BusinessDay 20 Jul 2017

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

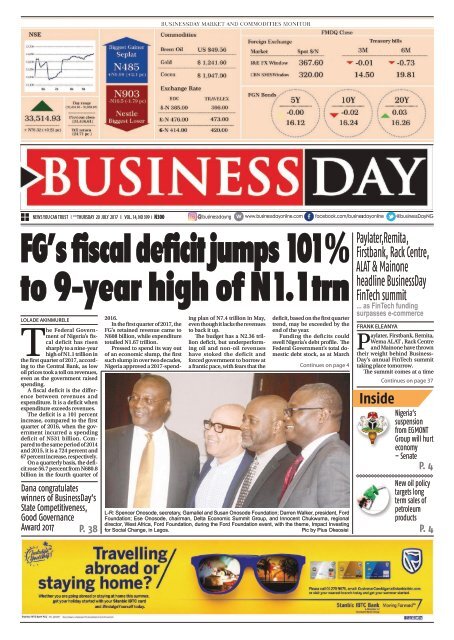

NEWS YOU CAN TRUST I **THURSDAY <strong>20</strong> JULY <strong>20</strong>17 I VOL. 14, NO 399 I N300 @ g<br />

FG’s fiscal deficit jumps 101%<br />

to 9-year high of N1.1trn<br />

LOLADE AKINMURELE<br />

The Federal Government<br />

of Nigeria’s fiscal<br />

deficit has risen<br />

sharply to a nine-year<br />

high of N1.1 trillion in<br />

the first quarter of <strong>20</strong>17, according<br />

to the Central Bank, as low<br />

oil prices took a toll on revenues,<br />

even as the government raised<br />

spending.<br />

A fiscal deficit is the difference<br />

between revenues and<br />

expenditure. It is a deficit when<br />

expenditure exceeds revenues.<br />

The deficit is a 101 percent<br />

increase, compared to the first<br />

quarter of <strong>20</strong>16, when the government<br />

incurred a spending<br />

deficit of N531 billion. Compared<br />

to the same period of <strong>20</strong>14<br />

and <strong>20</strong>15, it is a 724 percent and<br />

67 percent increase, respectively.<br />

On a quarterly basis, the deficit<br />

rose 56.7 percent from N680.8<br />

billion in the fourth quarter of<br />

Dana congratulates<br />

winners of <strong>BusinessDay</strong>’s<br />

State Competitiveness,<br />

Good Governance<br />

Award <strong>20</strong>17 P. 38<br />

<strong>20</strong>16.<br />

In the first quarter of <strong>20</strong>17, the<br />

FG’s retained revenue came to<br />

N608 billion, while expenditure<br />

totalled N1.67 trillion.<br />

Pressed to spend its way out<br />

of an economic slump, the first<br />

such slump in over two decades,<br />

Nigeria approved a <strong>20</strong>17-spending<br />

plan of N7.4 trillion in May,<br />

even though it lacks the revenues<br />

to back it up.<br />

The budget has a N2.36 trillion<br />

deficit, but underperforming<br />

oil and non-oil revenues<br />

have stoked the deficit and<br />

forced government to borrow at<br />

a frantic pace, with fears that the<br />

deficit, based on the first quarter<br />

trend, may be exceeded by the<br />

end of the year.<br />

Funding the deficits could<br />

swell Nigeria’s debt profile. The<br />

Federal Government’s total domestic<br />

debt stock, as at March<br />

Continues on page 4<br />

L-R: Spencer Onosode, secretary, Gamaliel and Susan Onosode Foundation; Darren Walker, president, Ford<br />

Foundation; Ese Onosode, chairman, Delta Economic Summit Group, and Innocent Chukwuma, regional<br />

director, West Africa, Ford Foundation, during the Ford Foundation event, with the theme, Impact Investing<br />

for Social Change, in Lagos.<br />

Pic by Pius Okeosisi<br />

Paylater,Remita,<br />

Firstbank, Rack Centre,<br />

ALAT & Mainone<br />

headline <strong>BusinessDay</strong><br />

FinTech summit<br />

... as FinTech funding<br />

surpasses e-commerce<br />

FRANK ELEANYA<br />

Paylater, Firstbank, Remita,<br />

Wema ALAT , Rack Centre<br />

and Mainone have thrown<br />

their weight behind Business-<br />

Day’s annual FinTech summit<br />

taking place tomorrow.<br />

The summit comes at a time<br />

Inside<br />

Continues on page 37<br />

Nigeria’s<br />

suspension<br />

from EGMONT<br />

Group will hurt<br />

economy<br />

– Senate<br />

P. 4<br />

New oil policy<br />

targets long<br />

term sales of<br />

petroleum<br />

products<br />

P. 4

2<br />

Thursday <strong>20</strong> <strong>Jul</strong>y <strong>20</strong>17

Thursday <strong>20</strong> <strong>Jul</strong>y <strong>20</strong>17<br />

3

4 BUSINESS DAY<br />

C002D5556<br />

Thursday <strong>20</strong> <strong>Jul</strong>y <strong>20</strong>17<br />

NEWS<br />

Nigeria’s suspension from EGMONT<br />

Group will hurt economy – Senate<br />

OWEDE AGBAJILEKE, Abuja<br />

Worried about the<br />

grave economic<br />

implication of<br />

Nigeria’s suspension<br />

from the<br />

EGMONT group, the Senate has<br />

taken steps to avert expulsion.<br />

The EGMONT Group is a network<br />

of national financial intelligence<br />

units and is the highest<br />

inter-governmental association of<br />

intelligence agencies in the world,<br />

with 154 member countries. It provides<br />

the backbone for monitoring<br />

international money laundering<br />

activities.<br />

Nigeria became a full member<br />

of the group in <strong>20</strong>07 during the<br />

administration of former President<br />

Olusegun Obasanjo.<br />

However, at its <strong>Jul</strong>y 7, <strong>20</strong>17<br />

meeting in China, Nigeria’s Financial<br />

Intelligence Unit (NFIU), the<br />

agency of government that represents<br />

the country at the meetings<br />

of the group, was suspended till<br />

January <strong>20</strong>18 with a threat of an<br />

expulsion if the country does not<br />

meet the standards of the group<br />

with regard to its operations.<br />

It cited inability of the Federal<br />

Government to make the NFIU<br />

FG’s fiscal deficit jumps 101% to nine year-high of...<br />

Continued from page 1<br />

<strong>20</strong>17 rose 8 percent to N11.9<br />

trillion, from N11.05 trillion as at<br />

December <strong>20</strong>16, while external<br />

debt stood at $US 39 billion, according<br />

to data from the Debt<br />

Management Office (DMO).<br />

“The deficit explains why the<br />

government has been borrowing<br />

massively, stoking interest rates<br />

and crowding out the private<br />

sector,” said Johnson Chukwu,<br />

CEO of Lagos-based financial<br />

advisory firm, Cowry Assets. “The<br />

challenge of such public borrowing<br />

is that it stifles credit to the<br />

productive (private) sector and<br />

would have a negative effect on<br />

the speed at which the country<br />

can exit recession.<br />

“Revenue has tanked and the<br />

government needs to take bold<br />

measures to cut down recurrent<br />

expenditure, to engender frugal<br />

spending,” Chukwu told <strong>BusinessDay</strong>.<br />

autonomous from the EFCC, interference<br />

of the acting chairman<br />

of the anti-graft agency, Ibrahim<br />

Magu in the affairs of the NFIU and<br />

divulging confidential information<br />

concerning EGMONT Group to<br />

the media.<br />

The global body stated that<br />

if Nigeria fails to comply with<br />

the group’s demands for a legal<br />

framework granting autonomy<br />

to the NFIU by January <strong>20</strong>18, the<br />

country would be expelled from<br />

the organisation.<br />

If this happens, Nigeria will<br />

no longer be able to benefit from<br />

financial intelligence shared by<br />

the other 153 member countries,<br />

including the United States, United<br />

Kingdom, Qatar, Saudi Arabia,<br />

Germany and Italy, among others.<br />

The Senate is blaming the Ex-<br />

Continues on page 37<br />

L-R: Saidu Mohammed, COO, Gas and Power NNPC; Chinwuba Oby Laura, regulating liaison officer, AITEO; Ibe<br />

