BusinessDay 17 Aug 2017

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NSE<br />

37,000<br />

36,800<br />

36,600<br />

36,400<br />

36,200<br />

Biggest Gainer<br />

Nestle<br />

N1,220<br />

+N11.9<br />

BUSINESSDAY MARKET AND COMMODITIES MONITOR<br />

FMDQ Close<br />

Commodities<br />

Foreign Exchange<br />

Treasury bills<br />

Brent Oil US $50.99 Market<br />

Gold $ 1,278.20 I&E FX Window<br />

Cocoa $ 1,836.00 CBN SMISWindow<br />

Spot $/N<br />

3M<br />

6M<br />

359.69 -1.20 -0.55<br />

305.65 19.40 19.67<br />

36,000<br />

6a 7a 8a 9a<br />

Day range<br />

(36,008.56 - 37,097.26)<br />

36,102.38<br />

-854.36 (-2.2 pc)<br />

Previous close<br />

(37,096.60)<br />

YtD return<br />

(34.34 pc)<br />

N214<br />

-N11<br />

Dangote Cement<br />

Biggest Loser<br />

Exchange Rate<br />

BDC<br />

$-N 364.00<br />

£-N 477.00<br />

€-N 428.00<br />

TRAVELEX<br />

367.00<br />

477.00<br />

432.00<br />

FGN Bonds<br />

5Y<br />

0.00<br />

16.36<br />

10Y 20Y<br />

-0.07 -0.10<br />

16.46 16.51<br />

NEWS YOU CAN TRUST I **THURSDAY <strong>17</strong> AUGUST 20<strong>17</strong> I VOL. 14, NO 418 I N300 @ g<br />

Nigeria’s bogus auto policy<br />

pushes car prices up 200%<br />

Dims hope of car ownership for middle-class<br />

MIKE OCHONMA<br />

Prices of brand new vehicles<br />

sold in Nigeria<br />

have risen by more<br />

than 200 percent between<br />

2014 and 20<strong>17</strong><br />

and are now out of the reach<br />

most individuals and corporate<br />

buyers who need them for their<br />

business.<br />

The significant rise in the<br />

prices of brand new vehicles<br />

has been blamed largely on the<br />

bogus auto policy, which raised<br />

import duty on cars to 35 percent<br />

in addition to a 35 percent levy,<br />

amounting to 70 percent, as well<br />

as a weaker naira.<br />

Analysts say the policy automatically<br />

raises the prices<br />

of cars by 70 percent, pricing<br />

out the middle-class and other<br />

low income earners in need of<br />

mobility.<br />

Added to this, is the weaker<br />

exchange rate of the naira that<br />

is compounded by the increase<br />

in duties and levies on imported<br />

new vehicles.<br />

According to industry watchers,<br />

the 70 percent increase in<br />

taxes on imported new vehicles,<br />

along with the 86 percent fall in<br />

exchange rate of the naira from<br />

N196 to the dollar, to relative<br />

stability at N365 in recent times,<br />

including other incidental expenses<br />

at the ports and company<br />

overhead costs, have combined<br />

to force prices of vehicles northwards.<br />

Many individuals who can no<br />

longer afford the new cars have<br />

resorted to maintaining their<br />

old cars for extended periods of<br />

time, even as prospects of workable<br />

financing schemes remain<br />

unavailable.<br />

Many banks accustomed to<br />

Continues on page 2<br />

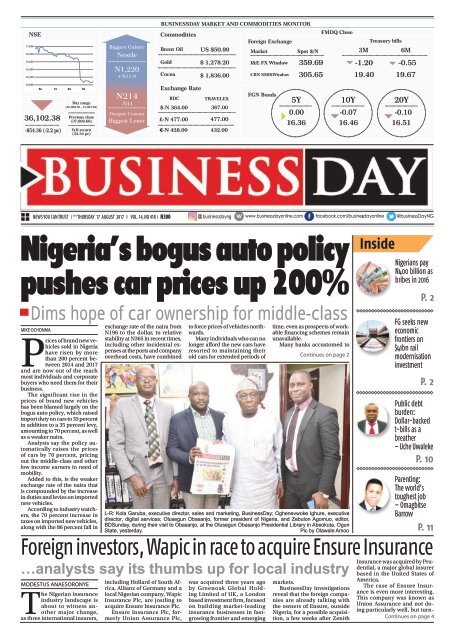

L-R: Kola Garuba, executive director, sales and marketing, <strong>BusinessDay</strong>; Oghenevwoke Ighure, executive<br />

director, digital services; Olusegun Obasanjo, former president of Nigeria, and Zebulon Agomuo, editor,<br />

BDSunday, during their visit to Obasanjo, at the Olusegun Obasanjo Presidential Library in Abeokuta, Ogun<br />

State, yesterday.<br />

Pic by Olawale Amoo<br />

Inside<br />

Nigerians pay<br />

N400 billion as<br />

bribes in 2016<br />

P. 2<br />

FG seeks new<br />

economic<br />

frontiers on<br />

$41bn rail<br />

modernisation<br />

investment<br />

P. 2<br />

Public debt<br />

burden:<br />

Dollar-backed<br />

t-bills as a<br />

breather<br />

– Uche Uwaleke<br />

P. 10<br />

Parenting:<br />

The world’s<br />

toughest job<br />

– Omagbitse<br />

Barrow<br />

P. 11<br />

Foreign investors, Wapic in race to acquire Ensure Insurance<br />

Insurance was acquired by Prudential,<br />

a major global insurer<br />

…analysts say its thumbs up for local industry based in the United States of<br />

including Hollard of South Africa,<br />

Allianz of Germany and a by Greenoak Global Hold-<br />

<strong>BusinessDay</strong> investigations<br />

was acquired three years ago markets.<br />

America.<br />

MODESTUS ANAESORONYE<br />

The case of Ensure Insurance<br />

is even more interesting.<br />

The Nigerian insurance local Nigerian company, Wapic ing Limited of UK, a London reveal that the foreign companies<br />

are already talking with<br />

industry landscape is Insurance Plc, are jostling to based investment firm, focused<br />

This company was known as<br />

about to witness another<br />

major change, Ensure Insurance Plc, for-<br />

insurance businesses in fast-<br />

Nigeria, for a possible acquisi-<br />

acquire Ensure Insurance Plc. on building market-leading the owners of Ensure, outside<br />

Union Assurance and not doing<br />

particularly well, but turnas<br />

three international insurers, merly Union Assurance Plc, growing frontier and emerging tion, a few weeks after Zenith<br />

