Course 4 May 2001 Solutions

Course 4 May 2001 Solutions

Course 4 May 2001 Solutions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

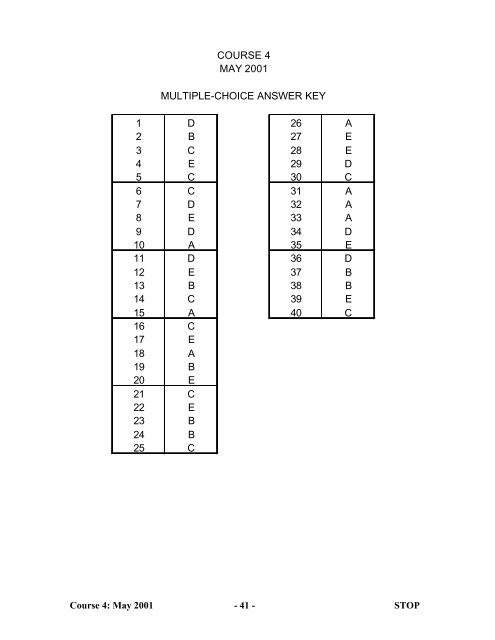

COURSE 4<br />

MAY <strong>2001</strong><br />

MULTIPLE-CHOICE ANSWER KEY<br />

1 D 26 A<br />

2 B 27 E<br />

3 C 28 E<br />

4 E 29 D<br />

5 C 30 C<br />

6 C 31 A<br />

7 D 32 A<br />

8 E 33 A<br />

9 D 34 D<br />

10 A 35 E<br />

11 D 36 D<br />

12 E 37 B<br />

13 B 38 B<br />

14 C 39 E<br />

15 A 40 C<br />

16 C<br />

17 E<br />

18 A<br />

19 B<br />

20 E<br />

21 C<br />

22 E<br />

23 B<br />

24 B<br />

25 C<br />

<strong>Course</strong> 4: <strong>May</strong> <strong>2001</strong> - 41 - STOP

<strong>Course</strong> 4 Exam <strong>Solutions</strong><br />

<strong>May</strong> <strong>2001</strong><br />

Item Number: 1<br />

Key: D<br />

Solution<br />

Because the autocorrelation function is zero starting with lag 2, this must be an MA(1) model.<br />

Then,<br />

−θ<br />

− .4 = ρ = , −.4 − .4 θ =−θ ,.4 θ − θ + .4 = 0.<br />

1<br />

2 2<br />

1 2<br />

1 1 1 1<br />

1+<br />

θ1<br />

This quadratic equation has two roots, 0.5 and 2. Because the coefficient’s absolute value must<br />

be less than 1, only 0.5 is acceptable.<br />

C4<strong>2001</strong>A

Item Number: 2<br />

Key: B<br />

Solution<br />

e λ 1<br />

The posterior distribution is π( λ|2)<br />

2! 3<br />

with parameters 3 and 3/4. The variance is 3(3/4) 2 = 27/16.<br />

−λ<br />

2<br />

−λ/3 2 −4 λ/3<br />

∝ e ∝ λ e which is a gamma distribution<br />

C4<strong>2001</strong>A

Item Number: 3<br />

Key: C<br />

Solution<br />

( 1− 3) + ( 2− 3) + ( 3− 3) + ( 4− 3) + ( 5−3)<br />

2 2 2 2 2<br />

2<br />

2<br />

= = =<br />

µ σ<br />

( 1− 3) + ( 2− 3) + ( 3− 3) + ( 4− 3) + ( 5−3)<br />

4 4 4 4 4<br />

µ<br />

4<br />

= = 6.8<br />

5<br />

µ<br />

4<br />

6.8<br />

γ<br />

2<br />

= = =<br />

4 1.7<br />

σ 4<br />

5<br />

2<br />

C4<strong>2001</strong>A

Item Number: 4<br />

Key: E<br />

Solution<br />

The calculations for each possibility are:<br />

Censored at 1 Censored at 2 Censored at 3 Censored at 4 Censored at 5<br />

Time d Y S $ d Y S $ d Y S $ d Y S $ d Y S $<br />

1 0 5 1 1 5 .80 1 5 .80 1 5 .80 1 5 .80<br />

2 1 4 .75 0 4 .80 1 4 .60 1 4 .60 1 4 .60<br />

3 1 3 .50 1 3 .53 0 3 .60 1 3 .40 1 3 .40<br />

4 1 2 .25 1 2 .27 1 2 .30 0 2 .40 1 2 .20<br />

5 1 1 0 1 1 0 1 1 0 1 1 0 0 1 .20<br />

This result may also be obtained by general reasoning. If the lapse occurs late, then the “death”<br />

times come earlier, leading to lower survival probabilities. If the lapse occurs early, then the<br />