Kachikwu, minister of state for petroleum resources; Samira Buhari, manager public sector and corporate relationship,<br />

AITEO, and Bekeme Masade, founder/CEO CSR-in-Action, during the 6th Sustainability in the Extractive<br />

Industries (SITEI) conference, theme “Building Local for Global” held in Abuja, yesterday. Pic by Tunde Adeniyi<br />

Pabina Yinkere, head of institutional<br />

business at Lagos-based<br />

investment bank, Vetiva Capital,<br />

urges the country to focus on<br />

growing its revenues.<br />

“The bulk of our revenue comes<br />

from oil, which we do not have<br />

control over (in terms of prices),<br />

for production, which we have<br />

some control on, we must ensure<br />

output is steady, or even grow it<br />

from current levels,” Yinkere said<br />

in an interview.<br />

Nigeria should also strive to<br />

raise its tax collections by enforcing<br />

better compliance, according<br />

to Yinkere.<br />

The CBN figures show that<br />

Federal Government’s retained<br />

revenue for the first quarter of<br />

<strong>20</strong>17 based on provisional data,<br />

amounted to N608.11 billion.<br />

This was below the proportionate<br />

quarterly budget estimate<br />

and the receipts in the preceding<br />

quarter by 9.9 and 31.0 percent,<br />

respectively.<br />

Of the total revenue, the Federation<br />

Account accounted for<br />

58.6 percent, while Federal Government<br />

Independent Revenue,<br />

VAT, and others (NNPC Refund<br />

and Exchange Gain) accounted<br />

for 12.8, 10.9, 9.3, 5.3 and 3.1 per<br />

cent, respectively.<br />

At N1.67 trillion, the CBN data<br />

indicated that the Federal Government’s<br />

expenditure for the<br />

first quarter of <strong>20</strong>17 was above<br />

the provisional quarterly budget<br />

estimate and the level in the preceding<br />

quarter by 6.9 and 7.3 per<br />

cent, respectively.<br />

The development, relative to<br />

the proportionate quarterly budget<br />

estimate, was attributed to the<br />

rise in capital expenditure.<br />

A breakdown of the total expenditure,<br />

showed that the recurrent<br />

expenditure at 63.3 percent<br />

still dominated, while capital and<br />

statutory transfers accounted for<br />

31.7 and 5.0 percent, respectively.<br />

Nigeria’s economy, which vies<br />

with South Africa’s to be the largest<br />

on the continent, shrank by<br />

1.5 percent last year, the first contraction<br />

since 1991, after revenue<br />

from oil, its biggest export, fell by<br />

almost half.<br />

About 30 percent of the budget<br />

will be spent on roads, rail, ports<br />

and power, to help stimulate business<br />

activity.<br />

Spending on capital projects<br />

to promote exports and in the<br />

oil-producing Niger delta region,<br />

is expected in the second half of<br />

the year.<br />

“Capital projects are likely to<br />

suffer, as revenues underperform,”<br />

said Muda Yusuf, director-general<br />

of the Lagos Chamber of Commerce<br />

and Industry (LCCI).<br />

Indications are that the Federal<br />

Government continues to struggle<br />

with its revenues, even beyond the<br />

first quarter. The Federal Government’s<br />

gross revenue was N458.42<br />

billion in May, 48.8 percent short<br />

of the monthly budget estimate of<br />

N894.76 billion, according to the<br />

Central Bank of Nigeria (CBN)’s<br />

monthly report.<br />

This has been the trend<br />

New oil policy<br />

targets long term<br />

sales of petroleum<br />

products<br />

…Nigeria targets 2.5m to 3m b/d<br />

crude production in 2 years<br />

…Over 30 individuals already<br />

in line for refinery financing<br />

scheme<br />

…As FEC approves National<br />

Social Protection Policy,<br />

National Employment Policy<br />

ELIZABETH ARCHIBONG<br />

Nigeria’s Federal Executive<br />

(FEC) Council on Wednesday<br />

approved a National Oil<br />

Policy which amongst other things,<br />

targets long term sales of petroleum<br />

products, which is the main<br />

source of the country’s revenue.<br />

In implementing the policy,<br />

officials say the government will<br />

hitherto consider geographical<br />

markets in long term contracting<br />

and sales of its oil, as opposed to<br />

the currently structured contracting.<br />

“How we sell our crude is going<br />

to be looked at, there is a lot of geographical<br />

market, we need to look<br />

at long term contracting and sales,<br />

as opposed to systemic contracting<br />

Continues on page 37<br />

throughout this year. Actual revenues<br />

have flunked government<br />

targets plagued by huge slippages<br />

in non-oil revenues and low oil<br />

prices and production to a less<br />

extent now.<br />

The country’s non-oil revenue,<br />

expected to relieve oil as the government’s<br />

dominant source of<br />

cash, came in at N1.13 trillion in<br />

the first five months of <strong>20</strong>17.<br />

That is half the size of a N2.2<br />

trillion five-month target set by the<br />

government (federal and states)<br />

for <strong>20</strong>17.<br />

Various analysts, and more<br />

recently, the World Bank, have<br />

expressed concerns over Nigeria’s<br />

debt profile, citing the inadequacy<br />

of current revenues to sustain<br />

interest rate payments.<br />

At the recent IMF/World Bank<br />

Spring Meetings in Washington,<br />

Catherine Pattillo, Assistant Director<br />

and Head of Fiscal Policy and<br />

Surveillance Division of the IMF,<br />

pointed out that Nigeria’s interest<br />

payment to tax revenue has more<br />

than doubled to 66 percent.