Continues on page 4

2 BUSINESS DAY<br />

C002D5556<br />

Thursday <strong>17</strong> <strong>Aug</strong>ust 20<strong>17</strong><br />

NEWS<br />

Nigerians pay N400 billion as bribes in 2016<br />

...customs officers, judges, police are highest bribe takers<br />

A<br />

National Bureau<br />

of Statistics’ (NBS)<br />

survey has shown<br />

that Nigerians paid<br />

about N400 billion<br />

or $4.6 billion as bribes in 2016.<br />

The survey, which was conducted<br />

between June 2015 and<br />

May 2016, was supported by the<br />

United Nations Office on Drugs<br />

and Crime (UNODC) and the<br />

European Union, wanted to assess<br />

the quality and integrity of<br />

public services in Nigeria. The<br />

amount paid as bribes by Nigerians<br />

to public officials was<br />

TELIAT SULE<br />

equivalent to 50 percent of the<br />

internally generated revenue<br />

(IGR) of the 36 states of the federation<br />

in 2016.<br />

Ninety-two percent (92%) of<br />

the bribes paid were in cash. And<br />

when compared with countries<br />

such as Afghanistan, Iraq and<br />

Western Balkans, surveyed by<br />

UNODC on similar issue, at 92<br />

percent, Nigeria and Iraq are<br />

countries where bribes are paid<br />

the most in cash.<br />

“Corruption is the bane of<br />

any progressive society. It stifles<br />

entrepreneurship, professionalism<br />

and erodes the value of<br />

hard work and honesty, and is<br />

Nigeria’s bogus auto policy pushes car...<br />

Continued from page 1<br />

changing cars for top executives<br />

every four years, have suspended<br />

the practice, due to high cost of<br />

procuring the new vehicles.<br />

The impact has been seen in a<br />

sharp drop in the sale of new vehicles<br />

in the country, resulting in<br />

the closure of many car dealerships<br />

and the consequent loss of jobs.<br />

The Federal Government had<br />

in 2013 increased the duties and<br />

levies on imported new vehicles,<br />

to encourage local auto assemblers<br />

through some incentives under<br />

the 2013-2023 National Automotive<br />

Industrial Development Plan<br />

(NAIDP) as supervised by the<br />

National Automotive Design and<br />

Development Council (NADDC).<br />

A sample list of car prices from<br />

the Koreans, Japanese and German<br />

manufacturers, which come<br />

in various engine capacities across<br />

model ranges, exclusively obtained<br />

by <strong>BusinessDay</strong>, showed that<br />

prices have more than doubled<br />

between 2014 and 20<strong>17</strong>.<br />

In 2014, a brand new Kia Cerato<br />

1.6 litre automatic transmission saloon<br />

car sold for N3.96 million but<br />

now costs N9.54 million in 20<strong>17</strong>,<br />

while a Kia Picanto 1-liter engine<br />

capacity, which cost N2.25m three<br />

years ago, is now sold for N4.95<br />

million in 20<strong>17</strong>.<br />

Toyota Corolla 1.6 liter GLI automatic<br />

transmission fabric sold for<br />

N4.45 million three years ago, now<br />

costs N18.9 million.<br />

In the same period, a Mercedes-<br />

Benz C200 luxury sedan, which<br />

was sold with a dealership price<br />

tag of N10.5 million, costs N25<br />

million in 20<strong>17</strong>, while a Mercedes<br />

G63AMG model which previously<br />

sold at N50 million, presently<br />

wears a price tag of N78 million.<br />

This shows a price jump of over<br />

100 percent and this applies to other<br />

brands of vehicles in the market,<br />

apart from those manufactured in<br />

Korea, Japan or Germany.<br />

According to Kunle Ade-Ojo,<br />

Managing Director/CEO, Toyota<br />

Nigeria Limited, the rise in vehicle<br />

prices is majorly due to the unfavourable<br />

exchange rate of the naira.<br />

Ade-Ojo explained that as the<br />

dollar is scarce, so also is the naira<br />

pretty much scarce and that bank’s<br />

interest rates have gone up.<br />

“Even though the exchange rate<br />

has moderated from a high of about<br />

N520 to the dollar at a very critical<br />

period and trading at about N366 to<br />

the dollar and below, from the end of<br />

2016 to 20<strong>17</strong>, it is still not available.”<br />

Ade-Ojo estimated that the<br />

country’s auto industry is expected<br />

to import and sell between 8,000<br />

and 10,000 new vehicles this year,<br />

which is lower than the 15,000 projected<br />

at the end of last year.<br />

The forecast, Ade-Ojo said,<br />

was based on the industry’s performance<br />

in the first quarter of<br />

20<strong>17</strong>, adding that at the end of the<br />

first quarter of 20<strong>17</strong>, total import<br />

figures in the nation’s automobile<br />

industry, from the nation’s ports,<br />

came to about 350 units, compared<br />

to about 3,500 units that came in at<br />

the same period last year.<br />

He said with this statistics, “imports<br />

dropped by about 90 percent<br />

between 2016 and 20<strong>17</strong> first quarter.<br />

one of the root causes of underdevelopment<br />

in our society. bribes were paid 82.3 million<br />

bribe payments, meaning that<br />

Over the years, we have seen the times by Nigerians during the<br />

effect of corruption manifesting period.<br />

across all sectors of society, with Furthermore, 62 out of every<br />

collusion across the public to 100 Nigerian adults that paid<br />

private sectors to sports bodies bribes during the period, paid<br />

and even civil society”, the survey at least once and at most three<br />

report stated.<br />

times in a year. Furthermore, 19<br />

The exercise covered 33,067 out of every 100 adults that paid<br />

households in the 36 states of bribes, did so at least four times<br />

the federation and the Federal and at most six times in year,<br />

Capital Territory (FCT), Abuja. just as 13 out of 100 Nigerian<br />

The survey findings further show adults paid bribes at least seven<br />

that 52.2 percent of Nigerian times and at most 15 times in a<br />

adults had contact with public year. Three out of every 100 paid<br />

officials, of which 32.3 percent bribes at least 16 times and at<br />

of such interactions resulted in Continues on page 4<br />

“In terms of retail sales, we are<br />

estimating, based on the information<br />

we have, that the auto market<br />

did about 2,000 vehicles, compared<br />

to about 5,000 vehicles that was<br />

done in first quarter of 2015, a drop<br />

of over 50 percent in retail sales.<br />

“Passenger cars reduced more<br />

than commercial cars and of<br />

course, when you look at the duties<br />

on passenger cars also at 70<br />

percent, compared to 35 percent<br />

for commercial, the impact is more<br />

on passenger vehicles.”<br />

Retail sales went from about<br />

32,000 in 2015 to about 18,000 last<br />

year, representing a market drop of<br />

about 42 percent.<br />

While giving the status of the<br />

implementation report of the<br />

NAIDP between October 2013 and<br />

June 20<strong>17</strong> at a recent stakeholders<br />

meeting involving local auto assemblers<br />

and other stakeholders in<br />

Lagos recently, Luqman Mamudu,<br />

Director of Policy & Planning,<br />

National Automotive Design &<br />

Development Council (NADDC)<br />

revealed that the automotive policy<br />

is seeing tremendous progress,<br />

despite doubts in some quarters<br />

and that soon, Nigerians will begin<br />

to see positive result.<br />

He disclosed that at the inception<br />

of the automotive policy in<br />

2013, the number of approved<br />

local assemblers by the NADDC<br />

was 11 companies and grew to 53<br />

companies in 20<strong>17</strong>.<br />

Production capacity rose from<br />

108,380 units in 2013 to 408,870<br />

units in 20<strong>17</strong>. Actual production<br />

size increased from 1665 in 2013;<br />

4776 in 2014; 11,332 in 2015 and<br />

started witnessing a drop from to<br />

11, 332 in 2015 to 10,673 in 2016<br />

and 8,473 in 20<strong>17</strong>.<br />

Reacting on the astronomical<br />

jump in prices of new vehicles, Olawale<br />

Jimoh, Marketing Manager,<br />

FG seeks new<br />

economic frontiers<br />

on $41bn rail<br />

modernisation<br />

investment<br />

... With GE and China’s<br />

Eximbank as principal actors<br />

MIKE OCHONMA with agency report<br />

Nigeria’s quest to explore<br />

new areas of revenue<br />

generation and diversification<br />

of its economy from oil<br />

is gaining traction, as the country<br />

seeks new opportunities<br />

through massive investment<br />

Continues on page 4<br />

L-R: Jean Ngbwo, president, Financial Markets Commission of Cameroon; Mounir Gwarzo, director-general, Securities<br />

and Exchange Commission (SEC), and Joe Mekwiliuwa, general manager, operations, Central Securities Clearing<br />

System plc, during a news conference by SEC on implementation of e-dividend registration, in Lagos, yesterday. NAN<br />

Kia Motors Nigeria Limited, stated<br />

that for over two years now, the<br />

steady increase in the prices of cars<br />

in Nigeria has been misconstrued<br />

by some industry followers.<br />

He argued that the local assembly<br />

of cars will invariably bring a<br />

new dawn that will result in affordable<br />

“Made in Nigeria” cars.<br />

That expectation should ideally<br />

not be out of place, if Nigeria’s economy<br />

over the years has been stable.<br />

He lamented that with the fast<br />

depreciation in the value of the<br />

naira, prices of cars have increased<br />

by more than 100 percent, which<br />

may still not totally compensate for<br />

the drop in the value of the naira.<br />

Jimoh lamented that at this<br />

stage of the country’s auto development,<br />

assembly plants still import<br />

SKD kits to assemble, on account<br />

of the dearth of component manufacturers<br />

in the country, among the<br />

interplay of other factors.