“death” times come later, leading to higher survival probabilities.<br />

C4<strong>2001</strong>A

Item Number: 5<br />

Key: C<br />

Solution<br />

This is testing H0: β4 = β5<br />

= 0, which is a joint test on several regression coefficients.<br />

The key formula is 5.21 (p.130 of Pindyck and Rubinfeld).<br />

2<br />

We are given: R UR = 094 .<br />

Also, we know: N = 42, k = 5 (total number of coefficients to be estimated) and q = 2<br />

Using 5.21, we obtain F =<br />

b094 . − 0915 . g / 2<br />

b1 − 094 . g / b42 −5g<br />

= 77 . .<br />

C4<strong>2001</strong>A

Item Number: 6<br />

Key: C<br />

Solution<br />

The number of expected claims (e) is proportional to the number of exposure units (n). Let e =<br />

cn. Using Bühlmann credibility and partial credibility gives:<br />

25 1 25/ 25<br />

= = c =<br />

100 2 25/ c+ k 25+<br />

ck<br />

Therefore ck = 25.<br />

When we have 100 expected claims,<br />

100/ c 100 100<br />

Z = = = = 0.80.<br />

100/ c+ k 100+ ck 100+<br />

25<br />

C4<strong>2001</strong>A

Item Number: 7<br />

Key: D<br />

Solution<br />

Following Example 2.71 in Loss Models (with no denominator because this problem has no<br />

deductible), the contribution to the likelihood function for a loss (x) below 1000 is<br />