Thursday <strong>20</strong> <strong>Jul</strong>y <strong>20</strong>17<br />

5

Thursday <strong>20</strong> <strong>Jul</strong>y <strong>20</strong>17<br />

6 BUSINESS DAY<br />

C002D5556<br />

NEWS<br />

Truck driver killed, banks set ablaze in Apapa<br />

JOSHUA BASSEY & HOPE MOSES-ASHIKE<br />

Frustration, anger boiled<br />

over in Nigeria’s premier<br />

port city of Apapa<br />

on Wednesday, as a truck<br />

driver was shot dead and<br />

two commercial banks set<br />

ablaze by angry truck drivers<br />

in ‘revenge.’<br />

Olarinde Famous, spokesperson<br />

of the Lagos State<br />

Police Command, who confirmed<br />

the incident, said the<br />

trigger-happy mobile policeman<br />

had been arrested.<br />

For keen observers of developments<br />

within Apapa in<br />

the last two weeks, the bloody<br />

incident may not present a<br />

surprise, as Apapa is synonymous<br />

with disorderliness and<br />

insanity on the road.<br />

Traffic gridlock within the<br />

environs has worsened since<br />

the start of remedial work on<br />

collapsed section of Ijora-<br />

Wharf Road, penultimate<br />

Monday. This is even as the<br />

alternative Mile 2-Tincan axis<br />

towards Creek Road remains<br />

in shambles, with haulage<br />

trucks and petroleum tankers<br />

Taleveras says third party contract meets international standards<br />

KELECHI EWUZIE<br />

Taleveras, a leading global<br />

energy and services company,<br />

active in all key areas<br />

of the oil and gas industry: upstream,<br />

midstream and downstream,<br />

says that all its third party<br />

contracting meets international<br />

standards.<br />

The company, while reacting<br />

to an online publications relating<br />

to a case against Atlantic Drilling<br />

Fluids, reiterates that the legal<br />

case is not against Taleveras or<br />

Igho Sanomi.<br />

In a statement signed by Alex<br />

School, legal counsel to the company,<br />

it discloses that “in relation<br />

to the US department case<br />

against Atlantic Drilling Fluids,<br />

Taleveras and the other two major<br />

oil trading houses (Glencore<br />

and Arcadia) were not faulted<br />

for embarking on a legitimate<br />

Over 460,000 unclaimed PVCs<br />

in custody - new Edo REC<br />

IDRIS UMAR MOMOH, BENIN<br />

Edo State office of the<br />

Independent National<br />

Electoral Commission<br />

(INEC) says over 460,000<br />

unclaimed Permanent Voters<br />

Cards (PVCs) by registered<br />

voters in the state are still in<br />

its custody since <strong>20</strong>16.<br />

The new INEC state resident<br />

commissioner, Obo<br />

Effanga, made the disclosure<br />

at a stakeholders’ meeting on<br />

the Continuous Voters Registration<br />

(CVR) on Wednesday<br />

in Benin City, the state<br />

capital.<br />

“We have a total of<br />

1,900,423 registered voter in<br />

Edo State prior to the continuous<br />

voter registration.<br />

At the end of <strong>20</strong>16, we have<br />

distributed 1,445,749 PVC<br />

while over 460,000 voters<br />

are yet to collect their PVCs.<br />

We have also registered additional<br />

38,448 voters during<br />

the CVR,” he said.<br />

Effanga also disclosed<br />

that the commission had<br />

registered 38,448 voters during<br />

the ongoing CVR in the<br />

parked indiscriminately on<br />

every available space.<br />

Trouble, it was gathered,<br />

started Wednesday morning<br />

when a mobile policeman<br />

shot the trailer driver.<br />

It could not be ascertained<br />

what infuriated the policeman.<br />

However, unconfirmed<br />

reports said he was angered<br />

by the refusal of the driver<br />

to give money demanded,<br />

which is common practice<br />

between security agents and<br />

truck drivers in Apapa.<br />

According to eyewitnesses,<br />

the verbal attacks that<br />

followed resulted in skirmishes<br />

amid which the mobile<br />

policeman opened fire,<br />

which fell a truck driver. One<br />

of the witnesses, who craved<br />

anonymity, told <strong>BusinessDay</strong><br />

at the scene of the incident<br />

that the mobile policeman<br />

escaped into a bank.<br />

Angered by the death of<br />

their colleague, truck drivers<br />

joined by horde of hoodlums<br />

were said to have mobilised<br />

to the bank to demand the<br />

killer mobile policeman be<br />

released to them, a request<br />

transaction, as all payments<br />

were made based on legitimate<br />

third party contracts with private<br />

companies and not NNPC.”<br />

It observes that this process<br />

involves verification of the contracts<br />

with the issuing authority<br />

to authenticate and “further<br />

compliance with our lending<br />

banks internal due diligence processes.”<br />

This is not different from<br />

international trading standards<br />

performed by the numerous international<br />

and major oil and gas<br />

companies operating in Nigeria.<br />

According to the company,<br />

“The ultimate aim of contracting<br />

is to off-take crude oil from<br />

asset productions. It is worthy to<br />

note that neither Taleveras nor its<br />

associated companies lifted any<br />

oil from this production. Terms<br />

of the agreement were breached<br />

and hence a legal dispute and<br />

appropriate filings made in restate,<br />

which ended this week,<br />

saying six additional registration<br />

centres had been created<br />

in the state to afford more<br />

people the opportunity to<br />

register and carry out their<br />

civic responsibility.<br />

While cautioning prospective<br />

eligible voters<br />

against double registration as<br />

the commission is poised to<br />

prosecute those found wanting,<br />

he called on the people<br />

to support the commission<br />

through sensitisation of the<br />

people on the need to come<br />

out to register, noting that it<br />

was the only way to exercise<br />

their franchise.<br />

He however assured that<br />

the commission would remain<br />

neutral in its assignment,<br />

and advised politicians<br />

not to always fraternise with<br />

the election body but the electorate<br />

that would determine<br />

their fate during elections.<br />

Speakers at the stakeholders’<br />

meeting however<br />

appealed to the new REC to<br />

be fair to all party and work<br />

towards ensuring credible<br />

election in the state.<br />

turned by other policemen<br />

attached to the bank.<br />

The rioting drivers were<br />

said to have gathered disused<br />

tyres and set Diamond Bank<br />

building ablaze and also<br />

torched a nearby Sterling<br />

Bank, specifically targeting<br />

air conditioners and ATM<br />

counters. The rioters were<br />

seen molesting bank staff and<br />

customers before the security<br />

officers arrived.<br />

Soldiers were seen joining<br />

policemen from Area ‘B’<br />

Police Command, Apapa,<br />

to arrest the situation with<br />

several gunshots fired into<br />

the air to scare the rampaging<br />

truck drivers. Amid fears of<br />

possible escalation of the riot<br />

and to avoid more damage,<br />

other banks in Apapa hurriedly<br />

shut operations, and<br />

were seen evacuating their<br />

staff and customers.<br />

Meanwhile, the management<br />

of Diamond Bank and<br />

Sterling Bank confirmed<br />

there was a fire incident as a<br />

result of mob action at their<br />

Creek Road, Apapa branches<br />

on Wednesday.<br />

spected court of jurisdiction.”<br />

In setting the record straight,<br />

the statement says one of Taleveras<br />

core activities since <strong>20</strong>00,<br />

is sourcing, trading and engaging<br />

in third party contracts, inclusive<br />

of oil and gas upstream<br />

operations. Taleveras, due to its<br />

capacity, trading expertise and<br />

financial strength, continues to<br />

source and engage in procuring<br />

third party oil contracts.<br />

