You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

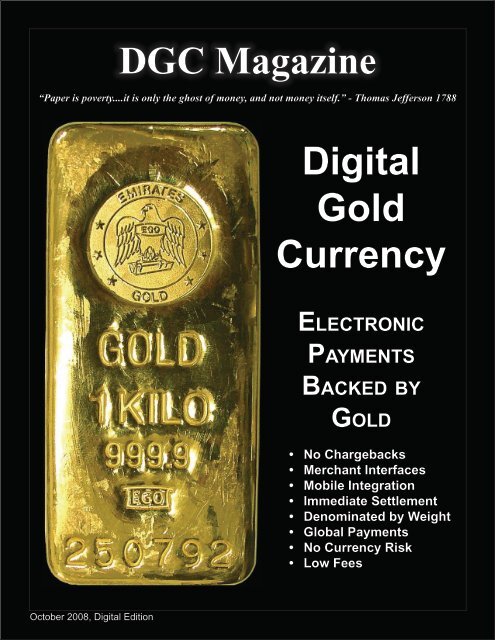

<strong>DGC</strong> <strong>Magazine</strong><br />

“Paper is poverty....it is only the ghost of money, and not money itself.” - Thomas Jefferson 1788<br />

October 2008, <strong>Digital</strong> Edition<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

<strong>Digital</strong><br />

<strong>Gold</strong><br />

<strong>Currency</strong><br />

El E c t r o n i c<br />

Pay m E n t s<br />

Ba c k E d B y<br />

Go l d<br />

No Chargebacks<br />

Merchant Interfaces<br />

Mobile Integration<br />

Immediate Settlement<br />

Denominated by Weight<br />

Global Payments<br />

No <strong>Currency</strong> Risk<br />

Low Fees

The <strong>Gold</strong>en Road To The Last Village<br />

by Paul Roseberg<br />

Page 5<br />

e-gold Engages KPMG to Assist<br />

in Development of AML Program<br />

Improvement<br />

Page 6<br />

The Future of Private money<br />

by Sidd, Co-Founder of Pecunix<br />

Page 8<br />

WebMoney Passes 6,000,000<br />

Registered Accounts<br />

Page 12<br />

Fiat currency<br />

by Patri Friedman<br />

Page 15<br />

Time for a gold rouble?<br />

Page 15<br />

A Modern <strong>Gold</strong> Standard?<br />

Page 18<br />

Notice: e-gold Bar Count Change<br />

Page 20<br />

India’s first spot bullion platform at<br />

Coimbatore<br />

Page 20<br />

On <strong>Gold</strong>en Island<br />

by Claire Wolfe<br />

Page 22<br />

What Will The ‘New’ E-gold Look<br />

Like?<br />

Page 27<br />

All E-gold Accounts Now Require Tax<br />

ID Information<br />

Page 30<br />

Cover is a 1 Kilo gold bar from Emirates <strong>Gold</strong><br />

http://emiratesgold.ae<br />

Banks Crumble, Wait for Physical<br />

Bullion Gets Longer<br />

by Patrick A. Heller<br />

Page 30<br />

BullionVault.com Becomes London<br />

Bullion Market Association Member<br />

Page 32<br />

’Top Shelf’ <strong>Digital</strong> <strong>Gold</strong><br />

by Mark Herpel<br />

Page 33<br />

Cryptohippie Gets A Big <strong>DGC</strong><br />

<strong>Magazine</strong> Endorsement<br />

Page 38<br />

Pay Zakat in <strong>Gold</strong><br />

by Omar Javaid CRITIC <strong>Magazine</strong><br />

Page 41<br />

Justice, Policing, and E-<strong>Gold</strong><br />

by Michael S. Rozeff<br />

Page 46<br />

The Inevitable End of the Central<br />

Banking and Political Money Regime<br />

by Thomas H. Greco, Jr.<br />

Page 52<br />

Print Issue Now Available.<br />

How to get a print copy?<br />

Go to http://www.magcloud.com and search<br />

for ‘<strong>DGC</strong>magazine’ order up one. To buy an<br />

issue with gold or get a free copy contact<br />

the editor.<br />

Editor, Mark Herpel<br />

editor@dgcmagazine.com<br />

Skype IM ‘digitalcurrency’<br />

What’s Inside<br />

<strong>DGC</strong> <strong>Magazine</strong> is published online 12 times a<br />

year. Subscriptions are currently free.<br />

© 2008 <strong>DGC</strong> <strong>Magazine</strong> All Rights Reserved<br />

<strong>DGC</strong> <strong>Magazine</strong> October Issue § 3

4 § <strong>DGC</strong> <strong>Magazine</strong> October Issue

th E Go l d E n ro a d to<br />

th E la s t Vi l l a G E<br />

by Paul Roseberg<br />

The US economy and the global financial system<br />

are tipping at the brink. You probably watch the<br />

financial channels every day to see if and when<br />

the markets will turn a corner and pull themselves<br />

back together. But it’s not just you – people in<br />

thousands of small towns all over the world are<br />

also watching, and that probably isn’t helping your<br />

business.<br />

As you get further away from the first-world cities<br />

where you live and work, it gets harder and harder<br />

to convince people to step into an all-electronic<br />

money regime. (These folks don’t trust their<br />

own local officials, much less money-masters in<br />

Washington or Brussels!)<br />

There is, however, one asset class that people in<br />

even the smallest village understand and respect,<br />

and that is gold. <strong>Gold</strong> requires no explanation, and<br />

it is always of value. Princes come and princes go,<br />

empires come and empires go, but gold remains<br />

unchanged. People in the smallest villages have<br />

understood this for a hundred generations. Instead<br />

of fighting against this long-held belief, why not<br />

turn it to your advantage? Use it!<br />

DIGITAL GOLD<br />

<strong>Digital</strong> gold is nothing new; it has been actively<br />

used for a decade or more by millions of people<br />

and at transaction rates in the billions of dollars<br />

per year. The gold remains in audited warehouses<br />

and ownership is exchanged electronically.<br />

Micro-payments? No problem. Send a thousandth<br />

of a gram if you like.<br />

<strong>Currency</strong>-to-currency conversions? Not even an<br />

issue. It never converts at all – it’s gold!<br />

There have certainly been regulatory issues with<br />

digital gold (the burden of being new), but there is<br />

a stunning lack of complaint from the actual users<br />

– they love it.<br />

The <strong>Gold</strong>en Road To The Last Village<br />

I won’t waste time in this article, explaining the fine<br />

points of digital gold systems. First of all, you can<br />

probably guess most of the details – the systems<br />

operate pretty much the way you’d expect them<br />

to operate. Secondly, you can poke around<br />

<strong>DGC</strong> <strong>Magazine</strong>’s web site and find most of the<br />

