2008 M1 Individual Income Tax Instructions - Minnesota Department ...

2008 M1 Individual Income Tax Instructions - Minnesota Department ...

2008 M1 Individual Income Tax Instructions - Minnesota Department ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2008</strong> <strong>Minnesota</strong><strong>Individual</strong><strong>Income</strong> <strong>Tax</strong>Forms and <strong>Instructions</strong>Inside this bookletForm <strong>M1</strong><strong>Minnesota</strong> income tax returnSchedule <strong>M1</strong>W<strong>Minnesota</strong> withholdingSchedule <strong>M1</strong>ED<strong>Minnesota</strong> K–12 Education CreditSchedule <strong>M1</strong>WFC<strong>Minnesota</strong> Working Family CreditForm M60Payment voucherDo you qualify for aProperty <strong>Tax</strong> Refund?see the back coverStart here:www.taxes.state.mn.us

General informationYou must file a <strong>Minnesota</strong> Form<strong>M1</strong>, <strong>Individual</strong> <strong>Income</strong> <strong>Tax</strong> Return,if you are a:• <strong>Minnesota</strong> resident required to filea federal income tax return, or• part-year resident or nonresidentof <strong>Minnesota</strong> and you have <strong>Minnesota</strong>gross income of $8,950 ormore.Filing requirementsand residency<strong>Minnesota</strong> residentsIf you were a resident of <strong>Minnesota</strong> for theentire year and are required to file a <strong>2008</strong>federal income tax return, you must also filea <strong>2008</strong> <strong>Minnesota</strong> Form <strong>M1</strong>.If you are not required to file a federalreturn, you are not required to file a <strong>Minnesota</strong>return. However, you must file a<strong>Minnesota</strong> return in order to:• claim refundable credits for which youmay qualify (the K–12 education, workingfamily or child care credits, etc.), or4• receive a refund if your employer withheld<strong>Minnesota</strong> income tax from yourwages in <strong>2008</strong>.Members of the Armed ForcesIf you consider <strong>Minnesota</strong> to be your home,you must file a <strong>Minnesota</strong> return as a resident,regardless of where you were stationedduring the year. However, if your grossincome included on your federal return,minus any compensation received for activeduty performed outside <strong>Minnesota</strong>, is lessthan $8,950, you are not required to file a<strong>Minnesota</strong> return.For more information, see <strong>Income</strong> <strong>Tax</strong> FactSheet #5, Military Personnel.Did you move into or out of<strong>Minnesota</strong> during the year?If you moved into or out of <strong>Minnesota</strong> in<strong>2008</strong>, you must file Form <strong>M1</strong> if you meet thefiling requirements for part-year residents.(See Filing requirements on page 5.)When you file, also complete Schedule<strong>M1</strong>NR, Nonresidents/Part-Year Residents,to determine your income received whilea <strong>Minnesota</strong> resident and income receivedfrom sources in <strong>Minnesota</strong> while a nonresident.You will pay <strong>Minnesota</strong> tax based onlyon that income.Did you purchase items over the Internet or throughmail order?<strong>Minnesota</strong> use taxIf you purchased taxable items for your ownuse without paying sales tax, you probablyowe use tax. Here are some cases when usetax is due:• You buy taxable items over the Internet,by mail order, from a shopping channel,etc., and the seller doesn’t collect <strong>Minnesota</strong>sales tax from you.• A seller in another state or country doesnot collect any sales tax from you on asale of an item that is taxed by <strong>Minnesota</strong>.• An out-of-state seller properly collectsanother state’s sales tax at a rate lowerthan <strong>Minnesota</strong>’s. In this case, you owethe difference between the two rates.The use tax is the same rate as the state salestax, 6.5 percent.If your total purchases subject to use tax areless than $770 in a calendar year, you arenot required to file a use tax return. This exemptionapplies only to items for personaluse, not to items for business use.If you buy $770 or more, you owe use taxon all taxable items purchased during theyear. File online at www.taxes.state.mn.us.Click on “Login to e-File <strong>Minnesota</strong>” on theright side of the screen. Enter your SocialSecurity number and click on individual usetax. You may also file a paper Form UT1,<strong>Individual</strong> Use <strong>Tax</strong> Return. Form UT1 andFact Sheet 156, Use <strong>Tax</strong> for <strong>Individual</strong>s, areavailable at www.taxes.state.mn.us, or bycalling 651-296-6181 or 1-800-657-3777.Local use taxesIf you buy taxable items for use in the citiesand counties listed in the box to the right,you must also pay local use taxes at the rateslisted.Did you serve in a combat zone atany time during <strong>2008</strong>?If so, you may be eligible for a credit of$59 for each month or part of a monthyou served in a combat zone and<strong>Minnesota</strong> was your home of record.To claim a credit, complete Form M99,Credit for Military Service in a CombatZone. To download this form, go towww.taxes.state.mn.us.If you considered <strong>Minnesota</strong> your permanenthome in <strong>2008</strong>, or for an indefiniteperiod of time, you were a resident for <strong>2008</strong>.For more information, see <strong>Income</strong> <strong>Tax</strong> FactSheet #1, Residency.Were you a resident of anotherstate and lived in <strong>Minnesota</strong>?If you were a resident of another state, youmay be required to file Form <strong>M1</strong> as a <strong>Minnesota</strong>resident if both of these conditionsapplied to you:1 you were in <strong>Minnesota</strong> for 183 or moredays during the tax year, and2 you or your spouse owned, rented orleased a house, townhouse, condominium,apartment, mobile home or cabin withcooking and bathing facilities in <strong>Minnesota</strong>,and it could be lived in year-round.ContinuedLocal use tax ratesCity/CountyRateAlbert Lea ............... 0.5%Austin ................... 0.5%Baxter .................. 0.5%Bemidji ................. 0.5%Brainerd ................. 0.5%Clearwater ................ 0.5%Cook County ............. 1.0%Duluth .................. 1.0%Hennepin County .......... 0.15%Hermantown ............. 0.5%Mankato ................. 0.5%Minneapolis ............... 0.5%New Ulm ................. 0.5%North Mankato ............. 0.5%Owatonna. ............... 0.5%Proctor ................. 0.5%Rochester ............... 0.5%St. Cloud area (Sartell, SaukRapids, St. Augusta, St. Cloud,St. Joseph and Waite Park) .... 0.5%St. Paul ................. 0.5%Transit Improvement <strong>Tax</strong>(Anoka, Dakota, Hennepin, Ramseyand Washington Counties) ..... 0.25%Two Harbors ............. 0.5%Willmar ................. 0.5%