Taleveras performs on these<br />

contracts handling the physical<br />

delivery, risk management and<br />

logistics from start point to its<br />

numerous first class end users<br />

and major refiners.<br />

IDRIS UMAR MOMOH, BENIN<br />

NPA surpasses revenue target in Q1<br />

AMAKA ANAGOR-EWUZIE<br />

Hadiza Bala Usman,<br />

managing director,<br />

Nigerian Ports Authority<br />

(NPA), said on<br />

Wednesday that the authority had<br />

surpassed its revenue target in the<br />

first quarter of the year following<br />

gradual return of business activities<br />

to Nigerian seaports.<br />

Speaking on a live television<br />

interview on CNBC Africa, Usman<br />

said the NPA had an attendant<br />

decline in revenue since the recession,<br />

which resulted to low<br />

business activities at port such that<br />

many oceangoing vessels exited<br />

Nigerian ports.<br />

“We had a revenue projection<br />

of N16 billion but we were able<br />

to make N118 billion in the first<br />

quarter. Though, we had attendant<br />

decline in revenue since the<br />

recession but we are now seeing<br />

an increase in the exportation of<br />

agricultural produce since <strong>20</strong>17<br />

such that we had been able to surpass<br />

our revenue projection for the<br />

KELECHI EWUZIE<br />

first quarter of <strong>20</strong>17,” Usman said.<br />

According to Usman, the NPA<br />

is working to set-up a standard<br />

operating procedure for the export<br />

of agricultural produce.<br />

“We have also worked to see<br />

how to increase the export of agricultural<br />

produce and solid minerals<br />

in our ports and our terminal<br />

operators are keen on doing that<br />

and they have started developing<br />

special desks in their respective<br />

terminals to assist agricultural<br />

and solid minerals exporters to<br />

fast track export of their cargoes,”<br />

he said.<br />

The NPA boss, who said that<br />

the NPA has a revenue projection<br />

of 250 billion for <strong>20</strong>17, also stated<br />

that the authority is hopeful to<br />

attain the projected revenue,<br />

substantial amount would be<br />

dedicated to building and upgrading<br />

existing infrastructure around<br />

the ports while the remaining<br />

would go to the Federal consolidated<br />

revenue fund for national<br />

development.<br />

To achieve our revenue target<br />

for the year, the NPA boss assured<br />

Nigerians that no new tariff would<br />

be introduced on port operators<br />

and users of port services but<br />

would retain the current tariff<br />

regime at the port.<br />

Noting that many terminal<br />

operators in the past has increased<br />

their tariff without government<br />

approval, Usman said that the<br />

NPA would sanction any terminal<br />

operator that increased tariff<br />

on terminal handling without<br />

obtaining government approval<br />

as stipulated in the concession<br />

agreement.<br />

“We have also gained the<br />

presidential approval to de-categorise<br />

oil and gas cargo and that<br />

approval was given to the NPA in<br />

the last two months. Oil and gas<br />

cargo does not exist anymore and<br />

all cargo would be handled across<br />

the new categorisation and we<br />

only recognise cargoes in line with<br />

the approved categorisation. And<br />

every terminal would be allowed<br />

to handle oil and gas cargo,” she<br />

added.<br />

Summit to address critical career options for Nigerians<br />

Critical issues students<br />

encounter when making<br />

career choices as a strategy<br />

to boost the future workforce<br />

in Nigeria will engage professionals<br />

from various walks of life at a<br />

workshop in Lagos soon.<br />

The workshop organised by<br />

Global Interns Nigeria, a studentcentred<br />

organisation, will address<br />

challenges faced by students who<br />

find it difficult to make proper<br />

career choices before entering<br />

tertiary institutions, leading to<br />

a large number of them losing<br />

interest in their course of study<br />

and also finding it difficult to<br />

secure satisfactory job.<br />

Olufunmilayo Modupe, CEO<br />

of Global Interns Nigeria, said the<br />

workshop was aimed at enhancing<br />

the perception of students<br />

on the right career path and<br />

prospects associated with them.<br />

Modupe said the event,<br />

which is the first phase of career<br />

guidance workshop dubbed<br />

“The Career Connect Series”<br />

for students in high schools and<br />

universities, would take place<br />

August 22, in Lagos.<br />

She stated that the workshop<br />

will help teenagers to understand<br />

the meaning of career choices<br />

through engaging sessions suitable<br />

for learning and networking.<br />

“It promises to be practical and<br />

interactive sessions between<br />

Group urges FG to investigate NDDC abandoned projects in Ondo communities<br />

Leadership of Ijaw Consultative<br />

Forum has called<br />

on the Federal Government<br />

to investigate the alleged<br />

abandonment of a bridge project<br />

and several others in some<br />

communities awarded to a<br />

contractor by the Niger Delta<br />

Development Commission<br />

(NDDC) in Ese Local Government<br />

Area of Ondo State.<br />

The call was contained in<br />

… targets N250bn annual revenue in <strong>20</strong>17<br />

a statement signed and made<br />

available to newsmen in Ondo<br />

State by the group national<br />

coordinator and the national<br />

secretary, Suffy Uguoji and<br />

Inkinyoulemo Peremini, respectively.<br />

Suffy said the bridge that<br />

linked the riverine Arogbo-<br />

Ijaw and Agadagba-Obon<br />

communities in the local government<br />

was awarded to contractor<br />

about 10 years ago after<br />

the payment of mobilisation<br />

fee by the NDDC.<br />

He also called on the authorities<br />

of the NDDC to complete<br />

some of the abandoned<br />

projects in some communities<br />

in the local government area.<br />

The coordinator also appealed<br />

to the state governor,<br />

Rotimi Akeredolu, and the<br />

NDDC to compel the contractor<br />

handling the project to go<br />

back to site or re-award the<br />

contract to another contractor<br />

with close monitoring.<br />

He however urged the<br />

government to find a lasting<br />

students and facilitators,” she<br />

assured.<br />

Modupe further explained<br />

that students are stereotyped<br />

when making career decisions,<br />

which were sometimes in line<br />

with the desire of their parents,<br />

without looking at the prospects<br />

or satisfaction in their choices.<br />

Global Interns Nigeria is a<br />

student-centred organisation<br />

connecting college and high<br />

school interns of predominantly<br />

Nigerian extraction to lifelong<br />

rewarding internship jobs and<br />

volunteering programmes in Nigeria<br />

and Ghana. It also provides<br />

professional and sound career<br />

advisory services to all its student<br />

subscribers.<br />

L-R: O’tega<br />

Emerhor,<br />

chairman,<br />

Transcorp<br />

Hotels plc; Chris<br />

Ngige, minister<br />

of labour and<br />

employment, and<br />

Tony Elumelu,<br />

chariman,<br />

Transnational<br />

Corporation of<br />

Nigeria plc, at the<br />

30th anniversary<br />

celebration of<br />

award-winning<br />

Transcorp Hilton<br />

Abuja.<br />

solution to the bridge project<br />

with a bid to ease and facilitate<br />

transportation of goods<br />

and services in the riverine<br />

communities.<br />

“It must be noted that the<br />

undaunted economic challenges<br />

are so enormous in our<br />

environment that we can not<br />

afford to miss the link bridge<br />

which is bound to boost our<br />

business activities in Arogbo<br />

community, which is an island<br />

that is totally cut off from the<br />

hinterland.

