPC 49%, Shell 25.6%, Elf 15.4%, and Agip 10%, has begun development work on an LNG export scheme at Bonny Island.

First proposed almost 30 years ago, the $4.5 billion plant will have capacity to produce 4.1 million tons/year of LNG beginning in 1999.

Exports were due to go to Italian electricity generator ENEL, Spanish gas distributor Enagas, Turkey's Botas, and Gaz de France.

ENEL had signed to take almost half the plant's output but in December 1996 canceled its contract because Italy's government had rejected a plan to build an LNG import terminal at Montalto di Castro.

Nigeria LNG is suing ENEL for breach of contract. The venture is looking to secure other customers.

South Africa

South Africa's ending of the apartheid regime and election of a democratic government have enabled the continent's strongest economy to return to international trade.

Already the country's three indigenous petroleum companies are working to expand outside South Africa. This is expected to benefit other countries on the continent.

Synthetic fuels

Sasol Ltd. was created by government to operate the country's synthetic fuels industry. Now Sasol is promoting proprietary synthetic fuels processes for international projects.

Most interesting of these is probably a natural gas to diesel fuel process, which Sasol reckons can allow development of gas fields far from markets and make use of gas currently flared.

This process is seen as an alternative to liquefaction for utilization of gas. One advantage is said to be its smaller plant size and therefore smaller minimum capital outlay.

Sasol claims a typical gas to diesel plant could be built for $300-400 million and could produce 10,000 b/d of diesel from 85 billion cu m/year of gas feedstock.

Though Sasol has built a successful pilot plant in South Africa, the first commercial scale development could be in Qatar, to utilize some of the gas produced in supergiant North field.

Sasol hopes to form a joint venture with Qatar General Petroleum Corp. to build a two-train 20,000 b/d capacity plant alongside Ras Laffan LNG export complex (OGJ, Mar. 24, 1997, Newsletter).

In another venture, Sasol and Norway's Statoil have formed an alliance to develop a floating production unit which incorporates a gas to synthetic crude oil plant.

The companies said such a floater would enable natural gas to be utilized at the point of production, eliminating the need to pipe gas to shore, reinject it, or flare it.

Statoil, which has gas reserves of more than 50 tcf, sees the floating gas to liquid concept as a potential means of utilizing remote gas finds in Europe.

The partners also intend to market floating gas conversion facilities to other oil and gas producers on a non-exclusive, case by case basis.

Engen's changes

Integrated petroleum company Engen Ltd., Johannesburg, last year floated off its exploration and production assets into Energy Africa, a company in which it holds a 60% interest.

The move was seen as a way of bringing in foreign capital to help it fund growth in upstream projects outside South Africa.

In the early post-apartheid period, Engen took shares in a number of international projects, including U.K. North Sea, Norway, and Oman developments.

Since then, the company has withdrawn from most of these to concentrate on building a portfolio of exploration and production assets throughout Africa.

Energy Africa earlier this year clinched a deal to take a share in 28 of Gabon's exploration and production projects.

A new company called Energy Africa Gabon SA was formed, owned 25% by Gabon's government and 75% by a 50/50 joint venture of Energy Africa and an African investment group.

This new unit has a stake in six potential developments. Energy Africa said the deal will involve it in most of Gabon's exploration successes, including deepwater licenses which hold considerable potential (OGJ, Feb. 3, 1997, p. 31).

Soekor work

Southern Oil Exploration Corp. (Pty.) Ltd. (Soekor) was formed by the apartheid government to undertake onshore and offshore oil and gas exploration in South Africa.

Soekor has developed F-A offshore gas field to provide natural gas to the Mossgas gas to liquids plant in Mossel Bay and expected to bring the country's first oil field, Oribi, on stream in April (OGJ, Mar. 17, 1997, p. 26).

Once Oribi is producing, Soekor intends to test other oil finds in the vicinity, with a view to developing them as subsea satellites. Soekor expects to be privatized under the government's restructuring program.

Once the company is privately owned, it intends to follow Engen in seeking overseas projects. Currently it is limited to South Africa by legislation.

In the long term, South Africa's re-emergence could benefit the Southern African Development Community (SADC), an inter-governmental group working to establish mutually beneficial strategies.

One of SADC's ideas is to link oil, gas, and electricity generation grids in countries south of the Sahara Desert. South Africa's petroleum companies could be a main driver in developing the continent's energy sector.

Copyright 1997 Oil & Gas Journal. All Rights Reserved.