General information (continued)If both conditions apply, you are considereda <strong>Minnesota</strong> resident for the length of timethe second condition applies. If the secondcondition applied for the entire year, youare considered a full-year <strong>Minnesota</strong> residentfor income tax purposes. If it appliedfor less than the full year, you are considereda part-year resident, and you must file Form<strong>M1</strong> if you meet the filing requirementsexplained in the next section.If you were a resident of another state, butthe conditions did not apply to you in <strong>2008</strong>,you were a nonresident of <strong>Minnesota</strong> forincome tax purposes. However, you mustfile Form <strong>M1</strong> if you meet the filing requirementsin the next section.For further details, see <strong>Income</strong> <strong>Tax</strong> FactSheet #2, Part-Year Residents, and Fact Sheet#3, Nonresidents.Filing requirements for part-yearresidents and nonresidents1 Determine your total income from allsources (including sources not in <strong>Minnesota</strong>)while a <strong>Minnesota</strong> resident.2 Determine the total of the following typesof income you received while a nonresidentof <strong>Minnesota</strong>:• wages, salaries, fees, commissions, tipsor bonuses for work done in <strong>Minnesota</strong>• gross rents and royalties received fromproperty located in <strong>Minnesota</strong>• gains from the sale of land or othertangible property in <strong>Minnesota</strong>• gains from the sale of a partnershipinterest, to the extent the partnershiphad property or sales in <strong>Minnesota</strong>• gain on the sale of goodwill or incomefrom an agreement not to competeconnected with a business operating in<strong>Minnesota</strong>• <strong>Minnesota</strong> gross income from a businessor profession conducted partlyor entirely in <strong>Minnesota</strong>. Gross incomeis income before any deductions orexpenses. This is the amount from line7 of Schedule C (1040), line 1 of ScheduleC-EZ (1040) or line 11 of ScheduleF (1040). Gross income from a partnershipor S corporation is the amount online 17 of Schedule KPI or line 17 ofSchedule KS.• gross winnings from gambling in <strong>Minnesota</strong>.3 Add step 1 and step 2. If the total is$8,950 or more, you must file Form <strong>M1</strong>and Schedule <strong>M1</strong>NR.If the result is less than $8,950 and youhad amounts withheld or you paid estimatedtax, you must file Form <strong>M1</strong> andSchedule <strong>M1</strong>NR to receive a refund.If only one spouse is required to file a <strong>Minnesota</strong>return and you filed a joint federalreturn, you must file a joint Form <strong>M1</strong>. CompleteSchedule <strong>M1</strong>NR and include a copy ofthe schedule when you file your return.Military personnel who are part-year residentsor nonresidents: When determiningif you are required to file a <strong>Minnesota</strong> returnusing the steps above, do not include:• active duty military pay for service outside<strong>Minnesota</strong> in step 1, or• active duty military pay for service in<strong>Minnesota</strong> in step 2.Michigan, North Dakota and Wisconsinresidents<strong>Minnesota</strong> has reciprocity agreements withMichigan, North Dakota and Wisconsin. Ifboth of the following conditions applied toyou in <strong>2008</strong>, you are not subject to <strong>Minnesota</strong>income tax:• you were a full-year resident of Michiganor North Dakota who returned to yourhome state at least once a month or werea full-year Wisconsin resident, and• your only <strong>Minnesota</strong> income was from theperformance of personal services (wages,salaries, tips, commissions, bonuses).For more information, see <strong>Income</strong> <strong>Tax</strong>Fact Sheet #4, Reciprocity.If you are a resident of a reciprocity stateand your only <strong>Minnesota</strong> source incomeis wages covered under reciprocity fromwhich <strong>Minnesota</strong> income tax was withheld,complete Schedule <strong>M1</strong>M to get a refundof the amount withheld. When you file:1. Enter the appropriate amounts from yourfederal return on lines A–D and on line 1of Form <strong>M1</strong>.2. Skip lines 2 through 7 of Form <strong>M1</strong>.3. Enter the amount from line 1 of Form<strong>M1</strong> on line 19 of Schedule <strong>M1</strong>M and online 8 of Form <strong>M1</strong>. Be sure to check thebox on line 19 of Schedule <strong>M1</strong>M to indicatethe state of which you are a resident.4. Complete the rest of Form <strong>M1</strong>.In addition to Schedule <strong>M1</strong>M, you mustalso complete and enclose Schedule <strong>M1</strong>W,<strong>Minnesota</strong> <strong>Income</strong> <strong>Tax</strong> Withheld, FormMWR, Reciprocity Exemption/Affidavit ofResidency, and a copy of your home state taxreturn. Do not complete Schedule <strong>M1</strong>NR.If your wages are covered by reciprocity andyou do not want your employer to withhold<strong>Minnesota</strong> tax in the future, be sure to fileForm MWR each year with your employer.If you are filing a joint return and only onespouse works in <strong>Minnesota</strong> under a reciprocityagreement, you still must includeboth of your names, Social Security numbersand dates of birth on your return.If your gross income assignable to <strong>Minnesota</strong>from sources other than from theperformance of personal services coveredunder reciprocity is $8,950 or more, youare subject to <strong>Minnesota</strong> tax on that income.You must file Form <strong>M1</strong> and Schedule<strong>M1</strong>NR. You are not eligible to take the reciprocitysubtraction on Schedule <strong>M1</strong>M.Due date for filing andpaying is April 15Your <strong>2008</strong> <strong>Minnesota</strong> Form <strong>M1</strong> must bepostmarked by, brought to, or electronicallyfiled with the <strong>Department</strong> of Revenue nolater than April 15, 2009. If you file your taxaccording to a fiscal year, you have until the15th day of the fourth month after the endof your fiscal year to file your return.Your tax payment is due in full by April 15,2009, even if you file your return after thedue date.Paying your tax when filingyour return after April 15If you are unable to complete and file yourreturn by the due date, you may avoidpenalty and interest by paying your tax byApril 15. Estimate your total tax and pay theamount you owe electronically, by check orby credit card.For information on how to pay electronicallyor by credit card, see Payment options on thenext page.If you pay by check, you must send yourtax payment with a completed Form <strong>M1</strong>3,<strong>Income</strong> <strong>Tax</strong> Extension Payment, by April 15.Do not send in an incomplete Form <strong>M1</strong>.To avoid a late filing penalty, you must fileyour return by October 15, 2009.Continued5

General information (continued)Military extensions. Military personnelserving in, or in support of, presidentiallydeclared combat zones are allowed the sameextensions of time to file and pay their stateincome taxes as they are allowed for federaltaxes. When you file Form <strong>M1</strong>, enclose aseparate sheet stating you were serving in acombat zone.Payment optionsPay electronicallyYou can pay your tax electronically—even ifyou file a paper return—using the department’se‐File <strong>Minnesota</strong> system. There is nocharge to you for using this service.To pay electronically:• go to www.taxes.state.mn.us, andclick on “Make a payment” from thee‐Services menu, or• call 1‐800-570-3329 to pay by phone.Follow the prompts for individuals to makea payment.You will be given a confirmation numberand a date stamp when the transaction issuccessfully completed. Save this informationwith your tax records.Pay by credit cardYou may pay the amount you owe throughOfficial Payments Corporation, a nationalcredit card payment service. You will becharged a fee by Official Payments for thisservice.Have your Visa, Master-Card, American Expressor Discover/Novuscredit card ready, andgo to www.officialpayments.com or call1-800-272-9829. When asked for the jurisdictionnumber, enter 3300. (All taxpayerspaying current year <strong>Minnesota</strong> individualincome tax must use this number.)At the end of your call or website visit, youwill be given a confirmation number. Besure to write down and save this confirmationnumber with your records. Your paymentwill be effective on the date you madethe request.Pay by check or money orderComplete the Form M60 payment voucher,which is included in this booklet, and sendit with your check made payable to <strong>Minnesota</strong>Revenue to the address provided onthe voucher.If you are filing a paper Form <strong>M1</strong>, send thevoucher and your check separately fromyour return to ensure that your payment isproperly credited to your account.Penalties and interestLate payment penaltyYour tax is due on the due date of yourreturn—April 15 for most individuals—even if you have an extension to file yourfederal return.If you pay all or part of your tax after thedue date, a penalty of 4 percent will be assessedon the unpaid amount.If you pay your tax 181 days or more afteryou file your return, you will be assessed anadditional 5 percent penalty on the unpaidtax.If you are unable to pay the full amountdue, file your return and pay as much as youcan by the due date to reduce your penalty.You can find additional information onpayment plans at www.taxes.state.mn.us.Late filing penaltyThere is no late filing penalty if your returnis filed within six months of the due date,which is October 15 for most individuals. Ifyour return is not filed within six months, a5 percent late filing penalty will be assessedon the unpaid tax.Penalty for fraudulently claiminga refundIf you file a return that fraudulently claimsa refund, you will be assessed a penalty. Thepenalty is 50 percent of the fraudulentlyclaimed refund.Other civil and criminal penaltiesThere are also penalties for failing to includeall taxable income, for errors due to intentionallydisregarding the income tax laws, orfor filing a frivolous return.Also, there are civil and criminal penaltiesfor knowingly or willfully failing to file a<strong>Minnesota</strong> return, for evading tax and forfiling a false or fraudulent return.InterestInterest will be assessed after April 15, 2009,on any unpaid tax and penalty. The rates aredetermined every year.The interest rate for 2009 is 5 percent.Where to file paper returnsIf you are filing a paper return, mail yourForm <strong>M1</strong>, including all completed <strong>Minnesota</strong>schedules, and your federal form andschedules in the printed envelope includedin this booklet. If you don’t have the printedenvelope, mail your forms to:<strong>Minnesota</strong> <strong>Individual</strong> <strong>Income</strong> <strong>Tax</strong>, Mail Station0010, St. Paul, MN 55145-0010Use enough postageTo avoid having the U.S. Postal Service returnyour income tax forms to you for morepostage, be sure to include enough postageon your envelope. If you enclose more thanthree sheets of paper, you will probablyneed additional postage.Stop writing checksPay electronically!6It’s Secure, Easy, Convenient, Freewww.taxes.state.mn.us