information you need.<br />

THE HUGE ADVANTAGE OF GOLD<br />

How hard would it be for you to make arrangements<br />

with a gold dealer in a regional city to accept your<br />

payments in return for gold and silver coins? You<br />

could probably get it done in a few days. At worst,<br />

you’d have to leave an escrow at the local bank.<br />

The dealer would make a few percent on each sale<br />

and you would actually generate a bit of revenue<br />

on each transaction.<br />

BUT… think about what that means to the doubting<br />

old man in the last little village of your territory.<br />

This man will not be impressed by your technology<br />

and he certainly doesn’t want to hear about your<br />

network. But you’ll get his immediate attention if he<br />

understands that when he uses your system, he’s<br />

using nothing but actual gold! Heck, you could give<br />

your first customer in the village a free bus ticket to<br />

the city to exchange some digital currency for gold<br />

or silver bullion. Can you think of a more visceral<br />

marketing technique than this person stepping off<br />

the bus and showing their friends and neighbors<br />

the shiny new coin they got with your system?<br />

THE ISSUE OF TRUST<br />

Hawala and similar value transfer systems have<br />

endured because of trust. The Hawaladar is a<br />

trusted man in the community, tribe or clan. For<br />

him to betray that trust would generate horrible<br />

consequences for himself and for his family. You<br />

cannot compete with that. You are an outsider.<br />

You can, however, make the issue entirely moot.<br />

<strong>Gold</strong> does not require trust. It simply is what<br />

it is. And if your currency is known to represent<br />

physical gold, the issue of trust becomes almost<br />

meaningless. I send you a payment and you<br />

receive it instantly (unlike Hawala). And if you<br />

have any reservations at all, you can run to the<br />

next village and turn it into gold bullion.<br />

<strong>DGC</strong> <strong>Magazine</strong> October Issue § 5

The <strong>Gold</strong>en Road To The Last Village<br />

Speed and redemption trump the ancient way.<br />

Sure, some will still prefer the ancient way simply<br />

because of its age, but that sort of resistance seldom<br />

lasts in the face of overwhelming advantages.<br />

WHO NEEDS A BANK?<br />

Bank accounts are creatures of the West’s industrial<br />

era. They certainly made sense in their time and<br />

place, but opening one is an unwieldy, unpleasant<br />

experience. People would rather not go through<br />

the process if they don’t have to.<br />

The traditional banking and currency model is<br />

also problematic for businesses. Consider your<br />

own: Instead of creating complex hierarchical<br />

systems for transferring value (the MMT device,<br />

the intermediary, the local bank account, currency<br />

converters, hubs, etc.), why not just use electronic<br />

gold and flatten out the entire process? How<br />

much more profitable would you be, minus a few<br />

layers?<br />

<strong>Digital</strong> gold is a better architecture, and - soon<br />

enough - it will be adopted.<br />

Moreover, this is the way to “bank the unbanked.”<br />

Getting these people to rearrange their lives<br />

your way involves getting them to a bank, getting<br />

them to fill out forms full of highly personal and<br />

embarrassing information, and begging them to<br />

trust this new institution with their earnings. I don’t<br />

have to tell you that this is not an easy sell in many<br />

places. But, if you offer them gold, and require only<br />

a visit to their local store, they will be interested<br />

and even eager.<br />

Why spend time and money forcing unwanted<br />

burdens upon your customers, when it’s easier<br />

and cheaper to do things their way?<br />

OBSTACLES & REWARDS<br />

There will be obstacles to face if you decide to rollout<br />

a digital gold system. Most of them will revolve<br />

around the phrase, “We’ve never done it that way.”<br />

People in the hierarchy of existing systems may<br />

object. You may find yourself facing-off against an<br />

old institution. Some people may even say bad<br />

things about you.<br />

Make no mistake, digital gold is the best way to<br />

do business with the last village, and perhaps the<br />

6 § <strong>DGC</strong> <strong>Magazine</strong> October Issue<br />

only way. But, if the obstacles don’t seem worth<br />

crossing, you can certainly keep trying as you<br />

have been.<br />

Some company is going to do this – the advantage<br />

to be gained is too large to ignore. That company<br />

will then use their advantage and become an<br />

industry leader… possibly the industry leader.<br />

© Copyright 2008 by Paul A. Rosenberg<br />

Paul is the author of A Lodging of Wayfaring Men<br />

and other books. You can find his work at<br />

http://www.veraverba.com<br />

E-G o l d ® En G a G E s kPmG to<br />

as s i s t E-G o l d in i t s dE V E l o P m E n t<br />

o f aml Pr o G r a m im P r o V E m E n t<br />

Melbourne, FL (PRWEB) September 30, 2008<br />

-- e-gold Ltd. announced today that it has<br />

retained KPMG LLP to assist e-gold Ltd. with<br />

the development of an improved Anti-Money<br />

Laundering Program. KPMG’s Advisory Services<br />

practice brings significant industry knowledge and<br />

experience that will greatly benefit e-gold Ltd.,<br />

e-gold Ltd. announced.<br />

Dr. Douglas Jackson, e-gold Ltd. Chairman, said,<br />

“e-gold Ltd. is seeking to have one of the market’s<br />

most effective Anti-Money Laundering Programs.”<br />

Dr. Jackson said e-gold Ltd.’s goal is to implement<br />

significant enhancements to its Anti-Money<br />

Laundering Program in the next 30-60 days.<br />

About e-gold:<br />

e-gold is integrated into a secure accountbased<br />

payment system, operating globally 24/7,<br />

featuring instantaneous payment settlement with<br />

no charge back risk, at lower cost. Shopping<br />

cart, automation, and mobile phone interfaces<br />

are available. Operational since 1996, e-gold has<br />

settled over 90M transactions, serves customers<br />

in 165 countries, and has a circulation of over 2.2<br />

metric tons of e-gold.<br />

For information contact Bill Cunningham, US<br />

1-321-956-1200 ext 127 Or visit<br />

http://www.e-gold.com

The True Nature of Money<br />

Administrative Headquarters<br />

Net Transactions Limited<br />

12-14 David Place<br />

St. Helier, Jersey<br />

JE2 4TD<br />

Channel Islands (UK)<br />

Tel: +44-1534-511-977<br />

Fax: +44-1534-511-988<br />

http://www.<strong>Gold</strong>Money.com<br />

<strong>Gold</strong>Money<br />

<strong>DGC</strong> <strong>Magazine</strong> October Issue § 7

The Future of Private Money<br />

Th e Fu T u r e o F Pr i vaT e m o n e y<br />

Since the early 1990s forward thinkers have been<br />

discussing various technologies that could be<br />

used for private money. With the arrival of strong<br />

cryptography and the Internet, digital cash in the<br />

form of “<strong>Digital</strong> Bearer Certificates” became a real<br />

possibility. In this article we will look at the history<br />

behind the idea of bearer certificates and why it is<br />

more relevant today than ever before.<br />

th E h i s t o r y o f wa r E h o u s E<br />

r E c E i P t s a s m E a n s o f E x c h a n G E.<br />

Since around 330 BC in Ancient Egypt warehouse<br />

receipts have been used as a form of money.<br />

Farmers deposited grains in secure warehouses<br />

and received written receipts for specific quantities<br />

of grain. The receipts could be returned and<br />

exchanged for the grain when needed. These<br />

receipts were much easier to carry, store and<br />

exchange than bags of grain, so they were used<br />

as a secure and convenient form of payment. The<br />

warehouse receipt itself had no inherent value; it<br />

was only a symbol for something of value. These<br />

highly successful ancient grain banks eventually<br />

evolved into the goldsmith banks in seventeenth<br />

century England.<br />

These were the early days of the mercantile<br />

revolution when gold and silver coins were the<br />

common money. No banks existed in England at the<br />

time so people stored their wealth with the leading<br />

goldsmiths of London, who already had stores of<br />

precious metal in secure private vaults. For each<br />

deposit of precious metal, the goldsmiths issued<br />

paper receipts certifying the quantity and purity of<br />

the metal. Like the grain receipts, the goldsmiths’<br />

receipts soon began to circulate as a safe and<br />

convenient form of money backed by the gold and<br />

silver in the vaults. These receipts represented a<br />

promise by the goldsmith to exchange the receipt<br />

for a certain amount and quality of metal, and<br />

were “negotiable” in that anyone (the bearer of the<br />

8 § <strong>DGC</strong> <strong>Magazine</strong> October Issue<br />

b y Si d d, Co-Fo u n d e r o F Pe C u n i x<br />

receipt) could present the receipt to the goldsmith<br />

and take possession of the metal.<br />

The system of goldsmith receipts worked<br />

exceptionally well so the obvious question to ask<br />

is why, if the warehouse receipt system worked so<br />

well, did it not continue to be used through to the<br />

present?<br />

th E d E c l i nE<br />

With their warehouse receipts working extremely<br />

well as money, and earning a decent fee for<br />

storing the precious metal, the goldsmiths became<br />

well known and prosperous. It was not long<br />

before people began asking the goldsmiths to<br />

lend them money. Merchants needed to expand,<br />

farmers wanted to buy more land, the borrowed<br />

money could facilitate wealth and prosperity. The<br />

goldsmiths soon learned that they didn’t need to<br />

lend their own gold. They could simply write out<br />

more receipts to “create money”, even if they<br />

didn’t have the metal in their vault to back them<br />

up. Nobody except the goldsmiths knew how much<br />

gold they had in their vaults, or how many receipts<br />

they had issued. The receipts were still accepted<br />

at their full value, even though in reality there was<br />

not enough gold to back them up. A subtle change<br />

had happened; the goldsmiths had become<br />

bankers, and the papers they were issuing were<br />

no longer warehouse receipts, but had become<br />

bankers’ notes (bank notes). The paper was no<br />

