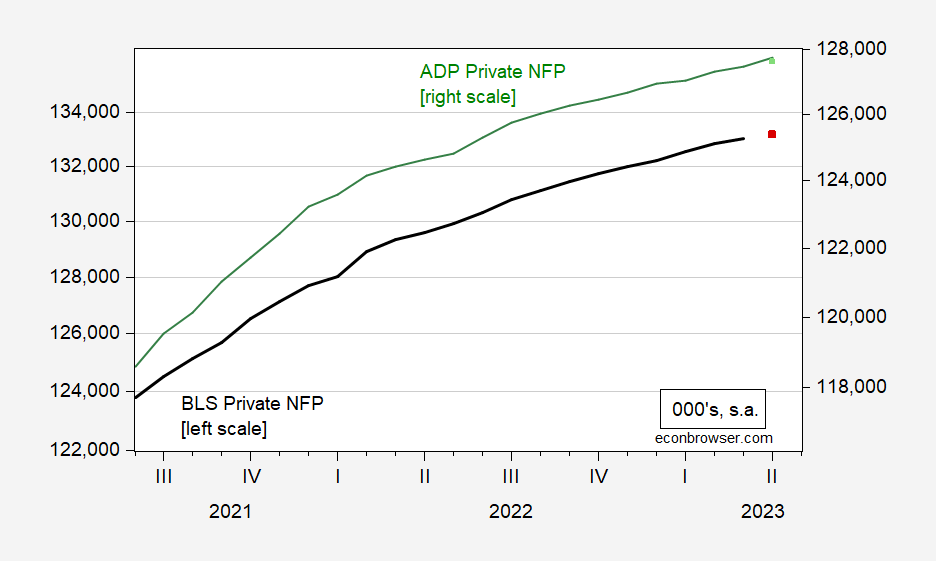

ADP private nonfarm surprises on upside, 296 vs 148 thousands. Using the first differences regression in this post to nowcast BLS private NFP, what does the picture look like?

First, the data as we have it now, along with Bloomberg consensus levels.

Figure 1: BLS private nonfarm payroll employment (black. left log scale), Bloomberg consensus of 5/3 (red square, left log scale), ADP private NFP (green, right log scale), and Bloomberg consensus of 5/3 (green square, right log scale), all in 000’s, s.a. Source: BLS and ADP via FRED, Bloomberg, and author’s calculations.

And here is the forecast from the regression (updated to include March data for BLS series, April data for ADP; adj-R2 = 0.66)

Figure 2: Log first difference of BLS private NFP (bold black), nowcast based on ADP data through April (light blue), +/- one standard error band (gray lines), Bloomberg consensus of 5/3 (red square). Source: BLS, ADP, Bloomberg and author’s calculations.

The point forecast is for 0.14% 0.27% m/m growth, or 267.2 365 thousand increase vs. Bloomberg consensus of 160 thousand. Note that the above graph shows the +/- one standard error band; a +/- 2 standard error band (barely) encompasses the Bloomberg consensus. [corrections 5/5]

Interestingly, CME Fed funds futures indicate slightly lower probability of raising rates today, but slightly higher at the June meeting (relative to yesterday’s futures contracts).

Bruce Hall must have made this Trump campaign ad!

https://www.msn.com/en-us/news/politics/trump-caught-using-photos-from-his-own-time-as-president-to-argue-life-is-worse-under-biden/ar-AA1aHjMG?ocid=msedgdhp&pc=U531&cvid=4c17c739555b483e98e626758bbe8b2d&ei=16

Donald Trump launched a new campaign ad this week purporting to show that the United States is doing worse under President Biden than it did during his time in the White House, but as Forbes points out, the two most prominent photos in the ad are from Trump’s own presidency. One of the photos showing a burning cop car was taken in Chicago on May 30, 2020. Another image shows migrants wading through knee-deep water with the caption, “Central American migrants cross the Suchiate River from Mexico to Guatemala, near Tecun Uman, Guatemala, Tuesday, Jan. 21, 2020″ — meaning that the people weren’t traveling north to the U.S. Both photos were taken during Trump’s watch. “The U.S. presidential election is still a year and a half away, but both Joe Biden and Donald Trump are already running ads,” writes Forbes’ Matt Novak. “The GOP is even running ads made completely with artificial intelligence. And if Trump’s current tactics are any indication, he’s going to keep lying as we get closer to election day.”