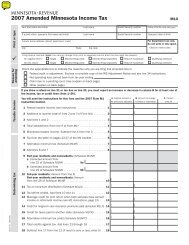

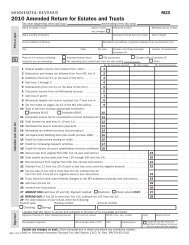

Special situationsEstimated paymentsIf you expect to owe $500 or more,or <strong>Minnesota</strong> tax wasn’t withheldIf your income includes pensions, commissions,dividends or other sources not subjectto withholding, you may be required to pay<strong>Minnesota</strong> estimated income tax payments.You must pay estimated tax if you expectto owe $500 or more in <strong>Minnesota</strong> tax for2009 after you subtract the amounts of any:• <strong>Minnesota</strong> income tax you expect to bewithheld from your income for 2009, and• credits (K–12 education, child and dependentcare, working family, JOBZ jobsand cattle tuberculosis testing credits) youexpect to receive for 2009.See <strong>Individual</strong> Estimated <strong>Tax</strong> Payments <strong>Instructions</strong>on our website for details on howto estimate and pay your tax.To pay electronically:• go to www.taxes.state.mn.us, and click on“Make a payment” from the e-Servicesmenu, or• call 1‐800‐570-3329 to pay by phone.If you want to charge your payment, seePayment options on page 6.If you pay by check, you must send yourpayment with a completed Form <strong>M1</strong>4. Besure to use the personalized <strong>M1</strong>4 vouchersyou may have received from the departmentor those provided by your tax preparer toensure your payments are credited properlyto your account.Reporting federal changesIf the Internal Revenue Service (IRS)changes or audits your federal tax or youamend your federal return and it affectsyour <strong>Minnesota</strong> return, you have 180 daysto amend your <strong>Minnesota</strong> return. File Form<strong>M1</strong>X, Amended <strong>Minnesota</strong> <strong>Income</strong> <strong>Tax</strong> Return,within 180 days after you were notifiedby the IRS or after you filed your federalamended return.If the changes do not affect your <strong>Minnesota</strong>return, you have 180 days to send a letter ofexplanation to the department. Send yourletter and a complete copy of your federalamended return or the correction noticeyou received from the IRS to:<strong>Minnesota</strong> Revenue, Mail Station 7703, St.Paul, MN 55146-7703.If you fail to report the federal changes asrequired, a 10 percent penalty will be assessedon any additional tax.If you need to correct youroriginal <strong>Minnesota</strong> return—you must file an amended return, Form<strong>M1</strong>X, within 3½ years of the due date ofyour original <strong>Minnesota</strong> return. Do not filea corrected Form <strong>M1</strong> for the same year.Filing on behalf of adeceased personIf a person received income in <strong>2008</strong> anddied before filing a return, the spouse orpersonal representative should file Form <strong>M1</strong>for the deceased person. The return mustuse the same filing status that was used tofile the decedent’s federal return.If you are filing Form <strong>M1</strong> for a deceasedperson, enter the decedent’s name and youraddress in the name and address section.Print “DECD” and the date of death afterthe decedent’s last name.For more information, see <strong>Income</strong> <strong>Tax</strong>Fact Sheet #9, Filing on Behalf of a Deceased<strong>Tax</strong>payer.Claiming a refund on behalfof a deceased personIf you are the decedent’s spouse and you areusing the joint filing method, the departmentwill send you the refund.If you are the personal representative, youmust include with the decedent’s returna copy of the court document appointingyou as personal representative. You willreceive the decedent’s refund on behalf ofthe estate.If no personal representative has been appointedfor the decedent and there is noRefund of campaign contributionsYou may be able to claim a refund of contributionsmade to qualified <strong>Minnesota</strong>political parties, candidates for statewideoffices or the <strong>Minnesota</strong> Legislature. Themaximum refund is $50 for single personsand $100 for married couples.Complete Form PCR, Political ContributionRefund Application, and mail it withyour original contribution receipt, Formspouse, you must complete Form M23,Claim for a Refund Due a Deceased <strong>Tax</strong>payer,and include it with the decedent’sForm <strong>M1</strong>.For more information, see <strong>Income</strong> <strong>Tax</strong>Fact Sheet #9, Filing on Behalf of a Deceased<strong>Tax</strong>payer.Power of attorneyThe department is prohibited by law fromdisclosing your private information. If youwant to grant power of attorney to an attorney,accountant, agent, tax return prepareror any other person as an attorney-in-fact,complete Form REV184, Power of Attorney.The person you appoint will be able to performany and all acts you can perform forpurposes of dealing with the department.If you wish, you may limit the authority tospecific powers, such as representing youduring an audit process.If you are divorced,widowed or legallyseparated and still owe ajoint liabilityIf in the past you filed a joint return witha former spouse and you still owe part ofthe joint liability, you may be eligible forthe Separation of Liability Program. Forinformation, contact the <strong>Tax</strong>payer RightsAdvocate at the address below.If you have tax problems— and cannot resolve them through normalchannels, you may contact the <strong>Tax</strong>payerRights Advocate.Write to:<strong>Tax</strong>payer Rights Advocate<strong>Minnesota</strong> RevenueP. O. Box 7335St. Paul, MN 55107-7335EP-3. Canceled checks are not acceptableas receipts.For contributions made in <strong>2008</strong>, you mustfile the <strong>2008</strong> Form PCR by April 15, 2009.For contributions made in 2009, file the2009 Form PCR by April 15, 2010. FormPCR is available on our website atwww.taxes.state.mn.us.7

Completing your returnUse of InformationInformation not requiredAlthough not required on Form <strong>M1</strong>, we askfor:• a code number indicating a political partyfor the State Elections Campaign Fund,• your daytime telephone number in casewe have questions about your return, and• the telephone number of the person youpaid to prepare your return.All other information requiredYou must provide by <strong>Minnesota</strong> law (M.S.289A.08, subd. 11) your Social Securitynumber, date of birth and all other informationin order to properly identify youand to determine your correct tax liability.If you don’t provide it, the department willreturn your form to you. This will delayyour income tax refund or if you owe tax,your payment will not be processed and youmay have to pay a penalty for late payment.If your return is audited and you appeal theaudit decision to the <strong>Minnesota</strong> <strong>Tax</strong> Court,your Social Security number and otherprivate information on your return may becomepublic by being included in the court’sfile. This may also happen if you fail to payyour income tax liability and a tax lien isfiled against you with the county recorder orSecretary of State. Your private informationmay be listed on the lien, which is public.Use of information from yourincome tax returnAll information you enter on your incometax return is private. The department willuse the information to determine your taxliability and may include the information aspart of tax research studies. The informationmay also be used to verify the accuracy of anytax returns you file with the department.Also, according to state law, the departmentmay share and/or match some or all of theinformation, including your Social Securitynumber, with:• the IRS and other state governments fortax administration purposes,• the Social Security Administration forpurposes of administering the <strong>Minnesota</strong>Working Family Credit,• <strong>Minnesota</strong> state or county agencies towhich you owe money,• another person who must list some or allof your income or expenses on his orher <strong>Minnesota</strong> income tax return,8• the <strong>Minnesota</strong> <strong>Department</strong> of HumanServices for purposes of child support collection,verifying income for parental contributionamounts under children’s serviceprograms, refundable tax credits claimedby applicants or recipients of various assistanceprograms, or the <strong>Minnesota</strong>Careprogram,• a court that has found you to be delinquentin child support payments,• the <strong>Minnesota</strong> <strong>Department</strong> of Employmentand Economic Development if you receivedunemployment compensation or are participatingin an enterprise or JOBZ zone,• the <strong>Minnesota</strong> <strong>Department</strong> of Finance forpurposes of preparing a revenue forecast,• the <strong>Minnesota</strong> Racing Commission if youapply for or hold a license issued by thecommission, or own a horse entered in anevent licensed by the commission,• any <strong>Minnesota</strong> state, county, city or otherlocal government agency that you areasking to issue or renew your professionallicense or your license to conduct business,including a gambling equipment distributorlicense and a bingo hall license,• the <strong>Minnesota</strong> <strong>Department</strong> of Labor andIndustry for purposes of administeringlaws relating to tax, workers’ compensation,minimum wage and conditions of employment,• a county, city or town that has been designatedas an enterprise or JOBZ zone,• the state auditor, if your business is receivingJOBZ benefits,• the <strong>Minnesota</strong> State Lottery before you cancontract to sell lottery tickets, or if you wina lottery prize of $600 or more,• a local assessor for purposes of determiningwhether homestead benefits have beenclaimed appropriately,• the <strong>Department</strong> of Health for purposes ofepidemiologic investigations,• the Legislative Auditor for purposes ofauditing the <strong>Department</strong> of Revenue or alegislative program,• the <strong>Minnesota</strong> <strong>Department</strong> of Commercefor locating owners of unclaimed property,• sources necessary to use statutorily authorizedtax collection tools for collecting taxor nontax debts,• the <strong>Minnesota</strong> <strong>Department</strong> of VeteransAffairs, for purposes of locating veteransand notifying them of health hazards theywere exposed to as a result of service in thearmed forces, and of potential benefits towhich they, their dependents or survivorsmay be entitled, or• a district court to determine eligibility for apublic defender.There also may be instances in which thedepartment will assist other state agenciesin mailing information to you. Althoughthe department does not share your addressinformation, we may send the informationto you on behalf of the other state agency.If filing a paper returnIf you are filing a paper Form <strong>M1</strong>, be sureto read page 16. If you fail to follow theinstructions provided, processing of yourreturn may be delayed.Name and address areaEnter the information in the name and addresssection in all capital letters using blackink. Be sure to use your legal name; do notenter a nickname.If you live outside of the United States, besure to mark an X in the oval box to theleft of your address to indicate you have aforeign address. This allows the scanningequipment to properly record your address.If you are married and filing separateincome tax returns, enter your spouse’sname and Social Security number in thearea provided in the filing status area. Donot enter your spouse’s name or Social Securitynumber in the name and address areaat the top of your return.Date of birthYou are now required by law to enter themonth, day and year you were born on yourreturn. If you are filing a joint return, alsoenter your spouse’s date of birth.Federal filing statusYou must use the same filing status to fileyour <strong>Minnesota</strong> return that you used to fileyour federal return. Mark an X in the ovalbox to show the filing status you used to fileyour <strong>2008</strong> federal return.State electionscampaign fundYou may designate $5 of state money togo to help candidates for state offices paycampaign expenses. To designate, find theparty of your choice in the list provided onyour return and enter the correspondingcode number where indicated. If you choosethe general campaign fund, the $5 will bedistributed among candidates of all majorparties listed on Form <strong>M1</strong>. If you are filing ajoint return, your spouse may also designatea party. Designating $5 will not reduce yourrefund or increase your tax.