Thursday <strong>20</strong> <strong>Jul</strong>y <strong>20</strong>17<br />

7

8<br />

Thursday <strong>20</strong> <strong>Jul</strong>y <strong>20</strong>17

Thursday <strong>20</strong> <strong>Jul</strong>y <strong>20</strong>17<br />

Harvard<br />

Business<br />

Review<br />

Global Business Perspectives<br />

BUSINESS DAY<br />

9<br />

CONNECTING THE WORLD ONE BUSINESS AT A TIME<br />

All-clear for big banks raises fears of a return to risk<br />

The JPMor gan Chase bank branc h<br />

It took a decade — and $<strong>20</strong>0<br />

billion in fines — but the big<br />

banks are back.<br />

The Federal Reserve’s<br />

passing grade for all 34 of the<br />

institutions it checks annually for financial<br />

soundness, the first all-clear<br />

since the Fed tests began in <strong>20</strong>11, is<br />

a watershed moment.<br />

The immediate winners include<br />

investors as well as bank executives,<br />

who could see their already-ample<br />

pay packages expand further. Even<br />

as the broader market fell on <strong>Jul</strong>y<br />

6, bank stocks surged as investors<br />

cheered the big dividend increases<br />

announced by J.P. Morgan Chase,<br />

Wells Fargo, Citigroup and others<br />

following the Fed’s statement.<br />

Looking out further, many big<br />

institutions might have more flexibility<br />

to lend, a major factor in<br />

promoting the long-term growth of<br />

businesses. At least in theory, the<br />

greater capital that the banks now<br />

hold and less stringent oversight of<br />

the financial sector by Washington<br />

could give the economy a shot in the<br />

arm after years of caution.<br />

“It’s not a sudden thing. It’s<br />

been a long time coming,” said Guy<br />

Moszkowski, managing partner at<br />

Autonomous Research U.S., an independent<br />

firm in New York. “But<br />

American banks are more soundly<br />

capitalized today than at any time<br />

in my career, which started in 1979.”<br />

On the other hand, critics fear<br />

that the easing of regulatory pressure<br />

and a more laissez-faire-oriented<br />

White House could set the stage<br />

for a return to the bad old days of<br />

enormous leverage and freewheeling<br />

deals until the music inevitably<br />

stops.<br />

“This isn’t the time to put the<br />

brakes on regulation,” said Mark T.<br />

Williams, a banking expert at Boston<br />

University and a former bank<br />

examiner for the Federal Reserve.<br />

He noted that, with the 10 largest<br />

American banks holding 80% of all<br />

banking assets, “this concentrated<br />

financial power residing at the top<br />

banks should be carefully monitored.”<br />

It was exactly 10 years ago this<br />

<strong>Jul</strong>y, as the housing bubble collapsed,<br />

that the first cracks in the<br />

country’s economic edifice appeared.<br />

Within 18 months Bear<br />

Stearns and Lehman Brothers were<br />

gone, and once-invincible names<br />

such as Citigroup and Bank of<br />

America teetered on the edge, necessitating<br />

a federal bailout.<br />

The economic and psychological<br />

scars of the financial crisis and the<br />

ensuing recession linger, as do the<br />

industry’s public-relations woes.<br />

In terms of financial metrics<br />

such as earnings, dividends for<br />

shareholders and the ability to absorb<br />

potential losses in the event of<br />

a recession, however, the financial<br />

sector clearly has turned a page.<br />

The banks tested by the Fed now<br />

have a $1.25 trillion capital cushion,<br />

compared with less than half that in<br />

<strong>20</strong>09.<br />

In a <strong>Jul</strong>y 5 statement, Michael<br />

Corbat, chief executive of Citigroup,<br />

said, “Today marks a significant<br />

milestone for Citi and our shareholders.”<br />

The Fed’s assessment, he<br />

said, demonstrated that “Citi has<br />

the ability to withstand a severe<br />

economic scenario and remain well<br />

capitalized, while also substantially<br />

increasing our level of capital return.”<br />

Although President Donald<br />

Trump has promised to roll back<br />

many of the rules imposed after<br />

the financial crisis while appointing<br />

regulators with a much lighter<br />

touch, many bank analysts say that<br />

memories of <strong>20</strong>08 and the penalties<br />

that followed nonetheless will inhibit<br />

risk-taking in the future.<br />

“Parts of the industry had a<br />

near-death experience, while some<br />

financial institutions actually had<br />

a death experience,” Moszkowski<br />

noted, adding that, as was the case<br />

following the crash of 1929, “the legislative<br />

and regulatory response was<br />

quite harsh.”<br />

“(The <strong>20</strong>08 crisis) forced the U.S.<br />

banking system to recognize its<br />

losses and recapitalize itself quickly,”<br />

Moszkowski said. “The lack of<br />

that type of pressure in Europe has<br />

contributed to what has been a longer<br />

period of weakness and recovery<br />

there.”<br />

With European banks still hobbled,<br />

American banks have benefited<br />

in recent years, boosting their<br />

share of global revenues from underwriting<br />

and advice on mergers<br />

and acquisitions.<br />

Nearly a decade of historically<br />

low interest rates, engineered by the<br />

Fed, also has helped banks rebuild<br />

their financial fortunes, even as savers<br />

and investors watched the yields<br />

on their money-market accounts<br />

and certificates of deposit shrink.<br />

“The banking industry has pretty<br />

radically de-risked its balance<br />

sheet,” said Chris Kotowski, a senior<br />

research analyst at Oppenheimer.<br />

For example, he said, in <strong>20</strong>07<br />

banks held more than $250 billion<br />

dollars’ worth of corporate bonds<br />

on their trading desks and other<br />

accounts. By April <strong>20</strong>17 that figure<br />

stood at only a little more than $54<br />

billion.<br />

The current rate of delinquencies<br />

on products such as credit cards and<br />

commercial-real-estate loans is half<br />

what it was during previous periods<br />

of healthy economic growth,<br />

Kotowski added.<br />

At the same time, while banks<br />

may have the ability to lend more<br />

freely, anemic demand for credit<br />

and slow economic growth are likely<br />

to restrain new loan growth. The Fed<br />

is only now in the process of slowly<br />

raising interest rates in the face of<br />

what policy-makers see as stronger<br />

economic growth. If rates keep<br />

moving up, higher borrowing costs<br />

for businesses and consumers most<br />

likely would offset whatever benefit<br />

slightly easier credit from a healthier<br />

banking system provides.<br />

There are other shifts by big<br />

banks, wrought by the financial crisis<br />

and the long economic recovery<br />

since then, that won’t be reversed.<br />

After shedding tens of thousands<br />

of workers and shuttering hundreds<br />

of branches, the banking industry<br />

isn’t about to go on a hiring or building<br />

spree.<br />

“Necessity is the mother of invention,<br />

and banks have been<br />

forced to operate more cheaply,”<br />

Moszkowski said. “Changing customer<br />

behavior, like use of mobile<br />

banking, has also enabled them to<br />

cut back on branches and staff.”<br />

While bankers themselves might<br />

be more cautious about lending or<br />

about blurring the distinction between<br />

traditional banking and Wall<br />

Street-style trading, one element of<br />

the go-go years has made a comeback<br />

recently: big pay packages for<br />

top executives. With the big rally in<br />

bank stocks since the election in November,<br />

the options packages and<br />

other stock-based incentives that<br />

bank executives received in recent<br />

years have swollen in value.<br />

“Executive compensation hasn’t<br />

declined since the financial crisis,”<br />

Williams said. “It’s gone up.”<br />

In <strong>20</strong>16 J.P. Morgan Chase chief<br />

executive Jamie Dimon received<br />

a total pay package of $28 million.<br />

In <strong>20</strong>06 his overall compensation<br />

equaled $27 million.<br />

For his part, Kotowski believes<br />

that memories of Lehman, plus the<br />

enormous fines paid to regulators,<br />

will serve as a check on appetite for<br />

risk for years to come.<br />

“Even if bankers all started behaving<br />

like drunken sailors tomorrow,”<br />

Kotowski said, “it would take<br />

years before problems arose.”<br />

(Nelson D. Schwartz is an economics<br />

writer for The New York<br />

Times.)<br />

<strong>20</strong>17 Harvard Business School Publishing Corp. Distributed by The New York Times Syndicate

