Abstract

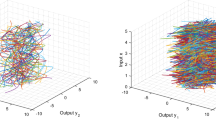

In this paper we derive the asymptotic properties of the least squares estimator (LSE) of fractionally integrated autoregressive moving-average (FARIMA) models under the assumption that the errors are uncorrelated but not necessarily independent nor martingale differences. We relax the independence and even the martingale difference assumptions on the innovation process to extend considerably the range of application of the FARIMA models. We propose a consistent estimator of the asymptotic covariance matrix of the LSE which may be very different from that obtained in the standard framework. A self-normalized approach to confidence interval construction for weak FARIMA model parameters is also presented. All our results are done under a mixing assumption on the noise. Finally, some simulation studies and an application to the daily returns of stock market indices are presented to corroborate our theoretical work.

Similar content being viewed by others

Notes

To cite few examples of nonlinear processes, let us mention the self-exciting threshold autoregressive (SETAR), the smooth transition autoregressive (STAR), the exponential autoregressive (EXPAR), the bilinear, the random coefficient autoregressive (RCA), the functional autoregressive (FAR) (see Tong (1990) and Fan and Yao (2008) for references on these nonlinear time series models).

Recall that the fractional version of Cesàro’s Lemma states that for \((h_t)_t\) a sequence of positive reals, \(\kappa >0\) and \(c\ge 0\) we have

$$\begin{aligned} \lim _{t\rightarrow \infty }h_tt^{1-\kappa }=\left| \kappa \right| c \Rightarrow \lim _{n\rightarrow \infty }\frac{1}{n^{\kappa }}\sum _{t=0}^n h_t=c. \end{aligned}$$

References

Aknouche A, Francq C (2021) Count and duration time series with equal conditional stochastic and mean orders. Economet Theory 37(2):248–280

Akutowicz EJ (1957) On an explicit formula in linear least squares prediction. Math Scand 5:261–266

Anderson TW (1971) The statistical analysis of time series. Wiley, New York

Baillie RT, Chung C-F, Tieslau MA (1996) Analysing inflation by the fractionally integrated ARFIMA-GARCH model. J Appl Economet 11(1):23–40

Beran J (1995) Maximum likelihood estimation of the differencing parameter for invertible short and long memory autoregressive integrated moving average models. J Roy Stat Soc Ser B 57(4):659–672

Beran J, Feng Y, Ghosh S, Kulik R (2013) Long-memory processes. Probabilistic properties and statistical methods. Springer, Heidelberg

Berk KN (1974) Consistent autoregressive spectral estimates. Ann Stat 2:489–502 (collection of articles dedicated to Jerzy Neyman on his 80th birthday)

Boubacar Maïnassara Y (2012) Selection of weak VARMA models by modified Akaike’s information criteria. J Time Series Anal 33(1):121–130

Boubacar Mainassara Y, Carbon M, Francq C (2012) Computing and estimating information matrices of weak ARMA models. Comput Stat Data Anal 56(2):345–361

Boubacar Mainassara Y, Francq C (2011) Estimating structural VARMA models with uncorrelated but non-independent error terms. J Multivar Anal 102(3):496–505

Boubacar Maïnassara Y, Kokonendji CC (2016) Modified Schwarz and Hannan-Quinn information criteria for weak VARMA models. Stat Inference Stoch Process 19(2):199–217

Boubacar Maïnassara Y, Saussereau B (2018) Diagnostic checking in multivariate ARMA models with dependent errors using normalized residual autocorrelations. J Am Stat Assoc 113(524):1813–1827

Brillinger DR (1981) Time series: data analysis and theory, vol 36. SIAM

Cavaliere G, Nielsen MØ, Taylor AR (2017) Quasi-maximum likelihood estimation and bootstrap inference in fractional time series models with heteroskedasticity of unknown form. J Economet 198(1):165–188

Chiu S-T (1988) Weighted least squares estimators on the frequency domain for the parameters of a time series. Ann Stat 16(3):1315–1326

Dahlhaus R (1989) Efficient parameter estimation for self-similar processes. Ann Stat 17(4):1749–1766

Davidson J (1994) Stochastic limit theory. An introduction for econometricians. Advanced texts in econometrics. The Clarendon Press, Oxford University Press, New York

Davis RA, Matsui M, Mikosch T, Wan P (2018) Applications of distance correlation to time series. Bernoulli 24(4A):3087–3116

Ding Z, Granger CW, Engle RF (1993) A long memory property of stock market returns and a new model. J Empir Finance 1:83–106

Dominguez MA, Lobato IN (2003) Testing the martingale difference hypothesis. Economet Rev 22(4):351–377

Doukhan P, León J (1989) Cumulants for stationary mixing random sequences and applications to empirical spectral density. Probab Math Stat 10:11–26

Escanciano JC, Velasco C (2006) Testing the martingale difference hypothesis using integrated regression functions (Nonlinear Modelling and Financial Econometrics). Comput Stat Data Anal 51(4):2278–2294

Fan J, Yao Q (2008) Nonlinear time series: nonparametric and parametric methods. Springer

Fox R, Taqqu MS (1986) Large-sample properties of parameter estimates for strongly dependent stationary Gaussian time series. Ann Stat 14(2):517–532

Francq C, Roy R, Zakoïan J-M (2005) Diagnostic checking in ARMA models with uncorrelated errors. J Am Stat Assoc 100(470):532–544

Francq C, Zakoïan J-M (1998) Estimating linear representations of nonlinear processes. J Stat Plann Inference 68(1):145–165