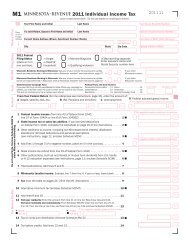

Line instructionsLine instructionsBefore you enter amounts on Form <strong>M1</strong>,read the instructions on page 16.• Round amounts to the nearest dollar.Drop amounts less than 50 cents andincrease amounts 50 cents or more to thenext higher dollar.• If the line does not apply to you or if theamount is zero, leave the boxes blank.Federal return informationLines A–DLine A—Federal wages, salaries,tips, etc.Enter your wages, salaries, tips, etc. from:• line 7 of federal Form 1040,• line 7 of Form 1040A,• line 1 of Form 1040EZ,• line 8 of Form 1040NR, or• line 3 of Form 1040NR-EZ.Line B—<strong>Tax</strong>able IRA distributions,pensions and annuitiesEnter the total of your taxable IRA distributionsand your taxable pensions andannuities:• add lines 15b and 16b of federal Form1040,• add lines 11b and 12b of Form 1040A, or• add lines 16b and 17b of Form 1040NR.Line C—UnemploymentcompensationEnter the unemployment compensation youreceived in <strong>2008</strong> that is included on:• line 19 of federal Form 1040,• line 13 of Form 1040A,• line 3 of Form 1040EZ, or• line 20 of Form 1040NR.Line D—Federal adjusted grossincomeEnter your <strong>2008</strong> federal adjusted grossincome from:• line 37 of federal Form 1040,• line 21 of Form 1040A,• line 4 of Form 1040EZ,• line 35 of Form 1040NR, or• line 10 of Form 1040NR-EZ.If your federal adjusted gross income is anegative number (less than zero), mark anX in the oval box on line D to indicate it is anegative number.<strong>Minnesota</strong> incomeLines 1–5Line 1—Federal taxable incomeEnter your federal taxable income from:• line 43 of federal Form 1040,• line 27 of Form 1040A,• line 6 of Form 1040EZ,• line 40 of Form 1040NR, or• line 14 of Form 1040NR-EZ.If your federal taxable income is a negativenumber (less than zero), you shouldhave entered a zero on your federal return.However, on your <strong>Minnesota</strong> return, enterthe actual number and mark an X in theoval box on line 1 to indicate it is a negativenumber.Line 2—State income tax or salestax addition<strong>Minnesota</strong> does not allow you to deductstate income tax or sales tax. If you itemizeddeductions on your <strong>2008</strong> federal Form1040, you must add back any amounts youdeducted on line 5 of federal Schedule A forincome or sales tax. (Shareholders and partners,see instructions in the next column.)Skip this line if you filed Form 1040A or1040EZ, or if you filed Form 1040 but didnot itemize deductions.If you itemized deductions, follow the stepsbelow to determine line 2. You must usethe amounts from your federal Schedule A,even if your deductions were limited.1 Amount from line 29 ofyour federal Schedule A . ....2 If you are not a dependent,use the table in the nextcolumn to find the amountfor this step. Dependents:Enter the standard deductionfrom your federal return . . . .3 Subtract step 2 from step 1 (ifresult is zero or less, enter 0) .4 State income or sales tax fromline 5 of federal Schedule A andany additional state income taxyou may have included on line 8(other taxes) of Schedule A ..5 Enter the amount from step 3 or step 4,whichever is less, on line 2 of Form <strong>M1</strong>.Married couples filing separate returns:Each spouse must complete a separateworksheet. If step 4 is less than step 3for either spouse, each spouse must enterthe step 4 amount of their own worksheeton line 2 of their Form <strong>M1</strong>.Table for step 2Check the boxes that apply to you and yourspouse. If you are married filing separately,check boxes only for your own status, unlessyour spouse has no gross income and cannotbe claimed as a dependent by another person:you: 65 or older blindyour spouse: 65 or older blindIn the table below, find your filing statusand the number of boxes you checked above(from 0-4) and enter the appropriate dollaramount in step 2 in the previous column:boxes dollarfiling checked amountstatus above for step 2single: 0 $ 5,4501 6,8002 8,150married 0 $ 10,900filing jointly, or 1 11,950qualifying 2 13,000widow(er): 3 14,0504 15,100married 0 $ 5,450filing 1 6,500separately: 2 7,5503 8,6004 9,650head of 0 $ 8,000household: 1 9,3502 10,700S corporation shareholders and individualpartners: Even if you did not itemizedeductions on your federal return, includeon line 2 your pro rata share of income taxespaid by the corporation or partnership thatwere deducted in arriving at the entity’sordinary income or net rental income. Thisamount, if any, will be provided on theSchedule KS or KPI you received from theentity.Nonresident aliens: Enter on line 2 theamount of state income tax from line 1 ofyour Schedule A (1040NR) or included online 11 of Form 1040NR-EZ.9

Qualifying education expensesIn general, education expenses that qualifyfor either the K–12 education subtraction online 7 or the credit on line 30 of Form <strong>M1</strong>include:• instructor fees and tuition for classes orlessons taken outside the normal schoolday if the instructor is not the child’s sibling,parent or grandparent,• purchases of required educational materialfor use during the normal school day,• fees paid to others for driving your childto and from school for the normal schoolday, and• computer hardware for personal use inyour home and educational software.The types of expenses that qualify only forthe subtraction are private school tuitionand tuition paid for college or summerschool courses that are used to satisfy highschool graduation requirements.You must save your itemized cash registerreceipts, invoices and other documentationwith your tax records. The department mayask to review them.Expenses that do not qualify for either:• purchases of materials for extracurricularactivities,• fees paid to others for transporting yourchild to and from activities outside thenormal school day, and• fees for extracurricular academic instructionprovided by the child’s sibling, parentor grandparent.If you qualify for the education credit—enter your qualifying expenses on the appropriateline of your Schedule <strong>M1</strong>ED andenter your expenses that qualify only for thesubtraction on line 7 of Form <strong>M1</strong>. You cannotuse the same expenses to claim both thecredit and the subtraction.The total of your subtraction and creditcannot be more than your actual allowableexpenses.If you do not qualify for the educationcredit—enter all of your qualifying expenses,up to the maximum amount allowed, online 7 of Form <strong>M1</strong>.If you have any of the following types of educationalexpenses, include them on the lines indicated:Include only as a subtraction on line 7 of Form <strong>M1</strong>:Qualifies for:credit subtractionPrivate school tuition ............................... XTuition for college courses that are used tosatisfy high school graduation requirements .............. XInclude on line 7 of Schedule <strong>M1</strong>ED or line 7 of Form <strong>M1</strong>:Fees for after-school enrichment programs, such as scienceexploration and study habits courses (by qualified instructor*) . X XTuition for summer camps that are primarily academic infocus, such as language or fine arts camps* ............. X XInstructor fees for drivers education course if theschool offers a class as part of the curriculum ............ X XFees for all-day kindergarten** ........................ X XInclude on line 8 of Schedule <strong>M1</strong>ED or line 7 of Form <strong>M1</strong>:Tutoring* ....................................... X XMusic lessons* .................................. X XInclude on line 9 of Schedule <strong>M1</strong>ED or line 7 of Form <strong>M1</strong>:Purchases of required educational material (textbooks, paper,pencils, notebooks, rulers, etc.) for use during the regularpublic, private or home school day . . . . . . . . . . . . . . . . . . . . . X XInclude on line 10 of Schedule <strong>M1</strong>ED or line 7 of Form <strong>M1</strong>:Purchase or rental of musical instruments used during theregular school day ................................. X XInclude on line 11 of Schedule <strong>M1</strong>ED or line 7 of Form <strong>M1</strong>:Fees paid to others for transportation to/from school or forfield trips during the normal school day, if the school is locatedin <strong>Minnesota</strong>, Iowa, North Dakota, South Dakota or Wisconsin . X XInclude on line 14 of Schedule <strong>M1</strong>ED or line 7 of Form <strong>M1</strong>:Home computer hardware and educational software*** ...... X XExpenses that do not qualify for either—You cannot claim the following expenses:• Costs for you to drive your child to/from school and to/from tutoring, enrichment programsor camps that are not part of the school day• Travel expenses, lodging and meals for overnight class trips• Fees paid for and materials and textbooks purchased for use in a program thatteaches religious beliefs• Sport camps or lessons• Purchase of books and materials used for tutoring, enrichment programs, academiccamps or after-school activities• Tuition and expenses for preschool or post-high school classes• Costs of school lunches• Costs of uniforms used for school, band or sports• Monthly Internet fees• Noneducational software* Study must be directed by a qualified instructor. A qualified instructor is a person who is not the child’s sibling, parent or grandparent and meets one ofthe following requirements: is a <strong>Minnesota</strong> licensed teacher or is directly supervised by a <strong>Minnesota</strong> licensed teacher; has passed a teacher competency test;teaches in an accredited private school; has a baccalaureate degree; or is a member of the <strong>Minnesota</strong> Music Teachers Association.** If you are using all-day kindergarten fees to qualify for the dependent care credit, you cannot use the fees as qualifying education expenses for the credit orsubtraction.*** Computer-related expenses of up to $200 can be used to qualify for a credit and an additional subtraction of up to $200 per family. For example, if you have$300 of computer expenses and you qualify for both the credit and subtraction, you may use $200 of the expenses to qualify for a $150 credit andthe remaining $100 of expenses can be used for the subtraction.11