An informative thread that pgl disrupts on the very first comment with a personal attack…

I wonder if pgl’s comments are created by ChatGPT run amok. I also wonder if the Fed’s minutes are created by ChatGPT…would they be more or less decipherable if they were created by ChatGPT?

Did Jonny boy gets his little feelings hurt? Just wait until you see how our host took down every bit of your BS on mortgage rates!

A reader asked:

https://fred.stlouisfed.org/graph/?g=qVRw

January 15, 2018

Thirty- & Fifteen-Year Fixed Rate Mortgage Average and 10-Year Treasury Rate, 2017-2023

https://fred.stlouisfed.org/graph/?g=136lF

January 15, 2018

Thirty-Year Fixed Rate Mortgage Average minus 10-Year Treasury Rate, 2017-2023

That may interesting but there is an issue here – something called maturity matching. Yes little Jonny boy never got one should match 30 year notes with 30 year notes. Not 30 year v. 10 year. Now we know Jonny will protest that he has read about the graphed spread as something some other clueless cited. But then that does not excuse the failure to maturity match.

Yes —— —– — never got one should match 30 year notes with 30 year notes. Not 30 year v. 10 year.

[ This is incorrect. ]

Is it? See the most recent post from our host.

https://www.bankrate.com/mortgages/analysis/

The 30-year mortgage rate is set each Thursday, according to the rate of the 10-year Treasury:

https://fred.stlouisfed.org/graph/?g=137Pa

January 15, 2018

Thirty-Year Fixed Rate Mortgage Average minus 10-Year Treasury Rate, 2007-2023

“The 30-year mortgage rate is set each Thursday, according to the rate of the 10-year Treasury”

Reported not “set”. Please stop trying to rationalize JohnH’s stupidity.

the 10 year is a benchmark, because the 30 year mortgage tends to follow it rather closely. but as we have seen, there is a spread that does vary with time. so the 30 year mortgage is not simply set by the 10 year treasury. if that were the case, the spread would not vary, would it?

can you tell me why this is incorrect?

BTW I see that little Jonny boy is trying to defend his ignoring maturity matching because – well Jonny boy still defends the premise that the earth is flat.

There is something common in mortgage contracts called the right to refinance if interest rates fall. So any measured spread includes the value of this option in addition to some credit risk premium. And anyone who gets options price (I know – way over Jonny boy’s little head) realizes that the value of this option is very low when mortgage rates are low but rises when mortgage rates pass 6%.

But I have to apologize for bringing real finance to a discussion led by a little boy who throws tantrums in the sand box when someone notes how clueless he really is.

Here pgl goes again…telling mortgage bankers how to calculate their mortgage spread!!! And why not, since pgl knows better…just ask him!

And he thinks tge St. Louis Fed is wrong when it says: “Total mortgage spread is the difference between the Freddie Mac Survey 30-year mortgage rate and the 10-year Treasury yield.”

https://www.stlouisfed.org/on-the-economy/2020/july/mortgage-rates-not-matching-declines-in-treasury-yields

What pgl is too stupid to know is that lenders are in fact maturity matching…because the average mortgage is held by the mortgagee for only about tens years.

But pgl will continue to insist that HIS way is the only right way,

“the average mortgage is held by the mortgagee for only about tens years.”

So Jonny boy says without a shred of support. BTW – this author is one person. He is not the entire St. Louis FED.

But ah Jonny boy – do see the latest from Dr. Chinn. He gets is. You don’t.

“Here pgl goes again…telling mortgage bankers how to calculate their mortgage spread!!!”

I not telling bankers anything. And bankers are not doing your stupid calculation. Someone writing a FRED blog paper is not a banker. Come on Jonny – we know you are a moron. So why continue to write such stupid trash?