Thursday <strong>20</strong> <strong>Jul</strong>y <strong>20</strong>17<br />

10 BUSINESS DAY<br />

C002D5556<br />

COMMENT<br />

CHRISTOPHER AKOR<br />

Chris Akor, a First Class<br />

graduate of Political Science,<br />

holds an MSc in African Studies<br />

from the University of Oxford and<br />

is <strong>BusinessDay</strong>’s Op-Ed Editor<br />

christopher.akor@businessdayonline.com<br />

With the recent dismissal<br />

of the asset<br />

declaration case<br />

against the Senate<br />

President, Bukola<br />

Saraki, not many people are still<br />

optimistic that the anti-corruption<br />

fight of this administration will still<br />

bear much fruit. The two-man panel<br />

of the Code of Conduct Tribunal did<br />

not even deem it necessary to call<br />

the Senate President to enter his<br />

defence as it unanimously upheld<br />

the no-case submission filed by the<br />

Saraki. According to the Chairman<br />

of the CCT, the evidence adduced by<br />

the prosecution was “so unreliable<br />

that no reasonable tribunal could<br />

convict” anyone based on it.<br />

Saraki’s acquittal is the latest in a<br />

series of high profile corruption cases<br />

the government has lost or bungled<br />

in the last two years. The most painful<br />

part is not even that the cases are<br />

lost but the way the judges dismiss<br />

the cases. Just like in Saraki’s case,<br />

most of the judges do not even bother<br />

to call on the accused to enter their<br />

defence. They just simply uphold<br />

the “no case” submissions of the<br />

accused after the prosecution had<br />

laboured in vain, over many months<br />

or years, trying to prove their cases.<br />

Justice Jude Okeke, in dismissing<br />

the case against Justice Ademola, his<br />

comment is free<br />

Send 800word comments to comment@businessdayonline.<br />

What is needed to salvage Nigeria’s<br />

shambolic anti-corruption fight?<br />

wife and Joe Agi, spoke the minds<br />

of many judges who handle cases<br />

of corruption in Nigeria when he<br />

advised prosecution agencies to<br />

“ensure proper investigation of matters<br />

before proceeding to court” and<br />

that “the court of law cannot rely on<br />

mere speculations to condemn any<br />

defendant”.<br />

True, our anti-corruption agencies<br />

are so weak and lack the capacity<br />

to successfully prosecute<br />

corruption cases. Shoddy and lazy<br />

investigation and incompetent<br />

prosecution often combine to scuttle<br />

many of such cases. Besides, the<br />

corrupt often fight back, according<br />

to acting president Osinbajo, with<br />

tremendous resources by spending<br />

lavishly on “Ogbologbo lawyers” to<br />

outwit clueless prosecutors.<br />

But the weakness and incapacity<br />

of our anticorruption agencies alone<br />

do not explain the failure to successfully<br />

prosecute corruption cases. As<br />

Olu Fasan, one <strong>BusinessDay</strong>’s most<br />

incisive columnist argued, “...all over<br />

the world, corruption is notoriously<br />

difficult to detect and successfully<br />

prosecute.” The main reason being<br />

that “the legal principle ‘He who asserts<br />

must prove, not he who denies’<br />

puts excessive legal and evidential<br />

burden on the prosecution and allows<br />

the accused, who usually have<br />

unlimited resources, often stolen<br />

money, to frustrate the prosecution.<br />

And, of course, the court is limited to<br />

the evidence adduced by the parties,<br />

and can’t inform itself by adducing<br />

its own evidence. It must come to<br />

a decision, even if the evidence is<br />

inadequate or inconclusive. In these<br />

circumstances, the prosecution that<br />

can’t adduce probative evidence to<br />

prove to its case will lose out.”<br />

We know from history that the<br />

real cause of corruption is the<br />

absence of a real and capable<br />

state. However, in the fight<br />

against corruption in Nigeria,<br />

the emphasis is not on the creation<br />

or building of a capable<br />

state (strong institutions as well<br />

as institutions of restraints)<br />

but on the enactment of laws<br />

and creation of agencies that<br />

are still subject to the whims<br />

and caprices or in the Nigerian<br />

parlance “the body language”<br />

of the ‘big man’<br />

But we cannot just shrug our hands<br />

and lament. Corruption is one of the<br />

greatest impediments to development<br />

and until it is successfully stopped or<br />

curtailed, we cannot successfully fight<br />

poverty, diseases and other by-product<br />

of underdevelopment. The respected<br />

columnist, lawyer and political economist<br />

therefore proposes a reversal of<br />

the burden of proof in corruption cases<br />

“so that where someone is accused,<br />

say, of receiving a bribe or of being in<br />

possession of unexplained wealth, the<br />

onus is on the accused to prove that<br />

he or she is not guilty of the offence.”<br />

Of course, that proposal isn’t entirely<br />

new. As he pointed out himself,<br />

quite a number of countries – both<br />

developed and developing – have successfully<br />

reversed the burden of proof<br />

with positive results. The overriding<br />

consideration is the “prevalence of corruption<br />

worldwide and the difficulty<br />

of proving intention, even where the<br />

circumstances are strongly suggestive<br />

of criminality.”<br />

I am neither a lawyer nor a legal<br />

expert and do not readily comment<br />

on matters I’m not very conversant<br />

with. But if I must air my views, I think<br />

this proposal, while persuasive and<br />

logical, will be very problematic in Nigeria<br />

and will create more problems<br />

than it is meant to solve. While the<br />

weakness and incapacity of prosecutorial<br />

authorities is often cited for the<br />

loss of most of these cases, a nuanced<br />

reading of events will reveal a different<br />

story – the lack of political will to<br />

ruthlessly and dispassionately fight<br />

corruption in Nigeria. This, for me,<br />

accounts for the failure of our various<br />

anti-corruption wars since 1999<br />

and not the weakness or incapacity<br />

of prosecutorial agencies.<br />

For instance, it was clear from the<br />

outset that the arraignment of Saraki<br />

at the CCT was for purely political<br />

reasons. While being arraigned at the<br />

CCT, the Senate president was subjected<br />

to a harsh and rigorous media<br />

trial as well as adverse public opinion<br />

to force his resignation or impeachment.<br />

To further drive the pressure,<br />

both the Senate President and his<br />

deputy were arraigned in court for<br />

forging the order rule book of the<br />

Senate. But once the goal of removing<br />

him from office wasn’t achieved,<br />

the government virtually abandoned<br />

the cases. While it discontinued the<br />

case on forgery of Senate rule book,<br />

the one at the CCT was allowed to<br />

continue but prosecuted shoddily.<br />

Certainly, only one outcome was<br />

possible.<br />

Perhaps, the most perplexing of<br />

the cases was the one against the former<br />

minister of Niger Delta, Godsday<br />

Orubebe, who was accused of diverting<br />

N2 billion. It was an embarrassed<br />

Attorney General that confirmed<br />

that the N1,965,576,153.46, which<br />

Orubebe allegedly diverted, “has<br />

not been expended, but is awaiting<br />

further contract decisions and directives<br />

from the ministry of Niger-Delta<br />

Affairs”. It was obvious that the trial<br />

was a phantom one.<br />

We know from history that the real<br />

cause of corruption is the absence<br />

of a real and capable state. However,<br />

in the fight against corruption in<br />

Nigeria, the emphasis is not on the<br />

creation or building of a capable state<br />

(strong institutions as well as institutions<br />

of restraints) but on the enactment<br />

of laws and creation of agencies<br />

that are still subject to the whims and<br />

caprices or in the Nigerian parlance<br />

“the body language” of the ‘big man’,<br />

who use the agencies to prosecute his<br />

political battles. Obasanjo was most<br />

famous for this.<br />

Nigeria, just like Uganda and<br />

many other African countries claiming<br />

to fight corruption, may just be<br />

engaged in what Harvard’s Ricardo<br />

Hausmann terms ‘isomorphic mimicry’<br />

– the creation of institutions<br />

that act in ways to make themselves<br />

“look like institutions in other places<br />

that are perceived as legitimate,” but<br />

which in reality are not. Nigeria’s<br />

anti-corruption war thus far involves<br />

the use the media to demonise, to<br />

persecute, and to destroy people’s<br />

personal and political capital and<br />

has nothing to do with rooting out<br />

corruption in the country. Surely,<br />

no one will suggest that the burden<br />

of proof be reversed in such a polity!<br />

Send reactions to:<br />

comment@businessdayonline.com<br />

EJIKE NWOLISA<br />

Nwolisa is an economist based in<br />

Lagos<br />

The economics of madness<br />

Economics is not often associated<br />

with the insane. The discipline<br />

is anchored on human rationality.<br />

However, economics<br />

cannot be completely separated from<br />

“societal madness”. For instance, mental<br />

ill-health and poverty has a cyclical<br />

relationship; poverty increases the risk<br />

of mental disorder and having a mental<br />

disorder increases the likelihood<br />

of descending into poverty. Research<br />

has consistently shown that economic<br />

crises negatively affect the population’s<br />

mental health. A holistic look at the<br />

lives of ordinary people whose mental<br />

state have been turned upside down by<br />

economic policies buttresses this fact.<br />

According to Michael Foucault, the<br />

author of Madness and Civilization,<br />

madness is not a natural unchanging<br />

thing but rather depends on the society<br />

in which it exists. How a society treats<br />

their mad people is a reflection of their<br />

humanity and advancement. In USA,<br />

the state of Indiana once legalized the<br />

sterilization of lunatics, idiots, criminals<br />

and imbeciles to prevent their<br />