Francq C, Zakoïan J-M (2005) Recent results for linear time series models with non independent innovations. In: Statistical modeling and analysis for complex data problems, vol 1 of GERAD 25th Anniv Ser. Springer, New York, pp 241–265

Francq C, Zakoïan J-M (2007) HAC estimation and strong linearity testing in weak ARMA models. J Multivar Anal 98(1):114–144

Francq C, Zakoïan J-M (2019) GARCH models: structure, statistical inference and financial applications. Wiley

Giraitis L, Surgailis D (1990) A central limit theorem for quadratic forms in strongly dependent linear variables and its application to asymptotical normality of Whittle’s estimate. Probab Theory Related Fields 86(1):87–104

Granger CWJ, Joyeux R (1980) An introduction to long-memory time series models and fractional differencing. J Time Ser Anal 1(1):15–29

Hallin M, Taniguchi M, Serroukh A, Choy K (1999) Local asymptotic normality for regression models with long-memory disturbance. Ann Stat 27(6):2054–2080

Hauser M, Kunst R (1998) Fractionally integrated models with arch errors: with an application to the swiss 1-month Euromarket interest rate. Rev Quant Financ Acc 10(1):95–113

Herrndorf N (1984) A functional central limit theorem for weakly dependent sequences of random variables. Ann Probab 12(1):141–153

Hosking JRM (1981) Fractional differencing. Biometrika 68(1):165–176

Hsieh DA (1989) Testing for nonlinear dependence in daily foreign exchange rates. J Bus 62(3):339–368

Hualde J, Robinson PM (2011) Gaussian pseudo-maximum likelihood estimation of fractional time series models. Ann Stat 39(6):3152–3181

Keenan DM (1987) Limiting behavior of functionals of higher-order sample cumulant spectra. Ann Stat 15(1):134–151

Klimko LA, Nelson PI (1978) On conditional least squares estimation for stochastic processes. Ann Stat 6(3):629–642

Kuan C-M, Lee W-M (2006) Robust \(M\) tests without consistent estimation of the asymptotic covariance matrix. J Am Stat Assoc. 101(475):1264–1275

Ling S (2003) Adaptive estimators and tests of stationary and nonstationary short- and long-memory ARFIMA-GARCH models. J Am Stat Assoc 98(464):955–967

Ling S, Li WK (1997) On fractionally integrated autoregressive moving-average time series models with conditional heteroscedasticity. J Am Stat Assoc 92(439):1184–1194

Lobato IN (2001) Testing that a dependent process is uncorrelated. J Am Stat Assoc 96(455):1066–1076

Lobato IN, Nankervis JC, Savin NE (2001) Testing for autocorrelation using a modified box- pierce q test. Inter Econ Rev 42(1):187–205

Newey WK (1991) Uniform convergence in probability and stochastic equicontinuity. Econometrica 59(4):1161–1167

Nielsen MØ (2015) Asymptotics for the conditional-sum-of-squares estimator in multivariate fractional time-series models. J Time Ser Anal 36(2):154–188

Palma W (2007) Long-memory time series. Wiley series in probability and statistics. Theory and methods. Wiley, Hoboken

Romano JP, Thombs LA (1996) Inference for autocorrelations under weak assumptions. J Am Stat Assoc 91(434):590–600

Shao X (2010a) Corrigendum: a self-normalized approach to confidence interval construction in time series. J. R. Stat. Soc. Ser. B Stat. Methodol. 72(5):695–696

Shao X (2010b) Nonstationarity-extended Whittle estimation. Economet Theory 26(4):1060–1087

Shao X (2010c) A self-normalized approach to confidence interval construction in time series. J R Stat Soc Ser B Stat Methodol 72(3):343–366

Shao X (2011) Testing for white noise under unknown dependence and its applications to diagnostic checking for time series models. Economet Theory 27(2):312–343

Shao X (2012) Parametric inference in stationary time series models with dependent errors. Scand J Stat 39(4):772–783

Shao X (2015) Self-normalization for time series: a review of recent developments. J Am Stat Assoc 110(512):1797–1817

Sowell F (1992) Maximum likelihood estimation of stationary univariate fractionally integrated time series models. J Economet 53(1–3):165–188

Székely GJ, Rizzo ML, Bakirov NK (2007) Measuring and testing dependence by correlation of distances. Ann Stat 35(6):2769–2794

Taniguchi M (1982) On estimation of the integrals of the fourth order cumulant spectral density. Biometrika 69(1):117–122

Taqqu MS, Teverovsky V (1997) Robustness of Whittle-type estimators for time series with long-range dependence (Heavy tails and highly volatile phenomena). Commun. Statist. Stoch. Models 13(4):723–757

Tong H (1990) Non-linear time series: a dynamical system approach. Oxford University Press

Whittle P (1953) Estimation and information in stationary time series. Ark Mat 2:423–434

Zhu K, Li WK (2015) A bootstrapped spectral test for adequacy in weak ARMA models. J Econometr 187(1):113–130

Zhu K, Ling S (2011) Global self-weighted and local quasi-maximum exponential likelihood estimators for ARMA-GARCH/IGARCH models. Ann Stat 39(4):2131–2163

Acknowledgements

We sincerely thank the anonymous referees and Editor for helpful remarks.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Boubacar Maïnassara, Y., Esstafa, Y. & Saussereau, B. Estimating FARIMA models with uncorrelated but non-independent error terms. Stat Inference Stoch Process 24, 549–608 (2021). https://doi.org/10.1007/s11203-021-09243-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11203-021-09243-7

Keywords

- Nonlinear processes

- FARIMA models

- Least-squares estimator

- Consistency

- Asymptotic normality

- Spectral density estimation

- Self-normalization

- Cumulants