The 30-year mortgage rate is set each Thursday, according to the rate of the 10-year Treasury:

https://www.bankrate.com/mortgages/analysis/

This is not how the 30 year mortgage rate is set. I don’t know why you are insisting on supporting the insanity from JohnH.

ltr’s Theory of Term Structure “with Chinese characteristics”.

[ I’m sorry…… I know that was a cheap shot, but damn it, some dark part inside of me couldn’t resist ]

You made me laugh with that one!

https://www.bankrate.com/mortgages/analysis/

“How does the 10 year treasury correlate to mortgage rates?

‘Fixed-rate mortgages are tied to the 10-year Treasury rate. When that rate goes up, the popular 30-year fixed-rate mortgage tends to do the same, and vice versa….’ “

I don’t know why you are insisting on supporting the insanity…

I don’t know why you are insisting on supporting the insanity…

I don’t know why you are insisting on supporting the insanity…

https://www.bankrate.com/mortgages/analysis/

“How does the 10-year Treasury correlate to mortgage rates?

‘Fixed-rate mortgages are tied to the 10-year Treasury rate. When that rate goes up, the popular 30-year fixed-rate mortgage tends to do the same, and vice versa….’ “

Correlate is not setting. Come on – you are generally better than this.

Off topic, another look at “the most important election in 2023”:

https://www.nakedcapitalism.com/2023/05/erdogan-makes-comeback-in-turkish-polls-opposition-sends-mixed-signals-on-russia.html

Pretty level-headed for Yves Smith. Worth reading, if only to catch up on Turkish politics.

Global average ocean surface temperature was ever so slightly holy-crap-this-has-never-happened-before in April:

https://twitter.com/ClimateDefiance/status/1653542465805197314/photo/1

That’s probably just “weather” or “because liberals” or something like that, so no need to freak out.

The source of the chart, Climate Defiance, notes that the El Nino expected this year may have not yet arrived, or have only partly arrived. If the temperature rise in April is the El Nino, then it ain’t good, but we don’t have to wait for the other shoe to drop. If the rise reflects CO2-driven change, then we are in for even more surface temperature rise when El Nino does fully arrive.

For those eager to cast asparagus for pitiful reasons, the BBC reports the same facts, but is less willing to hope for the best:

http://www.bbc.com/news/science-environment-65339934.amp

The BBC flat out says El Nino is still on the way. Bye-bye coral reefs. Hello big storms.

Auto-correct changed “political” to “pitiful”. I left it; sometimes, auto-correct is a better writer than I am.

When you attacked asparagus, you took it too far. Olive oil, garlic and salt. With Salsa?? With a nice steak can make it more tolerable.

OK, yeah it makes your ___ smell funny. It’s not any worse than uuuh….. sulfur soap….. https://www.walmart.com/ip/Sulfur-Soap-Removes-Mites-Washes-Hands-Bath-Soaps-Body-Cleansers-Women-Men-Faces-Washes-F4X9/1725025442?wmlspartner=wlpa&selectedSellerId=101241613&adid=222222222271725025442_142237155539_18503876870&wl0=&wl1=g&wl2=c&wl3=625813167114&wl4=pla-1811116262315&wl5=9026166&wl6=&wl7=&wl8=&wl9=pla&wl10=657134131&wl11=online&wl12=1725025442&veh=sem&gclid=EAIaIQobChMIj7Tw0MHa_gIVO_LjBx1W9Q5DEAQYCyABEgJAmPD_BwE&gclsrc=aw.ds

That’s the exact same brand sulfur soap they forced students at the state Uni I worked at in China to carry around during SARS. Learn to love the stink friend, learn to love the stink.

A reader remarked that an American advisory company has warned about a looming rice shortage in China and developing Asia and Africa. The warning was in turn written about in the Chinese press. However, China has well over 2 years of rice in storage and grain storage capacity is being significantly added to. Also, while China has had ample rice harvests for years, planting acreage is being added to, rice varieties are being steadily improved, crop protection is being improved and China has been steadily adding to available field water supplies. Chinese spending on general water conservancy just this year will be above $125 billion.