longer backed up by real metal in a vault, but by<br />

the bankers’ promise to pay the bearer the value<br />

on the note. It is obvious that these new bankers<br />

were being dishonest, and ultimately their fraud<br />

was revealed and the system collapsed.<br />

The problems with the early goldsmith bankers<br />

were caused primarily by a lack of adequate<br />

financial governance. What the goldsmiths lacked<br />

was a system that would keep them honest and

<strong>DGC</strong> <strong>Magazine</strong> October Issue § 9

The Future of Private Money<br />

would allow their customers to have reasonable<br />

certainty that the warehouse receipts they were<br />

using truly were as valuable as claimed. If those<br />

early bankers had allowed or encouraged their<br />

customers to elect a trustworthy member of the<br />

community to act as an auditor of their affairs, the<br />

problem would not have arisen. The auditor would<br />

simply examine and count all the precious metal<br />

in the vault, then examine the banker’s receipt<br />

book. It would be instantly obvious if there was a<br />

difference in the amount of reserve and the value<br />

of the issued receipts. If the people who used the<br />

receipts for trade trusted the auditor they could<br />

always be confident that the receipts had full<br />

value.<br />

Unfortunately instead of implementing honest<br />

auditing and keeping the money supply private, the<br />

government stepped in and started to regulate the<br />

banking industry. This was the beginning of the end<br />

for anything remotely resembling honest money.<br />

Money has degenerated over the years to the<br />

point that it is highly dishonest and untrustworthy.<br />

Bankers and governments do an extremely poor<br />

job of protecting the wealth of the people who<br />

trust them and the current runaway inflation and<br />

financial breakdown is perfect evidence of this. As<br />

we watch government money steadily decline in<br />

value, we need to replace it with money of real<br />

substantive value.<br />

wa r E h o u s E r E c E i P t s t o d ay<br />

In the early 1990s, Nick Szabo coined the term<br />

“<strong>Digital</strong> Bearer Certificate” and described it as a<br />

broad term incorporating various technologies. A<br />

digital bearer certificate may come in various forms<br />

such as digital cash, digital warehouse receipt,<br />

digital certificate of deposit, digital credit note, etc.<br />

Each of these forms may also come in various<br />

forms: digital cash may be cryptographically<br />

blinded or not, it may be one-use only, it may have<br />

cryptographic integrity or not, etc. “Cryptographic<br />

Warehouse Receipt” describes a specific type<br />

of digital bearer certificate which uses modern<br />

technology to implement exactly the same idea<br />

as the goldsmiths’ receipts of old. Warehouse<br />

receipts are an established principle still used in<br />

modern society, most commonly for agricultural<br />

10 § <strong>DGC</strong> <strong>Magazine</strong> October Issue<br />

and industrial trade, and have an established<br />

legal status. Most warehouse receipts are issued<br />

in negotiable form so they can easily function as a<br />

money substitute.<br />

The technology is available to create a system<br />

of gold or silver (or any commodity) warehouse<br />

receipts issued by an efficient and secure<br />

computerized system under a policy of strong<br />

governance. Using modern highly secure<br />

cryptographic techniques and combining this with<br />

the Internet, we can efficiently facilitate both local<br />

and international exchanges between traders,<br />

merchants and their customers.<br />

If we use a computer to create the receipt, the<br />

issuing warehouse can cryptographically “sign”<br />

the document to guarantee its authenticity. It<br />

isn’t possible for anyone to create counterfeit<br />

warehouse receipts because they don’t have the<br />

signing key. The receipts can be digitally stored<br />

in a database or as text files, and can be passed<br />

from person to person using Internet facilities such<br />

as e-mail and instant messaging. As long as there<br />

is always a strong governance system in place,<br />

people who use these warehouse receipts can be<br />

confident that the receipt has real value.<br />

After the historical success and failure of warehouse<br />

receipts, it is reasonable to ask what relevance<br />

they have today. Right now we are experiencing<br />

a serious crisis in the fraudulent money system<br />

currently run by bankers in collusion with corrupt<br />

governments and we need to create a practical<br />

and honest alternative. During the last 15 years we<br />

have seen various experiments in private money<br />

issuance based on gold, with the most successful<br />

being e-gold, the Liberty Dollar and various clones<br />

of e-gold such as <strong>Gold</strong>Money and Pecunix. These<br />

private money systems have served their purpose<br />

well as experiments, but unfortunately have flaws<br />

and consequently do not appear to be resilient<br />

enough to survive. Bankers and governments<br />

don’t easily accept honest competition and these<br />

early experiments have recently come under<br />

attack. Both e-gold and Liberty Dollar have been<br />

charged by the United States authorities with<br />

alleged offenses ranging from “money laundering”,<br />

unlicensed money transmitting and fraud.

<strong>DGC</strong> <strong>Magazine</strong> October Issue § 11

The Future of Private Money<br />

As the pioneer in online digital money, e-gold is<br />

an excellent case study that can help us develop<br />

private money into the future. Although e-gold<br />

models themselves as an issuer of digital gold<br />

currency, their main function is more in the line of<br />

an account based payment system. This means<br />

that they are able to control who uses their system<br />

and how their system is used, and the government<br />

expects them to do that. If we look at the Federal<br />

Reserve Bank (that issues US Dollars) we can see<br />

that they don’t have this problem. Once they have<br />

printed the money and distributed it into the world,<br />

they have absolutely no control on who uses the<br />

money or how it is used. Consequently it would<br />

be impractical to accuse the Federal Reserve<br />

Bank of facilitating crime and they can plausibly<br />

deny knowledge of any alleged crime. In the case<br />

of e-gold, it is much easier for law-enforcement<br />

agencies to accuse e-gold of facilitating crime than<br />

it is for them to find and charge the real criminals,<br />

as they must do if Federal Reserve notes are used.<br />

Furthermore, e-gold has no way to plausibly deny<br />

any knowledge of the alleged crime because they<br />

have complete records of every e-gold transaction.<br />

The introduction of cryptographic warehouse<br />

receipts would put the issuer in the same position<br />

as the Federal Reserve Bank in terms of plausible<br />

deniability and could protect the issuer from<br />

frivolous attacks by lazy law-enforcement agencies.<br />

Clearly the current political and legislation regime<br />

in the world does not encourage private currencies<br />

in the way they have been implemented to date so<br />

innovators need to come up with new systems to<br />

challenge the status quo.<br />

Research indicates that there is a distinct change<br />

in human consciousness rapidly spreading<br />

throughout the world. Perhaps it is due to the<br />

facilitation of massive and instant information<br />

exchange through the Internet, but no matter<br />

what facilitates this process of change, people<br />

are waking up to the realities of life under corrupt,<br />

violent controlling governments. The world is<br />

ready for honest money that puts the economic<br />

power back into the hands of the people who<br />

produce, and forces governments to work as they<br />

should. The issue of gold based money in the form<br />

of warehouse receipts suits this new paradigm<br />

perfectly.<br />

12 § <strong>DGC</strong> <strong>Magazine</strong> October Issue<br />

Payments between people, merchants and<br />

customers using well governed cryptographic<br />

warehouse receipts are secure, private and<br />

highly resistant to government interference. The<br />

larger the number of independent private money<br />

issuers, the more resilient the system will become.<br />

Today we have the ideal situation to use this type<br />

of private money for worldwide trade. We have<br />

extremely efficient computer and Inter-network<br />

systems and modern highly secure cryptographic<br />

techniques. It’s time for people to take back the<br />

control of their wealth and money, and one way to<br />

ensure this is for them to return to the system that<br />

stood the test of time (approximately 2500 years).<br />

Using precious metals, gold and silver as money,<br />

combined with the efficiency, security and privacy<br />

offered by cryptographic warehouse receipts is a<br />

viable solution for honest worldwide commerce in<br />

the future.<br />

1 http://en.wikipedia.org/wiki/Social_evolution_of_money<br />

2 http://en.wikipedia.org/wiki/Banknote<br />

3 http://szabo.best.vwh.net/bearer_contracts.html<br />

4 http://anoncvs.aldigital.co.uk/lucre/theory2.pdf<br />

5 https://ffij33ewbnoeqnup.onion.meshmx.com/doc.php<br />

6 http://en.wikipedia.org/wiki/Warehouse_receipt<br />

wE Bmo n E y Pa s s E s 6,000,000<br />

rE G i s t E r E d ac c o u n t s<br />

Congratulations to Webmoney for now having more<br />

than 6 million registered accounts. Webmoney<br />

Transfer, the highly trusted and recognized leader<br />

in global digital currency, has just passed a major<br />

milestone of 6 million accounts. Look out PayPal....<br />

It was just March, that Webmoney passed 5<br />

million accounts, so they are rapidly advancing<br />

their global client base much faster than any other<br />

digital currency. This is more than 1 million new<br />

users in just the past 6 months. Webmoney is a joy<br />

to use and offers thousands of easy-to-find funding<br />

locations around the globe.<br />

In May of this year their Webmoney Keeper Mobile<br />

product won a National E-Finance Innovations<br />

Award for 2008. Earlier in April, Webmoney along<br />

with VISA co-sponsored the annual <strong>Digital</strong> Money<br />

Forum-2008 in London.