Lines 8–12Line 8—Other subtractions(Schedule <strong>M1</strong>M)Complete Schedule <strong>M1</strong>M (included in thisbooklet) if in <strong>2008</strong>, you:• did not itemize deductions on your federalreturn and your charitable contributionswere more than $500,• reported 80 percent of bonus depreciationas an addition to income on Form<strong>M1</strong> in a year 2003 through 2007, or youreceived a federal bonus depreciationsubtraction in <strong>2008</strong> from an estate ortrust,• reported 80 percent of federal section 179expensing as an addition to income in2006 or 2007,• were age 65 or older (as of January 1,2009); are permanently and totally disabledand you received federally taxable disabilityincome; and you qualify under the Schedule<strong>M1</strong>R income limits (see Schedule<strong>M1</strong>R—<strong>Income</strong> qualifications in the nextcolumn),• received benefits from the Railroad RetirementBoard, such as unemployment,sick pay or retirement benefits,• were a resident of Michigan, NorthDakota or Wisconsin, and you receivedwages covered by reciprocity from which<strong>Minnesota</strong> income tax was withheld,• worked and lived on the Indian reservationof which you are an enrolled member,• received federal active duty military payfor services performed outside <strong>Minnesota</strong>while a <strong>Minnesota</strong> resident,• NEW are a National Guard member whoreceived out-of-state training,• received compensation for state or federalactive service performed in <strong>Minnesota</strong> as amember of the National Guard or reservists,• received active duty military pay whilea resident of another state and you arerequired to file a <strong>Minnesota</strong> return,• incurred certain costs when donating ahuman organ,• paid income taxes to a subnational levelof a foreign country (equivalent of a stateof the United States) other than Canada,• received business or investment incomeexemptions for participating in a Job OpportunityBuilding Zone (JOBZ),12Schedule <strong>M1</strong>R—<strong>Income</strong> qualificationsIf you (or your spouse if filing a joint return) are age 65 or older or permanently and totallydisabled, use the table below to see if you are eligible for the subtraction.Complete Schedule <strong>M1</strong>R and Schedule <strong>M1</strong>M:and your and your Railroadadjusted Ret. Board benefitsgross and nontaxableincome* is Social Securityif you are: less than: are less than:Married, filing a joint return and both spousesare 65 or older or disabled . . . . . . . . . . . . . . . . . $42,000 .......... $12,000Married, filing a joint return and one spouseis 65 or older or disabled .................. $38,500 .......... $12,000Married filing a separate return, you livedapart from your spouse for all of <strong>2008</strong>,and you are 65 or older or disabled ........... $21,000 .......... $ 6,000Filing single, head of householdor qualifying widow(er) and youare 65 or older or disabled . . . . . . . . . . . . . . . . . $33,700 .......... $ 9,600* Adjusted gross income is federal adjusted gross income (line 37 of federal Form 1040or line 21 of Form 1040A) plus any lump-sum distributions reported on federal Form 4972less any taxable Railroad Retirement Board benefits.• were insolvent and you received a gainfrom the sale of your farm property thatis included in line 37 of Form 1040, or• NEW received a post service educationaward for service in an AmeriCorps NationalService program.If you complete Schedule <strong>M1</strong>M, include theschedule when you file Form <strong>M1</strong>.<strong>Tax</strong> before creditsLines 11–16Line 11—<strong>Tax</strong> from tableTurn to the tax table on pages 22 through27. Using the amount on line 10, find thetax amount in the column of your filing status.Enter the tax from the table on line 11.Line 12—Alternative minimumtax (Schedule <strong>M1</strong>MT)You may be required to pay <strong>Minnesota</strong> alternativeminimum tax if you were requiredto pay federal alternative minimum tax, or ifyou had large deductions (such as gamblinglosses, mortgage interest or K-12 educationexpenses) when you filed your federal orstate return.If you were required to pay federal alternativeminimum tax, complete Schedule<strong>M1</strong>MT, Alternative Minimum <strong>Tax</strong>. If youwere not required to pay federal alternativeminimum tax, complete the following steps:1 Personal exemptions from line 42 of federalForm 1040 or line 26 of Form 1040A.2 Determine the total of the followingitems:• accelerated depreciation• exercise of incentive stock options• tax-exempt interest or dividends from<strong>Minnesota</strong> private activity bonds notincluded on line 2 of Schedule <strong>M1</strong>M• K-12 education expenses from line 7 ofForm <strong>M1</strong>• amortization of pollution-controlfacilities• intangible drilling costs• depletion• reserves for losses on bad debts offinancial institutions• circulation and research and experimentalexpenditures• mining exploration and developmentcosts• installment sales of property• tax sheltered farm loss• passive activity loss• income from long-term contracts forthe manufacture, installation or constructionof property to be completedafter <strong>2008</strong>Continued

Lines 12–15• gains excluded under IRC section 1202• preferences and adjustments from anelecting large partnership (from theAMT adjustment boxes from yourSchedule K-1 of federal Form 1065-B).3 Add step 1, step 2 and line 40 of Form1040.4 Subtract lines 4, 14 and 20 of federalSchedule A (1040) from step 3.5 You must complete Schedule <strong>M1</strong>MT ifstep 4 is more than:• $55,000 if you are married and filinga joint return or filing as a qualifyingwidow(er),• $27,750 if you are married and filingseparate returns, or• $41,925 if you are single or filing headof household.Before you complete Schedule <strong>M1</strong>MT, youmust complete Part I of federal Form 6251,even if you were not required to file Form6251 with your federal return.On your Schedule <strong>M1</strong>MT, if line 27 is morethan line 28, you must pay <strong>Minnesota</strong> alternativeminimum tax. Include the scheduleand Form 6251 when you file Form <strong>M1</strong>.Line 14—Part-year residents andnonresidents:Your tax is determined by the percentage ofyour income that is assignable to <strong>Minnesota</strong>.Complete Schedule <strong>M1</strong>NR to determineyour <strong>Minnesota</strong> tax to enter on line 14.See pages 4 and 5 to determine if you were aresident, part-year resident or nonresident.If you complete Schedule <strong>M1</strong>NR, enter theamounts from lines 23 and 24 of Schedule<strong>M1</strong>NR on lines 14a and 14b of Form <strong>M1</strong>. Includethe schedule when you file your return.Line 15—<strong>Tax</strong> on lump-sumdistribution (Schedule <strong>M1</strong>LS)If you received a lump-sum distributionfrom a pension, profit-sharing or stockbonus plan in <strong>2008</strong>, you must file Schedule<strong>M1</strong>LS, <strong>Tax</strong> on Lump-Sum Distribution, ifboth of the following conditions apply:• you filed federal Form 4972, and• you were a <strong>Minnesota</strong> resident when youreceived any portion of the lump-sumdistribution.If you complete Schedule <strong>M1</strong>LS, include theschedule and Form 4972 when you file Form<strong>M1</strong>.ContinuedWhere do your <strong>Minnesota</strong> tax dollars go?Economic development 2.2%State government 1.5%Environment, energy,and natural resources 2.9% Agriculture and veterans 1.1%Debt service and other 3.6%Health andhuman services 37.3%Public safety 3.9%Property taxaids and credits 5.6%Higher education 5.7%Transportation 9.4%K–12 Education 27.0%All Funds – Biennium <strong>2008</strong>/09Source: <strong>Minnesota</strong> <strong>Department</strong> of FinanceIncludes fees and federal grants*Percentages do not add up to 100% due to rounding.13