Thursday <strong>17</strong> <strong>Aug</strong>ust 20<strong>17</strong><br />

C002D5556<br />

BUSINESS DAY<br />

3

4 BUSINESS DAY<br />

C002D5556<br />

Thursday <strong>17</strong> <strong>Aug</strong>ust 20<strong>17</strong><br />

NEWS<br />

Foreign investors, Wapic in race to acquire...<br />

Continued from page 1<br />

around and positioned in just<br />

three years, and both Hollard<br />

of South Africa and Allianz of<br />

Germany are taking a serious<br />

look at it.<br />

An industry source who prefers<br />

not to be named, says this<br />

brings, funding, capacity, skills<br />

and an enhanced image for Nigeria’s<br />

insurance industry, underscoring<br />

the great potential<br />

available in the local market,<br />

in which many international<br />

insurers are working hard to<br />

position in.<br />

Mohammed Kari, commissioner<br />

for Insurance, says Nigeria’s<br />

vision 2020 Development<br />

Plan, describes the insurance<br />

sector as a gross untapped<br />

opportunity with low market<br />

penetration.<br />

Kari says foreign investors,<br />

having noted these great opportunities,<br />

are attracted by the<br />

huge potential in the Nigerian<br />

insurances space.<br />

“These investors are ready<br />

to position themselves for the<br />

future and so, have taken position<br />

in the industry and in<br />

partnership with indigenous<br />

companies for development<br />

and growth.”<br />

Kari noted that three foreign<br />

acquisitions into the sector<br />

took place in 2014, two in 2015,<br />

five in 2016 and two acquisitions<br />

are now in progress.<br />

In an email response from<br />

<strong>BusinessDay</strong> enquiries, Joe<br />

Macaulay, an insurance analysts,<br />

said these developments<br />

would lead to job creation in<br />

the industry. “It is estimated<br />

that given time and with sufficient<br />

support of the regulatory<br />

authority and government, not<br />

less than 100,000 jobs can be<br />

created within five years. This is<br />

because global players are very<br />

big on retail and the agency<br />

distribution model.”<br />

Macaulay noted that underwriting<br />

capacity, which has<br />

been a challenge, will receive a<br />

major boost, “most of the companies<br />

in the industry don’t<br />

have the underwriting capacity<br />

to retain larger proportions of<br />

the risks they write.”<br />

He says there is an outflow of<br />

premiums to the foreign markets,<br />

pointing out that these<br />

global insurers with deep pockets<br />

and shareholders’ funds<br />

will deploy greater capital to<br />

their Nigerian subsidiaries,<br />

thus increasing the ability of<br />

Nigerian businesses to retain<br />

more premiums.”<br />

Nigerians pay N400 billion as bribes in...<br />

Continued from page 4<br />

most 30 times in a year, while<br />

another three out of every 100<br />

paid bribes more than 30 times<br />

in a year.<br />

Nigerian Police officers top<br />

the list of public officials who<br />

asked for bribes directly and they<br />

were followed by public utilities<br />

officials and customs officers.<br />

The findings show that six out of<br />

every 10 bribes paid to Nigerian<br />

police officers were asked for<br />

directly, while others were asked<br />

On human capacity, he said,<br />

“there is a skills gap in underwriting<br />

of special risks such as<br />

Aviation, Engineering and Oil &<br />

Gas, so with these global players,<br />

experience in appraising<br />

such risks will readily be passed<br />

to the Nigerian underwriters.<br />

“Nigerians will experience<br />

a massive improvement in the<br />

quality of service they currently<br />

get from the insurance industry<br />

because these companies will<br />

introduce global best practices<br />

and systems.”<br />

On corporate governance,<br />

Macaulay said “this is certainly<br />

one area that will receive a<br />

great deal of attention and<br />

positive impact. NAICOM will<br />

indeed be extremely happy at<br />

this development.<br />

“On awareness, I see insurance<br />

uptake growing massively.With<br />

the very deep<br />

pockets of global players and<br />

the new competition, they all<br />

will spend a lot of money on<br />

marketing communications<br />

and advertisements. This is<br />

not only going to create more<br />

awareness, it will also create<br />

more opportunities for public<br />

relations firms and advertising<br />

companies too.<br />

“Another area I see as positive<br />

for the industry, is product<br />

innovation”, he says, stating<br />

that these foreign companies<br />

will transfer knowledge<br />

and research-based information<br />

to help in product development.<br />

At the last count, global insurance<br />

companies including<br />

the likes Old Mutual, Metropolitan<br />

Life, Sanlam; Greenoaks;<br />

NSIA; Saham; AXA; Liberty<br />

and SwissRe are already here<br />

in Nigeria.<br />

FG seeks new economic frontiers on $41bn rail...<br />

Continued from page 4<br />

into the rail sector.<br />

Following years of neglect<br />

under prolonged and inept military<br />

rule, freight-rail capacity<br />

reduced to 15,000 metric tons a<br />

year in 2005, from three million<br />

tons four decades earlier. According<br />

to a transport ministry<br />

source, recent developments<br />

indicate that the Federal Government<br />

is determined to open<br />

up its rail system to private<br />

investors, following decades of<br />

government control.<br />

Key projects include building<br />

a second railway line connecting<br />

the nation’s two biggest<br />

cities, the commercial capital,<br />

Lagos, and Kano in the north.<br />

The 1,100-kilometer (680-<br />

mile) line will carry freight and<br />

passengers, even as government<br />

also wants to construct a coastal<br />

railway that connects Lagos to<br />

the eastern city of Calabar.<br />

The two new railways are expected<br />

to cost $20 billion, with<br />

most of the funding coming<br />

from the Export–Import Bank of<br />

China, which has so far released<br />

$5.9 billion. China’s Civil Engineering<br />

and Construction Co.<br />

is building the project and both<br />

railways should be ready by the<br />

end of 2019.<br />

Another $16 billion will be<br />

invested in additional rail routes<br />

to link up all the country’s interstate<br />

network to state capitals,<br />

with extension across the northern<br />

border into neighbouring<br />

Niger’s southern city of Maradi,<br />

according to Bloomberg.<br />

Amaechi, Minister of Transportation,<br />

had told Business-<br />

Day during a recent visit to the<br />

Nigeria Railway Corporation<br />

to inspect the $5.851 billion<br />

for indirectly. For customs officers<br />

and their counterparts in<br />

public utilities, five out of every<br />

10 bribes paid to them were<br />

asked for directly, while the rest<br />

were asked indirectly.<br />