1 x / θ<br />

f ( x)<br />

= θ − e<br />

−<br />

−1000/<br />

θ<br />

while for observations censored at 1000 it is 1 − F(1000)<br />

= e . The<br />

likelihood function is:<br />

⎛ ⎞⎛ ⎞<br />

j<br />

L( θ) = ⎜ θ e ⎟⎜ e ⎟=<br />

θ e<br />

62 100<br />

−1 − x / θ −1000/ θ −62 − (28,140+<br />

38,000)/ θ<br />

∏<br />

The logarithm and its derivative are:<br />

∏<br />

⎝ j= 1 ⎠⎝ j=<br />

63 ⎠<br />

l( θ) =−62ln( θ ) −66,140θ<br />

l′ ( θ) =− 62θ + 66,140θ<br />

−1 −2<br />

−1<br />

Setting the derivative equal to zero yields θ ˆ = 66,140/62= 1067 .<br />

C4<strong>2001</strong>A

Item Number: 8<br />

Key: E<br />

Solution<br />

ˆ d<br />

1 1 1<br />

( 14<br />

i<br />

B ) = ∑ = + + = 4.65<br />

Qt ( ) 0.25+ 0.15+ 0.5 0.15+<br />

0.5 0.5<br />

ti≤14<br />

i<br />

C4<strong>2001</strong>A

Item Number: 9<br />

Key: D<br />

Solution<br />

ESSR<br />

− ESSUR<br />

F statistic = bN − kg b g<br />

q ESS<br />

N = 100<br />

k = 3<br />

q = 2<br />

Series I: F = 97<br />

Series II: F = 97<br />

Series III: F = 97<br />

b<br />

b<br />

UR<br />

g<br />

3552. 2−<br />

32338 .<br />

2 32338 .<br />

b<br />

b<br />

g<br />

13005 . − 11318 .<br />

2 11318 .<br />

b<br />

b<br />

g<br />

g<br />

g<br />

237. 0−<br />

2111 .<br />

2 2111 .<br />

b<br />

g<br />

g<br />

= 4. 78,<br />

Fail to reject<br />

= 7. 23,<br />

Reject<br />

= 595 . , Reject<br />

C4<strong>2001</strong>A

Item Number: 10<br />

Key: A<br />

Solution<br />

= E N A E X A = b2 / 3gb990g<br />

= 660<br />

= E N B E X B = b4 /<br />

276g<br />

= 368<br />

c = h = c = h c = h = b gb g = =<br />

c h c h c 1 2 h b gb gb g<br />

PcA500h 12/ 28 3/ 7 and Pc B500h<br />

4 / 7<br />

E L A<br />

E L B<br />

P L 500 A P N 1A P X 500 A 4 / 9 1/ 3 4 / 27 12/<br />

81<br />

P L = 500 B = P N = 2 B P X = X = 250 B = 4 / 9 2 / 3 2 / 3 = 16 / 81<br />

⇒ = = =<br />

( ) ( )<br />

E⎡⎣L2 L1 = 500⎤⎦<br />

= 3/7660+ 4/7368=<br />

493<br />

C4<strong>2001</strong>A

Item Number: 11<br />

Key: D<br />

Solution<br />

2 2<br />

( ) ( ) [ ] 2<br />

VHM = ⎡<br />

⎣<br />

1/2660 + 1/2368 ⎤<br />

⎦<br />

− 514 = 285,512− 264,196=<br />

21,316<br />

Total variance = 296,962<br />

EPV = Total variance – VHM = 275,646<br />

EPV<br />

1<br />

k = = 12.9314⇒ Z = = 0.07178<br />

VHM<br />

1+<br />

k<br />

Bühlmann credibility premium Z ( Z)<br />

= 500 + 514 1− = 513<br />

C4<strong>2001</strong>A

Item Number: 12<br />

Key: E<br />

Solution<br />

The distribution function is ( )<br />

yields the K-S statistic:<br />

F<br />

1<br />

x<br />

−3<br />

∫ 2(1 ) 1 . From it, the following table<br />

0<br />

2<br />

F x = + t dt = −<br />

( 1+<br />

x)<br />

x .1 .2 .5 1.0 1.3<br />

F x<br />

b g .174 .306 .556 .75 .811<br />

x −<br />

0 .2 .4 .6 .8<br />

bx<br />

g .2 .4 .6 .8 1.0<br />

n<br />

n +<br />

The K-S statistic is 0.189.<br />

F<br />

Max diff. .174 .106 .156 .15 .189<br />

C4<strong>2001</strong>A

Item Number: 13<br />

Key: B<br />

Solution<br />

2<br />

2<br />

∑c i h ∑c 2i<br />

2h<br />

Divide the first equation by Y − Y X − X<br />

2<br />

2<br />

∑cYi<br />

− Yh ∑cX3i<br />

− X3h<br />

to get the equations:<br />

and the second equation by<br />

r<br />

YX<br />

2<br />

sX<br />

s<br />

2 X3<br />

= $ 2 + $ 3 rX X = $ *<br />

2 + $ *<br />

β β β β 3r<br />

s s<br />

Y<br />

Y<br />

X X<br />

2 3 2 3<br />

r<br />

YX<br />

3<br />

sX<br />

s<br />

2<br />

X3<br />

= β $ rX X + β $ = β $ r<br />

2 3<br />

X2X<br />

+ β $<br />

3<br />

s<br />

s<br />

* *<br />

2 3 2 3<br />

Y<br />

Y<br />

Solve these equations for $ *<br />

rYX − r . . .<br />

2 YX r<br />

3 X 04 09 06<br />

2X<br />

−<br />

3<br />

β 2 =<br />

=<br />

2 2<br />

1−<br />

r 1−<br />

0.<br />