<strong>DGC</strong> <strong>Magazine</strong> October Issue § 13

14 § <strong>DGC</strong> <strong>Magazine</strong> October Issue<br />

http://www.seasteading.org/

fi at c u r r E n c y<br />

by Patri Friedman<br />

I find it a little baffling that people blame the current<br />

financial crisis on deregulation and laissez faire<br />

when it is occurring in a financial system built on top<br />

of fiat currency - arguably the greatest swindle of<br />

all time, and one perpetrated by the government.<br />

This is not to say that the current crisis couldn’t<br />

have been avoided by additional regulation. It is<br />

complex enough that proponents of both more and<br />

less regulation can reasonably imagine alternative<br />

approaches which fit their model and would have<br />

made things better. Thus each side can see, in the<br />

crisis, validation of their own beliefs. But it strikes<br />

me as insane to characterize any system built on<br />

top of fiat currency as a free market.<br />

Rothbard’s “What has the government done with<br />

our money?” [http://mises.org/money.asp] is a good<br />

introductory read on the subject of money. While I<br />

don’t agree with his views on the fraudulent nature<br />

of fractional reserve banking and he (of course)<br />

overstates the case against government / for the<br />

market, money is a topic where I believe there is<br />

some deep, basic truth to some of the strongest<br />

allegations of libertarians about the fraudulent and<br />

coercive nature of government.<br />

It blows my mind that we live in a world where<br />

most people don’t know that for a long time, money<br />

consisted of notes redeemable for gold or silver,<br />

until suddenly one day, the government (here &<br />

elsewhere) said “You must continue accepting<br />

these notes, but you can no longer trade them<br />

for metal - and we’re keeping all the metal we<br />

had been using to guarantee the notes.” In many<br />

cases, this was accompanied by a ban on the<br />

private ownership of the metal, or on taking it out<br />

of the country. People accepted the unbacked<br />

notes because it was illegal to do otherwise.<br />

It was theft on a colossal, mind-boggling scale, but<br />

it’s behind us and so we’ve forgotten about it.<br />

The history of money is a sordid history of legalized<br />

Fiat <strong>Currency</strong><br />

theft. It will be interesting to see what alternatives<br />

arise in the coming decades, and whether fiat<br />

money survives. I would guess that it won’t,<br />

because of the advantages of digital cash, except<br />

that the arguments which say digital cash will win<br />

in the future also say it should already have won,<br />

which it hasn’t, so perhaps those arguments are<br />

wrong. http://patrissimo.livejournal.com<br />

ti mE f o r a G o l d r o u B l E?<br />

(John Laughland for RIA Novosti) - 24/09/2008<br />

- There used to be a habit of framing old Tsarist<br />

bonds and putting them on the wall. Lenin’s<br />

decision to renege on the Russian imperial debt<br />

meant that it became mere paper, interesting only<br />

as a historical relic.<br />

In the light of the recent financial crisis in the USA,<br />

could the same thing happen now to the bonds<br />

issued by the American government, and could the<br />

country which has dominated the world for the last<br />

half century now enter history as a bankrupt state?<br />

And what can Russia do in the circumstances?<br />

The decision by the US government to inject<br />

$700 billion into the financial system means that<br />

the already gigantic annual budget deficit of the<br />

American state (previously some $450 billion a<br />

year) will now rise by a factor of three. The total<br />

state debt of the USA will rise to well over $11<br />

trillion. It is obvious that such a colossal debt can<br />

never be repaid. Instead, it will be serviced by more<br />

debt in the future. The contrast with Russia, which<br />

has painstakingly sanitised its state finances to<br />

the point that it now has more money to lend than<br />

the IMF, could hardly be greater.<br />

The recent financial crisis itself grew out of this<br />

American culture of debt. To some extent, all<br />

countries share it: since 1914, all countries use<br />

paper currencies, i.e. debt instruments which are<br />

never redeemed. Whereas before the First World<br />

War, bank notes were essentially vouchers for<br />

specific amounts of gold cash, now the “promise<br />

to pay the bearer” (which remains inscribed on<br />

British bank notes) is in fact hollow.<br />

In America, this basic culture of debt is aggravated<br />

<strong>DGC</strong> <strong>Magazine</strong> October Issue § 15

The Future of Private Money<br />

by the fact that other countries use the dollar itself<br />

as a reserve. This means that the United States<br />

can export dollars in order to pay for its imports<br />

without the dollar losing value. Other states also<br />

need dollars to buy key commodities like oil. The<br />

USA can therefore export paper currency almost<br />

indefinitely - the famous “deficit without tears”<br />

analysed by the great French economist, Jacques<br />

Rueff. Naturally, if the state itself encourages such<br />

a culture of debt by issuing unredeemable paper<br />

currency to pay for imports, and by accumulating<br />

such mountains of debt, then it is no surprise if the<br />

American financial markets themselves operate on<br />

the same basis. But the collapse of those markets<br />

is only a symptom of a much deeper problem, the<br />

basic insolvency of the American state itself.<br />

What can Russia do about this? At first sight,<br />

Russia’s role in the international financial system<br />

does not seem very large. However, as a major<br />

exporter of hydrocarbons, her role in the world<br />

economy is actually very important. As the age<br />

of the dollar draws to a close, Russia will have to<br />

consider selling her oil and gas not in the devalued<br />

American currency, but instead in the euro used<br />

by most of her customers. It is surely unnatural<br />

for two geographical neighbors to do such large<br />

volumes of business using the currency of a distant<br />

and now ailing nation.<br />

Second, the Russian leaders might also consider<br />

making their own currency, the rouble, convertible<br />

into gold. The idea of gold convertible currencies<br />

is extremely unpopular among most economists:<br />

they dismiss gold as a “barbarous relic” (to use<br />

the famous phrase of John Maynard Keynes)<br />

and suggest either the present regime of paper<br />

currencies or, at best, a link to a basket of<br />

commodities.<br />

Both these solutions are highly artificial and based<br />

on the same level of state control which has now<br />

just so spectacularly failed. Indeed, which is more<br />

“barbarous” - the reintroduction of gold as an<br />

instrument of payment, or the practice of amassing<br />

huge quantities of the precious metal to keep it<br />

locked underground in the vaults of central banks?<br />

The contempt of the Keynesians notwithstanding,<br />

it is an indisputable fact that gold does remain<br />

the ultimate store of value, which is precisely why<br />

16 § <strong>DGC</strong> <strong>Magazine</strong> October Issue<br />

states own so much of it.<br />

Russia has less to fear than other countries from<br />

the introduction of a currency convertible into<br />

gold. Governments are typically hostile to gold<br />

because it reduces their discretionary power over<br />

the currency and the economy: they say that the<br />

money supply cannot be made dependent on the<br />

production of gold mines. In reality, this argument is<br />

bogus because the amount of mined gold already<br />

in existence vastly exceeds the yearly production,<br />

so mining does not in fact have an appreciable<br />

impact on supply. But, as it happens, Russia is a<br />

major producer of gold anyway and therefore to<br />

some extent controls production.<br />

Secondly, Russia is vulnerable to her status as an<br />

exporter of primary materials - and as an exporter<br />

generally - especially in the age of inflation which<br />

is about to dawn. The more the Russian economy<br />

exports, the more her national paper currency will<br />

rise, making those exports more expensive. This is<br />

bad for an export-oriented economy. By contrast,<br />

the value of a gold rouble would depend not on<br />

the trade balance of the Russian economy at all,<br />

but instead simply on the price of gold itself which<br />

generally remains stable with relation to other<br />

commodities.<br />

Russia has shown surprising success in putting<br />

an end to the unipolar world of which American<br />

strategists have dreamed now for over a decade.<br />

There are no permanent victories in diplomacy,<br />

however, but a shift in the structure of the world<br />

financial system would help to entrench recent<br />

gains.<br />

John Laughland is a British historian and political<br />

analyst, and Director of Studies at the Institute of<br />

Democracy and Cooperation in Paris<br />

http://en.rian.ru/analysis/20080924/117072937.<br />

html

<strong>DGC</strong> <strong>Magazine</strong> October Issue § 17

A Modern <strong>Gold</strong> Standard<br />

a mo d e r n Go l d STa n d a r d?<br />

“be C a u S e, ‘WiT h o u T i nT e G r iT y, n o T h i nG W o r k S ’, T h e o n ly W a y o u T o F o u r C u r r e n T<br />

m e S S iS To r e S T o r e i nT e G r iT y To T h e dollar. We m u S T h av e a m o n e Ta r y S y S T e m<br />