However, the customs officials<br />

are the most expensive to deal<br />

with. This is because in every<br />

transaction where a customs officer<br />

asked for a bribe, an average of<br />

N88,587 was paid. The next most<br />

expensive to deal with are judges<br />

and magistrates, prosecutors,<br />

land registry officers, representatives<br />

of local/state government,<br />

teachers/lecturers, doctors and<br />

police officers. In any transaction<br />

that required that a bribe must<br />

be paid, the average amount collected<br />

by judges/magistrates was<br />

N18, 576. Prosecutors collected<br />

N10,072 bribe per transaction,<br />

while land registry officers, local/<br />

state government representatives<br />

and teachers/lecturers collected<br />

N8,782; N8,043 and N5,958 as<br />

bribe respectively. Doctors working<br />

in public hospitals and health<br />

centres and public utilities officers<br />

collected N5,925 and N4,373 as<br />

bribe per transaction respectively.<br />

Lagos-Ibadan rail segment<br />

of the Lagos-Kano standard<br />

gauge rail (SGR) project, that<br />

the plan of the ministry is to go<br />

to every nook and corner with<br />

the project.<br />

While reminding the Chinese<br />

Civil Engineering and Construction<br />

Company (CCECC)<br />

of the crucial need to deliver<br />

the Lagos-Ibadan project by<br />

December 2018 as contained<br />

in the Memorandum of Understanding<br />

(MoU), he noted that<br />

it was too early to share a timeline<br />

or funding details of other<br />

rail projects in the pipeline, as<br />

government is still talking to<br />

investors for this public-private<br />

project.<br />

He added that government<br />

is also trying to complete a $3<br />

billion line from Abuja to the<br />

southern oil hub of Warri by<br />

2018.<br />

With rail links to the existing<br />

and planned deep-sea ports,<br />

the country hopes to substantially<br />

reduce logistics costs and<br />

facilitate exports and imports.<br />

“There’s no economic development<br />

or growth without<br />

logistics, and for logistics to be<br />

efficient, you have to deal with<br />

the issue of railways,” the minister<br />

noted.<br />

Nigeria has witnessed a<br />

plunge in the price and output<br />

of oil, which accounts for more<br />

than 90 percent of foreign income<br />

and two-thirds of government<br />

revenue.<br />

President Muhammadu<br />

Buhari’s Economic Recovery<br />

and Growth Plan, presented in<br />

March, seeks to boost agriculture<br />

and manufacturing by developing<br />

the country’s transport<br />

network and power infrastructure,<br />

with the rail sector among<br />

L-R: Chizoma<br />

Okoli, executive<br />

director, business<br />

development,<br />

Diamond Bank plc;<br />

Uzoma Dozie, MD/<br />

CEO, Diamond<br />

Bank plc; Nneka<br />

Okekearu, deputy<br />

director, Enterprise<br />

Development<br />

Centre (EDC), and<br />

Peter Bankole,<br />

director, Enterprise<br />

Development Centre<br />

(EDC), at the<br />

press briefing on<br />

the launch of Building<br />

Entrepreneurs<br />

Today 7 (BET7) in<br />

Lagos, yesterday.<br />

Most of the bribes were paid<br />

in order to speed up procedures,<br />

avoid payment of fines, stop cancellation<br />

of public utilities and to<br />

receive preferential treatment.<br />

Among the six geopolitical zones,<br />

the highest bribe per transaction<br />

was paid in the South-East region.<br />

During the period covered by the<br />

survey, an average of N14,106 was<br />

paid as bribe per transaction in<br />

the South East zone; N8,190 bribe<br />

paid per transaction in South-<br />

South; N4,586 in North East;<br />

N4,002 in North West; N3,861 in<br />

North Central while N3,180 was<br />

paid as bribe per transaction in<br />

the priority projects.<br />

Rotimi Amaechi, Minister of<br />

Transportation said in Abuja,<br />

that the Federal Government<br />

has started a $41 billion railway<br />

expansion to reduce dependence<br />

on oil and diversify its<br />

struggling economy by improving<br />

transport links to allow the<br />

movement of goods around the<br />

country and to ports.<br />

As at the time of filing this report,<br />

General Electric Co of the<br />

United States is leading a group<br />

that is rehabilitating Nigeria’s<br />

3,505 kilometers of century-old,<br />

narrow-gauge railways, linking<br />

the coastal cities of Port Harcourt<br />

and Lagos with the north.<br />

The group, including Sino-<br />

Hydro of China, South Africa’s<br />

Transnet SOC Ltd. and the<br />

Netherlands’ APM Terminals<br />

BV will fund, revamp and operate<br />

the railways for a period to<br />

be decided in negotiations with<br />

the government, the minister<br />

said. They won the concession<br />

in May this year.<br />

It plans to invest $2.2 billion,<br />

Sabiu Zakari, permanent secretary<br />

in the Ministry of Transport,<br />

said at the time. Nigeria<br />

will then have two links between<br />

Lagos and Kano, with the new<br />

Chinese-built one allowing<br />

trains to travel twice as fast as<br />

they can on the existing link.<br />

Oke Maduegbuna, Managing<br />

Partner at Pete, Moss & Sam Ltd,<br />

a transportation and logistics<br />

consultancy, lamented that<br />

the country’s rail system was<br />

neglected for too long.<br />

He said, “There’s a new<br />

awareness among government<br />

officials of the economic benefits<br />

of a good rail network.” The<br />

Abuja-based expert added that<br />

the new projects would succeed<br />

only if there is consistency in the<br />

planning and execution.<br />

Briefs<br />

Two more bosses quit White House panel<br />

Two more executives have resigned<br />

from a White House business<br />

council, amid controversy<br />

over President Donald Trump’s<br />

reaction to violent clashes in<br />

Virginia last weekend.<br />

Inge Thulin of manufacturer<br />

3M and Denise Morrison of<br />

Campbell Soup Co announced<br />

their decisions on Wednesday.<br />

Seven groups have withdrawn<br />

after the far-right rally in Charlottesville.<br />

Ryanair accuses Lufthansa of Air Berlin ‘conspiracy’<br />

Ryanair has accused Lufthansa<br />

and the German government<br />

of conspiring to carve up<br />

collapsed airline Air Berlin.<br />

Lufthansa is negotiating over<br />

buying Air Berlin planes, which<br />

are still flying following a 150m<br />

euro German government loan.<br />

Ryanair said there was an<br />

“obvious conspiracy” between<br />

Germany, Lufthansa and Air<br />

Berlin to carve up the assets.<br />

Dulux owner Akzo Nobel strikes truce with activist investor<br />

An activist investor hedge<br />

fund has agreed to halt its longrunning<br />

feud with Dulux paint<br />

owner AkzoNobel.<br />

US hedge fund Elliott Advisors<br />

reached a “standstill”<br />

agreement after clashing with<br />

Akzo over the way the company<br />

should be run.