6<br />

X X<br />

2 3<br />

b gb g<br />

b g<br />

= −0.<br />

22.<br />

C4<strong>2001</strong>A

Item Number: 14<br />

Key: C<br />

Solution<br />

σ<br />

2<br />

H<br />

di<br />

15 20 13<br />

20 = ∑ = + + = 0.0144<br />

2 2 2<br />

Y 100 65 40<br />

( )<br />

ti<br />

≤20<br />

σ H b20g = 0. 0144 = 012 .<br />

i<br />

C4<strong>2001</strong>A

Item Number: 15<br />

Key: A<br />

Solution<br />

=zτ<br />

µ $ S $ btgdt<br />

τ<br />

0<br />

b g b g b g b g<br />

= 10 . × 1 + 085 . × 7 + 05885 . × 9 + 03972 . × 8 = 1542 .<br />

z<br />

D<br />

L V$ $ S$<br />

di<br />

µ = τ N M<br />

2<br />

τ<br />

∑ btgdt<br />

ti<br />

i=<br />

1<br />

QP Yib Yi − dig<br />

O<br />

2 2 2<br />

= 14424 . × 00018 . + 8474 . × 00068 . + 3178 . × 00120 .<br />

= 0.9840<br />

The 95% confidence interval is:<br />

15.42± 1.96×<br />

0.9840<br />

b<br />

135 . , 17.<br />

4<br />

g<br />

C4<strong>2001</strong>A

Item Number: 16<br />

Key: C<br />

Solution<br />

The Weibull density function is<br />

.5<br />

.5 ( x / θ )<br />

θ − −<br />

f ( x) = .5( x ) e . Therefore the likelihood function is<br />

The logarithm and its derivative are:<br />

10<br />

.5<br />

−.5<br />

−( x j/ θ)<br />

L( θ) = ∏.5( xjθ)<br />

e<br />

j=<br />

1<br />

−.5<br />

10<br />

10 −5<br />

∏ xj<br />

θ<br />

j=<br />

1<br />

⎛ ⎞<br />

= (.5)<br />

e<br />

∑<br />

⎜ ⎟<br />

⎝ ⎠<br />

∝ θ<br />

−.5<br />

−5 −488.97θ<br />

e<br />

.<br />

−.5 10 .5<br />

−θ<br />

x<br />

j = 1<br />

j<br />

l( θ) =−5lnθ−488.97θ<br />

l′ =− +<br />

−.5<br />

−1 −1.5<br />

( θ) 5θ 244.485 θ .<br />

Setting the derivative equal to zero yields<br />

2<br />

ˆ (244.485/5) 2391.<br />

θ = =<br />

C4<strong>2001</strong>A

Item Number: 17<br />

Key: E<br />

Solution<br />

The estimated variance of the forecast errors is the sum of the squares of the error terms divided<br />

by T − p − q. In this case, after 100 observations, the sum of the squares of the error terms must<br />

equal 98, because the sum divided by b100 −1−1g, or 98, is 1.0.<br />

The 101 st observation introduces a new error term equal to 188−197, or − 9. The square of that<br />

term is 81. Adding 81 to the previous sum of 98 gives a new total of 179. Dividing 179 by<br />

b101−1−1g, or 99, gives a new estimated variance of 1.8.<br />

C4<strong>2001</strong>A

Item Number: 18<br />

Key: A<br />

Solution<br />

− 5 .2 6 1.2<br />

The posterior distribution is ( |0) e λ −<br />

(.5)5 e λ −<br />

(.5).2e λ −<br />

π λ<br />

2.5 e λ −<br />

∝ ⎡<br />

⎣<br />

+ ⎤<br />

⎦<br />

= + .1 e<br />

λ . The<br />

∞<br />

−6 1.2<br />

normalizing constant can be obtained from 2.5 e λ − λ<br />

∫<br />

⎡ + .1 e ⎤dλ<br />

= .5<br />

0 ⎣<br />

⎦ and therefore the exact<br />

−6λ<br />

−1.2λ<br />

posterior density is π( λ|0) = 5 e + .2e<br />

. The expected number of claims in the next year is<br />

∞<br />

−6λ<br />

−1.2λ<br />

5 5 5<br />

the posterior mean, E( Λ |0) = ∫ λ[5 e + .2 e ] dλ<br />

= + = = .278.<br />

0<br />

36 36 18<br />

C4<strong>2001</strong>A

Item Number: 19<br />

Key: B<br />

Solution<br />

There are 365 observations, so the expected count for k accidents is<br />

produces the following table:<br />

− .6 k<br />

e (.6)<br />

365pk<br />

= 365 which<br />

k!<br />

No. of accidents Observed Expected Chi-square<br />

0 209 200.32 0.38<br />

1 111 120.19 0.70<br />

2 33 36.06 0.26<br />

3 7 7.21 1.51**<br />

4 3 1.08<br />

5 2 0.14*<br />

*This number is 365 minus the sum of the other expected counts.<br />

**The last three cells must be grouped to get the expected count above 5. The calculation for the<br />

test statistic is (12 – 8.43) 2 /8.43 = 1.51. The total of the chi-square numbers is the test statistic of<br />