T h aT iS n o T b a S e d u P o n a lie. a ‘m o d e r n G o l d S Ta n d a r d’ W o u l d d o T h e T r iC k.”<br />

— Louis R. Woodhill, “Time for a Modern <strong>Gold</strong> Standard,” June 17th, 2008.1<br />

One of the most-reported stories of the year also happens to be the biggest problem most-ignored by<br />

politicians: inflation and the weak dollar. Plenty has been written about the problem, but very few have<br />

written anything in the way of solutions, and even fewer leaders in Washington have responded with<br />

anything other than band-aids and bromides.<br />

Fortunately, that may be starting to change. Yesterday, writing for Real Clear Markets, Congressman<br />

Ted Poe (R-TX) in his piece “Congress Must Stabilize the Dollar”2 outlined his bill, H.R. 6690, the<br />

“Sound Dollar and Economic Stimulus Act of 2008”. It would set the value of the dollar to one fivehundredth<br />

of an ounce of gold. In his words:<br />

“aT $804/o z, T h e C u r r e n T m a r k e T P r iC e o F G o l d r e F l e C T S T h e e x P e C TaT i o n<br />

(a n d F e a r) o F F u T u r e i n F l aT i o n. i b e l i e v e T h aT FixinG T h e va l u e o F T h e dollar<br />

n o W in T e r m S o F G o l d aT $500/o z W i l l S T o P T h e C u r r e n T i n F l aT i o n W iT h o u T<br />

C a u S i nG d e F l aT i o n. ho W e v e r, m y b i l l a l S o P r o v i d e S a P o W e r F u l S u P P ly-S i d e<br />

S T i m u l uS, in T h e F o r m o F F i rS T-y e a r e x P e n S i n G o F a l l C a P i Ta l i n v e S T m e n T, To<br />

e n S u r e T h aT e C o n o m iC G r o W T h a C C e l e r aT e S aT T h e S a m e T i m e T h aT i n F l aT i o n iS<br />

b e i n G S T o P P e d. br i nG i nG T h e dollar P r iC e o F G o l d d o W n To $500 W i l l b r i nG<br />

T h e P r iC e o F G a S o l i n e d o W n F r o m i T S C u r r e n T $3.50/G a l l o n To l e S S T h a n<br />

$2.50/G a l l o n. iT W i l l S T r e n G T h e n T h e dollar a G a i n S T F o r e iG n C u r r e n C i eS.<br />

mo S T i m P o rTa n T, iT W i l l P r e v e n T am e r iC a n S’ i nC o m e S a n d S av i n G S F r o m b e i n G<br />

S To l e n b y i n F l aT i o n.”<br />

This mirrors a proposal from Louis Woodhill of June 17th. In response to publisher Steve Forbes’ call for<br />

a “modern gold standard” in his June 16th piece, “Unilateral Disarmament,”3 Mr. Woodhill outlined his<br />

plan to stabilize the U.S. dollar with just such a standard amid soaring inflation over the past decade:<br />

“un d e r a m o d e r n G o l d S Ta n d a r d, T h e Fe d W o u l d u S e i T S oP e n ma r k e T<br />

o P e r aT i o nS To F o r C e T h e Comex P r iC e o F G o l d d o W n To (S ay ) $500/o z a n d<br />

k e e P iT T h e r e. aT T h aT P o i nT W e W o u l d h av e a F i aT C u r r e n C y W h o S e va l u e W a S<br />

d e F i n e d in T e r m S o F T h e m a r k e T va l u e o F G o l d. un l i k e T h e o l d G o l d S Ta n d a r d,<br />

G o l d W o u l d n o T b e m o n e y, a n d m o n e Ta r y o P e r aT i o nS W o u l d n o T C r e aT e a n y<br />

a d d iT i o n a l d e m a n d F o r G o l d. Th e m o n e Ta r y b a S e W o u l d a u T o m aT iC a l ly e x Pa n d<br />

a n d C o n T r a C T in r e S P o n S e To m a r k e T d e m a n d. be C a u S e T h e Fe d h a S T h e P o W e r<br />

To d e l i v e r o n a C o m m iT m e n T To S Ta b i l i z e T h e va l u e o F T h e dollar a G a i n S T G o l d,<br />

18 § <strong>DGC</strong> <strong>Magazine</strong> October Issue

a m o d e r n G o l d S Ta n d a r d W o u l d h av e i nT e G r iT y.<br />

A Modern <strong>Gold</strong> Standard<br />

“un d e r a m o d e r n G o l d S Ta n d a r d, T h e W o r l d W o u l d b e C e r Ta i n o F F u T u r e va l u e<br />

o F T h e dollar. all o F T h e e C o n o m iC C o S T S C u r r e n T ly d e v o T e d To h e d G i nG<br />

F l u C T u aT i o nS in T h e va l u e o F m o n e y W o u l d b e av o i d e d.”<br />

This proposal differs from the old gold standard because under that standard, gold was money.<br />

Governments using the standard would redeem the paper currency for gold at a fixed price upon demand.<br />

The problem, according to Mr. Woodhill, was that “[f]rom the beginning, there wasn’t enough gold<br />

in the world to honor this promise. This was a fundamental lie… [that] was implemented via<br />

‘fractional gold coverage’ laws that allowed central banks to issue (typically) up to 2.5 times as<br />

much base money as the value of their gold holdings.”<br />

In contrast, this modern gold standard would simply peg the value of the dollar to the value of one fivehundredth<br />

an ounce of gold at $500/oz without requiring the nation’s central bank to stockpile bullion to<br />

match the dollar printed. According the Mr. Poe, instead, the amount of money would be “determined<br />

by the demand for money, which depends upon the transactions people want to do and how<br />

much money they want to hold.”<br />

To justify this course, he writes, “What matters about money is not its quantity but its value…”<br />

which would be pegged to gold at $500/oz.<br />

A potential flaw to Mr. Poe’s plan is if the quantity of dollars exceeded the actual demand for dollars.<br />

Under those circumstances, the value of gold would plummet, as would the value of the dollar. Therefore,<br />

the way that the demand for dollars is measured would be of critical importance to enacting the Poe<br />

plan. Would it simply be the amount of money borrowed? Would it include population growth? Economic<br />

growth?<br />

<strong>DGC</strong> <strong>Magazine</strong> October Issue § 19

A Modern <strong>Gold</strong> Standard<br />

Of course, that’s the same problem that exists today: Inflation is up because the supply of dollars<br />

currently exceeds the actual demand. Dollars are worth less, so prices are marked up. A potential<br />

upside outlined by Mr. Poe is pegging the value of the dollar to gold is that it would increase the demand<br />

for dollars:<br />

“i b e l i e v e T h aT T h e d e m a n d F o r T h e n e W l y -S Ta b l e dollar W i l l b e S o G r e aT<br />

T h aT T h e Fe d W i l l a C T u a l ly h av e To e x Pa n d T h e m o n e Ta r y b a S e… on C e T h e<br />

Fe d i m P l e m e n T S i T S n e W d i r eC T i v e F r o m Co n G r e S S, e v e r y dollar in T h e W o r l d<br />

W i l l h av e T h e S a m e m a r k e T va l u e a S o n e F i v e-h u n d r e d T h o F a n o u n C e o F G o l d.<br />

Fr o m T h e n o n, T h e m o n e Ta ry b a S e W i l l e x Pa n d a n d C o n T r a C T a u T o m aT iC a l ly in<br />

r e S P o n S e To m a r k e T d e m a n d.”<br />

And then the American people’s purchasing power would increase, prices would stabilize, and the<br />

economy could begin long-term growth based upon the certainty of costs. And two of the biggest<br />

problems facing the economy would be solved at one and the same time: inflation and the weak<br />

dollar.<br />

*http://www.getliberty.org/content.asp?pl=37&contentid=37#A_Modern_<strong>Gold</strong>_Standard<br />

1-http://www.realclearmarkets.com/articles/2008/06/time_for_a_modern_gold_standar.html<br />

2-http://www.realclearmarkets.com/articles/2008/09/congress_must_stabilize_the_do.html<br />