Thursday <strong>17</strong> <strong>Aug</strong>ust 20<strong>17</strong><br />

C002D5556<br />

BUSINESS DAY<br />

5

Thursday <strong>17</strong> <strong>Aug</strong>ust 20<strong>17</strong><br />

6 BUSINESS DAY<br />

C002D5556<br />

NEWS<br />

Wike calls for increased investments<br />

in science/technology<br />

IGNATIUS CHUKWU<br />

Rivers State Governor<br />

Nyesom Wike has<br />

called for increased<br />

investment in science<br />

and technology for the<br />

nation to experience rapid<br />

development.<br />

Speaking at the Government<br />

House Port Harcourt<br />

on Tuesday, when he granted<br />

audience to the National Executive<br />

Council of the Science<br />

Teachers Association of Nigeria<br />

(STAN), Wike, who was the<br />

immediate past education<br />

minister, regretted that the<br />

Federal Government was yet<br />

to give the sciences the priority<br />

attention they deserve.<br />

The governor said science<br />

teachers should be encouraged<br />

with necessary incentives<br />

to carry out their responsibilities<br />

of preparing Nigerian<br />

children for developmental<br />

roles. He said: “Nigeria cannot<br />

develop unless the nation<br />

invests in the teaching of science<br />

and mathematics at all<br />

levels. That is the way to go.<br />

… sponsors 400 teachers<br />

We cannot talk of development<br />

without science and<br />

mathematics. There must be<br />

the needed encouragement<br />

and incentives for teachers of<br />

mathematics.”<br />

The governor commended<br />

STAN for their contributions<br />

to the development of science<br />

education over the last six decades,<br />

and informed that his<br />

administration had invested in<br />

the equipping of science laboratories<br />

in selected schools<br />

to ensure that students had<br />

practical knowledge.<br />

He directed the sponsorship<br />

of 400 science teachers for<br />

the ongoing workshop in the<br />

state, noting that such workshops<br />

would improve their<br />

capacity to impact knowledge.<br />

Earlier, president of STAN,<br />

Mohammed Moulud, commended<br />

the efforts of the<br />

Rivers State government in<br />

enhancing the quality of delivery<br />

of science, technology,<br />

engineering and mathematics<br />

education in the state schools.<br />

BBC News broadcasts a week of special<br />

programming on Africa’s rising population<br />

BBC News has announced<br />

a weeklong<br />

series exploring<br />

the steep incline in<br />

Africa’s population and the<br />

continent’s coping mechanisms.<br />

The population of Africa<br />

is predicted to double to two<br />

and a half billion in just 30<br />

years. On a continent where<br />

nearly two thirds of people<br />

are already under 25, this vast<br />

new baby boom has the potential<br />

to provide a huge pool<br />

of workers ready to transform<br />

African economies, or the<br />

potential to create an even<br />

greater migration problem.<br />

BBC Africa correspondent,<br />

Alastair Leithead, has<br />

been investigating the potential<br />

of this “demographic dividend”<br />

in a series of special<br />

TBY, LCCI host roundtable on Fintech, digitalisation in banking<br />

The Business Year<br />

(TBY), a media and<br />

research firm, recently<br />

organised an<br />

exclusive event in Lagos, entitled<br />

“Harnessing Digitalisation<br />

in Nigeria’s Financial<br />

Sector,” in conjunction with<br />

the Lagos Chamber of Commerce<br />

and Industry (LCCI).<br />

Leland Rice, TBY’s editorin-chief,<br />

moderated a dialogue<br />

between Oscar Onyema,<br />

CEO, Nigerian Stock<br />

Exchange; Uzome Dozie,<br />

CEO, Diamond Bank; Tayo<br />

Oviosu, CEO of PAGA; Juliet<br />

Nwanguma, country manager<br />

of PayU; Valentin Obi,<br />

CEO of eTranzact, and Muda<br />

Yusuf, director-general of<br />

LCCI.<br />

Reducing costs and driving<br />

client-oriented innovation<br />

were at the centre of the<br />

discussion, with attendees<br />

engaging in a debate over<br />

the role of banks and regulators<br />

to streamline financial<br />

transactions.<br />

reports from across Africa.<br />

For a week, beginning <strong>Aug</strong>ust<br />

21, BBC World News and<br />

BBC World Service will broadcast<br />

daily features within Focus<br />

on Africa, looking at matters<br />

such as the rapid urbanisation<br />

in Nigeria, the industrial<br />

revolution in Ethiopia, contraception<br />

in Niger and food<br />

sustainability in Kenya.<br />

From Monday, more information<br />

can also be found on<br />

bbc.com/africapopulation,<br />

including a written in-depth<br />

analysis, a series of short videos<br />

and additional features.<br />

A special documentary,<br />

Africa’s Population Explosion,<br />

will also broadcast on<br />

BBC World News (DStv 400)<br />

at 2330 GMT on <strong>Aug</strong>ust 25,<br />

and 1130 & 1630 GMT on<br />

<strong>Aug</strong>ust 26.<br />

According to Dozie, in the<br />

last 20 years the banking sector<br />

has evolved and adjusted<br />

to market conditions, and “it<br />

took Diamond Bank 23 years<br />

to acquire 7 million customers<br />

using 300 branches and<br />

in the last two years it took no<br />

branches to acquire another<br />

7 million customers by partnership<br />

and collaboration.”<br />

Digital infrastructure<br />

is thus a necessary tool to<br />

merge the needs of financial<br />

institutions and clients.<br />

Obi agreed on the progress<br />

of the Nigerian banking<br />

sector, and insisted on the<br />

excessive costs of a cashbased<br />

economy and the<br />

importance of data in providing<br />

financing tools. He<br />

expressed, “How we analyse<br />

the data will help in the situation<br />

of lending.”<br />

On the same note, Onyema<br />

said, “We have to find<br />

new ways to provide capital<br />

to firms that are looking for<br />

equity,” to which Oviosu an-<br />

Strong macro-economic prospects drive<br />

mutual funds AUM above N300bn mark<br />

MODESTUS ANESORONYE<br />

Nigeria’s Mutual<br />

Funds, currently<br />

swelling<br />

with over<br />

N300 billion<br />

in asset under management,<br />

have continued to<br />

attract local and foreign<br />

investors.<br />

The growing level of<br />

interest is attributed to<br />

economic prospect, stock<br />

market and interest rate<br />

rally, as well as improved<br />

mutual funds offerings, the<br />

Securities and Exchange<br />

Commission has said.<br />

This is further backed by<br />

a recent report by Quantitative<br />

Financial Analytics,<br />

which estimated that<br />

Nigerian mutual funds attracted<br />

the sum of N42<br />

billion inflows in Q1, 20<strong>17</strong>,<br />

as against the N49 billion<br />

inflows recorded the entire<br />

2016. Nigeria’s mutual<br />

funds’ assets also grew to<br />

N318 billion as at the beginning<br />

of H2, 20<strong>17</strong>, up by<br />

42 percent on a YTD basis,<br />

from the 2016-year end<br />

value of N223.6 billion.<br />

Speaking on this trend<br />

at the launch of one of<br />

such funds, Emeka Okolo,<br />

senior fund manager and<br />

head, Coronation Asset<br />

Management, said active<br />

portfolio management by<br />

experienced professionals<br />

offer investors better prospects<br />

on their investments,<br />

especially in periods of<br />

market volatility and economic<br />

downturn, as is being<br />

experienced in Nigeria,<br />

making mutual funds an<br />

optimal choice.<br />

On the Coronation Mutual<br />

Funds, Okolo noted,<br />

“No one can doubt the<br />

capacity and expertise of<br />

Coronation Asset Management<br />

to deliver competitive<br />

returns to investors in the<br />

Coronation Mutual Funds.<br />

The level of professionalism<br />

and quality of investments<br />

will be difficult to match by<br />

other mutual fund managers<br />

in Nigeria and the West<br />

African sub-region. This,<br />

along with the proposed<br />

investment mix and the<br />

fund structures, distinguish<br />

these mutual funds.<br />

“Indeed, the recently<br />

launched, naira denominated,<br />

open-ended mutual<br />

funds by Coronation Assets<br />

Management, which witnessed<br />

a high subscription<br />

rate by individual, retail<br />

and institutional investors<br />

has continued to elicit<br />

excitement. The Mutual<br />

Funds – N1.5 billion Money<br />

Market Fund, N400 million<br />

Fixed Income Fund and<br />

the N200 million Balanced<br />

Fund, were all offered at par<br />

of N1 each.’<br />

In the same vein, Tunde<br />

Folawiyo, chairman of the<br />

bank , said the funds offer all<br />

strata of investors, individual<br />

and corporate, an opportunity<br />

to diversify their investment<br />

portfolios backed by<br />

the strength of the Coronation<br />

Brand and managed<br />

by a team of experienced<br />

professionals at Coronation<br />

Asset Management.<br />

According to Folawiyo,<br />

the Money Market Fund<br />

will exclusively invest in<br />

short-dated money market<br />

instruments, offering<br />

capital preservation and<br />

liquidity to investors.<br />

L-R: Samuel Rowland, compliance officer, Lagos State Lotteries Board; Ojeh Afam, deputy manager, National Lottery<br />

Regulatory Commission; Ope Wemi-Jones, group head, inclusive banking, Access Bank plc; Banjo Adegbohungbe,<br />

group head, corporate operations, Access Bank plc, and Olusola Ogunbode, senior manager, National Lottery Regulatory<br />

Commission, at the first monthly selection of the Access Bank Family Fortune promo held at the bank’s Admiralty Way<br />

branch, Lekki, Lagos, yesterday.<br />

swered that providing capital<br />

needed to go through implementation<br />

of a distribution<br />

network that accessed the<br />

mass market.<br />

TBY and the speakers<br />

also discussed the role of<br />

Fintech companies and their<br />

relationships with banks and<br />

the role of regulators. On the<br />

matter, Nwanguma admitted<br />

the need for Fintech companies<br />

and banks to cooperate<br />

since they both need each<br />

other, emphasising banks’<br />

role in working with end-users<br />

and Fintech companies’<br />

role in developing payment<br />

processing technologies.<br />

Collaboration with the<br />

regulators is also deemed to<br />

be crucial, as new Fintech<br />

actors are unable to grow<br />

and operate in the long-term<br />

without rules of engagement.<br />

Innovation has to be<br />

sustained, creating a scheme<br />

of tax incentives and facilitating<br />

access to financing,<br />

especially for SMEs.<br />

Solid minerals sector to contribute up to 3% of GDP by 2025 - PwC<br />

KELECHI EWUZIE<br />

Industry close watchers<br />

say if the right steps<br />

are taken and the current<br />

momentum is sustained,<br />

the Nigerian solid<br />

minerals sector can contribute<br />

up to 3 percent of gross<br />

domestic products (GDP)<br />

by 2025.<br />

They are optimistic that<br />

going by the measures outlined<br />

in the current roadmap,<br />

the sector’s contribution can<br />

move up from 0.5 percent to<br />

3 percent.<br />

Cyril Azobu, advisory<br />

partner and mining leader<br />

at PwC Nigeria, says several<br />

important developments in<br />

the Nigerian mining sector in<br />

the last year bode well for the<br />

industry’s future, “perhaps,<br />

the most significant is the<br />

approval in <strong>Aug</strong>ust 2016 of a<br />

new roadmap for the sector<br />

by the government.”<br />

Azobu, while speaking<br />

about the upcoming Nigeria<br />

Mining Week scheduled for<br />

October 16-19, in Abuja, says<br />

the high-level strategic mining<br />

investment platform will<br />

link investors, project developers,<br />

financiers, technology<br />

providers and government<br />

to share best practices and<br />

demonstrate the latest strategies<br />

to evolve the sector<br />

successfully.<br />

According to Azobu, “My<br />

vision for the sector is one<br />

that is profitable to all stakeholders<br />

and in which the<br />

Nigerian people are able to<br />

enjoy the maximum benefits<br />

possible for these natural<br />

endowments.”<br />

He further says that the<br />

Nigeria Mining Week is organised<br />

by the Miners Association<br />

of Nigeria in partnership<br />

with Spintelligent and<br />

PwC Nigeria.<br />

On the new roadmap for<br />

the sector, the expert says<br />

this very important policy<br />

document has really set the<br />

tone for the development of<br />

the sector.<br />

“Following from this, we<br />

have seen the constitution of<br />

the Mining Implementation<br />

and Strategy team whose<br />

duty is to co-ordinate the implementation<br />

of the roadmap<br />

and programme manage its<br />

execution,” he states.<br />

He adds: “Furthermore,<br />

the Federal Government also<br />

approved a N30bn Mining<br />

Intervention Fund. A significant<br />

proportion of the fund<br />

has gone into data gathering<br />

and a part of it is to go<br />

into capacity building for<br />

artisanal miners. We are also<br />

seeing the Federal Government<br />

making efforts to take<br />

advantage of some strategic<br />

minerals such as Steel and<br />

Bitumen but all of these are<br />

still in the early stages.”<br />

It would be recalled that<br />

the board of the Solid Minerals<br />

Development Fund was<br />

inaugurated by the minister<br />

of mines and steel development,<br />

Kayode Fayemi.