Then there is the rice crop in developing Asia and Africa, and China has been steadily working on improving rice cropping from Madagascar and Tanzania to the Philippines….

https://english.news.cn/20230503/026d7825289148d9ae8ce13e0ec25498/c.html

May 3, 2023

Chinese rice breeding tech boosts agricultural development in Asia, Africa

BEIJING — In a laboratory at the Chinese Academy of Agricultural Sciences (CAAS) in northern Beijing, researchers are busy tagging and editing genes in rice, a key component of the complex breeding process of green super rice (GSR).

As its name suggests, this variety of rice boasts high yields while remaining environmentally friendly.

“We apply the method of genetic screening to put the quality or the traits that we need in the rice,” said Xu Jianlong, a professor at the Laboratory for Molecular Rice Breeding under the Institute of Crop Sciences, CAAS.

Since 2008, under the support of the Chinese government and the Bill & Melinda Gates Foundation, the laboratory began to develop GSR varieties to boost the agricultural development in resource-poor areas in Africa and Asia.

“We have been breeding different GSR varieties that are able to adapt to different ecological environments in different countries. In Africa, for example, we breed varieties that are more resilient to drought and high temperature, while in Southeast Asia where typhoons are common, we produce rice that is resilient to collapse and diseases such as bacterial blight,” Xu explained.

According to the expert, when super typhoon Haiyan hit the Philippines in 2013, all crops of local rice varieties at the island of Leyte were wiped out. “However, the GSR8 variety we trialed planting there showed better tolerance to flooding, drought and salt damage, with a harvest of 1.2 tons per hectare.”

The Philippine government then decided to promote the use of GSR8 seeds, resulting in the rapid expansion of GSR variety to cover 430,000 hectares in 2014. As of 2018, the GSR varieties have been promoted in the Philippines for a total of 1.09 million hectares, accounting for 22.64 percent of the country’s rice acreage. By 2021, the cumulative area of GSR varieties reached 10.8 million hectares in the Philippines.

Successful stories were also found in other Asian countries. The NIBGE-GSR1, which was promoted in Pakistan, has an average yield of about 9.5 tons per hectare, compared to 7 tons for the local variety. Currently, six GSR varieties, including NIBGE-GSR1, 2, 3, 7, 8, and NIAB GSR39, have been certified by the Pakistani authorities, according to CAAS.

For the CAAS experts, the roll-out of the GSR in Africa has been quite challenging, since the agricultural infrastructure there is relatively poor.

With the technical support of CAAS, Green Agriculture West Africa Ltd., attached to Chinese construction company CGCOC Group, has developed the GSR variety GAWAL R1 to help increase rice production. Validated in Nigeria in 2017, GAWAL R1 yielded about 30 percent more than the local variety Faro 44. With its popularization, the average rice yield across Nigeria rose from 1.98 tons per hectare in 2019 to 2.5 tons per hectare in 2022….

New detail on how we ended up with the second-worst U.S. president of the last century, a war of choice in Iraq, a greatly expanded deficit and a loss of regard for the U.S around the world. And a lot of dead people who didn’t need to be dead. And Iran on its way to nuclear weapons. And the normalization of presidents who don’t read, listen or bother much with facts:

https://edition.cnn.com/2023/05/02/politics/bush-gore-oconnor-supreme-court-2000/index.html

More on the debt ceiling –

Krugman is talking up what to me is a new idea for pushing the debt-ceiling default date into the future – premium bonds. The idea is to issue bonds on a discounted basis, like bills. The discounted value of a note maturing inten years is considerably lower than the nominal value at maturity, and that difference lowers the nominal value of debt under the limit.

The Fed isn’t involved in this scheme. That’s a plus. Krugman offers one view in which I have limited confidence:

“If you try to explain all this, people’s eyes glaze over — which is good! Hard to get outraged over something that baffles you.”

If a bunch of partisan hacks demagogue this issue, as they have so many others, the public could be convinced of things which are completely wrong, because the public doesn’t have the background to ward off misinformation.