2.85.<br />

C4<strong>2001</strong>A

Item Number: 20<br />

Key: E<br />

Solution<br />

The likelihood ratio test statistic is ( − 382.4+ 385.9)<br />

⋅ 2= 7.<br />

C4<strong>2001</strong>A

Item Number: 21<br />

Key: C<br />

Solution<br />

8<br />

2<br />

20<br />

2<br />

⎛Yt<br />

−α⎞ ⎛Yt<br />

−α<br />

⎞<br />

∑ ∑ to be a minimum. Setting the derivative equal to<br />

We need for S( α)<br />

= ⎜ ⎟ + ⎜ ⎟<br />

t= 1⎝ 0.4 ⎠ t=<br />

9 ⎝ 0.6 ⎠<br />

8 20<br />

1 1<br />

zero produces the equation S′ ( α) = 2( Yt<br />

− α) + 2( Yt<br />

− α) = 0.<br />

.4 t= 1 .6 t=<br />

9<br />

produces the equation:<br />

∑ ∑ Multiplying by 0.6<br />

0 = 3(8Y<br />

− 8 α) + 2(12Y<br />

−12 α)<br />

1 2<br />

0 = 24Y<br />

+ 24Y<br />

−48α<br />

1 2<br />

αˆ = .5 Y + .5Y<br />

1 2<br />

C4<strong>2001</strong>A

Item Number: 22<br />

Key: E<br />

Solution<br />

Ο=4<br />

E = (.29 − .27) + (.35 − .27) + (.41 − .27) + 7.465 ( − .27)<br />

= 1.605<br />

b<br />

Chi-square statistic = 4 − 1605 . / 1605 . = 357 .<br />

The 0.05 level of significance is 3.84, so the answer is (E).<br />

g<br />

2<br />

C4<strong>2001</strong>A

Item Number: 23<br />

Key: B<br />

Solution<br />

The Bühlmann-Straub credibility factor is<br />

n<br />

w +<br />

n +<br />

a<br />

v<br />

m<br />

which goes to<br />

n<br />

n +<br />

w<br />

a<br />

as m goes to infinity.<br />

C4<strong>2001</strong>A

Item Number: 24<br />

Key: B<br />

Solution<br />

With a lognormal error component, the linear model should be for the logarithm of the<br />

observation. A model that conforms to the description is<br />

lnY = α + α D + β X + ε .<br />

* * * *<br />

1 2 1<br />

Exponentiating both sides yields<br />

* * * *<br />

α1 α2 D β1<br />

X ε<br />

Y = e e e e<br />

and then defining an unstarred quantity as its starred version exponentiated, we have<br />