Thursday <strong>17</strong> <strong>Aug</strong>ust 20<strong>17</strong><br />

C002D5556<br />

BUSINESS DAY<br />

7

Thursday <strong>17</strong> <strong>Aug</strong>ust 20<strong>17</strong><br />

8 BUSINESS DAY<br />

C002D5556<br />

NEWS<br />

Onayekan to speak on Nigeria’s current recession,<br />

economic recovery at CBU national conference<br />

FRANK UZUEGBUNAM<br />

The 20<strong>17</strong> annual lecture<br />

of the Catholic<br />

Brothers United<br />

(CBU), one of the<br />

pious associations at the<br />

St. Agnes Catholic Church,<br />

Maryland Lagos, to be held<br />

in October this year is focusing<br />

on the country’s current<br />

recession and ongoing efforts<br />

of the government to turn the<br />

economy around and engender<br />

overall growth of critical<br />

sectors of the economy.<br />

The CBU in its determined<br />

efforts to support national<br />

development through<br />

the annual lecture platform<br />

through which it generates<br />

discourse among major<br />

stakeholders in both the political<br />

and economic space is<br />

set to hold the event which is<br />

the 18th in the series.<br />

This year’s lecture with<br />

the theme, “ Proffering solutions<br />

to the current economic<br />

recession: The religious<br />

perspective” is to be<br />

delivered by His Eminence,<br />

John Cardinal Onaiyekan,<br />

the Archbishop of Abuja.<br />

According to president of<br />

the CBU, Emmanuel Okoro,<br />

the topic is timely given the<br />

sustainable efforts and commitment<br />

by the federal government<br />

to exit the country<br />

from the present economic<br />

woes.<br />

Okoro said the CBU as an<br />

association made up of professionals,<br />

entrepreneurs and<br />

business men sees the body<br />

as a stakeholder in the ongoing<br />

economic restructuring<br />

process and as also considers<br />

it a duty and national assignment<br />

to support genuine and<br />

determined activities to move<br />

Nigeria away from poverty.<br />

He observed that religion<br />

should not be separated from<br />

the society as religion plays<br />

important role in shaping the<br />

entire society, by engaging<br />

public office holders, government<br />

officials as well as policy<br />

makers in issues of national<br />

development.<br />

“Religion impacts discipline,<br />

spiritual knowledge and<br />

right attitude to the people<br />

particularly the youths by<br />

encouraging them to be worthy<br />

ambassadors as well as<br />

imbibe the culture of patriotism<br />

in their daily lives, and<br />

so our annual lecture which<br />

has been sustained for the<br />

last 18 years has made significant<br />

impact through robust<br />

discourse and solutions they<br />

have proffered in the previous<br />

lectures”, Okoro said, adding<br />

that the teeming youths in the<br />

society as well as operators in<br />

the economy will benefit from<br />

the robust discussion by his<br />

Eminence given his pedigree<br />

and statesman position in<br />

national issues.<br />

Lagos lauds Sterling Bank’s<br />

sustainability campaign<br />

In a show of endorsement<br />

of Sterling<br />

Bank’s sustainability<br />

campaign known as<br />

Sterling Environmental<br />

Makeover (STEM), senior<br />

officials of Lagos State government<br />

have paid tributes<br />

to the initiative, saying it<br />

is in line with the state’s<br />

vision of encouraging residents<br />

to show respect for<br />

the environment.<br />

Addressing a crowd at<br />

the flag off of the mega<br />

cleaning exercise that took<br />

place at the Computer Village<br />

in Ikeja at the weekend,<br />

Babatunde Adejare,<br />

Lagos State commissioner<br />

for the environment, commended<br />

the bank for its<br />

outstanding show of commitment<br />

to the campaign<br />

for a livable environment.<br />

Adejare said, “We need<br />

to have more respect for our<br />

environment than we do<br />

now. The state government<br />

cancelled the monthly sanitation<br />

exercise because it<br />

believed that cleaning the<br />

environment should be<br />

part of our daily lives and<br />

not just a monthly routine.”<br />

The commissioner disclosed<br />

that the state government<br />

recently introduced<br />

the Cleaner Lagos<br />

Initiative in a bid to better<br />

manage solid waste, and<br />

urged participants in the<br />

cleaning exercise to extend<br />

the practice to their different<br />

homes as part of their<br />

contribution to the emergence<br />

of a cleaner Lagos fit<br />

for human habitation.<br />

In his welcome address,<br />

Yemi Adeola, CEO of Sterling<br />

Bank, said the STEM<br />

programme was being held<br />

simultaneously in eight<br />

other locations across the<br />

country. These include<br />

the seven state capitals of<br />

Ogun, Oyo, Kwara, Rivers,<br />

Enugu, Plateau, Kano, and<br />

in Abuja.<br />

STEM is the bank’s corporate<br />

social responsibility<br />

initiative that promotes<br />

sanitation and helps to<br />

reduce the impact of human<br />

activities on the environment<br />

with the aim of<br />

making planet earth a clean<br />

and safe place for all, Adeola<br />

explained.<br />

Also speaking, Mojeed<br />

Babajide, chairman of<br />

Ikeja Local Government,<br />

thanked the bank for the<br />

initiative, adding that the<br />

local government was very<br />

happy to partner it, and<br />

echoed the commissioner’s<br />

plea for refuse to be properly<br />

packed for officials of<br />

LAWMA to pick them up<br />

in a bid to ensure a cleaner<br />

Lagos.<br />

TCN secures $1.55bn to revive<br />

transmission projects, expand grid<br />

HARRISON EDEH, Abuja<br />

Transmission<br />

Company of Nigeria<br />

(TCN) has<br />

secured $1.55 billion<br />

from multilateral<br />

donors to revive<br />

some transmission projects<br />

and expand the grid.<br />

Usman Gur Mohammed,<br />

the interim managing<br />

director, disclosed this<br />

on the sideline of the 18th<br />

Monthly Power Sector and<br />

Stakeholders meeting in<br />

Kumboso, Kano State.<br />

Mohammed said in a<br />

statement that the intervention<br />

came from the<br />

World Bank, African Development<br />

Bank, Islamic<br />

Development Bank, European<br />

Union and JICA.<br />

According to Mohammed,<br />

“the funding is to resuscitate<br />

transmission projects<br />

and further expand the transmission<br />

grid. Projects to be<br />

executed include the Abuja<br />

transmission project, which<br />

would provide sub-stations<br />

as well as another transmission<br />

line for supply to Abuja<br />

from Lafia.<br />

“We have also resuscitated<br />

the JICA project that<br />

has been on the drawing<br />

board for a long time now.<br />

These projects, plus others<br />

are being executed around<br />

the country,” he said.<br />

He recalled that when he<br />

assumed office he discovered<br />

that TCN’s capacity to wheel<br />

power was actually higher<br />

than that of the distribution<br />

companies (Discos).<br />

To him, there was need<br />

however for further expansion<br />

of the grid, which made<br />

it expedient for TCN to seek<br />

the support of the Federal<br />

Ministry of Finance and Ministry<br />

of Power, Works and<br />

Housing to raise funding<br />

from donor agencies.<br />

“On growing the load and<br />

avoid load rejection, we are<br />

working with Discos to see<br />

how to improve their capacity<br />

and we have appointed,<br />

interface focal officers to<br />

help the Discos pick more<br />

load,” he said.<br />

On TCN’s part, he said the<br />

transmission company was<br />

working towards realising<br />

20,000 megawatts of transmission<br />

capacity in the next few<br />

years, pointing out that Right<br />

of Way was a crucial challenge<br />

in the power sector, which had<br />

resulted in a study by the West<br />

African Power Pool on the international<br />

transmission lines.<br />

He pointed out further<br />

that since the payment of<br />

compensation for Right of<br />

Way in Nigeria had become a<br />

crucial problem, TCN started<br />

collaborating with state governments.