3-http://www.forbes.com/business/forbes/2008/0616/031.html<br />

no t i cE: E-G o l d Ba r co u n t ch a n G E<br />

Craig Spencer has posted and item showing that<br />

the e-gold bar count has changed by -16 bar(s)<br />

to 178 bars. [Since there are both kilogram and<br />

400oz LBMA bars in e-gold's inventory the actual<br />

total weight (2.22 Mg or 71375 oz) has been accounted<br />

for in terms of the equivalent number of<br />

nominal bars of exactly 400oz weight.]<br />

http://scbbs.net/craigs/fencome.asp<br />

in d i a’s f i r s t s P o t B u l l i o n<br />

P l at f o r m at co i mB at o r E<br />

RiddiSiddhi Bullions (RSBL) Ltd, the biggest bullion<br />

dealer in the country, has launched India’s first<br />

electronic over-the-counter spot trading platform<br />

(RSBL Spot - spot precious metals online Trading)<br />

at Coimbatore. RSBL Spot is currently trading<br />

with contracts of 100 gm (.999) and 1 kg (.995)<br />

gold, and 30 kg silver (.999) with delivery centres<br />

at Mumbai, Ahmadabad, Hyderabad, Vijayawada<br />

and Coimbatore. The trading platform does not<br />

charge for opening an account, commission for<br />

trading or for the usage of terminals.<br />

“RSBL Spot is a common solution for all problems<br />

20 § <strong>DGC</strong> <strong>Magazine</strong> October Issue<br />

faced by jewellers. With this platform, we have<br />

created an integrated systematic, transparent and<br />

efficient buy-sell mechanism for all wholesalers<br />

and retailers of jewellery. The prices on Spot are<br />

comparable to all international or domestic physical<br />

market prices. It has emerged as the benchmark<br />

for Indian prices of precious metals,” said Prithviraj<br />

Kothari, managing director, RSBL.<br />

The company is the only firm that owns the credit<br />

to start such a trading platform for bullion in rupees<br />

for jewellers, wholesalers, jewellery manufacturers,<br />

hedgers and investors. The e-trading platform<br />

RSBL Spot also provides trading facilities without<br />

the involvement of any intermediaries.<br />

Within 5 months of its launch, the RSBL Spot has<br />

registered 300-plus clients. RSBL Spot recorded<br />

a total volume of 6 tonne gold and has already<br />

recorded a volume of 2.3 tonne for the month of<br />

August. “We have outperformed the combined<br />

volume of 3,093.033 kg of all gold ETFs (exchange<br />

traded funds) in the country,” said Samir Shah,<br />

vice-president, RSBL Spot.<br />

http://www.financialexpress.com/news/India-sfirst-spot-bullion-platform-at-Coimbatore/353297

<strong>DGC</strong> <strong>Magazine</strong> October Issue § 21

On <strong>Gold</strong>en Island<br />

ON GOLDEN ISLAND<br />

By Claire Wolfe<br />

I couldn’t help it. The place reminded me of<br />

Hardyville.<br />

Yeah, Hardyville -- the grubby little mid-nowhere<br />

town that adopted me years ago, but eventually<br />

chewed me up and spit me out. Now here I was<br />

floating on a man-made mobile island, rocking<br />

gently on the territorial waters of some fiscally<br />

friendly sheikdom, palm trees waving, global<br />

sophisticates slouching elegantly past my outdoor<br />

cafe table in designer semi-nudity or gliding by in<br />

flowing robes.<br />

Nope, definitely not Hardyville. Not a sagebrush or<br />

a cowboy hat in sight.<br />

Still, the place is Hardyville right down to its<br />

monumental steel, concrete, and thermoplastic<br />

bones. (The island is so massive, they say, that<br />

you can’t actually feel all that floating and rocking<br />

in anything less than a hurricane. Yeah. Tell that to<br />

my inner ears.)<br />

The island has an official name, but nobody bothers<br />

with it. Most people, in one language or another,<br />

call the place something like Isla d’Oro. Or Ile en<br />

Or. However they might say it in Chinese or Arabic<br />

or Swahili -- it’s always <strong>Gold</strong>en or <strong>Gold</strong> Island.<br />

And that’s what it lives on. <strong>Gold</strong> is what it does. And<br />

all that that implies. Freedom. Which of course is<br />

why it reminds me of my old free-wheeling, freemarketing<br />

town.<br />

<strong>Gold</strong> Island is a floating center for anonymous<br />

digital gold systems. And for the actual storage<br />

and shipment of precious metals.<br />

Not the center, mind you. Just a center. Doesn’t<br />

do to keep all your eggs in one basket, even if the<br />

basket floats on some of the 21st century’s best<br />

construction. A basket can fall. So this is just one<br />

of five or six.<br />

And when I say “floating” I mean that in more<br />

than one sense. Like Nathan Detroit’s Permanent<br />

22 § <strong>DGC</strong> <strong>Magazine</strong> October Issue<br />

Floating Crap Game from the old Damon Runyon<br />

stories, if the location around it gets unfriendly,<br />

<strong>Gold</strong> Island can get under ponderous weigh toward<br />

a friendlier locale.<br />

But I have to apologize for going on so long<br />

describing the place. This article isn’t meant<br />

as a Utopian tour. (Don’t you hate those old SF<br />

books and movies that drag you yawning all the<br />

way through “And this is how Our Utopia came to<br />

be ... and this is how it benefits the downtrodden<br />

workers” kind of thing?) Trust me, I’m not going<br />

to do that to you. I’m here to tell you about my<br />

first really big, serious business deal using digital<br />

gold.<br />

I was on <strong>Gold</strong> Island to finalize that transaction.<br />

There was actually no need for either party to be<br />

there, but I thought it would be cool to see <strong>Gold</strong><br />

Island at last and meet the long-distance associate<br />

I’d been negotiating with.<br />

Ah, there he is now, heading for my cafe table.<br />

After diplomatically hiding his disappointment that<br />

I’m not a hot babe (I could have warned him about<br />

that), the Monsieur sits down.<br />

This being a Mediterraneanish sort of place, we<br />

don’t get right down to business. You know the<br />

obligatory European and Mideastern chitchat. My<br />

impatient American self chafes, but I tell myself to<br />

learn to love the more leisurely pace.<br />

So over appetizers and aperitifs, we do what<br />

passes for chit-chat hereabouts: we talk politics.<br />

“’Ave you come recently from America?” he queries<br />

in a gentle accent that makes him sound a little<br />

less Pepe LePew than I’ve just written him.<br />

I explain that I haven’t set foot at home in five<br />

years.<br />

“Ah yes,” he sighs, nibbling at crudites grown<br />

right here on the island (but really, I promise I’m<br />

not going to do that “tour of Utopia” thing on you;<br />

I won’t drag you off to look at the hydroponic<br />

gardens or the solar panels). “I used to love to visit<br />

the United States,” he continues. “The energy. The

Anybody<br />

Seen Our<br />

<strong>Gold</strong>?<br />

The gold reserves of the United States have not been fully and independently audited for half a century.<br />

Now there is proof that those gold reserves and those of other Western nations are being used for<br />

the surreptitious manipulation of the international currency, commodity, equity, and bond markets.<br />

The objective of this manipulation is to conceal the mismanagement of the U.S. dollar so that it might<br />

retain its function as the world’s reserve currency. But to suppress the price of gold is to disable the<br />

barometer of the international financial system so that all markets may be more easily manipulated.<br />

This manipulation has been a primary cause of the catastrophic excesses in the markets that now<br />

threaten the whole world. Surreptitious market manipulation by government is leading the world to<br />

disaster. We want to expose it and stop it.<br />

Who are we?<br />

We’re the <strong>Gold</strong> Anti-Trust Action Committee Inc., a non-profit, federally taxexempt<br />

civil rights and educational organization formed by people who recognize<br />

the necessity of free markets in the monetary metals. For information about<br />

GATA, visit: http://www.GATA.org.<br />

GOLD ANTI-TRUST ACTION COMMITTEE INC.<br />

7 Villa Louisa Road, Manchester, Connecticut 06043-7541 USA<br />

CPowell@GATA.org<br />

GATA welcomes financial contributions, which are federally tax-exempt<br />

under Section 501-c-3 of the U.S. Internal Revenue Code. GATA is<br />

not a registered investment adviser and this should not be considered<br />

investment advice or an offer to buy or sell securities.