Y<br />

= αα β ε<br />

D X<br />

1 2 1<br />

.<br />

Note that when D is 1, the value of Y is multiplied by<br />

2<br />

α and so the hypothesis to test is if this<br />

value is equal to 0.8.<br />

C4<strong>2001</strong>A

Item Number: 25<br />

Key: C<br />

Solution<br />

The function of interest is f ( αβ , ) = α+ 10 β.<br />

The partial derivatives are 1 and 10 and so the<br />

variance can be estimated as<br />

⎡αˆ 2<br />

⎤⎡1<br />

⎤<br />

σˆ<br />

[ 110]<br />

Var ˆ<br />

f<br />

= ⎢ ˆ⎥⎢ 10<br />

⎥<br />

⎣β<br />

⎦⎣ ⎦<br />

⎡ 0.00055 −0.00010⎤⎡ 1⎤<br />

= [ 110]<br />

⎢<br />

0.00010 0.00002<br />

⎥⎢<br />

10<br />

⎥<br />

⎣−<br />

⎦⎣ ⎦<br />

= 0.00055− 2× 0.00010× 10+ 0.00002×<br />

100<br />

= 0.00055<br />

and so the standard deviation is the square root, or 0.02345.<br />

C4<strong>2001</strong>A

Item Number: 26<br />

Key: A<br />

Solution<br />

Following Klein and Moeschberger with the time scale shifted by 1997:<br />

T i L i R i d i Y i P[ L< l | L<<br />

3]<br />

i<br />

0 0 2 6<br />

1 0 2 5<br />

2 0 2 4 15 (99/160) ⋅ 0 = 0<br />

0 1 1 3<br />

1 1 1 2 16 (9/10) ⋅ (11/16) = 99/160<br />

0 2 0 1 10 9/10<br />

9 99<br />

P[ L= 1| L< 3] = P[ L< 2| L< 3] − P[ L< 1| L< 3]<br />

= − = 0.28125<br />

10 160<br />

C4<strong>2001</strong>A

Item Number: 27<br />

Key: E<br />

Solution<br />

From formula 15.41:<br />

yt<br />

825 784 710 918<br />

zt<br />

= , z6 = , z18 = , z30 = , z42<br />

=<br />

y%<br />

843 804 740 905<br />

t<br />

From formula 15.42:<br />

~z 6 =<br />

1<br />

4bz6 + z18 + z30 + z42g<br />

~ z<br />

1 . . . . .<br />

6 = 4<br />

09786 + 09751+ 09595+ 10144 = 09819<br />

b<br />

Adjustment factor = 12/11.9607 =1.0033<br />

g<br />

z<br />

y<br />

6<br />

a<br />

42<br />

= .9819*1.0033=<br />

0.9851<br />

918<br />

= = 932<br />

0.9851<br />

C4<strong>2001</strong>A

Item Number: 28<br />

Key: E<br />

Solution<br />

Die/Spinner Prior probability Probability of<br />

getting a 12<br />

Posterior<br />

Probability<br />

AX 1/4 3/4× 1/2= 3/8 1/4<br />

AY 1/4 3/4× 1= 3/4 1/2<br />

BX 1/4 1/4× 1/2= 1/8 1/12<br />

BY 1/4 1/4× 1= 1/4 1/6<br />

Total 1 3/2 1<br />

Die/Spinner Expected Value Posterior Probability Expected Value ×<br />

posterior probability<br />

AX (3/4)(1/2)(12+c) 1/4 1.125+3/32c<br />

AY (3/4)(12) 1/2 4.5<br />

BX (1/4)(1/2)(12+c) 1/12 0.125+1/96c<br />

BY (1/4)(12) 1/6 0.5<br />

Total 1 6.25+10/96c<br />

Because the expected value is 10, 6.25+10/96c = 10, so c = 36.<br />

C4<strong>2001</strong>A

Item Number: 29<br />

Key: D<br />

Solution<br />

Summing the ranks of the A’s (being careful to average for ties) gives<br />

(1+2+6+6+8.5+8.5+10+11+13.5+20) = 86.5 (or 123.5 working with B’s).<br />

*<br />

E R = 105, Var R = 175,so r =± 1.398giving p=<br />

0.162.<br />

( ) ( )<br />

H0 H0<br />

C4<strong>2001</strong>A

Item Number: 30<br />

Key: C<br />

Solution<br />

The maximum likelihood estimate of the mean, θ, is the sample mean, 367.9.<br />

2<br />

Two years of inflation at 5% inflates this scale parameter toθ = 1.05 (367.9) = 405.6.<br />