One issue which Krugman doesn’t rise but which could cause big, in some cases unanticipated, adjustments in find income markets, is the rise in the duration of outstanding Treasury debt if that debt is issued on a discount basis. No coupon payments means an automatic extension of duration. Another related issue is the use of Treasuries for hedging and benchmarking. Change the payment stream and you change a lot.

This is not to say that Krugman’s idea is bad; default is almost certainly worse than adjusting to what would probably be a rolling adjustment to premium bonds. But, if banks are, for instance, having a problem with maturity transformation and market liquidity is sometimes not what it should be, there are some risks to premium bonds.

Raising the debt limit is the least risky option. Big time.

A thousand times Oops!!! I got this wrong. It’s an above-market premium, not a discount note. Egg on my face.

The issues remain the same, but with duration reduced rather than extended.

https://twitter.com/i/flow/login

Proves Krugman’s point about not understanding stuff.

Krugman calling out WaPo on the coin was kind of entertaining. Wondering who the editor was on that one?? I bet if Ziva Branstetter had been there that one wouldn’t have slipped through the cracks~~and she doesn’t even specialize in economics.

Some have attributed the high mortgage spread to volatility. But the MOVE index is just a little bit higher than a year ago, while the mortgage spread is 60 basis points higher. And the 10 year treasury is half a per cent higher than a year ago.

https://www.google.com/finance/quote/MOVE:INDEXNYSEGIS?window=5Y

“Some have attributed the high mortgage spread to volatility.”

Some? Who would that be little Jonny boy? Do see Dr. Chinn’s latest post. Argue with him – this should be fun.

Upon further reflection (not easy when I haven’t slept in the last 50 hours or so), the shift in duration that would result from issuing premium bonds would probably clear itself up in the secondary market. Premium bonds would trade (I’m guessing) at market interest rates in the secondary market, which would mean they would also be priced like market-yielding bonds. Which would mean carrying the same duration as Treasuries yielding market rates. I’m not at all sure that would be the case for perpetual bonds (which Krigman mentions), but perpetually would completely defang the debt ceiling.

There is no “rate hikes” in June. The party is over there. Now comes the time when rate decreases to balance interest rates begin. October???? January????

Econoday shows the following:

Nonfarm private forecast 153K

Range from 125K to 170K

Nonfarm total forecast 178K

Range from 140K to 200K

My hobby forecast:

Nonfarm private 150K

Nonfarm total 166K

Given ADP report could be far off the mark.

Gracias. Knowing your level of diligence, I see your forecasts as a worthwhile addition to information ahead of the release. Keep it up, please.

This is not how the 30 year mortgage rate is set. I don’t know why you are insisting on supporting the insanity from JohnH.

MD,

Thanks for the comments. Below are some comments about job openings, labor force and total employed that may be of interest.

Jason Lahart presented an interesting relationship in his column on April 4, 2023. The presented chart shows the relationship between job openings, labor force and total employment. The relationship presented as a ratio from FRED data link below, can be converted to a percent relationship as found in the column. The thought is that as long as the ratio or percentage are above zero, we may keep the unemployment rate from rising to uncomfortable levels.

From Lahart’s column:

“The number of job openings plus the level of overall U.S. employment was 2.4% higher than the number of people working or looking for work in February, compared with 2.9% in January. This “jobs-workers gap,” as Goldman Sachs economists have termed it, was only rarely positive in the two decades prior to the pandemic.”

As of the March 2023 the gap is about 2.25%

https://fred.stlouisfed.org/graph/?g=128Xj

Excellent! And what happened to the firewall?

https://www.wsj.com/articles/lower-job-openings-could-be-a-welcome-sign-for-u-s-economy-50b06842

Thanks very much. Justin makes the point in another recent column that employment circumstances can deteriorate very rapidly:

“In the run-up to past recessions, the weekly claims figures have often moved a bit higher—and then suddenly jumped.”

https://www.wsj.com/articles/the-labor-market-might-be-bending-it-isnt-breaking-8548c284

So complacency isn’t warranted, but “this time is different” is obviously true, and perhaps in a good way. Looks like labor hoarding is popular right now.