Line 18Credits against taxLines 18–22Line 18—Marriage creditTo qualify for the marriage credit, you mustmeet all of the following requirements:• you are filing a joint return,• both you and your spouse have taxableearned income, taxable pension or taxableSocial Security income,• your joint taxable income on line 10 ofyour Form <strong>M1</strong> is at least $32,000, and• the income of the lesser-earning spouse isat least $20,000.If you qualify, complete the Marriage CreditWorksheet (on this page) to determine yourcredit.14<strong>Instructions</strong> for steps 2 and 3 ofthe Marriage Credit WorksheetSeparately determine the total each spousereceived of the following types of income.Enter your result on step 2 and yourspouse’s result on step 3:• wages, salaries, tips and other taxableemployee compensation• self-employment income included on line3 of Schedule SE (1040), less the self-employmenttax deduction from line 6 ofSchedule SE• taxable pension and Social Security incomeincluded on lines 15b, 16b and 20bof Form 1040 or lines 11b, 12b and 14bof Form 1040A, minus any income youreceived from the Railroad RetirementBoard included on line 16b of Form 1040or line 12b of Form 1040A.Table for step 5 of the Marriage Credit WorksheetIf step 4 is: and step 1 is at least:at but $32,000 $52,000 $72,000 $92,000 $112,000 $132,000 $152,000least less than but less than:$52,000 $72,000 $92,000 $112,000 $132,000 $152,000 & overyour credit amount is:$20,000 $ 22,000 . $34 . . $34 . . $34. . . . $0 . . . . $0 . . . $0 . . . . $022,000 24,000 . . 68 . . . 68 . . . 68. . . . 0 . . . . . 0 . . . . 0 . . . . . 024,000 26,000 . 102 . . 102 . . 102. . . . 0 . . . . . 0 . . . . 0 . . . . . 026,000 28,000 . 136 . . 136 . . 136. . . . 37 . . . . . 0 . . . . 0 . . . . . 028,000 30,000 . 170 . . 170 . . 170. . . . 87 . . . . . 0 . . . . 0 . . . . . 030,000 32,000 . 168 . . 200 . . 200. . . 133 . . . . . 0 . . . . 0 . . . . . 032,000 34,000 . 134 . . 200 . . 200. . . 149 . . . . . 0 . . . . 0 . . . . . 034,000 36,000 . 100 . . 200 . . 200. . . 165 . . . . . 5 . . . . 0 . . . . . 036,000 38,000 . . 66 . . 200 . . 200. . . 181 . . . . 21 . . . . 0 . . . . . 038,000 40,000 . . 32 . . 200 . . 200. . . 197 . . . . 37 . . . . 0 . . . . . 040,000 42,000 . . . 0 . . 200 . . 200. . . 200 . . . . 53 . . . 16 . . . . 1642,000 44,000 . . . 0 . . 200 . . 200 . . 200 . . . . 69 . . . 32 . . . . 3244,000 46,000 . . . 0 . . 200 . . 200. . . 200 . . . . 85 . . . 48 . . . . 4846,000 48,000 . . . 0 . . 200 . . 200. . . 200 . . . 101 . . . 64 . . . . 6448,000 50,000 . . . 0 . . 200 . . 200. . . 200 . . . 117 . . . 80 . . . . 8050,000 52,000 . . . 0 . . 168 . . 200. . . 200 . . . 133 . . . 96 . . . . 9652,000 54,000 . . . 0 . . 134 . . 200. . . 200 . . . 149 . . 112 . . . 11254,000 56,000 . . . 0 . . 100 . . 200. . . 200 . . . 165 . . 128 . . . 12856,000 58,000 . . . 0 . . . 66 . . 200. . . 200 . . . 181 . . 144 . . . 14458,000 60,000 . . . 0 . . . 32 . . 200. . . 200 . . . 197 . . 160 . . . 16060,000 62,000 . . . 0 . . . . 0 . . 200. . . 200 . . . 200 . . 176 . . . 17662,000 64,000 . . . 0 . . . . 0 . . 200. . . 200 . . . 200 . . 192 . . . 19264,000 66,000 . . . 0 . . . . 0 . . 200. . . 200 . . . 200 . . 208 . . . 20866,000 68,000 . . . 0 . . . . 0 . . 200. . . 200 . . . 200 . . 224 . . . 22468,000 70,000 . . . 0 . . . . 0 . . 200. . . 200 . . . 200 . . 240 . . . 24070,000 72,000 . . . 0 . . . . 0 . . 168. . . 200 . . . 200 . . 256 . . . 25672,000 74,000 . . . 0 . . . . 0 . . 134. . . 200 . . . 200 . . 272 . . . 27274,000 76,000 . . . 0 . . . . 0 . . 100. . . 200 . . . 200 . . 288 . . . 28876,000 78,000 . . . 0 . . . . 0 . . . 66. . . 200 . . . 200 . . 304 . . . 30478,000 80,000 . . . 0 . . . . 0 . . . 32. . . 200 . . . 200 . . 320 . . . 32080,000 82,000 . . . 0 . . . . 0 . . . .0. . . 196 . . . 196 . . 319 . . . 33282,000 & over . . . . Complete steps 6 through 16 of the Marriage Credit Worksheet.Marriage Credit Worksheet1 Joint taxable income from line 10of Form <strong>M1</strong> (if less than $32,000,you do not qualify) .........2 Your total of earned income, taxablepension income and taxableSocial Security income . ......3 Your spouse’s total of earnedincome, taxable pension incomeand taxable Social Securityincome . ...................4 Amount from step 2 or step 3,whichever is less (if less than$20,000, you do not qualify) ..5 If step 4 is less than $82,000,use the table at left and the amountsfrom steps 1 and 4 to find your credit.Enter the credit here and skipsteps 6–16. See the instructionsbelow step 16 ..............If step 4 is $82,000 or more, continue withstep 6.6 Amount from step 4 .........7 Value of one personal exemptionplus one-half of the marriedjointstandard deduction ..... $8,9508 Subtract step 7 from step 6 ...9 Using the rate schedule for singlepersons on page 27, compute thetax for the amount on step 8 ..10 Amount from step 1 .........11 Amount from step 8 .........12 Subtract step 11 from step 10 (ifzero or less, you do not qualify)13 Using the rate schedule for singlepersons on page 27, compute thetax for the amount on step 12 .14 Line 11 of Form <strong>M1</strong> .........15 Add step 9 and step 13 . ......16 Subtract step 15 from step 14.If the result is more than $332,enter $332. If result is zero orless, you do not qualify. Entercredit here and see instructionsbelow .....................Full-year residents: Enter the result fromstep 5 or step 16, whichever is applicable, online 18 of Form <strong>M1</strong>.Part-year residents and nonresidents:Multiply the result from step 5 or step16, whichever is applicable, by line 25 ofSchedule <strong>M1</strong>NR. Enter the result on line 18of Form <strong>M1</strong>.