The expected amount paid per loss is<br />

E( X ∧1000) −EX<br />

( ∧100)<br />

= − − +<br />

−1000/405.6 −100/405.6<br />

405.6(1 e 1 e )<br />

= 283.<br />

C4<strong>2001</strong>A

Item Number: 31<br />

Key: A<br />

Solution<br />

L<br />

( â)<br />

β1 β 2<br />

β<br />

⎛<br />

3<br />

⎛ e ⎞⎛ e ⎞⎛e<br />

⎞⎞<br />

= ⎜⎜ β1 β2 β ⎟⎜<br />

3 β2<br />

β ⎟⎜<br />

3 β ⎟<br />

3<br />

e + e + e e + e e ⎟<br />

⎝⎝ ⎠⎝ ⎠⎝ ⎠⎠<br />

C4<strong>2001</strong>A

Item Number: 32<br />

Key: A<br />

Solution<br />

2 3<br />

∑∑<br />

i=<br />

1<br />

( − )<br />

mij xij xi<br />

i= 1 j=<br />

1<br />

2020<br />

vˆ = = = 505<br />

2<br />

2+<br />

2<br />

2<br />

∑<br />

( 3−1)<br />

2<br />

( − ) −ˆ ( 2−1)<br />

m x x v<br />

2<br />

4800−<br />

505 4295<br />

i i<br />

i=<br />

1<br />

ˆ = = = = 114.5333<br />

2 2 2<br />

1 2<br />

m−<br />

m<br />

100− ( 1/100) ( 25 + 75 ) 37.5<br />

∑ i<br />

m i=<br />

1<br />

a<br />

∑<br />

ˆ vˆ<br />

k = = 4.4092<br />

aˆ<br />

25<br />

Zˆ 1<br />

= = 0.850074<br />

25 + kˆ<br />

75<br />

and Zˆ 2<br />

= = 0.944475<br />

75+<br />

kˆ<br />

ZX ˆ<br />

Zˆ<br />

+ Zˆ<br />

X<br />

+ Zˆ<br />

1 1 2 2<br />

ˆ = = 105.4208<br />

µ<br />

1 2<br />

Bühlmann credibility premium Zˆ ( ) ( Z ˆ<br />

)( µ ˆ )<br />

= 97 + 1− = 98.26<br />

1 1<br />

C4<strong>2001</strong>A

Item Number: 33<br />

Key: A<br />

Solution<br />

According to a statement on page 159 of Pindyck and Rubinfeld, the estimator is unbiased.<br />

C4<strong>2001</strong>A

Item Number: 34<br />

Key: D<br />

Solution<br />

The observations are right and left truncated and the truncation depends upon the report year.<br />

For report year 1997 only claims settled at durations 1 and 2 can be observed, so the denominator<br />

must be the sum of those two probabilities. For 1998, only durations 0 and 1 can be observed<br />

and for 1999 only duration 0 can be observed. Calculation of the denominator probabilities is<br />