On <strong>Gold</strong>en Island<br />

openness. The very rush of it all. But ...” he puts<br />

down the carrot, sighs, and gestures to the barman<br />

for another drink.<br />

Yeah, exactly. When speaking of what the U.S. of<br />

A. has become, there’s always that sad, sorry “But<br />

...” Nobody ever has to say more.<br />

As with every great empire, its peak also defined<br />

its fall. All that tripping about the globe to convert<br />

everyone to “democracy” at swordpoint. All that<br />

inflation. All that militarization of every domestic<br />

berg and hamlet. All that bureaucracy. All those<br />

subsidies. All those bailouts. All those barrels<br />

of pork. The eventual curtailment of travel. The<br />

outlawing of privacy. The bread. The circuses. The<br />

long, slow, painful slide.<br />

Oh, don’t get me wrong, even in decline the United<br />

States is big and dangerous. Old Grandpa Grizzly<br />

still has claws.<br />

But America isn’t the alpha in the pack any more.<br />

In this post-empire world, the U.S. is no more than<br />

a beta or a delta. Others now offer bits of what the<br />

“land of the free” once promised. Some found it<br />

desirable to offer privacy and hands-off banking<br />

laws in exchange for incoming profits. The U.S.<br />

can still bluster and threaten, for sure. But its<br />

power to hunt and destroy has weakened -- and<br />

everyone knows it. So here we are.<br />

Time to order lunch. The waiter glides over and<br />

bows. I’m really beginning to wonder when<br />

Monsieur will grant his unspoken permission for<br />

us to get down to business. After all, pleasantries<br />

and pheasant breast aside, business is what we<br />

came here to do and what you came all this way<br />

to read.<br />

“May we,” I finally say, reaching for some notes in<br />

my attache case, “get started discussing the final<br />

point or two in our contract? I wanted to ask you<br />

about this provision ...”<br />

But Monsieur only gazes past me toward another<br />

table of business people.<br />

“Isn’t it amazing,” he muses, “that we could, had<br />

we chosen, have transacted our business entirely<br />

without ever even knowing each other’s names?”<br />

Haven’t we always taken that for granted? I<br />

thought. But he was right.<br />

In previous eras, one had to meet face to face,<br />

personally correspond, or send representatives to<br />

transact business. Then came the Internet with its<br />

power to change all that. But -- naturally -- almost<br />

as soon as the Internet made anonymous, longdistance<br />

transactions feasible, the powers that<br />

be rushed to make them impossible. Nations and<br />

giant corporations (driven largely by the dictates<br />

of the U.S.) developed what you might call “anal<br />

probe” methods of ensuring trust. For some<br />

bizarro reason, “they” imagined that trust could be<br />

enhanced by them knowing the totality of our lives<br />

while we knew less and less about their doings.<br />

That version of “trust” predictably didn’t work out.<br />

I coulda warned them about that, too. A lot of<br />

others tried, but the anal probers weren’t listening.<br />

Eventually, when their one-way trust model flopped<br />

like a dying fish, we got <strong>Gold</strong> Island.<br />

But my luncheon companion isn’t merely stating<br />

the obvious when he observes that anonymity and<br />

honest dealing can be compatible. He’s taking<br />

a profound step further. “And,” he continues,<br />

“ because of our ability to deal privately and<br />

anonymously through encryption, trust systems,<br />

and anonymous digital signatures ... we have also<br />

become more safe to meet face-to-face to conduct<br />

business as if all were legal and aboveboard. Do you<br />

see the irony? Because we can be anonymous, we<br />

therefore have less fear of meeting and talking.”<br />

“Well, after all, our business is legal and<br />

aboveboard,” I remind him. “It’s 100 percent legal<br />

within the territorial waters of our host nation, and<br />

on <strong>Gold</strong> Island itself.”<br />

But I understand his real point. Because Grandpa<br />

Grizzly’s opinion becomes less relevant every<br />

day, people can now meet and talk with less risk<br />

of being surveilled, harassed, and persecuted, as<br />

long as their business is non-violent and there’s no<br />

fraud involved.<br />

My companion is saying that because privacy is

On <strong>Gold</strong>en Island<br />

sacred, surrendering a bit of privacy has become<br />

safer.<br />

As the U.S. fell, it became natural, even necessary,<br />

that a place like <strong>Gold</strong> Island would rise. Truly<br />

private exchanges, of course, need a medium<br />

of exchange and a store of wealth that can be<br />

counted on despite the vagaries of human beings.<br />

As paper currencies became ever-more laughable,<br />

global traders of all sorts looked to a medium of<br />

value that didn’t rely on the (ha ha) “full faith and<br />

credit” of a bankrupt issuer. Thus ... gold, digi-gold,<br />

and <strong>Gold</strong> Island. The guy in Botswana who might<br />

never lay eyes on the national currency of the guy<br />

from Indonesia knows he gets something solid in<br />

return.<br />

But I’m sorry, there I go again, going on and on<br />

about how this particular not-quite-Utopia works. I<br />

promised you I wouldn’t do that. I said I’d tell you<br />

about my transaction.<br />

So ... over coffee and pastries, Monsieur and I<br />

finally do it. We spend 10 minutes hashing out the<br />

final details of our deal. He types the agreed-upon<br />

changes into his copy of the contract, e-signs it<br />

and emails it at me. I e-sign right back at him.<br />

Then one of us smoothly transfers gold to the<br />

account of the other. We shake hands. Then he,<br />

bless him, picks up the e-check.<br />

Voila! I told you I’d tell you about our business<br />

transaction, and there you have it.<br />

What? You say you want to know exactly what<br />

we were arranging to trade and who paid what<br />

to whom? You say you want to know whether our<br />

business was strictly “legal” under the oppressive<br />

laws you happen to live under? You say I’ve<br />

cheated you by going on (and on) about <strong>Gold</strong><br />

Island while saying next to nothing about the<br />

business at hand?<br />

But really, I told you the very, very, very most<br />

important things about our business: That it was<br />

conducted in sound currency and that it’s private.<br />

Everything else is mere detail.<br />

I learned a big lesson on <strong>Gold</strong> Island. I learned<br />

that I was wrong -- and had been for a long time.<br />

When digi-gold bugs used to talk to me about<br />

how digital gold could supplant or even exist sideby-side<br />

with paper currencies, I’d always argue<br />

Gresham’s Law: “Bad money drives out good.” As<br />

long as people would accept paper, I’d repeat, why<br />

spend gold or silver? Gresham always seemed<br />

like the immovable object.<br />

I just forgot that human beings, making free<br />

choices, are the irresistible force.<br />

As you smarter-than-I people know, Gresham’s<br />

law (and Wikipedia) actually says, “Gresham’s law<br />

applies specifically when there are two forms of<br />

commodity money in circulation which are forced,<br />

by the application of legal-tender laws, to be<br />

respected as having face values in a fixed-ratio for<br />

marketplace transactions.”<br />

Legal tender laws? Not around here, my friend.<br />

“Legal tender” commodity money became mere<br />

paper. “Full faith and credit” is revealed as snake<br />

oil. Those who do serious business on a global<br />

scale demand payment they can count on.<br />

So gold is golden.<br />

And privacy is sacred. Otherwise the whole system<br />

falls apart. What’s private remains private unless<br />

someone presents strong evidence of aggressive<br />

violence or fraud.<br />

So you see, I did tell you the most important thing,<br />

even if (I admit) I did leave out a few details.<br />

The rule of gold and privacy isn’t merely a<br />

rule for sound, free business or banking. It’s a<br />

fundamental rule for living among other human<br />

beings in a civilized society. Without respect for<br />

privacy, verifiable trust, and exchanges of solid<br />

value, civilization isn’t worthy of the name. <strong>Gold</strong><br />

Island and its fellow enclaves have snatched true<br />

civilization, true human decency, back from the<br />

barbarity of all-controlling empire.<br />

(c) Claire Wolfe 2008

wh at wi l l th E 'nE w' E-G o l d lo o k li kE?<br />

“Th e n e x T G e n e r aT i o n o F T h e e-Go l d ® a P P l i C aT i o n W i l l u n d e r Ta k e To e n F o r C e<br />

a ‘o n e-h u m a n b e i n G/o n e e-Go l d u S e r' r u l e,” Ja C k S o n W r o T e . “Th e a d va n Ta G e<br />

F r o m T h e C y b e r C r i m e-T h Wa r T i nG S Ta n d P o i nT W i l l b e a n e v e r-S T r o n G e r a b i l iT y<br />

To b l a C k l i S T a P e r S o n W h o h a S a b u S e d T h e e-Go l d S y S T e m.”<br />