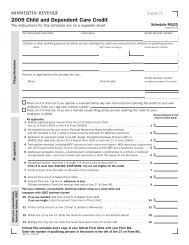

Lines 19–28Line 19—Credit for long-termcare insurance premiums paid(Schedule <strong>M1</strong>LTI)You may be able to claim a credit againsttax based on any premiums you paid in<strong>2008</strong> for a qualified long-term care insurancepolicy for which you did not receive afederal tax benefit.To qualify, your long-term care insurancepolicy must:• qualify as a federal deduction (see federalSchedule A of Form 1040), disregardingthe 7.5 percent income test, and• have a lifetime long-term care benefitlimit of $100,000 or more.The maximum credit is $100 per person.Part-year residents and nonresidents mayalso be eligible for the credit based on thepercentage of income taxable to <strong>Minnesota</strong>.If you qualify, complete Schedule <strong>M1</strong>LTI,Long-Term Care Insurance Credit, and includethe schedule when you file Form <strong>M1</strong>.Line 20—Credit for taxes paid toanother state (Schedule <strong>M1</strong>CR)If you were a <strong>Minnesota</strong> resident for all orpart of <strong>2008</strong> and you paid income tax bothto <strong>Minnesota</strong> and to another state on thesame income, you may be able to reduceyour tax. A Canadian province or territoryand the District of Columbia are considereda state for purposes of this credit.If you were a resident of another statebut are required to file a <strong>2008</strong> <strong>Minnesota</strong>income tax return as a <strong>Minnesota</strong> resident,you may be eligible for this credit. To beeligible, you must have paid <strong>2008</strong> state taxon the same income to both <strong>Minnesota</strong>and the state of which you were a resident.However, you must get a statement from theother state’s tax department stating you arenot eligible to receive a credit on that state’sreturn for income tax paid to <strong>Minnesota</strong>.Be sure to include this statement with yourForm <strong>M1</strong>.If you claimed a federal foreign tax creditand you included taxes paid to a Canadianprovince or territory, you cannot use thesesame taxes paid to determine your <strong>Minnesota</strong>credit.If you qualify, complete Schedule <strong>M1</strong>CR,Credit for <strong>Income</strong> <strong>Tax</strong> Paid to Another State,and include the schedule when you file yourreturn.If you worked in Wisconsin, NorthDakota or Michigan: If you were a fullorpart-year resident of <strong>Minnesota</strong> andhad <strong>2008</strong> state income tax withheld byMichigan, North Dakota or Wisconsin frompersonal service income (such as wages,salaries, tips, commissions, bonuses) you receivedfrom working in one of those states,do not file Schedule <strong>M1</strong>CR. Instead, you canget a refund of the tax withheld for the periodof time you were a <strong>Minnesota</strong> residentby filing that state’s income tax return withthat state.To get the other state’s income tax form, callthat department or go to their website:• Michigan <strong>Department</strong> of Treasury, 1‐800-367‐6263, www.michigan.gov/treasury• North Dakota Office of State <strong>Tax</strong> Commissioner,701-328-3450, www.nd.gov/tax• Wisconsin <strong>Department</strong> of Revenue,608-266‐1961, www.dor.state.wi.usNonresidents who sold a partnershipinterest: If you were a nonresident of <strong>Minnesota</strong>and you sold a partnership intereston which the gain realized is taxable to both<strong>Minnesota</strong> and to your home state, you maybe able to reduce your tax. If your homestate does not allow a credit for taxes paid to<strong>Minnesota</strong> on the gain, complete Schedule<strong>M1</strong>CRN, Credit for Nonresident Partnerson <strong>Tax</strong>es Paid to Home State. Do not fileSchedule <strong>M1</strong>CR.If you complete Schedule <strong>M1</strong>CRN, includethe schedule when you file your Form <strong>M1</strong>.Line 21—Alternative minimumtax credit (Schedule <strong>M1</strong>MTC)If you paid <strong>Minnesota</strong> alternative minimumtax in one or more years from 1990 through2007, but not for <strong>2008</strong>, complete Schedules<strong>M1</strong>MT and <strong>M1</strong>MTC, Alternative Minimum<strong>Tax</strong> Credit, to determine if you can claim acredit or carry forward any unused portionof your minimum tax credit.If you have never paid <strong>Minnesota</strong> alternativeminimum tax, you do not qualify forthis credit.If you complete Schedule <strong>M1</strong>MTC, besure to include the schedule and Schedule<strong>M1</strong>MT when you file your return.Line 24—Nongame Wildlife FundYou can help preserve <strong>Minnesota</strong>’s nongamewildlife, such as bald eagles and loons, bydonating to the Nongame Wildlife Fund.If you wish to donate, enter the amounton line 24. This amount will decrease yourrefund or increase the amount you owe.For more information on the fund, go towww.dnr.state.mn.us or write to: NongameWildlife Fund, <strong>Department</strong> of Natural Resources,500 Lafayette Road, Box 25,St. Paul, MN 55155.Total paymentsLines 26–33Line 26—<strong>Minnesota</strong> income taxwithheld (Schedule <strong>M1</strong>W)If you received W-2, 1099 or W-2G forms,or Schedules KF, KS or KPI that show <strong>Minnesota</strong>income tax was withheld for you for<strong>2008</strong>, you must complete Schedule <strong>M1</strong>W,<strong>Minnesota</strong> <strong>Income</strong> <strong>Tax</strong> Withheld.Be sure to include the schedule when youfile your Form <strong>M1</strong>. If the schedule is notenclosed when required, processing of yourreturn will be delayed and the departmentmay disallow your withholding amount.Do not send in your W-2, 1099 or W-2Gforms. Keep your W-2, 1099 and W-2Gforms with your tax records and have themavailable if requested by the department.Line 27—<strong>Minnesota</strong> estimatedtax and extension paymentsOnly three types of payments can be includedon line 27. They are:• your total <strong>2008</strong> <strong>Minnesota</strong> estimated taxpayments made in <strong>2008</strong> and 2009, eitherpaid electronically or with Form <strong>M1</strong>4,• the portion of your 2007 <strong>Minnesota</strong> incometax refund designated on your 2007Form <strong>M1</strong> to be applied to <strong>2008</strong> estimatedtax, and• any payment made by the due date whenyou are filing after the due date, eitherpaid electronically or with Form <strong>M1</strong>3.Do not include any other amounts online 27.Line 28—Child and dependentcare credit (Schedule <strong>M1</strong>CD)To qualify for the child and dependent carecredit, your household income—federaladjusted gross income plus most nontaxableincome—must be $36,030 or less, and oneof the following conditions must apply:• you paid someone (other than your dependentchild or stepchild younger thanage 19) to care for a qualifying15(<strong>Instructions</strong> continued on page 17)

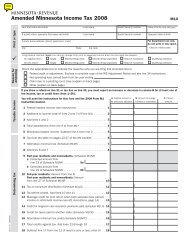

How to complete a paper returnForm <strong>M1</strong> is scannableThe <strong>Department</strong> of Revenue uses scanning equipment to capture the information from paper income tax returns. It isimportant that you follow the instructions below so your return is processed quickly and accurately.ABCUse black ink to enter the numbers inside the boxes. Donot highlight numbers, as this prevents the equipment fromreading the numbers.Please print and use CAPITAL LETTERS when enteringyour name, your spouse’s name and current address. Capitalletters are easier to recognize.Print your numbers like this:HIDo not write extra numbers, symbols or notes on yourreturn, such as cents, dashes, decimal points or dollar signs.Enclose any explanations on a separate sheet, unless you areinstructed to write explanations on your return.Do not staple or tape any enclosures to your return.If you want to ensure your papers stay together, use a paperclip.DEFG16Note: Do not put a slash through the “0” (Ø) or “7” (7); it maybe read as an “8.”Use whole dollars. You must round the dollar amountson your Form <strong>M1</strong> and schedules to the nearest dollar. Dropamounts less than 50 cents and increase amounts 50 cents ormore to the next dollar. For example: 129.49 becomes 129,and 129.50 becomes 130.Leave lines blank if they do not apply to you or if theamount is zero. Leave unused boxes blank.Mark an X in an oval box like this:Reporting a negative amount. If your federal adjustedgross income on line D or the amounts on line 1, 4 or 14b arenegative amounts (losses), be sure to mark an X in the ovalbox provided on the line (see example below). Failure to do sowill result in the loss being read by our processing equipmentas a positive amount. Do not use parentheses or a minus signto indicate a negative amount.If a negative number, mark an X in oval box., , .00Important remindersEnclose Schedule <strong>M1</strong>W when requiredIf you are claiming <strong>Minnesota</strong> income tax withheld on line 26 ofyour Form <strong>M1</strong>, you must complete and enclose Schedule <strong>M1</strong>Wwith your return. If the schedule is not enclosed, processing ofyour refund will be delayed, and the department may disallow theamount of your withholding.Also, do not send in your W-2, 1099 or W-2G forms. Keep theseforms with your tax records and save your <strong>2008</strong> tax records at leastthrough 2013. The department may ask you to show these records ifthere is any question.BFGPlease printFiling statusFundFederalDo not send W-2s. Enclose Schedule <strong>M1</strong>W toclaim <strong>Minnesota</strong> withholding.<strong>Tax</strong> before credits<strong>M1</strong>, ,0 — Stock No. 1008010<strong>2008</strong>11Your first name and initial Last name Your Social Security numberMark an If a joint return, spouse’s first name and initial Last nameX if aforeignaddress: Current home address (street, apartment number, route)<strong>Individual</strong> <strong>Income</strong> <strong>Tax</strong> <strong>2008</strong>Please print. Leave unused boxes blank. Do not use staples on anything you submit.Spouse’s Social Security numberYour date of birth (mm/dd/yyyy)City State Zip code Spouse’s date of birth<strong>2008</strong> federalfiling status (1) Single (2) Married filing joint (3) Married filing separate:(mark an X in Head ofEnter spouse’s name and(4)one oval box): Household (5) Qualifying widow(er) Social Security number hereState Elections Campaign FundPolitical party and code number:Your code: Spouse’s code:If you want $5 to go to help candidates for state offices pay campaign Republican . . . . . . . . . . . 11 Green . . . . . . . . . 14expenses, you may each enter the code number for the party of your Democratic Farmer-Labor . . 12 General Campaignchoice. This will not increase your tax or reduce your refund.Independence . . . . . . . . . . 13 Fund . . . . . . . . .15From your federal return (for line references see instructions, page 9), enter the amount of:D Federal adjusted gross income:A Wages, salaries, tips, etc.: B IRA, Pensions and annuities: C Unemployment: If a negative number, mark an X in oval box.. 00 , . 00 , . 00 , , . 00number, an X in If a negative1 Federal taxable income (from line 43 of federal Form 1040,line 27 of Form 1040A, or line 6 of Form 1040EZ) . . . . . . . . . . . . . . . . . . . . . . . . . . 1 ,mark,oval box.. 002 State income tax or sales tax addition. If you itemized deductions on federalForm 1040, complete the worksheet on page 9 of the instructions . . . . . . . . . . . 2 , , . 003 Other additions to your income, including the additional standard deductionfor property tax and non-<strong>Minnesota</strong> bond interest . . . . . . . . . . . . . . . . . . . . . . . . . . 3 , , . 00(see instructions, page 10, and enclose Schedule <strong>M1</strong>M)If a negative number, mark an X in oval box.4 Add lines 1 through 3 (if a negative number, mark an X in the oval box as indicated) . 4. 00Do you 5 State want income tax refund to from throw line 10 of federal Form this 1040 . form . . . . . . . . . . . . away? . . . 5 You . 006 Net interest or mutual fund dividends from U.S. bonds (see instructions, page 10) 6can, if 7 you Education expenses file you electronically. paid for your qualifying children in grades K–12 See page 2 for(see instructions, page 10). Enter the name and grade of each child: . . . . . . . . . . 7details.8 Other subtractions (see instructions, page 12, and enclose Schedule <strong>M1</strong>M) . . . . . . 89 Total subtractions. Add lines 5 through 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 910 <strong>Minnesota</strong> taxable income. Subtract line 9 from line 4(if result is zero or less, leave blank) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1011 <strong>Tax</strong> from the table on pages 22–27 of the <strong>M1</strong> instructions . . . . . . . . . . . . . . . . 1112 Alternative minimum tax (enclose Schedule <strong>M1</strong>MT) . . . . . . . . . . . . . . . . . . . . . . 1213 Add lines 11 and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1314 Full-year residents: Enter the amount from line 13 on line 14. Skip lines 14a and 14b.Part-year residents and nonresidents: From Schedule <strong>M1</strong>NR, enter the tax from line 27on line 14, from line 23 on line 14a, and from line 24 on line 14b (enclose schedule) . . . . . 14If a negative number, mark an X in oval box.a. <strong>M1</strong>NR,b. <strong>M1</strong>NR,line 23:, ,line 24:, ,15 <strong>Tax</strong> on lump-sum distribution (enclose Schedule <strong>M1</strong>LS) . . . . . . . . . . . . . . . . . . . 1516 <strong>Tax</strong> before credits. Add lines 14 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16, ,, ,, ,,, ,, ,, ,, ,, ,, ,, ,,, ,. 00. 00. 00. 00. 00. 00. 00. 00. 00. 00. 00If you pay your tax with a checkIf you owe an amount on line 36 of Form <strong>M1</strong> and you pay bycheck, you must complete a Form M60 payment voucher, which isincluded in this booklet. If you are filing a paper Form <strong>M1</strong>, send thevoucher and your check separately from your return to ensure thatyour payment is properly credited to your account.If you pay your tax after the due dateIf you pay your tax after April 15, 2009, you must pay penalty andinterest on the unpaid amount (see page 6 for details). Use theworksheet in the M60 instructions to determine the penalty andinterest to include with your tax payment.Form <strong>M1</strong> does not include a line to report penalty or interest.