summarized below.<br />

Probabilities<br />

Year<br />

Year Settled<br />

Reported 1998 1999<br />

1997 b1− pgp<br />

1− p p<br />

1998 1− p<br />

Sum<br />

(Denominator)<br />

− p p + p<br />

2<br />

b g b1 g b1<br />

g<br />

b g b1− pgp<br />

b1 − p gb1+<br />

pg<br />

b g b1− pg<br />

1999 1− p<br />

The likelihood function is:<br />

( )<br />

( ) ( )<br />

( 1+<br />

p)<br />

11<br />

2<br />

( )<br />

( ) ( )<br />

( )<br />

( ) ( )<br />

( )<br />

( ) ( )<br />

( )<br />

( )<br />

3 1 5 2 4<br />

⎛ 1− p p ⎞⎛ 1− p p ⎞⎛ 1−p ⎞⎛ 1− p p ⎞ ⎛ 1−<br />

p ⎞<br />

L( p)<br />

= ⎜ 1− p p 1+ p ⎟⎜ 1− p p 1+ p ⎟⎜ 1− p 1+ p ⎟⎜ 1− p 1+ p ⎟ ⎜ 1−<br />

p ⎟<br />

⎝ ⎠⎝ ⎠⎝ ⎠⎝ ⎠ ⎝ ⎠<br />

3 1 5 2<br />

⎛ 1 ⎞⎛ p ⎞⎛ 1 ⎞⎛ p ⎞<br />

= ⎜<br />

1 p ⎟⎜<br />

1 p ⎟⎜<br />

1 p ⎟⎜<br />

1 p ⎟<br />

⎝ + ⎠⎝ + ⎠⎝ + ⎠⎝ + ⎠<br />

3<br />

p<br />

=<br />

The loglikelihood is l( p) = 3ln( p) − 11ln( 1+<br />

p)<br />

Take the derivative with respect to p to obtain the equation to solve:<br />

3 11<br />

− = 0<br />

p 1 + p<br />

b<br />

g<br />

The solution is p $ = 3 .<br />

8<br />

C4<strong>2001</strong>A

Item Number: 35<br />

Key: E<br />

Solution<br />

( ) ( )<br />

t d Y ∆ H % 4 −t<br />

H t K t*<br />

i<br />

( t)<br />

∆Vˆ<br />

⎡ ⎣<br />

H%<br />

( t)<br />

⎤ t* = ⎦ b Kbt * g<br />

∆ % ˆ ( ) Kt (*)<br />

∆V ⎡H%<br />

t ⎤<br />

⎛ ⎞<br />

⎜<br />

b<br />

⎣ ⎦ b<br />

⎟ ⎝ ⎠<br />

1 1 9 0.1111 0.01235 1.0000 0.000 0.0000 0.000000<br />

3 2 8 0.2500 0.03125 0.3333 0.741 0.0617 0.001905<br />

5 1 5 0.2000 0.04000 −0.3333 0.741 0.0494 0.002439<br />

8 2 3 0.6667 0.22222 −1.3333 0.000 0.0000 0.000000<br />

10 1 1 1.0000 1.00000 −2.0000 0.000 0.0000 0.000000<br />

h ˆ(4) = 0.1111<br />

2<br />

σ [ hˆ<br />

(4)] = 0.00434<br />

2<br />

Lower confidence limit:<br />

1.96 0.00434/0.1111<br />

0.1111e − = 0.035<br />

Upper confidence limit:<br />

1.96 0.00434/0.1111<br />

0.1111e = 0.355<br />

C4<strong>2001</strong>A

Item Number: 36<br />

Key: D<br />

Solution<br />

See page 555 of Pindyck and Rubinfeld. The variance is 1/T, not T, and the statement is then<br />

only true for large displacements.<br />

C4<strong>2001</strong>A

Item Number: 37<br />

Key: B<br />

Solution<br />

The first step is to get the posterior distribution of P given no claims:<br />

π( p|0) ∝ f(0| p) π( p)<br />

= e<br />

−+ 1 0.01p<br />

(0.01)<br />

0.01p<br />

∝ e < p <<br />

,0 100<br />

The normalizing constant can be found from<br />

∫<br />

100 100<br />

0.01p<br />

0.01p<br />

0<br />

e dp = 100e = 100( e− 1) = 171.83.<br />

0<br />

The posterior density is<br />

Then,<br />

1<br />

π = < <<br />

171.83<br />

0.01p<br />

( p|0) e ,0 p 100.<br />

1 100<br />

171.83 171.83<br />

100<br />

0.01 p<br />

.5<br />

Pr( P > 50|0) = ∫ e dp = ( e− e ) = 0.622.<br />

50<br />

C4<strong>2001</strong>A

Item Number: 38<br />

Key: B<br />

Solution<br />

µ ( p) = 1−0.01p<br />

µ = E[ µ ( p)] = E(1− 0.01 p) = 1− 0.01(50) = 0.5<br />

2<br />

100<br />

a = Var[ µ ( p)] = Var(1− 0.01 p) = 0.0001 Var( p) = 0.0001 = 1/12<br />

12<br />

vp ( ) = 1−0.01p<br />

v= Evp [ ( )] = 0.5<br />

k = v/ a= (1/2)/(1/12) = 6<br />

Z = 4/(4+ 6) = 0.4<br />

P = 0.4(5/4) + 0.6(0.5) = 0.8<br />

c<br />

The number of claims is Poisson, so the mean and variance are the Poisson parameter, 1 – 0.01p.<br />

The mean and variance of p come from the uniform distribution.<br />

C4<strong>2001</strong>A

Item Number: 39<br />

Key: E<br />

Solution<br />

For a mixture, the mean and second raw moments are a mixture of the component means and<br />

second raw moments. Therefore,<br />

E( X) = p(1) + (1 − p)(10) = 10−9p<br />

2<br />

E( X ) = p(2) + (1 − p)(200) = 200−198p<br />

Var X p p p p<br />

2 2<br />

( ) = 200−198 −(10− 9 ) = 100−18 − 81 = 4.<br />

The only positive root of the quadratic equation is p = 0.983.<br />

C4<strong>2001</strong>A

Item Number: 40<br />

Key: C<br />

Solution<br />

s<br />

2<br />

=<br />

∑<br />

2<br />

ε$<br />

i 967<br />

1934<br />

N − 2<br />

= 5<br />

= .<br />

2<br />

β$<br />

s<br />

2<br />

s 1934 .<br />

= = = 0.<br />

0967<br />

2<br />

x 2000<br />

∑<br />

i<br />

s<br />

β$<br />

= 031 .<br />

C4<strong>2001</strong>A