Thursday <strong>17</strong> <strong>Aug</strong>ust 20<strong>17</strong><br />

Harvard<br />

Business<br />

Review<br />

Global Business Perspectives<br />

CONNECTING THE WORLD ONE BUSINESS AT A TIME<br />

BUSINESS DAY<br />

9<br />

Global Confidence in the United States Is Shaken<br />

Though only six<br />

months old, Donald<br />

Trump’s presidency<br />

already has had a<br />

major impact on<br />

how the world views the United<br />

States. Trump and many of his<br />

key policies are broadly unpopular<br />

around the globe and,<br />

according to a Pew Research<br />

Center survey spanning 37 nations,<br />

ratings for the United<br />

States have declined steeply<br />

in many nations. The rare<br />

countries where confidence<br />

in America has grown include<br />

Israel and Russia, with Israelis<br />

and Russians expressing greater<br />

support for Trump than for his<br />

predecessor, President Barack<br />

Obama.<br />

Criticism of the United States<br />

and its president for stubbornly<br />

rejecting trade agreements such<br />

as the Trans-Pacific Partnership<br />

or policies that could stem climate<br />

change are an indicator of<br />

the lack of public will in many<br />

countries to have their leaders<br />

cooperate with the Trump<br />

White House.<br />

A median of 22% responding<br />

to the survey said that they<br />

had confidence in Trump to do<br />

the right thing when it comes<br />

to international affairs. This<br />

stands in sharp contrast to the<br />

final years of Obama’s presidency,<br />

when a median of 64%<br />

expressed confidence in him.<br />

A median of 64% had a positive<br />

view of the nation in the last<br />

years of the Obama presidency,<br />

but today only 49% are favorably<br />

inclined toward America.<br />

The decline in confidence in<br />

the president has come mostly<br />

in advanced economies. America’s<br />

image also has suffered in<br />

emerging markets and developing<br />

countries, however, where<br />

some of Trump’s proposed<br />

policies — notably his promise<br />

to build a wall along the Mexican<br />

border and his efforts to<br />

restrict entry into the United<br />

States from Muslim-majority<br />

countries — are particularly<br />

unpopular.<br />

A majority of Israelis and<br />

President Donald Trump and his wife, Melania, escort former President Barack Obama and Michelle Obama to their<br />

helicopter after the inauguration ceremony at the Capitol in Washington, Jan. 20, 20<strong>17</strong><br />

Russians, at 56%, and 53% respectively,<br />

has confidence in<br />

the U.S. president. In Europe,<br />

however, a median of only 18%<br />

has confidence in Trump to do<br />

the right thing regarding world<br />

affairs.<br />

The president is not much<br />

more popular in the rest of the<br />

world. A median of only 14% in<br />

Latin America expresses confidence<br />

in him, including 5% in<br />

Mexico, 12% in Chile and 13% in<br />

Argentina. In comparison, 49%<br />

of Mexicans had confidence in<br />

Obama in his last year in office,<br />

as did 60% of Chileans and 40%<br />

of Argentines. Trump’s ratings<br />

are closer to some of those given<br />

President George W. Bush in<br />

his last year: 16% in Mexico, 7%<br />

in Argentina.<br />

Such disapproval surely is<br />

due, at least in part, to Trump’s<br />

proposal to build a wall along<br />

the border between the United<br />

States and Mexico to stem the<br />

flow of undocumented immigrants.<br />

A median of 83% of Latin<br />

Americans disapproves of such<br />

plans. Moreover, Latin Americans<br />

express harsh judgments<br />

of Trump’s personality. A median<br />

of 82% suggests that he is arrogant,<br />

77% that he is intolerant<br />

and 66% that he is dangerous.<br />

In sub-Saharan Africa a median<br />

of 50% has confidence in<br />

Trump. This includes 26% in<br />

Senegal and 39% in South Africa.<br />

Overall 56% of people in the<br />

region have a favorable view of<br />

the United States. Confidence<br />

in the U.S. president is down<br />

51 points in Senegal, however,<br />

down 33 points in Ghana and<br />

down 27 points in Tanzania.<br />

Although more than half<br />

the public in Ghana, Senegal<br />

and Tanzania still expresses a<br />

positive view of America, such<br />

sentiment is down 30 points in<br />

Ghana, 25 points in Senegal and<br />

21 points in Tanzania.<br />

Much of this decline may be<br />

attributed to opposition to proposed<br />

Trump administration<br />

policies. Only roughly a third<br />

of the public in sub-Saharan<br />

Africa favors Trump’s proposals<br />

to pull out of international<br />

climate-change agreements, to<br />

restrict entry to the U.S. from<br />

some Muslim-majority countries<br />

and to withdraw from<br />

major trade agreements. Notably,<br />

despite lukewarm feelings<br />

about Trump’s policies, a median<br />

of 61% of sub-Saharan Africans<br />

views Trump as a strong<br />

leader and 51% agree that he is<br />

qualified to hold his office.<br />

Views of Trump and the U.S.<br />

are low in the Middle East, except<br />

in Israel, where 56% of<br />

respondents have a positive<br />

opinion of the president, up 7<br />

points over Obama. In most of<br />

the region, views of America<br />

and its leader declined sharply<br />

during the Bush era and did not<br />

recover with Obama. Only 9%<br />

of Jordanians, 11% of Turks and<br />

15% of Lebanese see Trump in<br />

a positive light. This is down 34<br />

points in Turkey and 21 points<br />

in Lebanon from assessments<br />

of Obama.<br />

Much of this may be due to<br />

strong opposition to Trump’s<br />

proposed restrictions on the<br />

entry into the U.S. of people<br />

from Muslim-majority countries:<br />

Ninety-six percent of<br />

Jordanians and 88% of Lebanese<br />

disapprove of such plans.<br />

Trump’s image has done little<br />

to harm views of the United<br />

States in Lebanon and Jordan,<br />

however, where U.S. favorability<br />

is low and relatively unchanged<br />

compared with the Obama era.<br />

20<strong>17</strong> Harvard Business School Publishing Corp. Distributed by The New York Times Syndicate<br />

Only in Asia do publics<br />

in emerging and developing<br />

countries have a mixed view of<br />

the United States and its new<br />

president. In India 40% have<br />

confidence in Trump, down<br />

18 points from their view of<br />

Obama last year, and 45% voice<br />

no opinion. Only 23% of Indonesians<br />

have faith in the U.S.<br />

chief executive, down 41 points<br />

from their view of Obama, who<br />

spent a portion of his boyhood<br />

in that country. Views of the<br />

U.S. are down 14 points in Indonesia<br />

and 7 points in India.<br />

At the same time, Trump is<br />

relatively popular in both the<br />

Philippines, at 69%, and Vietnam,<br />

at 58%, his highest ratings<br />

among the 37 nations surveyed.<br />

These assessments are lower<br />

than views of Obama, however,<br />

down 25 points in the Philippines<br />

and 13 points in Vietnam.<br />

Still, Philippine and Vietnamese<br />

judgments of Trump may be<br />

buoying opinions of the United<br />

States: 84% of Vietnamese and<br />

78% of Filipinos have a favorable<br />

opinion of America, the<br />

highest rating for the nation in<br />

the 20<strong>17</strong> Pew Research Center<br />

survey.<br />

The nation’s image and global<br />

confidence in the U.S. president<br />

suffered under the Bush<br />

administration after 2000, but<br />

recovered during Obama’s tenure.<br />

The Trump era began on a<br />

sour note throughout much of<br />

the world, including emerging<br />

and developing nations.<br />

During the Bush years opposition<br />

to the United States and<br />

to its leader often made it difficult<br />

for leaders of other nations<br />

to work with the United States<br />

on issues such as Iraq. So far,<br />

possibly aware of their citizens’<br />

wariness of the Trump administration,<br />

many leaders are proceeding<br />

with their own plans on<br />

climate change, trade and the<br />

conflicts in Afghanistan, North<br />

Korea and Syria.<br />

(Bruce Stokes is director of<br />

global economic attitudes at the<br />

Pew Research Center.)