procreation. England enacted Lunacy<br />

Act to confine lunatics, the ancient Romans<br />

created fools courts for amusement<br />

and Australia once regarded<br />

madmen as special beings endowed<br />

with supernatural powers. All these<br />

ill treatments of mad people changed<br />

over time as mankind realized that no<br />

one is completely immune to insanity.<br />

Madness is everywhere and can<br />

commence at any time. An unexpected<br />

event can abruptly change the<br />

most reasonable and intelligent man<br />

into a roving idiot. Economic hardship<br />

for example can severely damage our<br />

human sensibilities. This is a painful<br />

reminder of how close man is to the<br />

edge of reason.<br />

It is possible to harness the positives<br />

of the mentally challenged for the<br />

good of the society. Some researchers<br />

even claim that creativity can be linked<br />

to a certain degree of madness. In our<br />

own society, despite their challenges,<br />

the mentally challenged have continued<br />

to contribute to our national GDP<br />

in their own unique ways over the<br />

years, though unreported. This might<br />

sound bizarre, illogical, inhuman or<br />

unethical but it is certainly factual.<br />

Before you think that the author is<br />

insane, pause a little and ponder over<br />

the following everyday scenes in our<br />

cities and villages.<br />

Scenario one: During work rush<br />

hours, do we not see drug addicts/<br />

street urchins and quasi mad men<br />

controlling traffic? If we do, it is unfair<br />

not to acknowledge their contribution to<br />

economic growth. If time is money then,<br />

anything that helps to reduce travel time<br />

surely contributes to national economic<br />

growth.<br />

Scenario two: In our market places,<br />

we have mad men music orchestra that<br />

produce sweet melodies that are appreciated<br />

well enough for passers-by to part<br />

with their hard earned money in recognition<br />

of their special talents. Music is about<br />

organizing chaos when so many people<br />

with so many instruments come together<br />

to create something harmonious. The<br />

synchronization of these mad men’s<br />

make shift musical instruments confirms<br />

that indeed order can come out of<br />

chaos. The elite can pay thousands to be<br />

entertained but mad men are providing<br />

entertainment services free of charge to<br />

the common men who cannot afford the<br />

fees charged by professional entertainers.<br />

If happy people make a prosperous nation<br />

then these special people contribute<br />

to national prosperity.<br />

Scenario three: In our villages, the<br />

quasi mad people (drunkards and<br />

charlatans) hiding under the cover of<br />

the spirit of irresponsibility often reveal<br />

dreaded truths that sane men could not<br />

dare to make public. Thus, the speech of<br />

a ‘mad man’ which ought to be worthless<br />

could indeed be of immense economic<br />

benefits since in all human interactions<br />

(economic transactions inclusive) availability<br />

of authentic information can be<br />

the key determinant to success.<br />

Scenario four: if there is no madness<br />

to mimic, the comedians who now make<br />

good money mimicking drunkards and<br />

their likes will not be in existence today.<br />

Jesters as professionals have withstood<br />

civilization over the ages. Till today,<br />

the speech of a madman is money and<br />

playing the fool is now a multi-billion<br />

naira profession.<br />

It might interest the policy makers to<br />

know that psychiatric service is one of<br />

the few professions that defy economic<br />

cycles. As economic woes worsen, drift<br />

to madness increases. In the same token,<br />

as economic prosperity advances,<br />

drift to binge drinking and other wild<br />

lifestyles of drugs and ecstasy which<br />

ultimately leads to addictions become<br />

the order of the day. In both cases, the<br />

psychiatric profession experiences a<br />

boom.<br />

While this set of really mad people<br />

highlighted above truly deserves our<br />

help, there is another set of mad people<br />

who genuinely deserve our condemnation.<br />

Tragically, this special set of people<br />

will never believe that they are indeed<br />

mentally degraded but their actions<br />

and inactions manifest madness of a<br />

higher order.<br />

Consider the following set of “mad<br />

men” - pastors who humiliate, molest<br />

and dupe their congregations;<br />

politicians who brazenly steal from the<br />

national treasury(some hide money in<br />

cemeteries and sewages, others burn<br />

stolen money in cemeteries for spiritual<br />

protection); our men in uniform<br />

who bully and sometimes kill without<br />

provocation innocent citizens they are<br />

supposed to protect; our lecturers who<br />

trade marks for sex and money thereby<br />

flooding the labour market with unemployable<br />

graduates; drivers who<br />

drive against the traffic, who endanger<br />

their lives and lives of others for no just<br />

reason; unclad ladies who walk about<br />

half naked distracting the few productive<br />

people.The madness of greed in<br />

our society today is one of our greatest<br />

banes as a nation. The list is endless.<br />

Unfortunately, this group of “special<br />

people” constitute security risk to<br />

our national economic development.<br />

They inflict their greatest damage on<br />

the psyche and values of the populous.<br />

With their actions and apparent<br />

success they foster on the nation the<br />

notion that “hard work does not pay”.<br />

Consequently, the citizens and other<br />

economic agents often make choices<br />

that are not in the overall interest of the<br />

economy, after all “if you can beat them,<br />

you join them”.<br />

The prevalence of corrupt leaders<br />

(a special set of mad men stealing what<br />

they don’t need) in our society has ensured<br />

that even the good ones with the<br />

very best of intentions will be treated<br />

with skepticism. The resultant impact<br />

is that the positives of expectation effect<br />

are lost. It is therefore more difficult for<br />

policies and programmes that worked<br />

well in other climes to function effectively<br />

in our own environment.<br />

Note: the rest of this article continues<br />

in the online edition of<br />

Business Day @https://businessdayonline.com/

Thursday <strong>20</strong> <strong>Jul</strong>y <strong>20</strong>17<br />

COMMENT<br />

BONGONOMICS<br />

BONGO ADI<br />

Bongo Adi, PhD is a faculty member<br />

of Lagos Business School<br />

There are undoubtedly,<br />

more schools today -<br />

primary, secondary<br />

and tertiary - than there<br />

has ever been in Nigeria’s<br />

history. This has translated<br />

to an ever increasing higher level<br />

of schooling for an individual Nigerian,<br />

measured by number of<br />

years spent in formal education.<br />

From a low of less than two years<br />

in 1950, the level of schooling for<br />

any random person in Nigeria has<br />

tripled to more than 6 years today.<br />

This increasing trend has marched<br />

on with a simultaneous explosion<br />

in the number of schools and<br />

colleges.<br />

But this triple increase in the<br />

average number of years spent<br />

in school and the explosion in<br />

number of schools seem to have<br />

largely proceeded to the detriment<br />

of quality and relevance. While<br />

schools and schooling have expanded,<br />

quality, competence and<br />

relevance have progressively deteriorated,<br />

even becoming abysmal.<br />

The situation has become so bad<br />

to the order that a typical university<br />

graduate today has educational<br />

competence that sometimes rivals<br />

that of a 4th grader in 1976. The<br />

Economist in January argued that<br />

just 1 in 4 of secondary school<br />

students in countries such as Nigeria<br />

could reach the basic level of<br />

attainment in standardized international<br />

tests.<br />

Deteriorating quality is unfor-<br />

comment is free<br />

Send 800word comments to comment@businessdayonline.<br />

Our education - The ticking time bomb<br />

tunately, not the only problem<br />

our education faces. As bad as it<br />

is, our schools are grossly insufficient<br />

to meet the demands of the<br />

teeming population that is 65%<br />

young people. So, even the bad<br />

school is not enough to go round.<br />

Although schools seem to have<br />

mushroomed out of every nook<br />

and cranny of this country, yet<br />

there seems to be a huge shortfall<br />

in availability and the gap between<br />

supply and demand looms large.<br />

It is on record that 2 out of every<br />

5 Nigerian children aged 6 - 11<br />

are out of school. According to<br />

a <strong>20</strong>16 UNESCO report, Nigeria’s<br />

out of school children totals more<br />

than 10.5 million which accounts<br />

for 47% of total out of school children<br />

in the world - the largest in<br />

the world. To the North of the<br />

country, the dismal statistics is 2<br />

out of every 3 infants out of school.<br />

Alongside these trends is the<br />

increasing loss of confidence in<br />

public schools which has fueled<br />

the explosion of private schools<br />

across the three levels of education<br />

in the country since 1983. Between<br />

<strong>20</strong>06 and <strong>20</strong>16, enrollment<br />

into private secondary schools in<br />

Nigeria grew from 11% to almost<br />

42%, a three-fold increase over a<br />

decade. The public secondary<br />

schools that produced the bulk<br />

of Nigeria’s current class of leaders<br />

have all but become an effigy<br />

of what they used to be. Their<br />

dismal state is evidently manifest<br />

in the Cowbell Mathematics<br />

competition which has been won<br />

by a disproportionate number of<br />

private secondary schools over the<br />

past 19 years of the competition.<br />

Proceeding to the tertiary level,<br />

the University of Ibadan, ranked<br />

801st in <strong>20</strong>16 by Times Higher<br />

Education is the only Nigeria university<br />

appearing in the top 1000<br />

universities in the world. Our<br />

universities have progressively<br />