Lines 28–34person while you, and your spouse if filinga joint return, were working or werelooking for work. A qualifying person andqualifying expenses are the same as forthe federal credit for child and dependentcare expenses, OR• you were an operator of a licensed familyday care home caring for your owndependent child who had not reached theage of six by the end of the year, OR• you are married and filing a joint return,your child was born in <strong>2008</strong>, and you didnot participate in a pre-tax dependentcare assistance program. You may be eligibleeven if you did not have actual childcare expenses.If one of the above conditions applies toyou, complete Schedule <strong>M1</strong>CD, Child andDependent Care Credit, to determine yourcredit. Married persons filing separatereturns cannot claim this credit.Nonresidents and part-year residents mayalso be eligible for this credit based onearned income taxable to <strong>Minnesota</strong>.Unlike the federal credit, which is allowedonly up to the amount of your tax liability,the <strong>Minnesota</strong> credit is refundable. So youmay be able to receive a refund even if youhave no tax liability. As a result, you mayqualify for the <strong>Minnesota</strong> credit even if youdid not have to file a federal return or didnot claim the federal credit.However, you must complete federal Form2441 or Schedule 2 of Form 1040A beforecompleting Schedule <strong>M1</strong>CD. This is neededeven if you did not claim the federal creditor file a federal return.If you complete Schedule <strong>M1</strong>CD, includethe schedule and federal Form 2441 orSchedule 2 of Form 1040A with Form <strong>M1</strong>.Indicate the number of qualifying personsin the boxes to the left of line 28.Line 29—<strong>Minnesota</strong> workingfamily credit (Schedule <strong>M1</strong>WFC)If you qualify for the federal earned incomecredit, you also qualify for the <strong>Minnesota</strong>working family credit. Use Schedule<strong>M1</strong>WFC, Working Family Credit, (includedin this booklet) and the WFC table on pages19–21 to determine your <strong>Minnesota</strong> credit.Nonresidents and part-year residents mayqualify for this credit based on the percentageof income taxable to <strong>Minnesota</strong>.If you complete Schedule <strong>M1</strong>WFC, includethe schedule with your return. Indicate thenumber of your qualifying children in theboxes to the left of line 29.Line 30—K–12 education credit(Schedule <strong>M1</strong>ED)You may receive a credit if you paid education-relatedexpenses in <strong>2008</strong> for yourqualifying children in grades kindergartenthrough 12 (K–12). See page 11 for informationon qualifying expenses.Married persons filing separate returns cannotclaim this credit.To qualify, your household income must beunder a certain limit based on the numberof qualifying children you have in gradesK–12. A qualifying child is the same as for thefederal earned income credit.If your total number of Your householdqualifying children is: income limit is:1 or 2 ..............$37,5003 ..................$39,5004 ..................$41,5005 ..................$43,5006 or more ........... ** For more than 5 children, the limit is$43,500 plus $2,000 for each additionalqualifying child.If your household income—your federaladjusted gross income plus most nontaxableincome—is more than the limits shown,you do not qualify for the credit. However,you may qualify for a subtraction. See line 7instructions on page 10.If you qualify for the credit, complete Schedule<strong>M1</strong>ED, K–12 Education Credit, (includedin this booklet). Expenses that cannot beused for the credit may be used for the subtractionon line 7 of Form <strong>M1</strong>. However, youcannot use the same expenses for both. Formore details, see <strong>Income</strong> <strong>Tax</strong> Fact Sheet #8,K–12 Education Subtraction and Credit.If you complete Schedule <strong>M1</strong>ED, include theschedule with Form <strong>M1</strong>. Also, indicate thenumber of qualifying children in the boxes tothe left of line 30.Save your original receipts and other documentationwith your tax records. The departmentmay ask you to show such records ifthere is a question concerning your credit orto verify the amount you claimed.Line 31—JOBZ jobs credit(Schedule JOBZ)A refundable jobs credit, based on higherpayingjobs, is available to qualified businessesoperating in a Job Opportunity BuildingZone (JOBZ). If you are a sole proprietoroperating a qualified business, see ScheduleJOBZ for details. If you complete ScheduleJOBZ, include the schedule with Form <strong>M1</strong>.Include any credit you may have received asa partner of a partnership, shareholder of anS corporation or beneficiary of an estate ortrust. You must include your Schedule KPI,KS or KF with Form <strong>M1</strong>.Line 32—Cattle tuberculosistesting creditIf you own cattle in <strong>Minnesota</strong> and you incurredexpenses during the year to test yourcattle for tuberculosis, you may qualify for acredit of 50 percent of your testing expenses.To determine your credit, follow the stepsbelow:1 Expenses you incurred to testyour cattle for tuberculosis ....2 The credit is 50% (.50)of your testing expenses ......3 Multiply step 1 by step 2. Enterthe result here and on line 32of Form <strong>M1</strong> .................50Refund or amount dueLines 34–39Line 34—Your refundIf line 33 is more than line 25, subtract line25 from line 33, and subtract the amount, ifany, on line 37. This is your <strong>2008</strong> <strong>Minnesota</strong>income tax refund. If the result is zero, youmust still file your return.Of the amount on line 34, you may choose to:1 receive the entire refund in the mail as apaper check (skip lines 35, 36, 38 and 39),2 have the entire refund deposited directlyinto a checking or savings account (see theline 35 instructions on page 18), or3 apply all or a portion of your refundtoward your 2009 estimated taxes and receivethe remaining amount, if any, in themail as a paper check (skip lines 35 and36, and complete lines 38 and 39).If you owe <strong>Minnesota</strong> or federal taxes,criminal fines or a debt to a state or countyagency, district court, qualifying hospitalor public library, the department will applyyour refund to the amount you owe. If youparticipate in the Senior Citizens Property<strong>Tax</strong> Deferral Program, your refund will beapplied to your deferred property tax total.Your Social Security number will be usedto identify you as the correct debtor. If yourdebt is less than your refund, you’ll receivethe difference.Generally, you must file your <strong>2008</strong> return nolater than October 15, 2012, or yourright to receive the refund lapses. 17