Thursday <strong>17</strong> <strong>Aug</strong>ust 20<strong>17</strong><br />

10 BUSINESS DAY<br />

C002D5556<br />

COMMENT<br />

UCHE UWALEKE<br />

Uche Uwaleke is the Head of<br />

Banking & Finance department at<br />

Nasarawa State University Keffi<br />

In an apparent move to ease<br />

the country’s huge debt service<br />

burden following the rising<br />

cost of servicing domestic<br />

debt, the federal government<br />

plans to refinance $3billion worth<br />

of naira-denominated short-term<br />

Treasury bills with dollar borrowing<br />

of up to three years’ maturity.<br />

According to the Finance Minister,<br />

Mrs. Kemi Adeosun, who made<br />

the disclosure recently, the plan,<br />

which is tantamount to ‘’debt restructuring’’<br />

involving borrowing in<br />

dollars instead of naira, will go a long<br />

way in halving the cost of borrowing<br />

thereby reducing the pressure on<br />

domestic debt service considering<br />

that ‘’the average rate at which we<br />

borrow internationally is at seven<br />

per cent; whereas on our Treasury<br />

bills, we are paying between 13 per<br />

cent and 18.5 per cent’’.<br />

Expectedly, not a few have voiced<br />

opposition to the plan, not least<br />

because the country’s experience<br />

with foreign creditors especially<br />

prior to 2005 (when Nigeria pulled<br />

free from the yoke of the Paris and<br />

comment is free<br />

Send 800word comments to comment@businessdayonline.<br />

Public debt burden: Dollar-backed t-bills as a breather<br />

London clubs) was nothing to write<br />

home about. There is the fear that<br />

despite the fact that foreign loans<br />

may be relatively cheaper, the debt<br />

burden will become more severe in<br />

the event of another oil price shock<br />

given the country’s over reliance on<br />

oil for foreign exchange. It is also<br />

argued that an additional $3 billion<br />

will add to the existing stock of foreign<br />

debt and since this will not be<br />

used for any productive investment,<br />

interest and principal repayments<br />

will be at the expense of investment<br />

in critical infrastructure.<br />

Be that as it may, the merits of<br />

the plan far outweigh the demerits.<br />

Treasury bills are short term debt<br />

instruments with a maturity profile<br />

of a maximum of 364 days. The refinancing<br />

arrangement will ensure<br />

that instead of rolling over the debts<br />

as they mature, the government is in<br />

a position to repay by borrowing for<br />

up to three years in the expectation<br />

that as the economy recovers and<br />

grows, the country will be in a better<br />

position to make repayment. It is<br />

equally expected that by reducing<br />

government’s borrowing by $3bn,<br />

more room is created for banks to<br />

lend to the private sector which may<br />

translate to downward pressure<br />

on interest rates. Furthermore, the<br />

immediate impact on the foreign<br />

exchange market will be positive<br />

since dollar denominated loans<br />

will typically increase the nation’s<br />

external reserves, thus helping to<br />

strengthen the naira<br />

Indeed, a cursory look at data<br />

from the Debt Management Office<br />

The refinancing arrangement<br />

will ensure that instead of<br />

rolling over the debts as they<br />

mature, the government is in<br />

a position to repay by borrowing<br />

for up to three years<br />

in the expectation that as<br />

the economy recovers and<br />

grows, the country will be<br />

in a better position to make<br />

repayment<br />

provides some justification for this<br />

initiative. As at March 31, 20<strong>17</strong>, the<br />

domestic debt stock of the federal<br />

government was about N12 trillion<br />

while the total external debt stock<br />

stood at $13,807.59 or about N4.3<br />

trillion. Of the domestic debt stock,<br />

Nigerian Treasury Bills constitute<br />

30.08 percent while FGN Bonds account<br />

for 68 per cent. Actual external<br />

debt service in 2016 was $353,093.54<br />

(about N108 million)with the bulk of<br />

the obligations (47 per cent) to Multilateral<br />

Institutions (mainly the World<br />

Bank Group and African Development<br />

Bank); while actual domestic debt service<br />

in 2016 stood at N1.3 trillion with<br />

Nigerian Treasury Bills taking up N336<br />

billion and FGN Bond N839billion.<br />

In the 20<strong>17</strong> budget, over N1.8 trillion<br />

is allocated for debt servicing alone<br />

the bulk of which is meant to service<br />

domestic debt.<br />

So the challenge really comes<br />

more from coping with domestic debt<br />

service than meeting foreign obligations.<br />

This is further confirmed by<br />

the 2016 Debt Sustainability Analysis<br />

report which stated that ‘’the liquidity<br />

ratio revealed gross weaknesses<br />

in the structure of the economy, as<br />

the ratio of Public Debt Service-to-<br />

Revenue of 28.10 percent as at end<br />

of December, 2015, breached the<br />

Country-Specific threshold of 28<br />

percent. This highlights a potential<br />

risk to the debt portfolio, which could<br />

be exacerbated by the developments<br />

in the international oil market, as further<br />

decline in global oil prices would<br />

exert undue pressures on the already<br />

fragile economy, including the debt<br />

position in the medium to long-term’’.<br />

Consequently, the Debt Management<br />

Strategy, 2016-2019, provides<br />

for the rebalancing of the debt portfolio<br />

from its composition of 84:16 as<br />

at end-December, 2015, to an optimal<br />

mix of 60:40 by end-December, 2019<br />

for domestic to external debts, respectively.<br />

The key policy recommendation<br />

of the 2016 DSA is to the effect<br />

that given ‘’the Country-Specific<br />

threshold of 19.39 percent for NPV of<br />

Total Public Debt-to-GDP ratio (up to<br />

20<strong>17</strong>), the borrowing space available<br />

is 5.89 percent of the estimated GDP<br />

of US$374.95 billion for 20<strong>17</strong>. To this<br />

end, the maximum amount that could<br />

be borrowed (domestic and external)<br />

by the FGN in 20<strong>17</strong> without violating<br />

the country-specific threshold will<br />

be US$22.08 billion (i.e. 5.89 percent<br />

of US$374.95 billion). It is proposed<br />

to be obtained from both the domestic<br />

and external sources as follows:<br />

new Domestic Borrowing US$5.52<br />

billion (equivalent of about N1,600<br />

billion); and new External Borrowing:<br />

US$16.56 billion (equivalent of<br />

about N4,800 billion)’’. It is pertinent<br />

to note that these are recommended<br />

maximum amounts that could be<br />

sourced, taking into cognizance<br />

the absorptive capacity of the domestic<br />

debt market and the options<br />

available in the international debt<br />

market. This policy stance has been<br />

reinforced by the recent economic<br />

headwinds and the rising cost of<br />

domestic borrowing. Hence, the shift<br />

of emphasis to external borrowing<br />

would help to reduce debt service<br />

burden in the short to medium-term<br />

and further create more borrowing<br />

space for the private sector in the<br />

domestic market.<br />

Now that the government has<br />

concluded with the prospective<br />

lenders and waiting for the nod of<br />

the National Assembly as disclosed<br />

by the Finance Minister, it is vital to<br />

put in the public domain detailed<br />

information regarding the sources<br />

and cost implications to enable<br />

the National Assembly reach a well<br />

informed decision which provides<br />

assurance that the plan is in sync<br />

with the government’s Economic<br />

Recovery and Growth Plan.<br />

To be sure, not even the Finance<br />

Minister is under any illusion that<br />

the $3 billion debt refinancing plan<br />

is a panacea to the country’s rising<br />

debt burden. But it does provide the<br />

much needed breather while the<br />

government concentrates on current<br />

efforts aimed at diversifying the<br />

country’s economy.<br />

I wish I were North Korea’s spokesman and speech writer<br />

OKEY NWACHUKWU<br />

Nwachukwu is a Lagos-based<br />

communications consultant<br />

With two bullies at<br />

the helms in the US<br />

and the Democratic<br />

People’s Republic of<br />

Korea (DPRK), as North Korea is<br />

officially known, the threat of nuclear<br />