Dr. Do u g l a s Ja c k s o n 'a ne w Be g i n n i n g'<br />

What will the new e-gold® look like?<br />

This is a question is on the minds of all e-gold®<br />

fans. Becoming a “<strong>Gold</strong>Pal” type operation and<br />

complying with all the US regulations, as PayPal<br />

does, could be a headache for the e-gold structure<br />

and business model. However, based on previous<br />

upgrades we believe that the talented team of<br />

programmers over at e-gold Ltd., who have always<br />

set the bar very high, will rise to the occasion and<br />

create a terrific new online product.<br />

Here is the end result of recent legal actions<br />

undertaken by the US Government and a brief<br />

The New e-gold<br />

outline of things to come...how e-gold® will be<br />

changing.<br />

“In a move to conform with U.S. laws, E-<strong>Gold</strong><br />

has filed an application with the Financial<br />

Crimes Enforcement Network (FinCEN), an<br />

agency within the U.S. Department of Treasury<br />

charged with deterring money laundering,<br />

Jackson said. E-<strong>Gold</strong> is seeking to be licensed<br />

as a money services bureau in those states<br />

that require it. In addition, E-<strong>Gold</strong> plans to add<br />

a number of provisions to its user agreement<br />

in hopes of stopping criminals from using the<br />

system to transfer illicit funds. Users will be<br />

<strong>DGC</strong> <strong>Magazine</strong> October Issue § 27

The New e-gold<br />

required to confirm that they will not use e-gold to violate any laws to which they are liable. Also, their<br />

accounts may be frozen and they could be subject to prosecution if E-<strong>Gold</strong> investigators determine<br />

they are laundering funds. The company also plans to release a new application that will prohibit one<br />

user from running multiple accounts under the control of multiple people. According to a Department<br />

of Justice news release, E-<strong>Gold</strong>’s operators also agreed to implement a “comprehensive money<br />

laundering detection program that will require verified customer identification, suspicious activity<br />

reporting and regular supervision by the Internal Revenue Service’s Bank Secrecy Act Division.”<br />

Ahead of all these changes, additions and upgrades most users are now asking what ‘old school’<br />

features will be retained and what new options, features or restrictions might emerge with ‘The New<br />

e-gold®’?<br />

1. Will an active marketplace of third party independent exchange agents still operate? Or<br />

will the new e-gold v2.0 be required to manage all exchange services ‘in house’?<br />

2. PayPal restricts the exchange of their units with any other digital money. Whether<br />

automated or not, will the new e-gold TOS still allow open market exchanges with other<br />

e-currency such as Pecunix, V-money or Webmoney?<br />

3. Will all transactions still be final and the slogan ‘get paid and stay paid’ remain true with<br />

no chargebacks?<br />

4. As PayPal and <strong>Gold</strong>Money now require, will e-gold users always be sending funds<br />

directly to e-gold and never using an independent agent?<br />

5. Will e-gold be available now be easily purchased with a credit card or ACH transfer as<br />

PayPal allows?<br />

6. Will all future e-gold accounts still operate as both a merchant & customer account with<br />

no distinction or additional requirements?<br />

7. Might e-gold require a monthly fee to operate an account?<br />

8. Will e-gold prepaid cards finally be popular?<br />

9. Will OmniPay ever move to or operate from the Dark Continent?<br />

10. In order to establish if a financial profit was generated by rising gold prices in a funded<br />

account, will an IRS form be required each time digital gold is sold? (As Crowne <strong>Gold</strong><br />

required)<br />

11. Will e-gold offer an in house debit card for withdrawals?<br />

12. Will e-gold accounts still be offered to almost every country around the world or will<br />

e-gold be forced into a country by country selection as PayPal does?<br />

13. Now that the bulk of legal issues appear to be sorted out, should the current e-gold Ltd.<br />

company just pack up and move outside the US?<br />

The e-gold® Team has a busy future ahead and most of us feel a very positive cycle of enormous growth.<br />

Let’s hope that the new version of the company will be able to retain their convenient, inexpensive and<br />

attractive features. Best wishes to Dr. Jackson and team for a successful future. Count on the 100%<br />

support from <strong>DGC</strong>magazine.<br />

Section 359 of the USA PATRIOT Act expanded the definition of “financial institution” to include not only a licensed sender<br />

of money but any other person who engages as a business in the transmission of funds, including any person who engages<br />

as a business in an informal money transfer system or any network of people who engage as a business in facilitating<br />

the transfer of money domestically or internationally outside the conventional financial institution system. Any individual<br />

or group of people engaged in conducting, controlling, directing or owning an informal value transfer system in the United<br />

States is operating as a financial institution. Therefore, IVTS operators must comply with all Bank Secrecy Act (BSA)<br />

requirements, which include establishment of an anti-money laundering (AML) program4, registration with the Financial<br />

Crimes Enforcement Network (FinCEN) as a money services business5, and compliance with the record keeping and<br />

reporting requirements, which include filing suspicious activity reports (SARs).<br />

e-gold, e-silver, e-platinum, e-palladium, e-metal, Better Money, AUG, AGG, PTG, PDG are trademarks of e-gold Ltd.<br />

28 § <strong>DGC</strong> <strong>Magazine</strong> October Issue

nOt AvAilAble tO US plAyerS<br />

http://www.betgold.com<br />

Professional flash gaming experience for alternative currency users.<br />

e-gold, e-bullion, Liberty Reserve and Pecunix accepted for online play.<br />

Instant Deposits & Instant Withdrawals - The Way A Casino Should Be.<br />

Table Games<br />

Video Poker<br />

Slot Machines<br />

Tournaments<br />

http://www.betgold.com/<br />

Professional Casino Gaming From Costa Rica.<br />

<strong>DGC</strong> <strong>Magazine</strong> October Issue § 29

e-gold Accounts Now Require Tax Info<br />

al l E-G o l d ac c o u n t s<br />

no w rE q u i rE ta x id<br />

in f o r m at i o n<br />

Here is a follow up to the previous story, the<br />

changes are already starting.<br />

US and non US users will now be required<br />

to provide personal tax information on their<br />

e-gold account.<br />

It was July 21 of this year when Dr. Jackson spelled<br />

out his plan for updating e-gold accounts. His goal<br />

is to quickly and properly make the e-gold system<br />

into a US financial business. From that post back<br />

in July, Dr. Jackson, acknowledges “... that e-gold<br />

is indeed a Financial Institution or Agency as<br />

defined in US law and should be regulated as a<br />

Financial Institution. E-gold Ltd. ...will be exerting<br />

every effort to bring e-gold into compliance with<br />

US law and regulation as quickly as possible.”<br />

Today, again announced from the e-gold blog, they<br />

are announcing a major move toward US financial<br />

compliance and customer identification. Effective<br />

immediately, all e-gold users will be required to<br />

provide a Personal Tax Identification Number for<br />

the point of contact on the account. Non US users<br />

will have to provide their local tax information for<br />

their jurisdiction.<br />

“e-gold Ltd. remains highly committed<br />

to continuing to offer a cost effective<br />

Internet payment system making<br />

instantaneous settlement, free of<br />

chargeback risk, available to customers<br />

around the world. We continue to be<br />

confident that a regulated e-gold rebuilt<br />

to a more systematic specification will<br />

be less hospitable to criminals, and more<br />

attractive to mainstream business use<br />

without being less accessible to those<br />

disregarded by legacy payment systems.”<br />

Congratulations to Dr. Jackson and the e-gold<br />

team on their move forward.<br />

30 § <strong>DGC</strong> <strong>Magazine</strong> October Issue<br />

Ba n k s cr u m B l E,<br />

wa i t f o r Ph y s i c a l Bu l l i o n<br />

GE t s lo n G E r<br />

This article is from Numismaster.com by Patrick A.<br />

Heller, Market Update, September 16, 2008<br />

What has happened to the U.S. dollar, stocks<br />

and precious metals markets in the past week<br />

has followed almost exactly the script I wrote<br />

seven days ago. There has been so much media<br />

coverage that I won’t repeat all the details here.<br />

However, there are two significant negative effects<br />

of the U.S. Treasury’s takeover of Fannie Mae<br />

and Freddie Mac. First, the takeover constituted<br />

an act of default on the trillions of dollars of<br />

outstanding derivative contracts with Fannie Mae<br />

and Freddie Mac, which now need to be promptly<br />

unwound without regard to losses. Second, the<br />

wiping out the equity of Fannie Mae and Freddie<br />

Mac shareholders affected shares held by many<br />

investment and hedge funds, which put several<br />

of them into horrible financial straits. The effect of<br />

these two factors have added to the other financial<br />

pressures that have been reported elsewhere.<br />

On Sept. 15, Lehman Brothers Holdings, Inc.<br />

announced that it was filing for Chapter 11<br />

bankruptcy. Bank of America announced that<br />

it was purchasing Merrill Lynch for a 60 percent<br />

premium above that company’s Sept. 12 closing<br />

stock price. Insurer AIG revealed that it is was<br />

seeking an emergency $40 billion loan from the<br />

federal government.<br />

In addition, 10 large banks and brokerages<br />

announced that they would each contribute<br />

$7 billion to create a $70 billion fund to provide<br />

emergency liquidity to the U.S. financial industry.<br />

Although this is being reported as a source of private<br />