become a mere totem and a rite of<br />

Without sound<br />

educational system,<br />

all the talks about<br />

competitiveness,<br />

innovation,<br />

knowledge-based<br />

economy, productivity,<br />

economic<br />

diversification remain<br />

mere political rhetoric<br />

passage for young people. Trapped<br />

in antiquated teaching technologies<br />

and less than medieval conditions,<br />

they have become increasingly<br />

incapable of producing functional<br />

education. Science, Technology,<br />

Engineering and Mathematics<br />

(STEM) education lag behind other<br />

countries in Africa. The recent<br />

World Economic Forum’s Human<br />

Capital Optimization Index shows<br />

that on a scale of 1 (worst) to 7 (best)<br />

Nigeria scores 2.6, below the global<br />

average of 3.8. Kenya, Rwanda,<br />

Mauritius, Cote d’Ivoire, Zambia<br />

and Ghana all score above 4. The<br />

conclusion to this is that Nigeria’s<br />

educational system is not able to<br />

compete in the new global system.<br />

To underscore the link between<br />

university education and economic<br />

development, the Nobel Prize in<br />

Economics have been awarded 3<br />

times to economists whose major<br />

contribution has been on the link<br />

between education or human capital<br />

and economic growth. Theodore<br />

W. Shultz (1979), Gary Becker (1992)<br />

and James Heckman (<strong>20</strong>00) made<br />

significant contributions to understanding<br />

the link between education<br />

and economic growth. Education<br />

C002D5556<br />

can increase the human capital<br />

inherent in the labour force, which<br />

increases labour productivity and<br />

thus transitional growth toward<br />

a higher equilibrium level of output.<br />

Education can also increase<br />

the innovative capacity of the<br />

economy, and the new knowledge<br />

on new technologies, products,<br />

and processes promotes growth.<br />

Finally, education can facilitate<br />

the diffusion and transmission of<br />

knowledge needed to understand<br />

and process new information and<br />

to successfully implement new<br />

technologies devised by others,<br />

which again promotes growth.<br />

It is therefore disturbing when<br />

the government continually decrease<br />

allocation to education and<br />

still make policy statements in the<br />

manner of boosting competitiveness,<br />

innovation, productivity etc.,<br />

as if these can be conjured up out<br />

of outer space.<br />

California as a state in the United<br />

States of America houses almost<br />

all the most valuable companies<br />

in the world today. Alphabet, Microsoft,<br />

Facebook, Apple, Amazon,<br />

Dell etc. are all based in Silicon Valley,<br />

California. It has been shown<br />

that the Silicon Valley technology<br />

cluster was attracted by California<br />

Institute of Technology and Stanford<br />

University - two academic<br />

institutions at the forefront of most<br />

advanced research and development<br />

in information and communications<br />

technology. These<br />

companies feed off the knowledge<br />

developed in these educational<br />

institutions in a mutually synergistic<br />

way.<br />

Without sound educational<br />

system, all the talks about competitiveness,<br />

innovation, knowledgebased<br />

economy, productivity,<br />

economic diversification remain<br />

mere political rhetoric. There is<br />

a very strong positive correlation<br />

between country’s investment in<br />

education and its growth. Coun-<br />

BUSINESS DAY<br />

11<br />

tries that have developed have rode<br />

on the back of the academic-industrial<br />

complex, whereby Research<br />

and Development is co-produced<br />

between the academia and the<br />

industry.<br />

Our education will continue to<br />

lack relevance unless there is a connection<br />

between what happens in<br />

industries and what lecturers and<br />

their students do in the classroom<br />

and laboratories. Unfortunately,<br />

this linkage is completely nonexistent<br />

in Nigeria today and there<br />

is no clear policy towards addressing<br />

this disconnect.<br />

At the same time, the world<br />

of work is rapidly changing as<br />

new technologies and processes<br />

disrupt established ways of doing<br />

things. This calls for new skillsset<br />

to cope with rapidly changing<br />

workplaces. But before this can be<br />

achieved, there is the other necessity<br />

of building the infrastructure<br />

that would enable an adaptive<br />

system to ensure that trends are<br />

timely identified and requisite<br />

interventions made. It is said that<br />

today’s students need “twenty-firstcentury<br />

skills,” like critical thinking,<br />

problem solving, creativity, and<br />

digital literacy. The ILO posits that<br />

an additional 280 million jobs will<br />

be required come <strong>20</strong>19. Therefore,<br />

in order not to be left far behind,<br />

policies must be enacted to ensure<br />

that frameworks and incentives are<br />

installed so that those jobs can be<br />

created and filled. Robust education<br />

systems – underpinned by<br />

qualified, professionally trained,<br />

motivated, and well-supported<br />

teachers – will be the cornerstone<br />

of this effort. As new development<br />

unravel our oil economy and<br />

unveils a post-oil future, it will be<br />

tragic if we fail to anticipate these<br />

transitions whose necessity can no<br />

longer be denied.<br />

Send reactions to:<br />

comment@businessdayonline.com<br />

RALPH AKPAN<br />

Ralph Akpan is an energy consultant<br />

with experience spanning over two<br />

decades with proven track records<br />

Despite the difficult operating<br />

conditions in<br />

Nigeria’s upstream oil<br />

and gas sector over the<br />

last few years, Nigerian companies<br />

are beginning to demonstrate the<br />

technical achievements that can<br />

be delivered if indigenous engineers<br />

are given the opportunity<br />

to innovate.<br />

As recently as 6 years ago, while<br />

30% of Nigerian upstream assets<br />

were in the hands of Nigerian oil<br />

and gas companies, only 5% of<br />

Nigerian production could be attributed<br />

to local ownership.<br />

Today, not only has that ratio<br />

improved dramatically following<br />

acquisitions of IOC assets by<br />

indigenous companies, and the<br />

steady growth of production from<br />

indigenous owned assets, but<br />

Nigerian engineers are starting to<br />

come into their own.<br />

In-country technological development<br />

requires the commitment<br />

and active participation<br />

of all stakeholders –from the<br />

development of enabling policies<br />

by the government, to private<br />

Investment in indigenous technology solutions improving<br />

efficiency in the Nigerian oil and gas sector<br />

sector players’ commitment to<br />

indigenous talent development<br />

and the provision of the financial<br />

resources to grow local capacity in<br />

a sustainable way.<br />

While many of our engineers<br />

were developed and trained by the<br />

IOC’s and can claim to be globally<br />

relevant, it has taken longer for a<br />

Nigerian company to own not just<br />

the financial benefits of an oil and<br />

gas asset, but to be at the cutting<br />

edge of technological development<br />

as well.<br />

Take the Ebok field offshore<br />

Akwa Ibom as an example. Already<br />

delivering 70% of Nigeria’s<br />

marginal field production with<br />

over 25,000 bpd, the technical<br />

team behind Ebok’s success are<br />

not willing to be complacent,<br />

especially in an environment<br />

of relatively low and potentially<br />

volatile oil prices. The need for<br />

production optimization and<br />

maximum reliability in a maturing<br />

field has never been greater.<br />

That is why the team at Oriental<br />

Energy Resources have been fo-<br />

cused on improving the company’s<br />

ability to detect faults in critical<br />

field infrastructure, before they<br />

can cause significant damage and<br />

downtime.<br />

The technology systems used<br />

in oil production are extremely<br />

complex and dynamic, and faults<br />

can appear at multiple points. Gas<br />

locking, changes in fluid characteristics,<br />

plugged pumps, and stuck<br />

valves are just some of the things<br />

that can degrade the performance<br />

of vital systems.<br />

Take the Electrical Submersible<br />

Pump (ESP). Regarded as one of<br />

the most critical components for<br />

oil production, it can be susceptible<br />

to this sort of degradation, with<br />

significant consequences on uptime,<br />

production targets, company<br />

revenue and government royalties.<br />

Understanding where faults can occur<br />

and actively ensuring that they<br />

don’t can be the difference between<br />

thousands of barrels of oil production<br />

every day, enabling the asset<br />

owner to maximize production and<br />

minimize costs.<br />

To effectively detect faults and<br />

better manage operations of the<br />

ESP technology, Oriental Energy<br />

Resources’ technical team have<br />

developed a data analytics system.<br />

The system conducts knowledge<br />

discovery and prescriptive analyses<br />

through multi-dimensional<br />

data flows, in order to detect<br />

events and subsequently, provide<br />

management recommendations to<br />

address and solve potential problems<br />

before they arise. The system<br />

is made up of an input devices<br />

layer, which retrieves information<br />

from multiple sources, and manages<br />

and stores production data<br />

for wells in multiple geographical<br />

locations across the world; subsequent<br />

layers – data collection and<br />

aggregation, cleaning and preprocessing,<br />

processing and event<br />

detection, intelligent control and<br />

real-time information publishing<br />

– then take the data collected and<br />

proffer recommendation-based<br />

production optimization methods<br />

for the ESP system.<br />

Test results demonstrate that<br />

the proposed methodology can<br />

be efficiently used in a wide range<br />

of ESP systems for performance<br />

management and surveillance, and<br />